Crisis reveals character, but when it comes to COVID-19 and insurance, crisis can also expose contrasts.

RGA South Africa conducted multiple “healthy living” surveys among 2,000 consumers to determine if strict lockdown and other public health mandates to impede the spread of the pandemic were influencing their propensity to let policies lapse. The result? Despite enduring serious economic shocks and income loss, those consumers who were most likely to view COVID-19 as a serious threat were also more likely to keep coverage current.

Age and Affordability Matter

Well before the start of the pandemic, market researchers found that a lack of financial literacy isn’t the only reason consumers let policies lapse. When budgets are tight, immediate short-term needs, such as housing, transportation, and food, can take priority over the long-term investment in insurance, and economic ripple effects from the SARS-CoV-2 outbreak continue to subject many individuals and families to severe financial stress.

When RGA asked policyholders whether they had canceled life insurance in the last two weeks or planned to do so in next two weeks – without replacement – 5.2% answered “yes.” Of this cohort, 86% of cancellations were linked to cost and 65% of were associated with loss of income due to COVID-19. In surveys conducted in June and July, RGA asked about respondents’ financial status during lockdown, excluding those who were studying, unemployed prior to the start of lockdown, or retired. The results below provide a useful comparison of the relative impact of the pandemic at different levels of financial stability. Almost a quarter of respondents indicated that they were not receiving income during lockdown, while 7% have been retrenched, or dismissed without cause. And while a high percentage of all respondents did not have insurance prior to the pandemic, there was a correlation between lapse rates and income lost.

Status | % of responses | % with no insurance | % with insurance who are canceling | Average age |

Received full income | 45% | 29% | 3.6% | 36 |

Received 51-100% of pre-lockdown income | 12% | 28% | 7.5% | 36 |

Received 1-50% of pre-lockdown income | 13% | 28% | 4.5% | 35 |

Did not receive an income during lockdown | 23% | 42% | 8.1% | 37 |

Retrenched since lockdown | 7% | 46% | 13.3% | 35 |

If money mattered, age influenced decision-making just as much: Younger respondents indicated greater willingness to allow their policies to lapse regardless of income.

Age band | % lapsing |

35 and under | 6.9% |

36 and over | 5.4% |

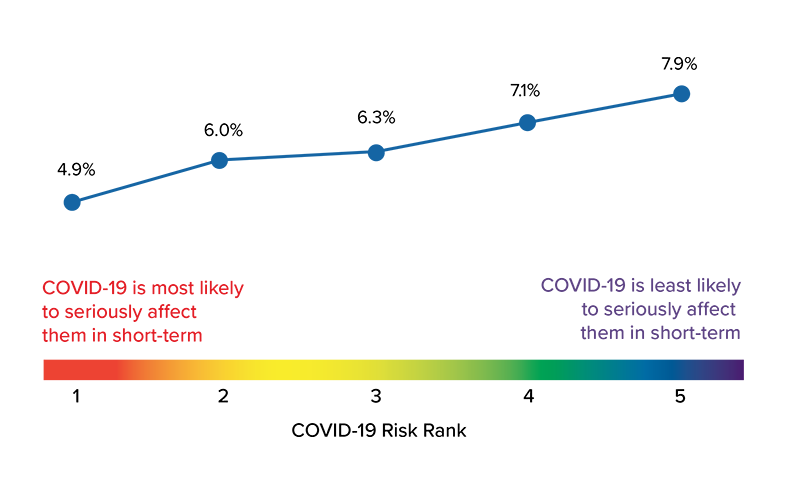

Threat Perception, Policy Lapsation?

