The search for growth in a low interest rate environment, combined with excess capital and regulatory developments, has prompted insurers to seek inorganic growth opportunities via mergers and acquisitions (M&A) within domestic and international markets.

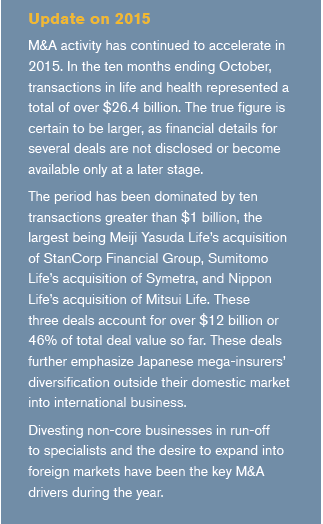

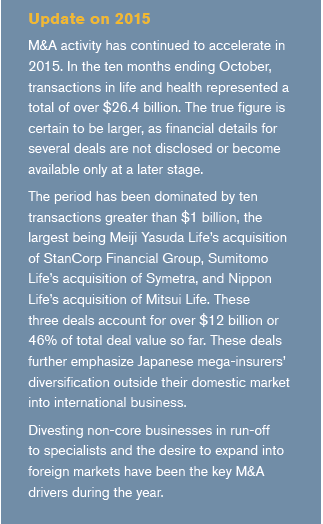

Although the number of deals has decreased over the past four years, the average deal size has tripled, averaging $781 million as of October 2015.

The key elements driving the increase in M&A include increased market share, entry into new markets, a desire to divest non-core operations and a heightened concern about regulatory changes. Most recently, a number of Japanese insurers have intensified their efforts to acquire international insurers to mitigate slow growth in their domestic markets, which have been impacted by unfavorable demographic changes and low investment returns.

The need to invest in technology, digitization and data analytics is another emerging driver that is helping improve sales, customer service and distribution efforts. With continued economic and regulatory uncertainty, acquisition within the life and health insurance industry is expected to accelerate in the near future.

Global Landscape

Since 2011, mergers and acquisitions within the Global Life and Health (L&H) insurance industry have grown at a compound annual growth rate (CAGR) of approximately 42%. Based on publicly reported data,i the average deal size has increased significantly from $280 million in 2011 to $781 million in the year to October 2015.

i Based on limited publicly reported data on deal sizes/value.

