The rise of non-communicable diseases

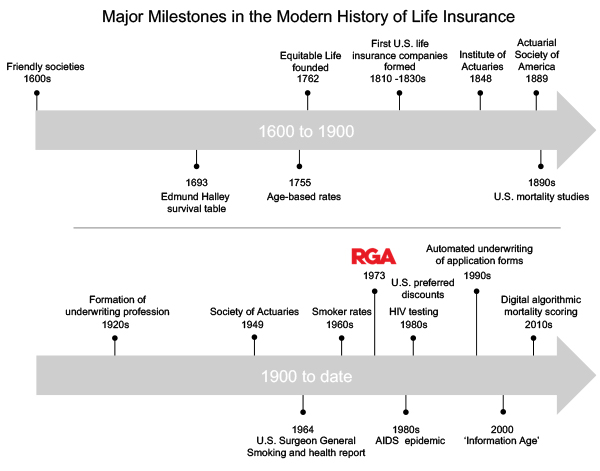

In the early 20th century a major shift occurred in the most common causes of death, which changed the focus of insurance underwriting. Along with the benefits of economic development came better disease control through cleaner water, better sanitation and improved personal hygiene. The emergence of antibiotics (1928) and the launch of large-scale vaccine production (1940s) supported the fight against the deadly infections that had plagued humans for millennia. For the first time in history, non-communicable diseases such as heart disease, stroke and cancer surpassed infectious diseases as the primary causes of death.

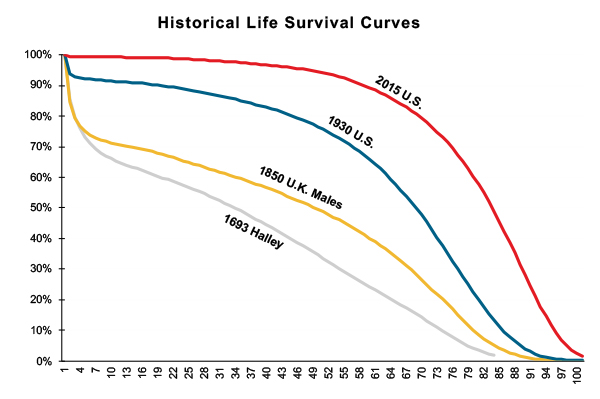

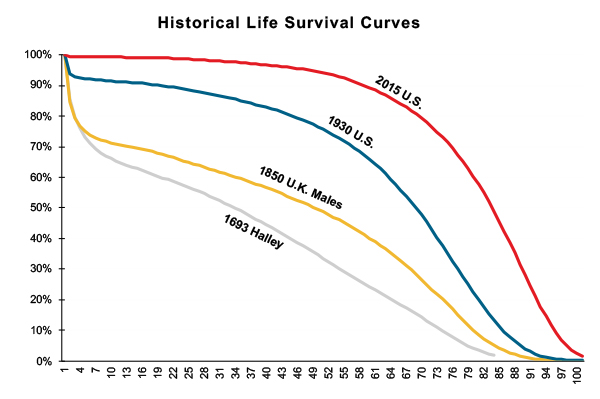

Survival curves from four points in time are illustrated in Figure 2 and show a significant improvement in the 1930 survival curve.

Figure 2:

Life survival curves 1693 to 2015

Source: Created by RGA from Various Sources

Smoker mortality (1960s)

The British Doctors Study established the link between smoking and lung cancer in the 1950s. [vi] In 1964, U.S. Surgeon General Luther Terry issued the landmark report alerting the nation to the deleterious health consequences of tobacco use.[vii] The smoking of tobacco had been growing in popularity since the 1920s; consequently, between 1940 and 1980, male incidence rate of lung cancer increased by a factor of seven. Female lung cancer incidence rates did not take off until the late 1960s. At that point, a few U.S. and Canadian carriers started to differentiate premiums for applicants by whether they were cigarette smokers, and doing so became common by the late 1970s. It should be noted that in many countries aggregate rates are still used, due to insufficient medical evidence obtained at underwriting stage to allow reliable classification of non-smokers.

Fluid collection, laboratory testing and the AIDS epidemic (1970 - 2000)

In the 1970s, fluid collection and laboratory testing was first introduced as an underwriting tool for large amounts of cover. By the 1980s however, the AIDS epidemic had led insurers to institute widespread laboratory testing at much lower policy amounts.

