As the global pandemic has put the outside world on pause, it has also unleashed rapid changes in our lives and livelihoods.

As populations shun crowds, stockpile supplies, and shelter-in-place, a new normal has emerged. Millions have adapted to COVID-19 by finding connection, interaction, and even employment online, while others have struggled with rising emotional and physical risks, and fresh sources of financial instability. Will this novel way of life become a new normal, even after the danger has passed, and what are the implications for the sale of insurance products?

RGA South Africa sought to explore this question, and better understand the psychology of a pandemic, by conducting a national online survey of 1000 people on 24 March 2020, three days before the nation's lockdown orders commenced. The organizers designed the polling sample to reflect a representative demographic profile of South Africa by age and race, while also covering all regions in the country. The survey has limitations, and care should be taken in extrapolating or deducing firm conclusions. In particular, because the survey was online and limited to 1000 participants, it potentially excludes parts of the population. Further, it provides limited credibility (due to the number of respondents).

Still, the survey does reveal some intriguing insights that can help carriers better understand insurance purchasing behaviors.

Threat Perception

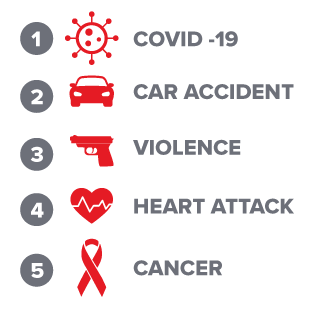

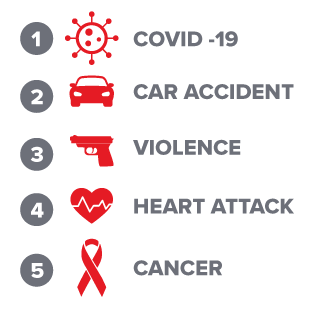

The vast majority of respondents see COVID-19 as a major threat to public health in South Africa. When asked to rate the level of danger presented by the coronavirus pandemic, a majority selected COVID-19 as the most lethal short-term threat among the options. This highlights the immediacy of the pandemic, and recency bias.

Interestingly, COVID-19 was ranked as the top threat by respondents of all ages, except those over 65, who placed the risk of heart attack and violence ahead of the risk of the pandemic.

Ranking of Short-Term Mortality and Serious Morbidity Risk

(most likely to least likely)

Money Worries

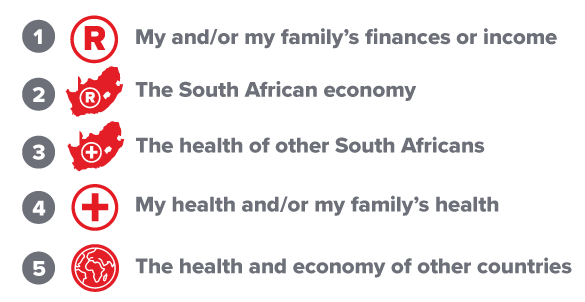

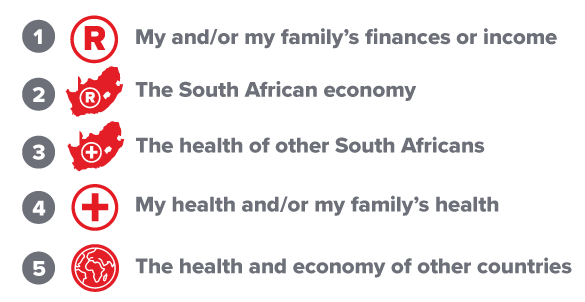

The pandemic also presents a direct threat to the financial security of individuals and families. Unsurprisingly, RGA's survey reveals that consumers and employers facing immediate concerns about making payroll and paying bills are far more likely to prioritize personal economic effects. When asked to rank concerns in order of significance, respondents ranked economic concerns first or second, while personal and family health considerations were fourth.

It is perhaps understandable that individuals may be more inclined to look inward and prioritize their own protection, and that of family members and loved ones, over the physical or financial health of people in other nations. When asked to weigh concerns about COVID-19's spread in other countries, global economic and health concerns consistently ranked lowest in perceived importance.