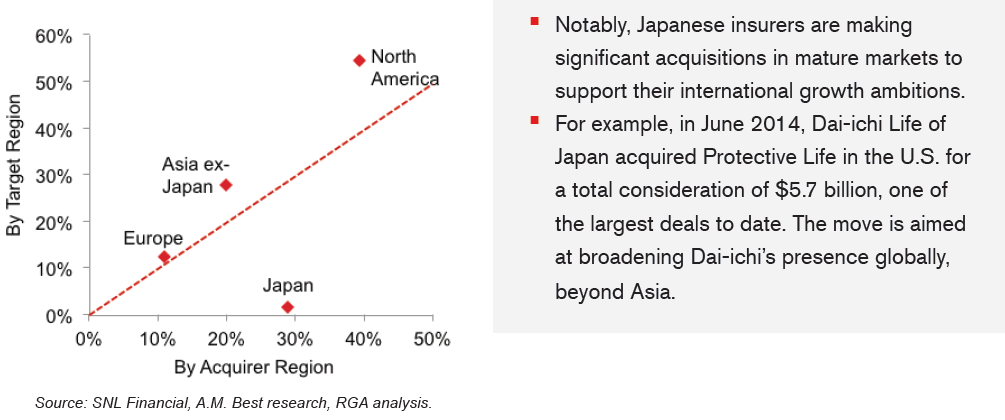

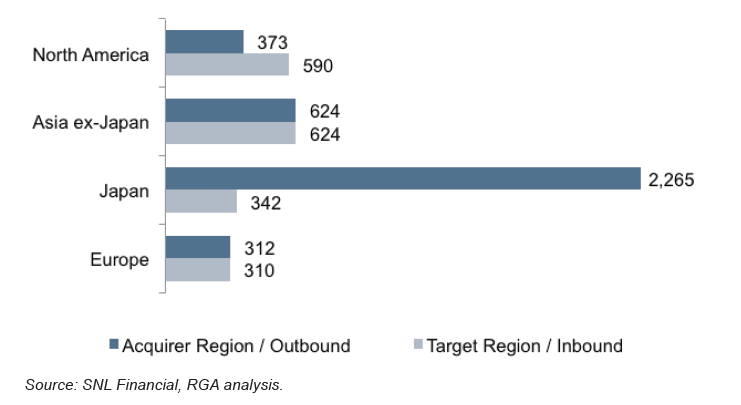

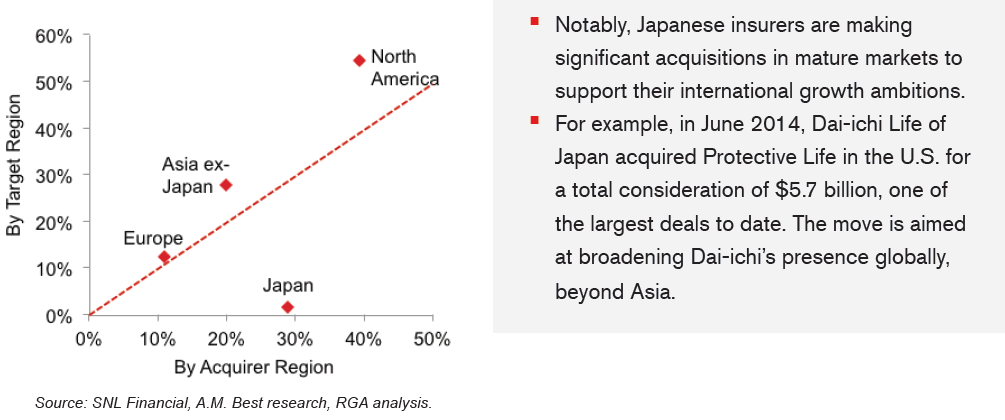

Over the period under consideration, acquirers focused on the following regions:

Background

Global L&H Insurance Transactions

Deal Value as a % of Totalii

iiSouth America and Africa are not shown in the graph due to less than 1% deal size both from an acquirer and target standpoint.

With the global economy showing signs of recovery, M&A activity in the industry is expected to increase as companies seek new opportunities for growth and diversification. The search for topline growth, capital management, reduced regulatory uncertainties, and geographic and product diversification are a few of the key themes resonating in the industry.

The continued low interest environment, along with an abundance of capital, has also prompted insurers to look for growth in international markets. Previously, insurers deployed excess capital in share buyback programs. However, there has been a shift in sentiment towards deal activity that can deliver product diversification, geographic reach, economies of scale and cost savings.

The search for growth remains the key driver, especially for those whose domestic markets have stagnated. European insurers are looking beyond their own market to emerging Asian and African markets. On the other hand, insurers in dynamic emerging markets, such as China and Brazil, are acquiring assets in mature stable markets to support their international growth ambitions. Regulation remains an important driver, especially in emerging markets. Raising the foreign investment cap from 26% to 49% in India has already spurred a flurry of activity with insurers increasing their share in current joint ventures. The recent regulations around C-ROSS (China Risk Oriented Solvency System), stricter bancassurance rules and Shanghai free trade zone (FTZ) are likely to usher in a wave of M&A in China.¹

As a means to add additional scale and build their core businesses, the following strategies have emerged among L&H players:

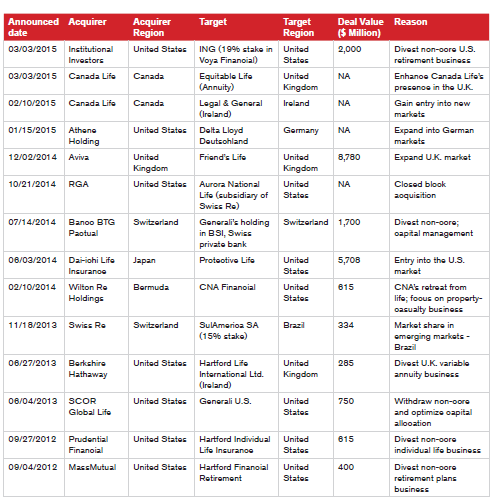

Increasing market share: In view of the continued slow organic growth, insurers are looking to M&A to boost earnings and market share. Sustained low interest rates are expected to continue into 2016, thereby impacting investment returns and profitability, especially among long-tailed life players. This is motivating insurers to consider opportunities to use excess capital, including via acquisitions.2 A recent example is Aviva’s acquisition of Friends Life for $8.8 billion, the biggest takeover announced in 2014. Expected benefits from this transaction include an increase in Aviva’s value of new business, doubling of Aviva’s corporate pension assets under administration and new opportunities by serving Friends Life’s £2 billion ($3 billion) of annual pensions business.3 Larger, capital intensive insurers that consider their domestic markets to be less attractive are investing in emerging markets, where prospects for growth from an emerging middle class are quite appealing. A number of U.S. and European insurers have been making acquisitions and/or forming ventures in Latin America, Southeast Asia and other emerging regions. Swiss Re’s acquisition of nearly 15% of SulAmérica S.A., the largest independent insurance group in Brazil, for $334 million is one example.4

A similar pattern is observed in the Asian market, particularly by Japanese insurers focusing on international expansion as they face a shrinking domestic market. The acquisitions in developed markets are also expected to increase their capabilities in longterm savings or pension products. Noteworthy deals include:

–– Dai-chi Life’s acquisition of U.S. based Protective life for $5.7 billion, one of the

largest deals in recent history. The Japanese insurer has stated that it will continue

to look for acquisition opportunities in the U.S.

–– Over the last seven years, Tokio Marine, Japan’s largest insurer by market capitalization, has spent over $15 billion acquiring life and non-life insurance companies in the U.S. Most recently, the insurer acquired HCC Insurance Holdings, an international specialty insurance group, for $7.5 billion. The insurer is also actively pursuing opportunities in other emerging markets, such as Brazil, Mexico, Thailand and Indonesia.1

–– Large Chinese and Korean organizations are also looking to acquire both life and non-life insurance companies in the more mature markets.

Gaining entry into new markets: With increasing competition in domestic markets, insurers are actively seeking entry into new and untapped markets.

To increase its presence in the U.K. market and respond to changes in pension legislation, Canada Life, a subsidiary of Great-West Lifeco, has made significant moves, including the acquisition of Equitable Life’s run-off business worth $1.7 billion and the purchase of Legal & General International (Ireland) Limited (LGII), a subsidiary of Legal & General Group Plc.

Another recent example is Athene’s purchase of Delta Lloyd’s German retirement and savings products business valued at over $5.1 billion in assets. This acquisition provides Athene with an entry point into the German marketplace.5,6

There is also continuing interest in a variety of emerging and under-penetrated markets within ASEAN, particularly in Indonesia where there is high interest because of the compounding potential benefit of growth in both population and per-person wealth. The other markets of interest include Malaysia and Thailand where changes in capital regimes, relatively low penetration, attractive demographics, and economics are driving M&A activity.7

Beyond just the traditional development options, insurers are also using alternative growth strategies, such as strategic alliances, for a few years or for a longer duration to achieve economies of scale and increase returns. This means of collaboration offers insurers the opportunity to tap into their partners’ resources, provide a more-diversified array of product offerings, and create a wider distribution channel.

Divesting non-core business

Since the financial crisis, several banks have been disposing of their insurance assets to improve balance sheets, repay loans given by governments during the bailout, and meet capital requirements. The financial crisis has forced banks to reassess their main business and dispose of any non-core businesses such as insurance, which is not seen as core to their future strategy. In March 2015, with the sale of 45.6 million shares or gross proceeds of $2 billion of Voya Financial, ING has exited the U.S. retirement, investment and insurance business after 40 years in the U.S. life insurance market. In Europe, ING is set to dispose of half of its insurance assets by the end of 2015 and the rest by the end of 2018.8,9