Insurance companies were quick to realize the advantages of laboratory testing beyond screening for HIV. Important mortality insights were gained from lipid profiles, liver and renal function tests and other blood biomarkers, and screenings for tobacco and recreational drugs.

The 1980s also saw the widespread introduction of “preferred rates” in North America. Using the additional information available from medical examinations and laboratory tests, insurers could now offer a preferred customer discount to applicants in excellent health. However, preferred segmentation was also a marketing tool: it was not uncommon for 75% to 80% of applicants to qualify.

In the 1980s and 1990s, companies assessed mortality risk using three main categories of data:

- Medical history: obesity, diabetes, high cholesterol, hypertension, cancer, heart disease, stroke, and mental and nervous disorders

- Family history: parents or siblings suffering from inherited diseases such as Huntington’s disease or from the early onset of diseases with a hereditary predisposition such as coronary artery disease, certain types of cancers and type 2 diabetes

- Lifestyle: tobacco use, excessive use of alcohol and/or recreational drugs, driving records, personal aviation, involvement in hazardous avocations, sports, or occupations, foreign residence or travel, and past felony conviction(s).

The 1990s also saw an increasing number of insurers introduce rules-based expert systems to automate the assessment of application forms. For the first time, underwriters were replaced by computerized processes.

The latter third of the 20th century saw significant advances in medicine’s understanding of human mortality and ability to extend life. Insurers also gained a more comprehensive view of mortality but data was still lacking. Reductions in tobacco use, better detection and treatment of numerous diseases, and socioeconomic progress allowed U.S. life expectancy at birth to increase by six years in the 30-year period from 1970 to 2000, according to the National Center for Health Statistics.[viii]

The Information Age (2000 to date)

The new millennium saw the advent of the Information Age. Big data, data analytics, data lakes, data science, and digital data are all now commonplace in insurance.

Greater access to data and better tools to analyze the data means life actuaries and underwriters can gain a holistic view of mortality through multivariate analysis of ever-expanding datasets. Deeper and broader mortality analysis is also enabling insurers to confirm and refine assessment of traditional risk factors and to identify new risk factors.

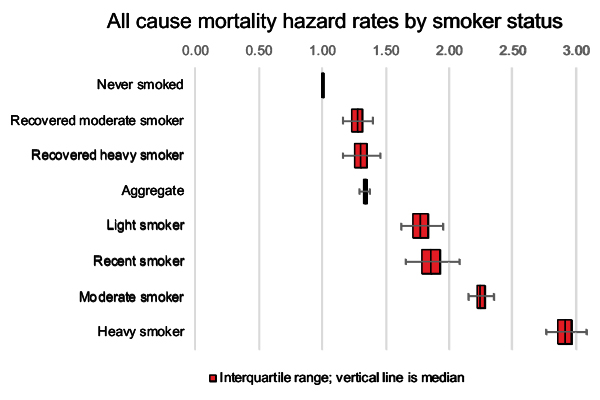

As an example, recent expansion of the mortality data from the National Health Interview Survey (NHIS) supports granular risk assessment across the spectrum of smoker activity. Figure 3 shows hazard rates for a range of cigarette smoking activities, allowing more refined mortality assessment of this important risk factor.

Source: Created by RGA from NHIS Data

New data sources are allowing the introduction of mortality algorithms leading to the digital transformation of the underwriting process. Major examples include the use of prescription histories, credit-based data and clinical laboratory test results to digitally calculate algorithmic mortality scores.

Today’s actuaries and underwriters need a good working knowledge of multivariate data modeling and the fundamentals of data science. Multivariate analysis is enabling a better segmentation of the business of life insurance, allowing underwriters to fine-tune applicant ratings at ever more granular levels (e.g., refining the assessment of people with diabetes based on their exercise, alcohol and smoking habits).

Gazing into the future

American inventor and futurist Ray Kurzweil, writing about exponential change in his 2001 article “The Law of Accelerating Returns,” said: "We won’t experience 100 years of progress in the 21st century - it will be more like 20,000 years of progress … There’s even exponential growth in the rate of exponential growth." [ix]

Kurzweil’s prediction has so far held true for the insurance industry. Exponential growth in data and computing technology looks likely to continue apace. Within the next decade wearable devices, genetic testing and digital health data are set to transform the risk assessment process. Other changes such as epigenetics, liquid biopsies, nanotechnology and our growing understanding of the microbiome, along with inventions that we cannot yet even imagine, will be important risk factors in the following decades.

