Few industries are as reliant on customer honesty as is life and health insurance

The use of new data sources to assess mortality and morbidity risk will undoubtedly change how we price and underwrite business in the future, but for now we are still quite dependent on applicant disclosures.

We would like to think people are completely honest and accurate when applying for insurance, but this is often not the case. This can lead to miscalculated and mispriced risk for insurers, and for consumers, it can mean higher average premiums and invalidated policies.

Fortunately, solutions exist that can reduce the disclosure gap. RGA’s Behavioral Science team has recently been conducting randomized control trials involving more than 20,000 individuals from 10 markets (Australia, Canada, France, Hong Kong, India, Malaysia, Singapore, South Africa, U.K., and U.S). The results highlight simple and practical steps insurers can take to improve disclosures and customer journeys.

Understanding Disclosure Gaps

Legendary advertising genius David Ogilvy once said: “Consumers don’t think how they feel. They don’t say what they think and they don’t do what they say.” Clearly, he understood disclosure gaps!

This sentiment applies quite easily to insurance applicants as well, as there is a consistent gap between what they say they have, are, and do, and what is indicated by population averages. Research by the medical testing and diagnostics company ExamOne, for example, shows that 18.2% of U.S. life insurance applicants fail to declare they are obese or morbidly obese,1 and 22.9% of applicants do not honestly disclose the extent of their tobacco usage.2

There are many reasons for disclosure gaps. Inaccuracy on behalf of the applicant may be intentional, driven by financial motives such as a desire to ensure coverage and reduce premiums, or by psychological motives such as the desire not to admit problematic things to oneself or others. Unintentional inaccuracy, also a factor, can be driven by not understanding the question or a lack of knowledge of one’s behaviors, but it can also be influenced by motives such as the applicant’s desire to use minimal mental effort when answering questions. Understanding these varied motives may enable our industry to address their effects.

Behavioral science has shown that the way a question is phrased and the context in which it is asked can significantly impact the accuracy of the responses it elicits. Over the past year, RGA’s Behavioral Science team has been conducting multiple trials and experiments to determine how best to design health questions in policy applications so that they elicit the most accurate responses.

In our latest research, participants – 2,000 from each of 10 markets – were asked to complete a healthy living survey. Participants were provided with a financial incentive to complete the survey, and to replicate the financial incentive that exists in the context of insurance policy applications to be less than completely honest, were told they would qualify for additional incentives if they were considered healthy.

We tested multiple versions of application questions in the following disclosure categories:

- Alcohol consumption

- Drug usage

- Tobacco usage

- Prior and existing medical conditions

- Family history of prior and existing medical conditions

- Height and weight

One version of each question, considered the control version, was based on current standard practice across the life insurance industry. To create control version questions, applications forms from 15 insurers were analyzed. The applications were for fully underwritten, simplified issue, and final expense products.

Respondents were presented with one randomly determined version of each question. Running the experiment as a randomized control trial meant relative disclosure rates could be compared in response to each version of each question. All results presented below were significant at the 99.9% confidence level (P<0.001).

Closing the Disclosure Gap

Past RGA research suggests there are three key principles for increasing the accuracy of applicant disclosures: Make it easier to be accurate, easier to be truthful, and harder to lie – that is, to make a false statement with the specific intent of deceiving. Our most recent experiment tested and proved simple yet effective ways to put these principles into practice.

Make it easier to be accurate: The key to making questions easier to answer accurately is to reduce the amount of mental processing and working memory required, known as “cognitive load,” needed to do so. In the drive to simplify applications by reducing the number of questions, insurers often combine multiple questions into one, thereby increasing the cognitive load required to answer each one. Applicants tend to want to answer questions quickly, and will often use mental shortcuts instead of giving full thought and time.

Ways to minimize cognitive load needs for applicants include:

- Using simple, everyday language – leave no room for confusion or ambiguity.

- Avoiding asking more than one thing in a question – numerous simple questions are easier to process than one long question.

- Prompting memory by listing possible answers – provide lists of common alcoholic drinks, drugs, medications, and other possible options.

- Avoiding free-text responses wherever possible – drop-down menus, scales, and other methods can provide for a range of responses.

Thus far, RGA’s behavioral science team research is showing that these methods work particularly well for questions on personal and family medical histories. For example, family history questions typically ask applicants to think simultaneously about each family member and all relevant medical conditions. We tested this standard format versus first asking how many siblings the applicant has and then asking them to go through the medical disclosure for each family member one by one. This approach increased the number of applicants from 51% to 62% who disclosed that at least one family member had at least one condition.

Importantly, this alternative question style had no significant impact on the time taken to complete the family history segment of the questionnaire. This emphasizes that fewer questions do not necessarily mean a simpler application process. An applicant will find it quicker to answer a questionnaire and to be more accurate when presented with a greater number of simpler questions.

Make it easier to be honest: Often people do not want to admit to their behaviors if there is shame or social stigma attached. They would rather shade the truth, or even be outright untruthful, than cause themselves psychological pain. Insurers therefore need to design questions in ways that let applicants feel comfortable that their behavior is acceptable and normal.