Ranking of Coronavirus (COVID-19) Impacts

(in order of greatest expected impact)

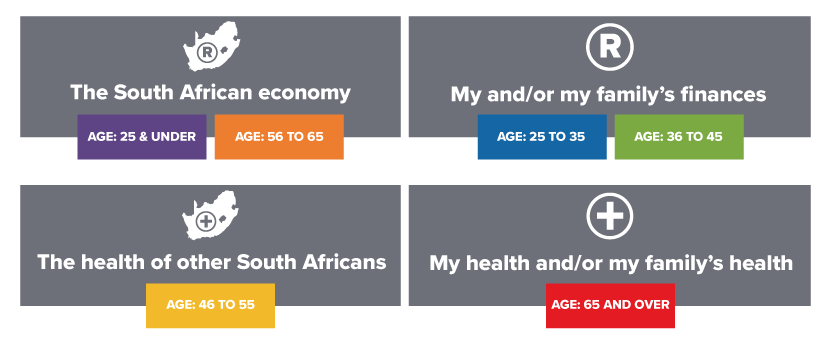

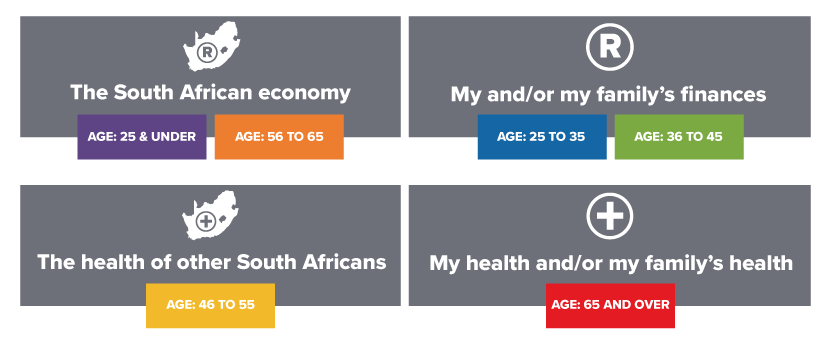

Top Ranked Impacts by Age Distrbutions

(The graphic below shows the impact that each age group selected as their main concern.)

There is a clear theme of financial concern, with 26- to 45-year olds reporting a greater concern for their own finances. Such sensitivity makes sense. This millennial demographic group is more indebted and shoulders greater financial burdens. Interestingly, those between 46 and 55 see the health of others as their biggest concern, while those over 65 were worried about their own health.

The spread by gender was broadly similar. However, women placed the South African economy ahead of personal finances as the key risk, while men held the opposite view.

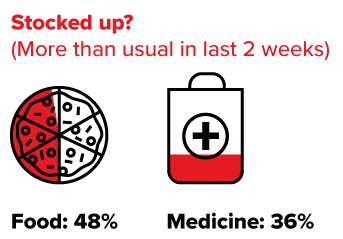

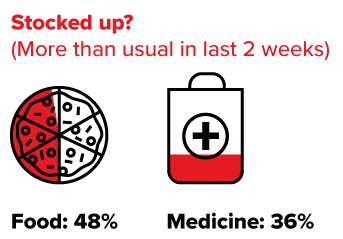

RGA also sought to understand how respondents' views translated into actions. One effective means to measure the level of economic anxiety caused by COVID-19 was to explore food and medical stockpiling behaviors.

Overall, 48% of people purchased more food, and 36% purchased more medical supplies than usual in the two weeks preceding South Africa's lockdown period.