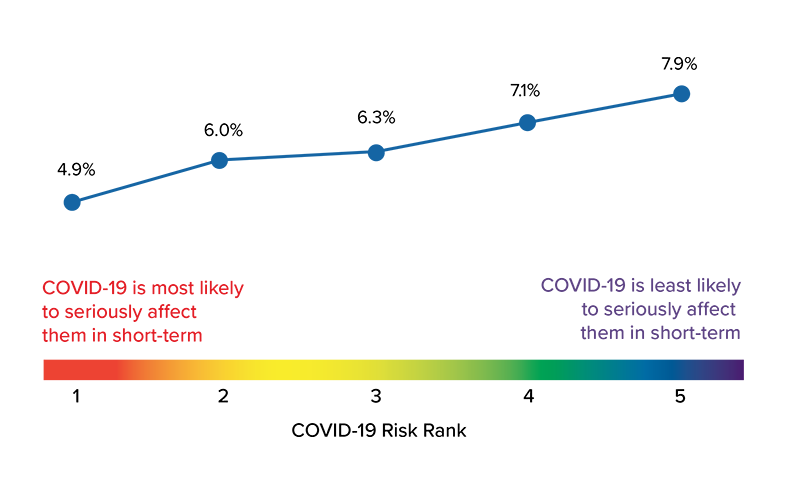

Still, these commonly cited reasons for lapse decisions may not tell the complete story. Early perceptions of the pandemic played a strong role on the decision to forgo coverage even months after the pandemic was announced. RGA researchers plotted lapse rate against survey respondents’ view of COVID-19’s threat across demographic groups. Consumers were asked to rate the short-term risk of death or serious illness from a variety of threats on a scale of 1-5 (1 most likely; 5 least likely). Unsurprisingly, the survey uncovered a strong correlation: The more likely the respondent was to perceive COVID-19 as a serious threat, the lower the policy lapse rate.