As a result of more stringent regulatory capital requirements, especially involving the need for higher capital, insurance companies are disposing of non-core and non-performing operations, often selling at cheaper prices. Divestitures are also driven by the desire to focus on core competencies. Buyers of the divested businesses are driven by the desire to raise their profiles in certain markets.1 Noteworthy examples include:

- In 2013, Hartford Financial sold its Retirement Plans business to MassMutual and its Individual Life Insurance business to Prudential Financial, Inc. for a cash ceding commission of $400 million and $615 million respectively. The insurer also divested its U.K. Variable Annuity Business, a part of its Talcott Resolution segment, to Berkshire Hathaway Inc. These transactions released significant excess capital and have fueled Hartford’s strategic goal of focusing on its core P&C insurance business.10

- CNA Financial Corporation sold 100% of the common stock of Continental Assurance

Company (CAC), an indirect, wholly owned life insurance subsidiary, to Wilton Re in Feb 2014. The transaction is expected to reduce CNA’s non-core Life & Group gross GAAP insurance reserves by $3.4 billion. This move is another example of insurers selling off their life subsidiaries to create a more focused P&C business.11 - As part of a three-year reorganization plan (ending Dec 2015) aimed at improving its financial performance, Generali has raised over $5.3 billion through asset sales, including the sale of its BSI Swiss private bank and its life reinsurance arm in the United States. The proceeds of planned disposals were used to secure capital, pay off debt and lower its higher-than-average borrowings. In addition, the group has succeeded in pushing its solvency ratio to 169%, 24 basis points higher than in January 2013, and changed its debt structure to optimize the structure of regulatory capital.12

Changing regulatory environment

As a consequence of globalization of markets and heightened concern for solvency, the insurance industry in recent years has experienced additional regulation. Since the onset of financial crisis, there has been a focus on reforming the regulatory environment. Major initiatives include the introduction of Solvency II in Europe, the Solvency Modernization Initiative (SMI) and the Dodd-Frank Act in the U.S., increased foreign direct investment in India, and C-ROSS and the creation of the Shanghai free trade zone in China, among others.

- Market consistent embedded value (MCEV), Solvency II and other market-value based frameworks put pressure on capital and increase volatility in earnings, which changes the perceived value of different businesses and in some instances, increases the amount of capital insurers and reinsurers are required to hold, all of which can lead to M&A activity.

- A good example of an insurer striving to meet Solvency II guidelines is Generali, the largest insurer in Italy. As previously mentioned, the insurer has engaged in a series of divestments to free up capital and improve its solvency ratio.

- Due to the proposed Basel III guidelines, capital invested in insurance subsidiaries is more restricted, resulting in banks divesting or downsizing their insurance businesses to raise capital (such as ING and HSBC).

- In advance of International Financial Reporting Standards (IFRS), European insurance and banking groups (with insurance operations) are reviewing how various assets/businesses will be treated and in some instances, as a consequence, have made decisions to divest.

- Other key regulatory issues, including Systemically Important Financial Institution (SIFI) designation, risk-based capital frameworks, principal-based reserving, and focus on consumer protection, governance and risk, could significantly affect how companies operate and engage in M&A.13

Reinsurers and Direct Company M&A

Reinsurers are involved in direct company M&A in various ways.

- Financing support

- Legal entity purchase

- Equity co-investment

1. Financing Support

Reinsurers often indirectly support direct company M&A by reinsuring the client’s existing business. The reinsurance ceding commission gives the client financial resources needed to pursue acquisition targets. Reinsurers can also support direct company M&A by reinsuring part of the target business. For example, when Philadelphia Financial Group, a leader in the high net worth insurance market, acquired Hartford Life Private Placement, RGA provided financing for the transaction. Scott Cochran, Executive Vice President, Global Acquisitions for RGA, commented: “RGA is fortunate to be able to support two important clients through our participation in this transaction. We look forward to both Philadelphia Financial and The Hartford benefiting from this arrangement.”

2. Legal Entity Purchase

Whereas direct companies tend to buy other direct companies for strategic reasons,

reinsurers are generally more interested in the financial value of the in-force business.