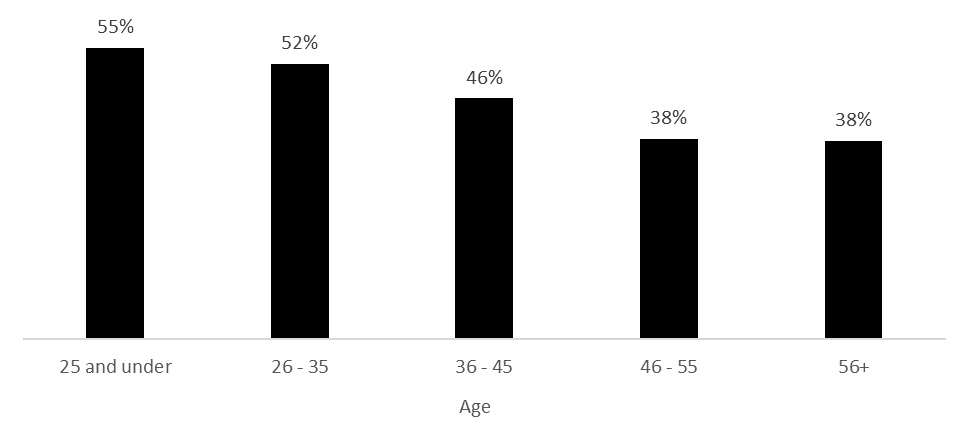

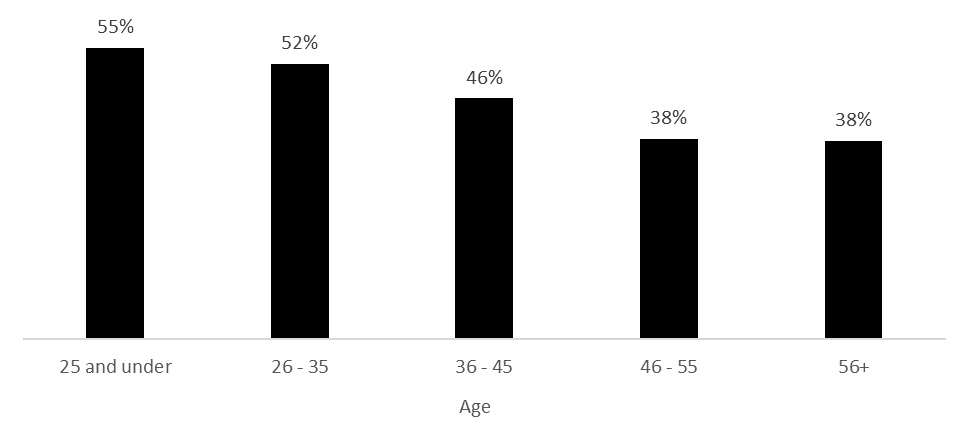

RGA found a broad correlation between age and the act of stocking up on food and general supplies, with younger individuals proving more likely to fill their pantries and their medicine cabinets. Over half of those age 25 and under purchased more food, while only 38% of those over 45 did so.

Asked: In the last 2 weeks I have stocked up on food and general supplies (more than usual):