Ways to phrase questions that can normalize and destigmatize applicant answers include:

- Assuming the behavior exists – ask “when did you last...?” rather than “have you ever...?”

- Minimizing an applicant’s feeling of being at the extremes of acceptable norms – provide multiple answer options that are weighted towards extremes of behavior.

Questions with the most potential to elicit feelings of shame or stigma are those asking about alcohol, tobacco, drug use, and weight.

In the drive for simplicity, many insurers have moved to asking simple binary questions, such as: “Do you smoke? Yes/No.” “Do you drink more than 28 units a week? Yes/No.”

A problem with binary questions such as these is that they make the underwriting rule, and therefore the “wrong” answer, too obvious. In addition, they increase the psychological cost of being honest: For example, someone who smokes three cigarettes a day might not consider themselves a smoker, but having to tick the “smoker” box on their application means admitting to themselves that they are.

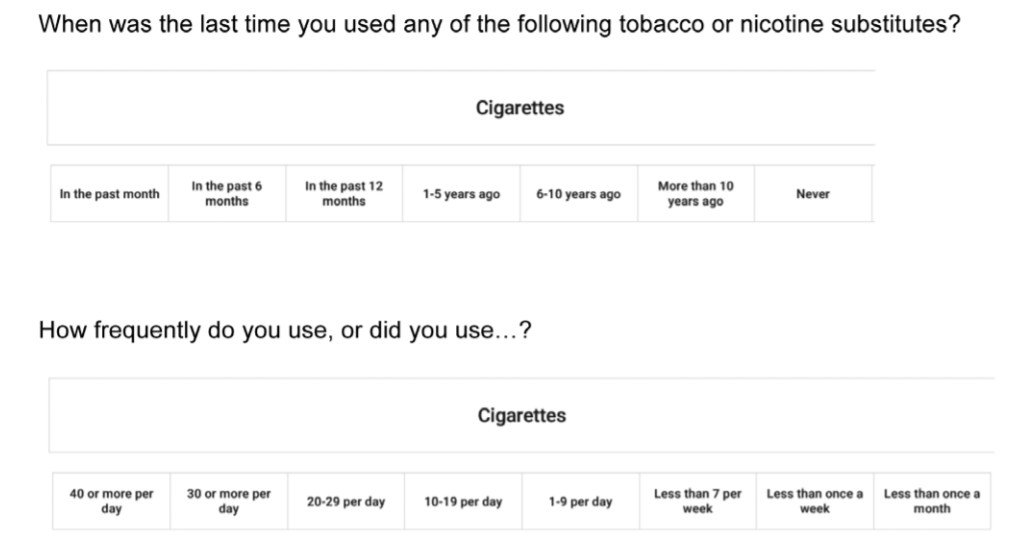

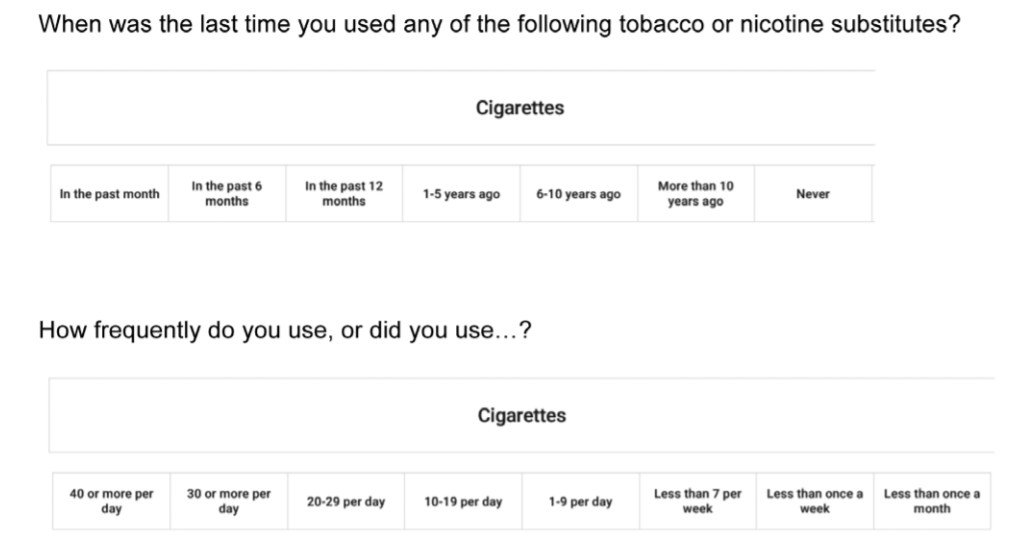

Figure 1 shows how we tested replacing standard binary “Have you ever used...?” style questions for tobacco and drugs with “When was the last time you used…?” questions. We then provided multiple answer options weighted towards most recent and most frequent usage. Applying these principles increased disclosure of tobacco use from 35% to 52%, disclosure of all drug use from 10% to 18%, and disclosure of marijuana use from 8% to 19%. This question format also had a particularly high impact on drug use disclosure in markets such as Hong Kong, Malaysia, and Singapore, where drugs laws are strictly enforced and where higher stigma is attached to their usage.