While strategic deals are often driven by the potential value of new business, financially motivated deals are all about deploying capital to support the in-force business as it runs off. Hence, the cost of capital is critical. Sometimes, our competitors use more leverage, have a lower cost of capital and as a result can offer a higher price to the seller. Nevertheless, we are able to win deals because RGA’s brand and relationships provide more certainty to close.

This was evident in RGA’s acquisition of Aurora National Life Assurance Company which closed in April 2015. Aurora represents the runoff business of the former Executive Life Insurance Company, whose 1991 insolvency sent shock waves through the industry. After rehabilitation, the block was ensnared in controversy that ended in litigation. Given Aurora’s history, regulators were highly involved in the process and R GA’s reputation and financial strength were important considerations beyond price. RGA leveraged our deep knowledge of the U.S. market while expanding our closed block capabilities.

3. Equity Co-Investment

The size of the life insurance run-off opportunity is huge. Instead of buying 100% of a company, we can participate in more diverse opportunities by holding smaller shares of each opportunity. Recently, the German regulator (Bafin) noted Cinven and Hannover Re’s partnership in acquiring Heidelberger Leben, Skandia Germany and Skandia Austria, and indicated that a pure private-equity vehicle without industry and market expertise would be problematic with transactions of this nature.

Of course, not buying 100% of a company generally means not having 100% control, so the key to a good co-investment opportunity is finding partne rs with similar views. In addition to private equity firms like Cinven, are there other partners that should be considered? To answer this question, it is instructive to study what happened in the P&C insurance space over the past ten years.

In August 2005, Hurricane Katrina created an opportunity for alternative capital in catastrophe insurance.

Initially, the hard market was dominated by hedge funds and private equity. Over time, mutual funds, pension plans and endowments entered the market seeking to diversify their holdings. This has resulted in a pool of capital with a longer investment horizon and lower return target.

In November 2014, Credit Suisse and ILS Investment Management closed a fund featuring longer tail P&C run-off business. They raised $576 million from pension plans, endowments and family offices.

If there are pension plans, endowments and family offices investing directly in longer tail P&C run-off business, one would think that there is also interest in investing directly in life business. Of course, given the complexity of life insurance products, expertise in selecting and managing risks is crucial. Equity co-investment gives RGA another tool to leverage our brand, relationships and expertise.

Future Outlook

Life and health insurance M&A transactions are expected to continue into H2 2015 and 2016 as insurers realize the need to create diversified businesses. As the market continues to remain competitive, challenging and over capitalized, insurers are under immense pressure to deliver underwriting profits. This, in turn, is expected to foster further activity in the M&A landscape.

Changing customer needs and demographic shifts (such as a burgeoning middle class with higher disposable income, and the growth of aging populations) are creating opportunities for insurance companies to expand.

Another emerging key driver is the investment in technology to improve sales, customer service and distribution efforts. Insurers are investing heavily in data analytics and predictive modeling techniques to deal with challenges in the insurance industry, i.e., fraud detection, policy retention, etc., and improve underwriting and risk management. To enhance distribution, insurers are investing in additional distribution outlets, digital platforms and enhancing support and back-office functionality.

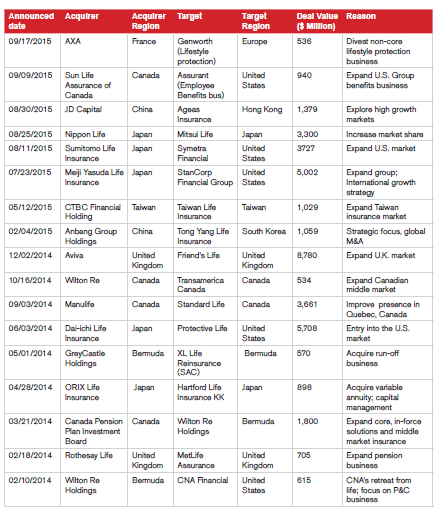

Appendix

Key Global L&H Transactions (referred in the Bulletin)

iii Does not include Aetna-Humana deal ($37 billion) and Anthem-Cigna deal ($54 billion) since these are under scrutiny by the Justice Department’s antitrust division.