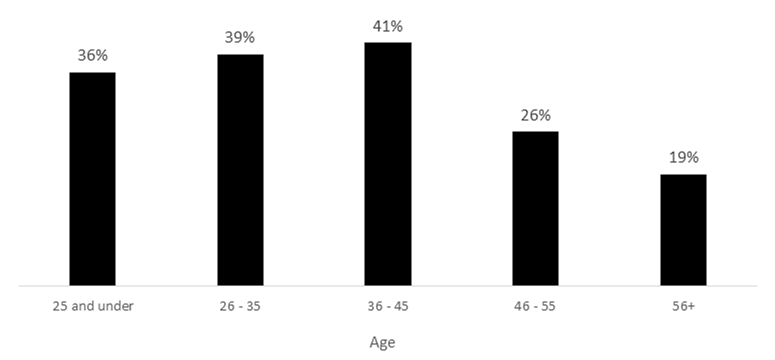

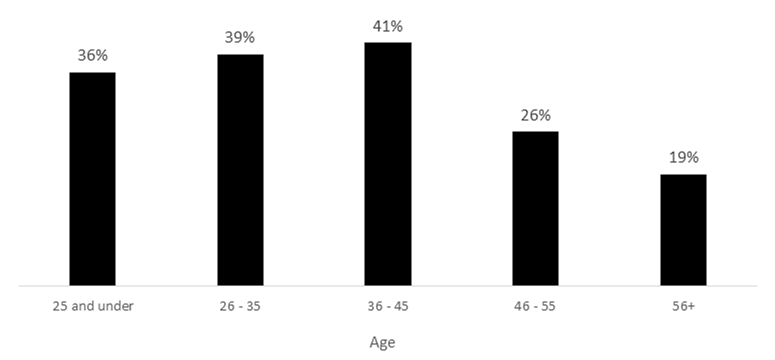

Purchases of medical supplies showed a similar pattern. Those under age 46 stocked up more than older respondents. Overall, 36% of people purchased more medical supplies than usual in the two weeks preceding South Africa's lockdown period. One possible explanation: Older individuals could have already had medical stockpiles on hand, having thought about these needs long before. For younger consumers, on the other hand, the pandemic may have prompted their first thoughts of medical purchasing needs.

Asked: In the last 2 weeks I have stocked up on medical supplies (more than usual):

It is clear that all respondents preferred to stock up on food rather than medicine. Still, a broad overlap exists: 80% of those stocking up on medical supplies also stocked up on food.

Taking Precautions

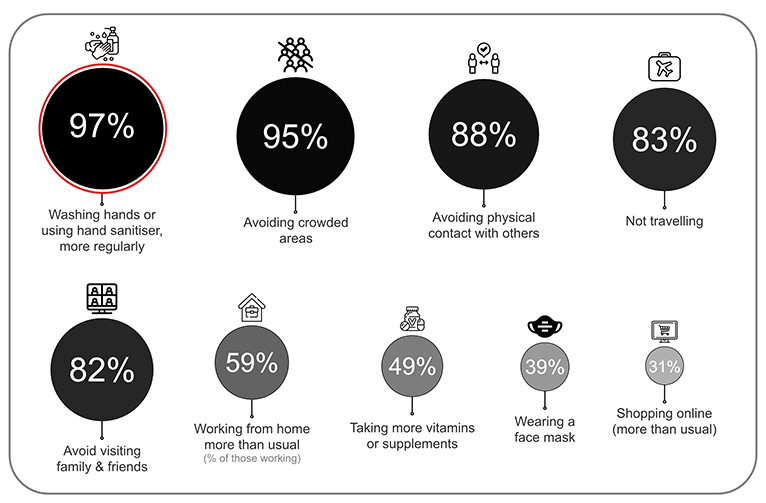

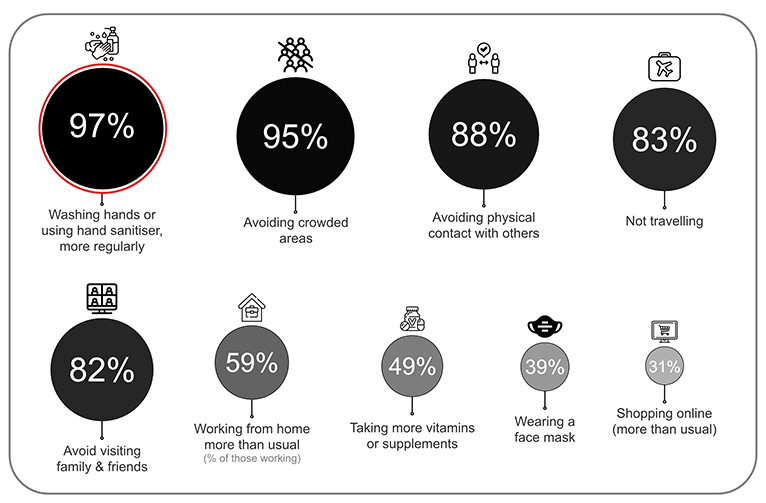

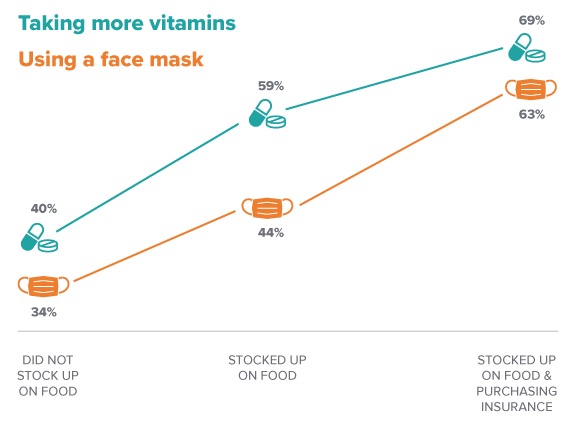

RGA asked what precautions people were taking to avoid COVID-19 as another way to gauge public concern and changing behaviors.