Wearable devices offer unique opportunities for insurance companies to assess lifestyle and mortality risk. Currently these devices measure metrics with a known connection to mortality such as physical activity, heart rate and sleep. Future sensors are expected to offer even more data to evaluate mortality, such as blood pressure, heart rhythm, pulse wave velocity, sitting time, stress levels, and even attempts to detect smoking habits.

Insurers are already starting to use data from wearable devices to motivate customers to improve their lifestyles. In return, insurers are giving appropriate premium discounts to customers engaging in healthy habits. In the future, adoption of wearable devices is likely to grow as the devices become more advanced, cheaper, and better connected. Within the next few years we anticipate insurers will have much greater opportunities to use wearable data in the insurance assessment process.

During the past five years, direct-to-consumer genetic testing has seen extraordinary growth. More than 16 million people now have access to their genetic data, with upward of eleven million individuals tested since the start of 2017.[x] Although genetic data is not typically available to life insurance companies, genetics has the potential to transform all aspects of medicine, including prevention of disease manifestation, accurate diagnosis and prognosis of disease, pharmacogenomics, and motivating lifestyle changes to improve health. Genomic medicine will almost certainly lead to major improvements in human mortality and longevity.

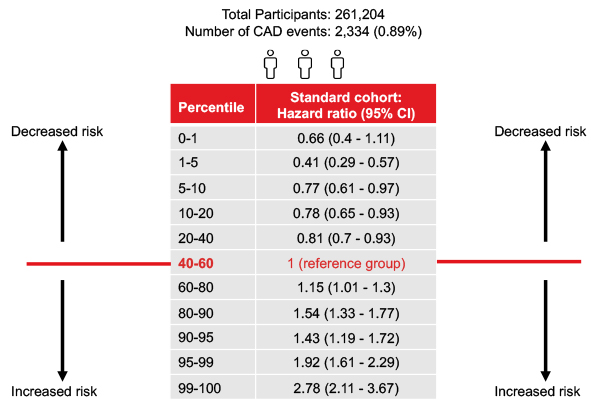

The UK Biobank is a cohort study of over 500,000 U.K. volunteers.[xi] It was established to identify the biometric, genetic and lifestyle determinants of disease and death. Through a joint research study on the UK biobank data with King’s College, London, RGA has quantified the importance of genetic risk information alongside traditional insurance underwriting risk factors. The study provided significant insights into the potential for genetic anti-selection.[xii]

This research collaboration focused on the utility of polygenic risk scores (PRSs) for mortality risk assessment. PRSs combine information across many genetic variants to give a single measure of genetic liability to disease. For example, Figure 4 shows the coronary artery disease PRS can predict incidence and death above and beyond traditional underwriting risk factors: a PRS in the highest 1%, for example, confers almost a threefold increased risk of coronary artery disease compared to the reference range.

Source: RGA-KCL Research Collaboration 11

As genetic testing increases in importance in mainstream medicine, the insurance industry will need to find ways to mitigate the anti-selection risk.

Increased access to digital health data is already changing the risk assessment process. Prescription history reports grew in popularity starting in 2010 and are now commonplace in the U.S., with about 80% utilization by companies today. Online access to both current and historical clinical laboratory test results are becoming available as well.

Several leading U.S. insurers are exploring access to electronic health records, particularly coded data which is readily amenable to automated assessment using machine learning and other artificial intelligence techniques. In the U.K., access to electronic health records by insurers is more advanced due to centralized storage of medical data with the family doctor.

We predict that digital health data will likely have the biggest transformational impact on life insurance assessment since the introduction of age-based premiums in 1762. Digital health data, supported by data from wearable sensors and other novel sources, will enable real-time, automated risk assessment, leaving assessment of only the more complex risks to human underwriters.

Don’t be left behind

Understanding the history of the life insurance industry can help explain where we are today and offer great insights into its future. Insurance assessment has seen massive changes over the previous two decades and even bigger and more exciting changes are sure to emerge in the next couple of decades. The major challenge for actuaries and underwriters alike is to keep pace with technological and medical advances.

More data available at the time of underwriting and advances in data-driven solutions will allow greater underwriting accuracy and allow pricing decisions to be tailored to the individual applicant. Just 250 years after the introduction of age-based premiums, perhaps actuarial tables based on age alone will be replaced by complex rating algorithms where age is just one factor.

Understanding the past and predicting the future can not only inform insurance and reinsurance companies’ plans and investment strategy, but can also change how the industry might influence the future. Predicting the future is difficult, but as U.S. President Abraham Lincoln once said “the best way to predict your future is to create it".