Assessing claimants’ occupational duties is a part of managing disability claims, but the information collected on claim forms is often inadequate. Techniques to improve this are needed.

Executive summary

Understanding the information gap

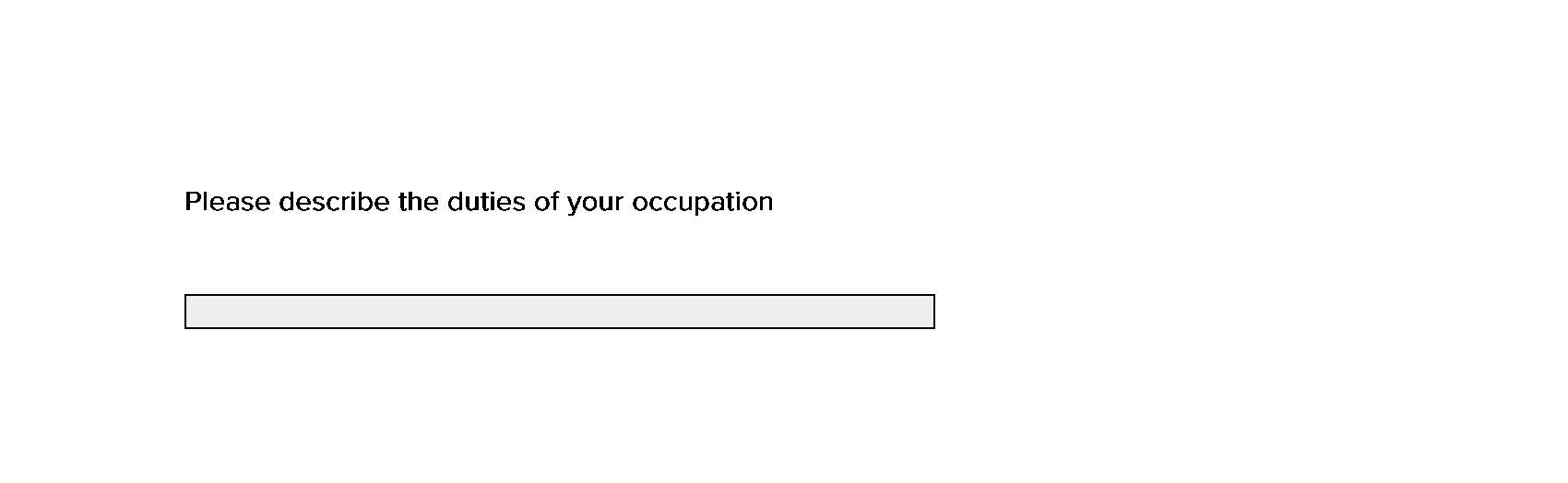

Forms typically ask claimants to record their occupational duties using open-format questions, such as “Please describe the duties of your occupation” followed by a free text input field. This gives little guidance to claimants on what information is required. To save effort, claimants give the minimum amount of information required, which is often insufficient, resulting in repeat requests for additional information. This can lead to delays in finalizing a claims decision.

Study design

In a large study of 8,000 people in key markets, we tested four versions of the occupational duties question:

- A typical free-text version

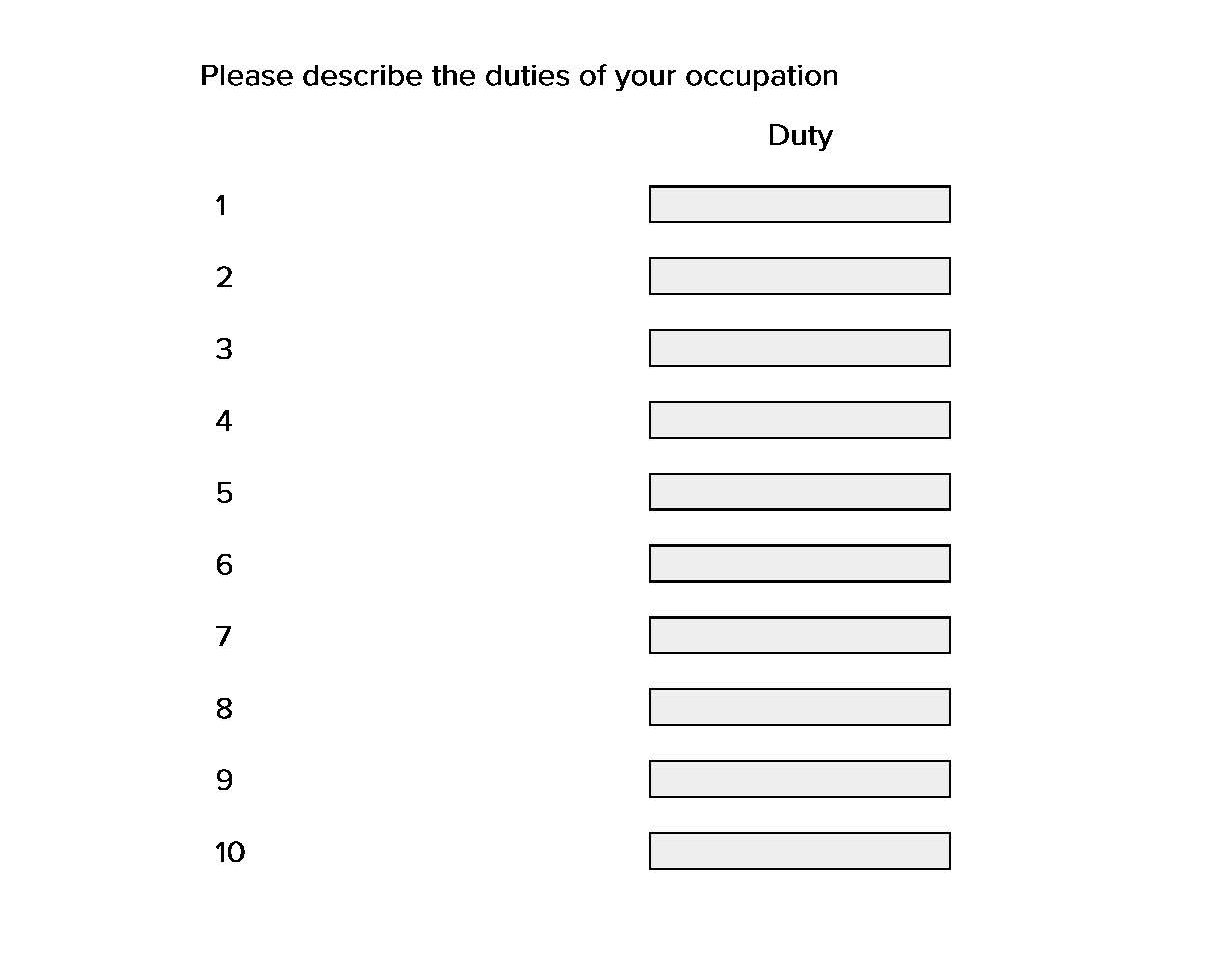

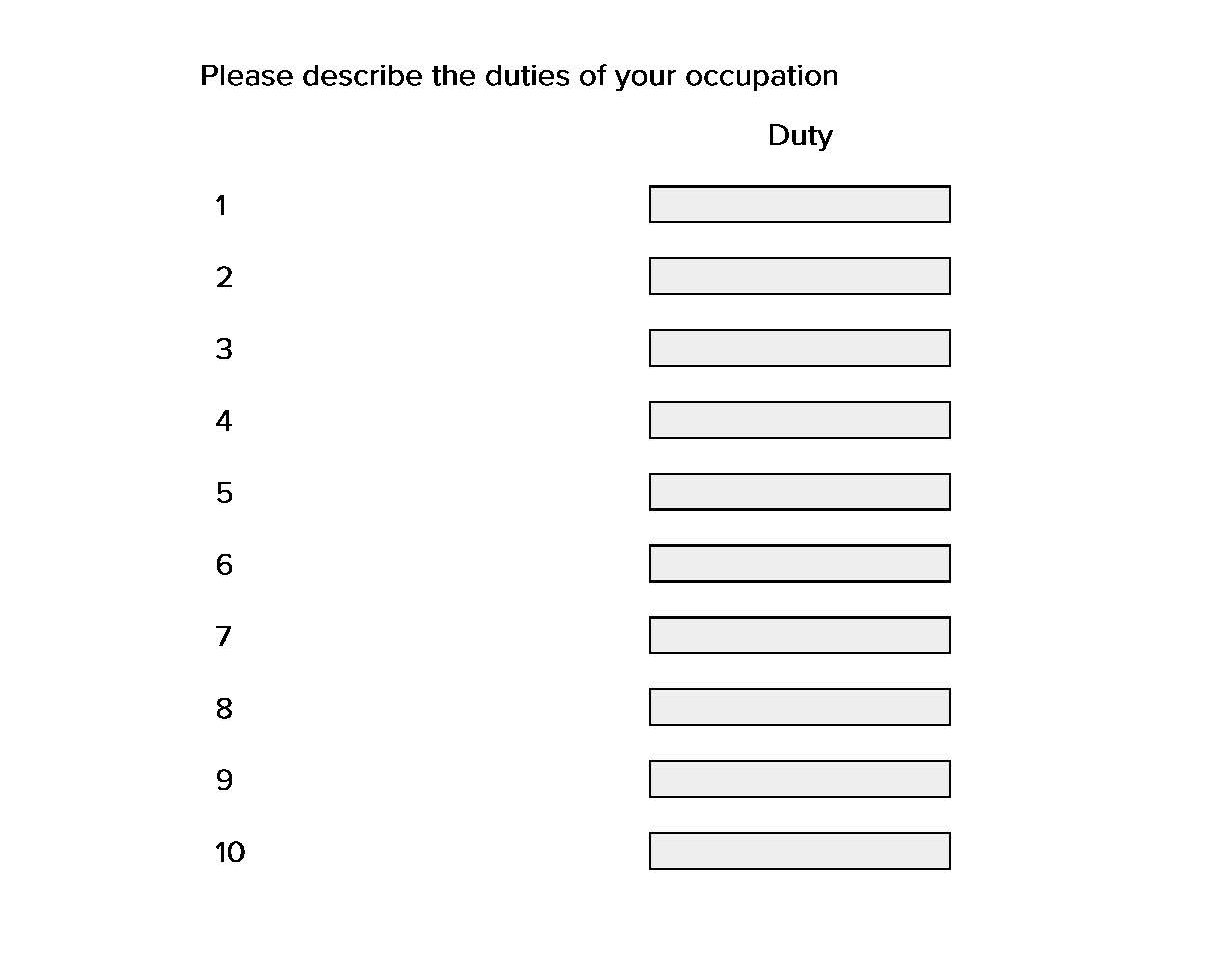

- A free text version that had 10 input fields to show respondents how much information was required