Consumers reported improving hygiene and avoiding people, including physical contact. Vitamins and face masks proved less popular. In addition, more than half of employed respondents reported working more from home even prior to the country's official stay-at-home order.

Purchasing Prompts

Could evidence of stockpiling or extra precautions suggest certain consumers would be more inclined to purchase life insurance in the wake of a pandemic? RGA asked South African consumers if they had either purchased life insurance in the last two weeks or planned to do so in the next two weeks.

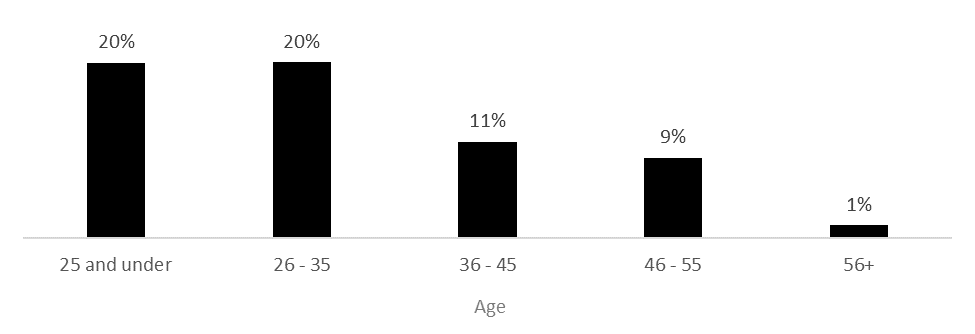

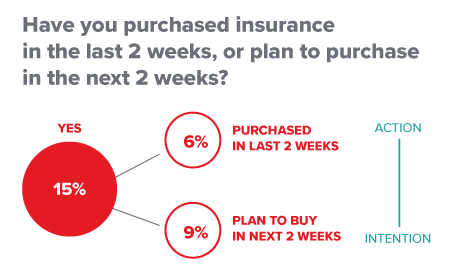

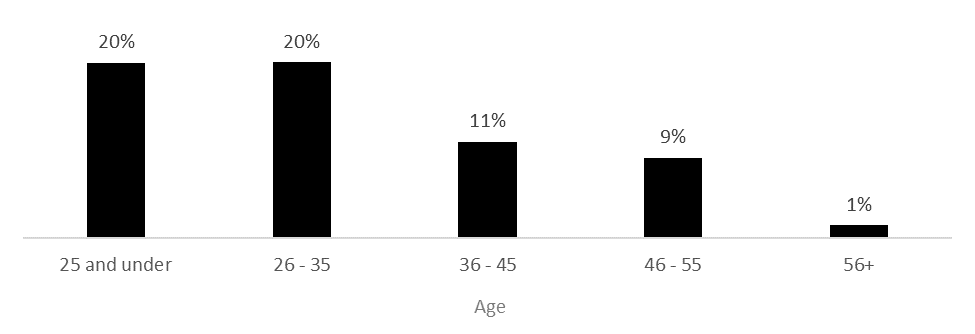

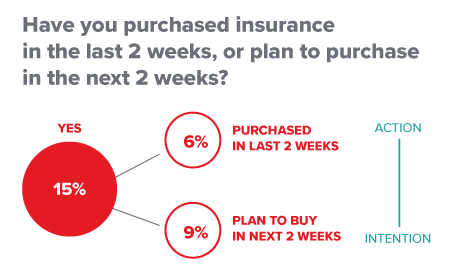

Overall, 15% of respondents had either purchased, or planned to purchase, insurance. This varied by age, with younger people more likely to buy. On average, those seeking insurance were 5.5 years younger than those who did not seek insurance.

Percent Buying, or Planning to Buy, Life Insurance

We further split the data by those who had purchased insurance recently (6%), and those who planned to buy in the next two weeks (9%). The bias towards future purchasing is likely to be a reflection of the traditional insurance challenge: Insurance is a financially sound purchase (creating intention to buy), but a gap exists between that intention and action.