Lapse Rate by COVID-19 Rank

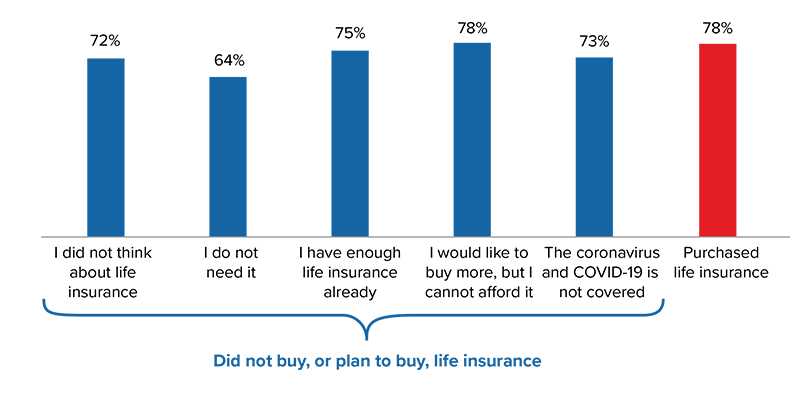

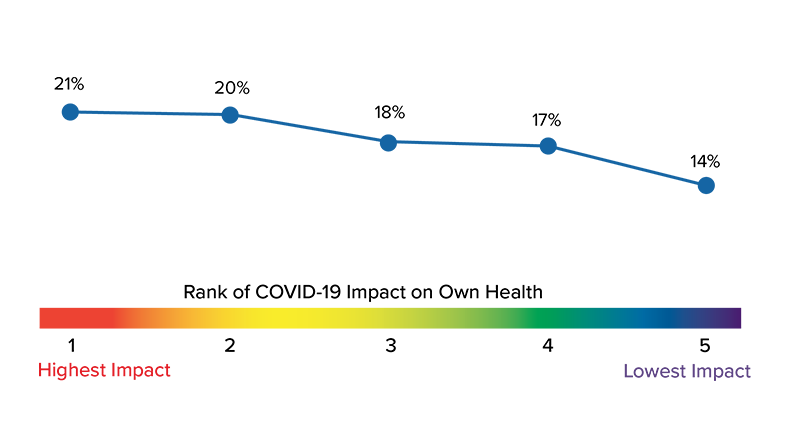

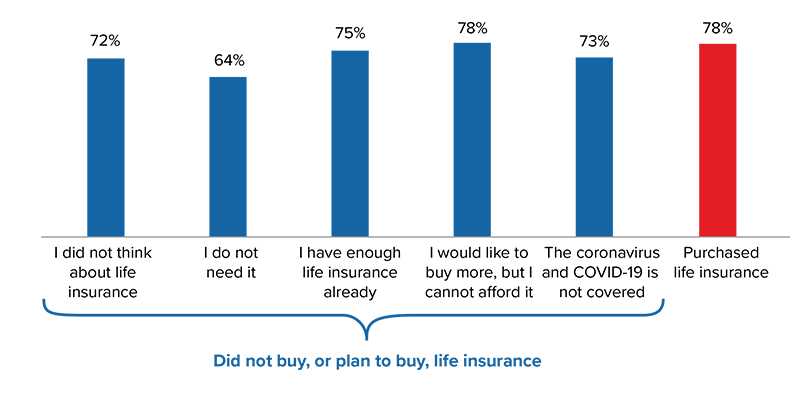

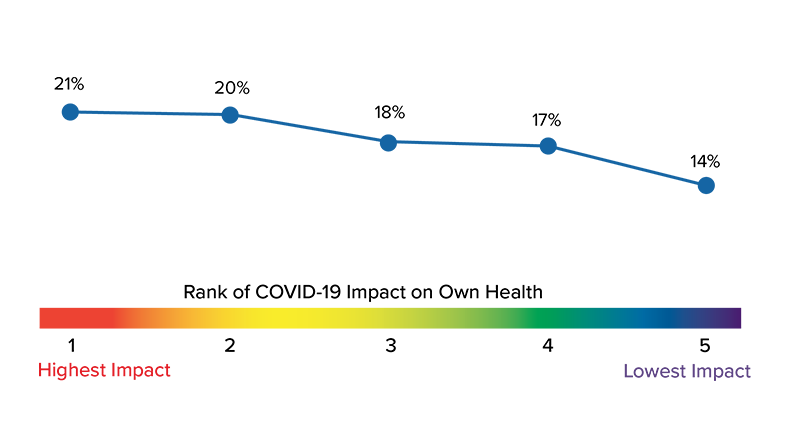

No market research on policy lapse can ignore overall consumer purchasing behavior, and RGA’s survey suggested that customer perceptions of the pandemic had implications at the very earliest stages of the insurance value chain. Those buying insurance, or who wanted to buy but couldn’t afford policies, indicated the highest concern about COVID-19 as a public health threat: 78% reported the coronavirus was a major danger. In contrast, those who did not see a need for insurance had less concern – 64% saw a major threat. Unsurprisingly, personal health worries also were closely associated with increased interest in protection products. Among those who identified COVID-19 as the greatest threat to either their personal health or that of their families, 21% also purchased insurance. In contrast, only 14% of those who believed COVID-19 posed a low health risk purchased insurance.

Percent Identifying COVID-19 as a Major Threat

Own Health Rated as Top Concern Compared to Life Insurance Purchasing

(% Purchasing Insurance)

Stockpiling Solutions

RGA research also linked some unexpected consumer behaviors to policy lapse rates. Upon the first lockdown in South Africa, many survey respondents reported furiously stockpiling emergency goods in anticipation of shortages. RGA tested the correlation between insurance purchasing behavior and general risk perceptions by cross-referencing this stockpiling against lapse rate in multiple surveys throughout 2020.

The comparison was revealing, and the results were remarkably persistent despite the passage of time and the progress of the pandemic. Previous analysis suggested that younger individuals tended to stockpile more food and medicine in response to lockdown measures. It is understandable, then, that RGA researchers observed a higher lapse rate among those who stockpiled food given the age and financial profiles of these policyholders. However, this relationship did not hold true for those who stockpiled medicine. Despite their younger ages, these individuals had a lower lapse rate.

| Lapse rate | Average age |

Did not stockpile food | 5.4% | 39 years |

Did stockpile food | 7.0% | 30 years |

| Lapse rate | Average age |

Did not stockpile medicine | 6.5% | 36 years |

Did stockpile medicine | 5.9% | 29 years |

What could drive this difference? Motivation. Those purchasing extra medicine in the face of a pandemic also reported greater concern about COVID-19 health risks, and hence were less likely to cancel life insurance. Extra food purchasing, in contrast, could indicate a concern with supply chain disruption due to lockdowns, rather than a concern around pandemic-related health risks.

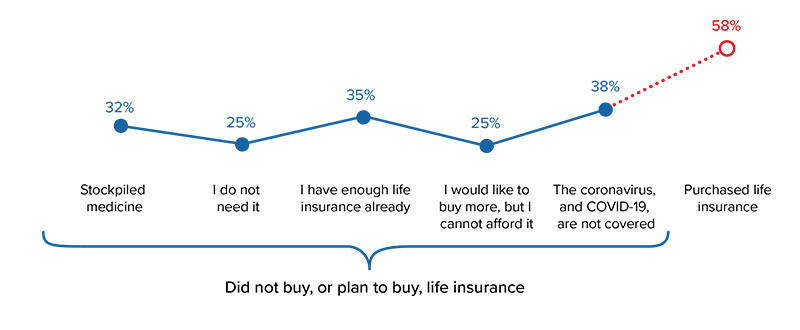

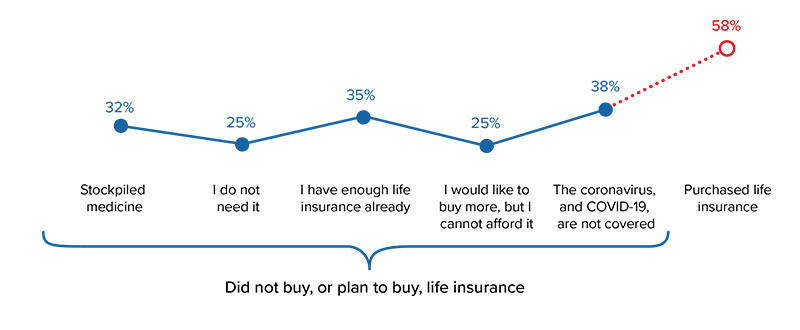

This relationship also was present among insurance buyers. While 35% of the total number of respondents stockpiled medicine, 58% of insurance purchasers did so. Those unable to afford insurance also were least likely to buy extra medicine, clearly indicating a financial constraint influencing behavior. It is important to note also that an element of panic-buying could also be at play, given that those respondents reporting having “enough” life insurance behaved in a similar manner to other groups who did not buy coverage.