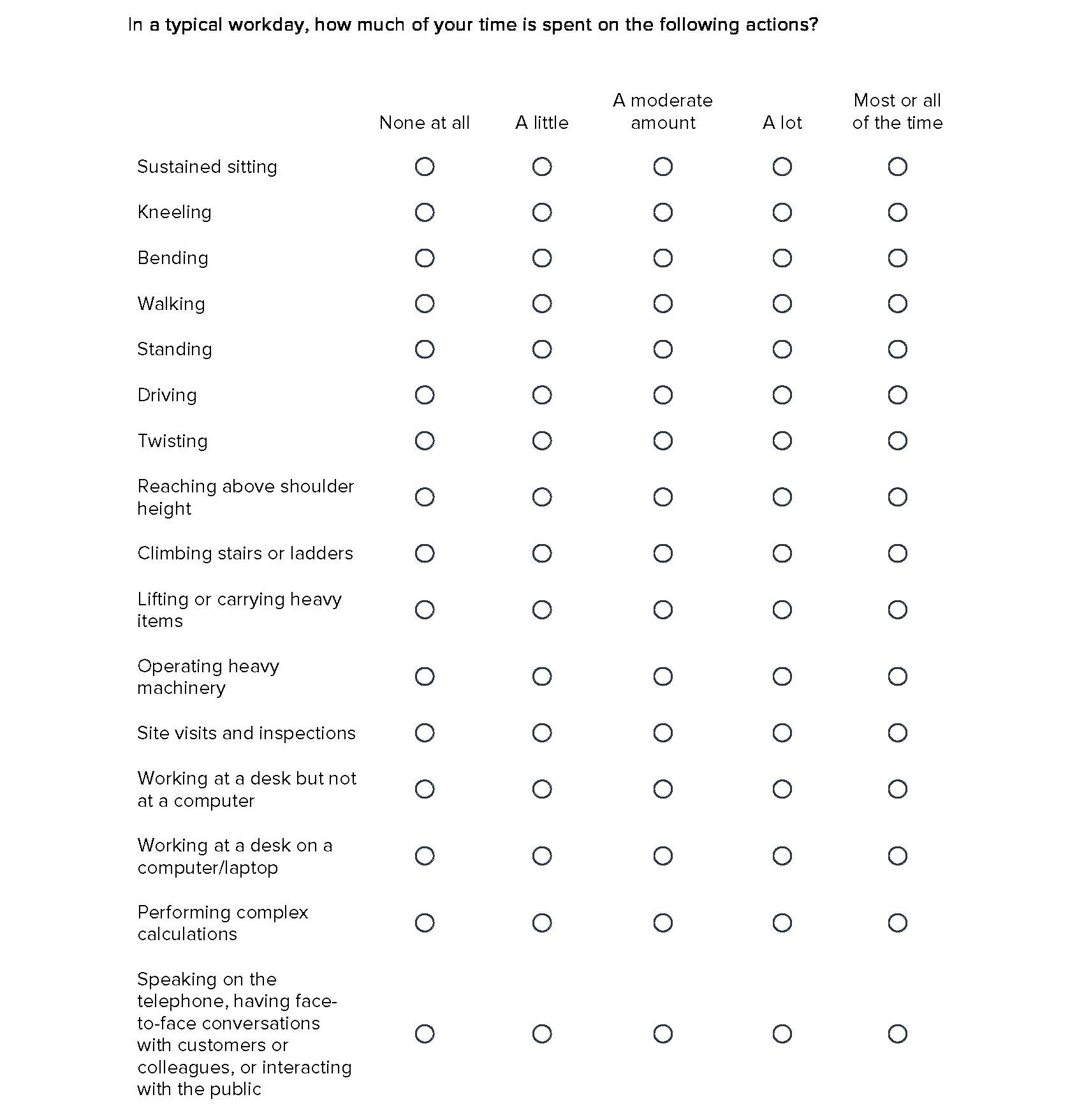

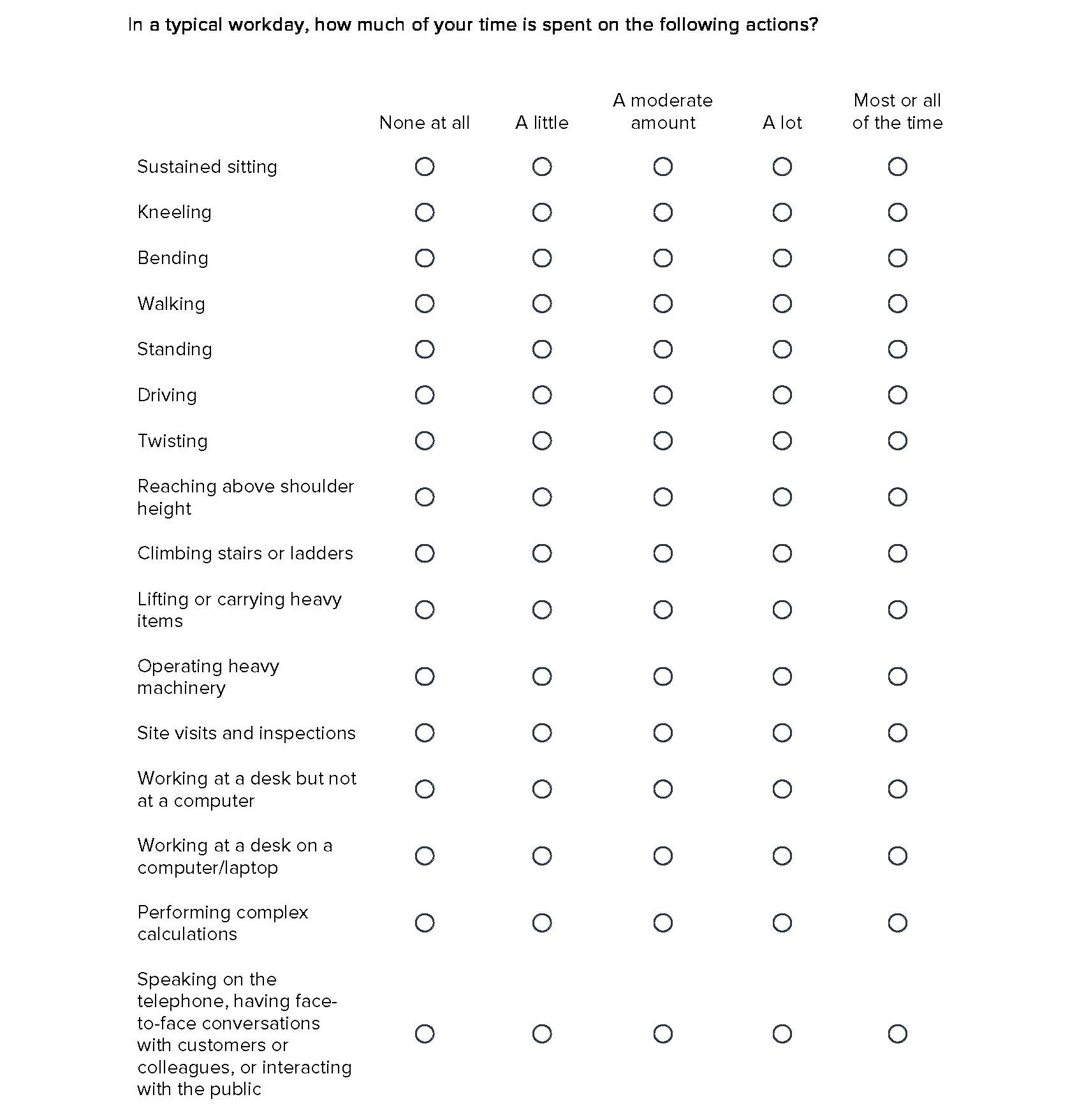

- A checklist with a full list of relevant duties requiring respondents to record the frequency of performing those duties on a scale from “None at all” to “All or most of the time”

- A condensed checklist, in which duties were grouped into relevant categories and the same frequency scale provided as with the full list

We measured respondents’ understanding and experience of answering the four question types and then asked claims assessors to rate the amount and quality of disclosures provided in the responses.

Key findings

- Checklist questions significantly improved the information provided and reduced the likelihood that a follow-up would be needed

- Respondents indicated that the checklist versions were significantly clearer and easier to answer

- Respondents noted they were less likely to leave details out to save time when using the checklists

- Respondents were more likely to perceive the checklist versions as quick to answer, even though they took slightly longer in reality

Conclusions

Including behavioral science-backed enhancements to the occupational duties question improved information quality and respondents’ experience. While free text questions appear simple at first glance, questions enhanced with checklists reduce the mental effort needed from claimants, which leads to better disclosures and customer experience. Disability claim forms could benefit from integrating these enhancements.

The information gap in disability claims assessments

Understanding a claimant’s occupational duties is essential for assessing claims, but often, the occupational information collected on claim forms is poor.

Here is a typical example, taken from a real claim form, of how claimants sometimes respond to occupational duties questions:

Q. What was your occupation at the time you became disabled?

A. General Practitioner