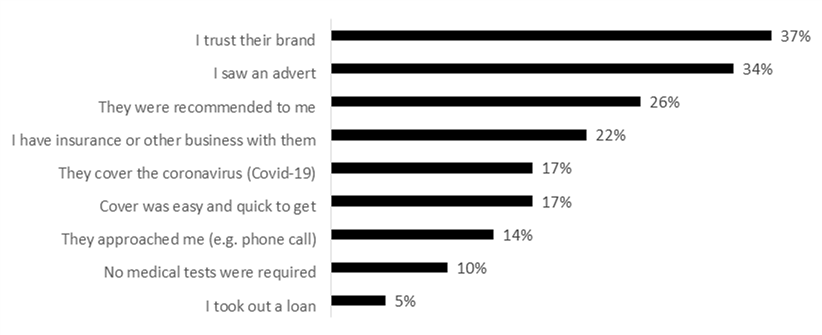

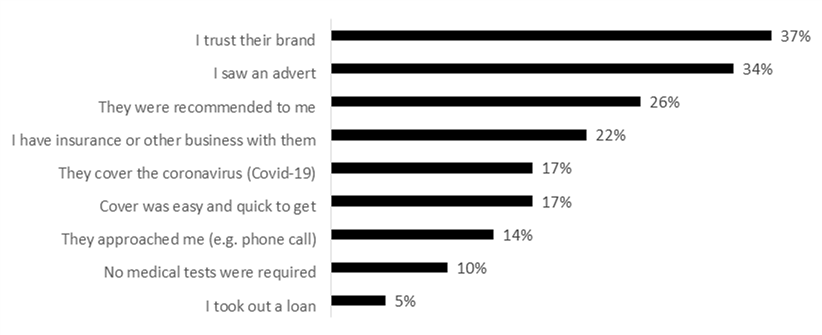

What prompted consumers to make a purchase? RGA asked those respondents who had already bought life coverage to identify the reasons why they had elected to buy insurance and why they had purchased from any particular carrier.

Trust in the insurer’s brand was the main driver in a decision to purchase coverage, followed by advertising and recommendations. Interestingly, 17% of survey respondents were motivated by the fact that COVID-19 would be covered by a plan.

Nine Reasons Why Respondents Purchased Insurance

Despite slight differences by age, the main drivers were the same:

- Under 36 years: This demographic focused more on a rapid and easy purchasing process (19% noting this as a factor), with 35% valuing trust.

- 36 years and older: Access to quick and easy cover was less valued among older cohorts at 12%, while 44% placed a premium on trust in the insurer.

Buy or Not Buy

Conversely, almost half of the respondents indicated that they already had enough life insurance and did not choose to purchase additional coverage amid the pandemic. Although sample bias is always a possibility, the large insurance gap in the South African market makes this less likely.

Affordability also presented a significant deterrent to sales, with over a quarter of respondents indicating "I would like to buy more, but cannot afford it." Those age 26 to 35 comprised the highest proportion (30%) of those unable to afford cover, while 22% of those over age 56 indicated that lack of funds would prevent a purchase.

The survey also underscored a familiar theme for life insurers. Even in the shadow of a pandemic, individuals at younger ages (25 and under) and older lives (over 65) were less likely to see a need for insurance. Causes for this outlook could include a youthful feeling of invincibility, resistance to thinking about death, or misunderstanding of the value of illness or disability benefits and the use of coverage for financial planning purposes.

The youngest cohort had the highest proportion (16%) of respondents who “did not think about it.” Overall, 40% of those 25 and younger either did not consider life insurance or felt that they didn’t need it.

Such attitudes remained consistent when it came to health/medical insurance purchasing. Approximately 17% of respondents indicated they had either purchased additional medical coverage over the past two weeks or had plans to do so within the next two weeks. And as with life insurance, additional medical insurance purchases were driven by younger people, with roughly one-fifth of the purchases coming from those under age 46.