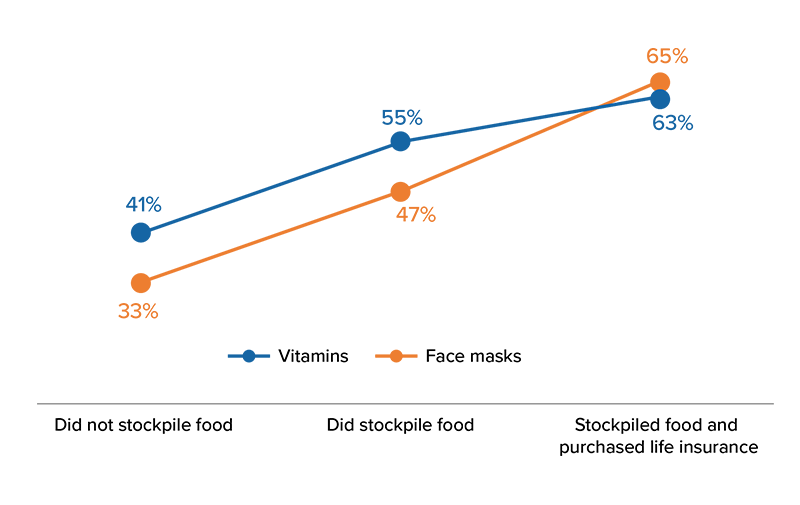

Stocked Up On Medicine = "Yes"

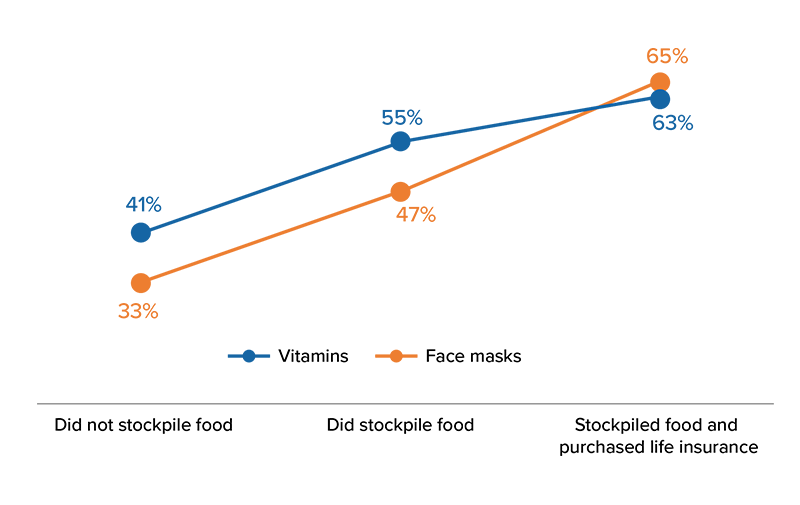

Similar trends emerged around physical contact. The risk-averse consumers stockpiling pantry shelves were also more likely to take additional precautions, such as wearing face masks and other personal protective equipment. And this same cohort also shared a greater propensity to purchase life insurance. The graph below shows that of those who stockpiled food and purchased insurance, 65% reported voluntarily using face masks, and 63% cited increased vitamin consumption. During this period, wearing face masks became compulsory in South Africa, so while RGA fielded multiple surveys, the face mask responses were gathered prior to the legal change, while data on vitamin purchases was gathered across all surveys.

In contrast to these results, those not stockpiling or not purchasing insurance were also much less likely to take other voluntary precautions.

% Using the Precaution

Summary

Many have speculated that the shock of the COVID-19 event itself may finally help close the protection gap by prompting millions of people to purchase life insurance. However, a look at lapse rates among policyholders in RGA’s market surveys reveal a more complex reality. Financial instability amid an agonizingly long global economic crisis could disrupt even the best intentions and understandably might lead policyholders to discontinue coverage. Yet policyholder age and policy affordability alone do not fully explain RGA’s research results. Consumer perceptions of risk vary widely among many demographic groups and may continue to hold an outsized influence over insurance purchasing priorities and lapse patterns long after COVID-19 is conquered.