Q. What were the specific duties of your occupation and what percentage of time did you spend performing each duty?

A. General Practitioner – 100%

Such answers provide little useful information about the functional demands of a claimant’s occupation. It also guarantees time-consuming follow-up work, which can be painful for both claims assessors and claimants. More effective ways to capture the needed information by the claim form could improve efficiency and customer experience by reducing these follow-ups.

RGA research has already shown that utilizing behavioral science in the design of underwriting forms can significantly improve disclosure rates. But less is known about how behavioral science can improve claim forms, and with it, claims processes.

Why do claimants provide poor information?

To design more efficient occupational duties questions, insurers need to understand why claimants provide poor information. This involves exploring how claimants process the question to produce an answer.

The question “What are the duties of your occupation?” seems simple on the surface. Consider, however, the steps claimants have to take to think through and then present the answer.

The claimant would have to:

- Understand what is meant by “occupational duties”

- Remember the exact types of duties of their occupations

- Think about whether they consider those duties to be typical of their jobs

- Consider what is relevant for the insurer to know

- Categorize the duties in ways that are useful for the insurer

- Estimate how much time is spent on a given duty, making this sum to 100% if a percentage scale is requested

- Repeat these steps for each duty after recording a response, or remember the previous steps

The occupational duties question, as currently presented, does little to bring order to this underlying complexity. As a result, claimants are likely to avoid this mental effort and instead put in the minimum mental work required to complete the question.