Perceptions and Purchasing

In RGA's survey, perceptions of COVID-19’s risk correlated with proclivity to purchase life insurance cover. Those inclined to purchase insurance (or who didn't buy insurance coverage only because COVID-19 was not covered) had the highest threat perception, at 84%.

Still, there were curious disconnects. Of those who "did not think about life insurance," 73% still saw COVID-19 as a major threat; and 68% who reported not needing life insurance also identified COVID-19 as a major danger. Both trends point to a need to more aggressively communicate the advantages of protection products during a pandemic.

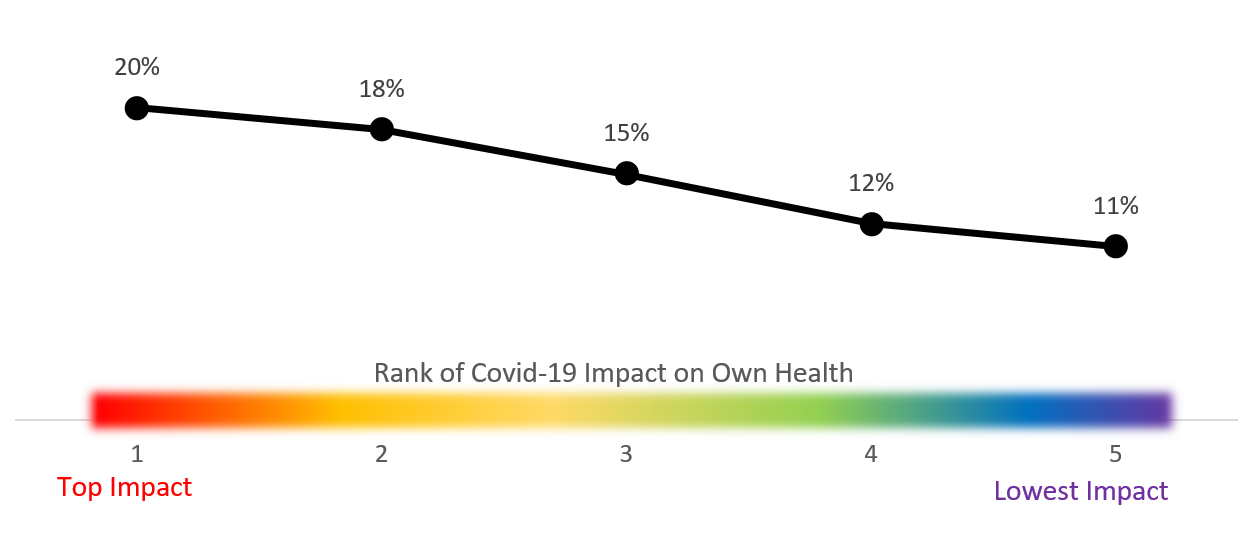

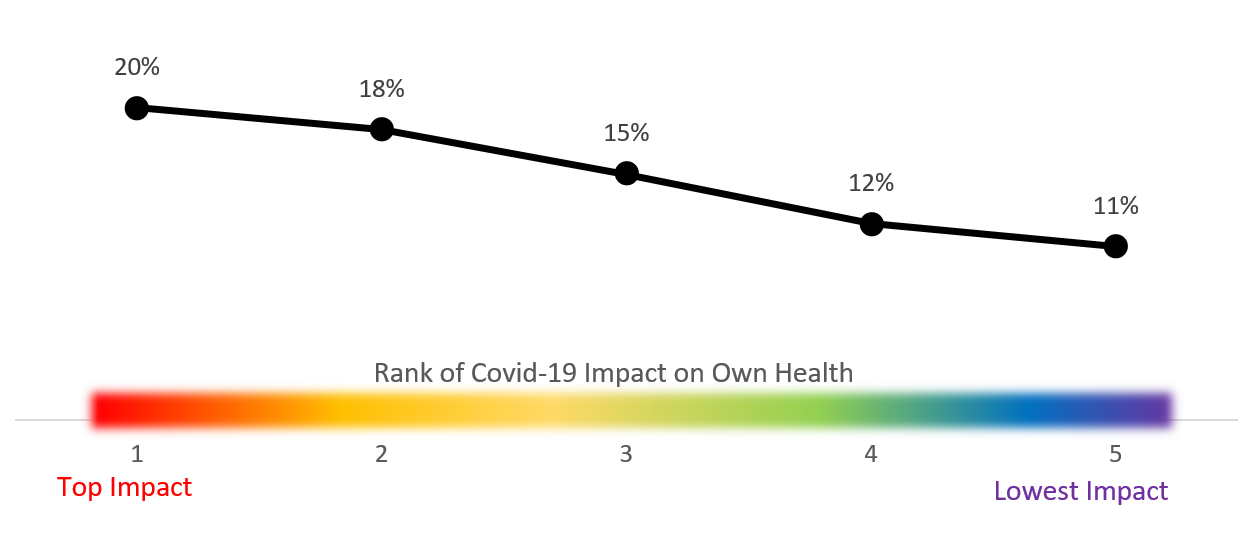

Those disconnects were again evident when analyzing the insurance purchasing behavior of respondents who identified their own health as the top COVID-19 concern.

For example, almost a quarter of those who declined to buy life insurance because "they didn't think about it" also ranked their own health as the top impact.

More logically, concern about health appeared to be closely associated with the likelihood of purchasing insurance, as illustrated below. Of those who perceived that COVID-19 posed the highest threat to their own health (or that of their families), 20% also purchased insurance. In contrast, only 11% of those who perceived COVID-19 as a low risk to health purchased insurance.

Percent Purchasing Insurance Compared to Level of COVID-19 Health Concern

Panicking or Planning

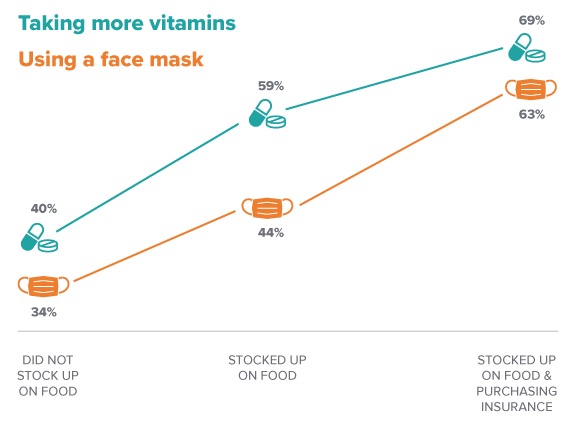

Ultimately, RGA's survey suggests the same perceptions of a threat influenced purchasing behaviors for food, medicine, and insurance in South Africa. Over two-thirds of those who purchased life insurance also stocked up on food (versus 48% of the total number of respondents). Perhaps not surprisingly, those who wanted life insurance, but couldn't afford it, also reported the least food stockpiling.

Similarly, just over one-third of the total number of respondents stockpiled medicine. In contrast, 61% of insurance purchasers did so. Again, those unable to afford insurance also were least likely to stock up on medicine, clearly indicating a financial constraint influencing behavior.

An element of panic-buying could also be at play, rather than pure long-term planning. This argument is supported by the fact that those who reported having enough life insurance behaved in a similar manner to other groups who didn’t buy insurance.

Similar trends emerged around physical contact. Those more risk-averse consumers stockpiling food were also more likely to take additional precautions such as wearing face masks and purchasing life insurance.

Is it possible that those buying insurance during an event like COVID-19 are doing so out of anxiety, rather than following a considered financial plan? If so, carriers could experience a higher lapse rate on these polices once the immediate threat has dissipated.

Instead of analyzing sales trends amid the pandemic, it is perhaps more important for insurers to reinvent how we sell insurance post-COVID-19. Ultimately, a reprioritization of protection products could be on the horizon as this unprecedented global health crisis unfolds.

Conclusion

COVID-19 has challenged nations and institutions in dramatic and sweeping ways. This new disease has forced many businesses to either swiftly adjust or shutter, directly threatened healthcare and social systems, and reshaped the very fabric of our daily lives. RGA's brief snapshot of the behaviors of South African consumers – as they stood on the very cusp of many of these changes – opens a window into how events may prompt many to reevaluate and re-prioritize life insurance in the months and years ahead.