Improving the question

We recently conducted an 8,000-person multi-region study to understand how the capture of occupational duties information in a claims form and the experience of the customer responding to that question can be improved.

To do this, we presented three alternative versions of the occupational duties question alongside the typical free-text question. Each variation had more specificity and required less mental processing from the respondent.

The typical free-text version of the occupational duties question presented was:

Variation 1 was also in free text but included 10 input boxes. This tactic is sometimes used by insurers to elicit more information from claimants. However, it does not help claimants or insurers to categorize the information.

Variation 2 presented a full checklist, which included the complete list of duties claims assessors need to consider. This format removed much of the claimant’s mental processing needs, from thinking through duties and categorizing them to deciding what items are relevant for the insurer to know.

The scale was based on how much time a claimant spends on a given duty, ranging from “none at all” to “most or all of the time”. This intentionally avoids using “percentage of time” as a metric, which forces claimants to make mathematical estimations or to make duties sum to 100% – which, in the case of duties completed simultaneously (such as “sitting” while completing “administrative tasks”), isn’t necessarily correct.

Variation 3 was also a checklist, but the format was condensed, with duties grouped into relevant categories.

Although the two checklist questions variations, with their greater specificity and smaller question components, did create lengthier questions overall, our hypothesis was that questions with more structure, even though longer, would be simpler to answer and more effective at producing useful information for claims assessors.

Testing the questions

We tested these four occupational duties questions on 8,000 study participants, comprising four nationally representative samples from Australia, Canada, South Africa, and the U.S. Participants were randomly assigned to complete one of the four question types as part of a lifestyle survey. They were then asked questions assessing their experiences answering the question they were given. We also measured their response time for the questions to determine to what extent changing the question type would increase (or decrease) the time claimants had to spend completing the form.

We then assessed the quality of the information collected by randomly selecting responses from each of the different versions and asking RGA’s claims experts to rate the value of the information provided.

We used statistical models to test whether the question type made a difference after considering factors such as demographics and the device used (e.g., desktop or mobile phone) to complete the questionnaire.

Results: information quality

First, we compared how claims assessors rated the quality of information provided by the different questions. Figure 1 shows a clear difference. The information was rated on a scale of 0 to 10, with 0 being “Not very useful” and 10 being “Very useful”.

Claims assessors rated the answers provided to the typical free text question as 2 on average for usefulness. In contrast, information generated by the condensed checklist (Variation 3) was rated 7.

Interestingly, claims assessors rated results from the condensed checklist (Variation 3) as more useful than those from the full checklist (Variation 2). This may be because it is a significant mental task for assessors to synthesize large amounts of information and make judgments. Hence, the smaller checklist may be just right for collecting more precise information from claimants while being more digestible for claims assessors.

Figure 1: Claims assessors' average ratings of the usefulness of information generated by the occupational duties questions:

We also asked claims assessors whether sufficient information was provided by responses to each of the questions. A similar pattern was seen here: more often, they said Variations 2 and 3 (the checklists) provided sufficient information, whereas the free text versions did not.

When we asked whether a follow-up phone call would be required to collect more information, 95% of the assessors strongly agreed the typical free text question would, and 74% of the assessors said the same for the condensed checklist. Hence, the checklists may also improve efficiency by reducing follow-up work.

Results: response time

Although the free text version of the question provided little useful information, it was the quickest for respondents to answer, taking an average of 18.5 seconds (Figure 2). This brevity may be because participants put in far less effort to answer it.

Of the three variations, the condensed checklist turned out to be the quickest to complete, averaging 35 seconds. Therefore, for an additional 16 seconds of completion time, claims teams could drastically improve the information they capture by utilizing a short checklist. The small increase in response time would likely be more than made up for in time savings later in the claims process generated by improved information capture.

Figure 2: Average time to complete each version of the occupational duties question (outliers removed)

Interestingly, we found that even though the checklists took longer than the typical free text question, more respondents perceived them as being quick to answer (54% strongly agreed) than the free text versions (45% strongly agreed). This is likely a side-effect of being easier to answer.