Figure 1:

Tobacco — Assume the behavior

We applied the same principles to the alcohol disclosure question but also tested additional changes. Figure 2 shows how to destigmatize high alcohol consumption. We provided high-value scales rather than free-text responses, which increased average disclosure rates from 3 to 8 drinks per week.

This question also shows how memory prompts were used to make it easier to be accurate. Disclosure was strongest when both techniques were used.

Make it harder to lie

No one is completely honest all the time. Most people tend to shade or stretch the truth, or even outright lie, up to the level that maintains their self- image as reasonably honest individuals. This is possible when it is easy to do so and easy to self- justify having done so.

Ways to make it harder to lie and let the applicant self-justify include:

- Not making the “wrong” answer obvious – avoid binary questions and clear cut-off points.

- Increasing the applicant’s sense that answers are being monitored (sentinel effect) and the salience of their decision to lie – ask for double-confirmation.

- Making lying more psychologically jarring by using language that triggers an emotional response.

Figure 2:

Alcohol — Normalize excessive behavior

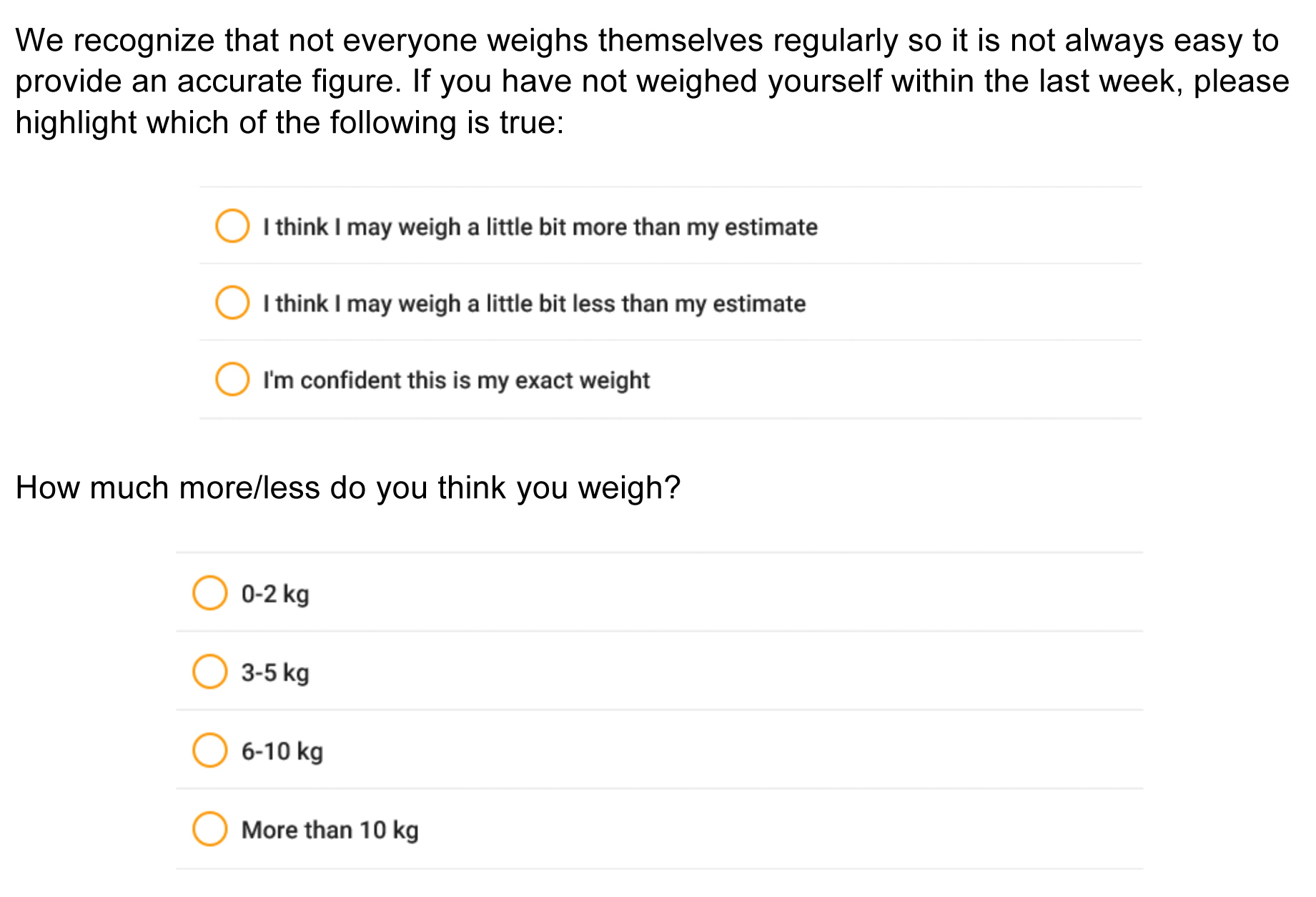

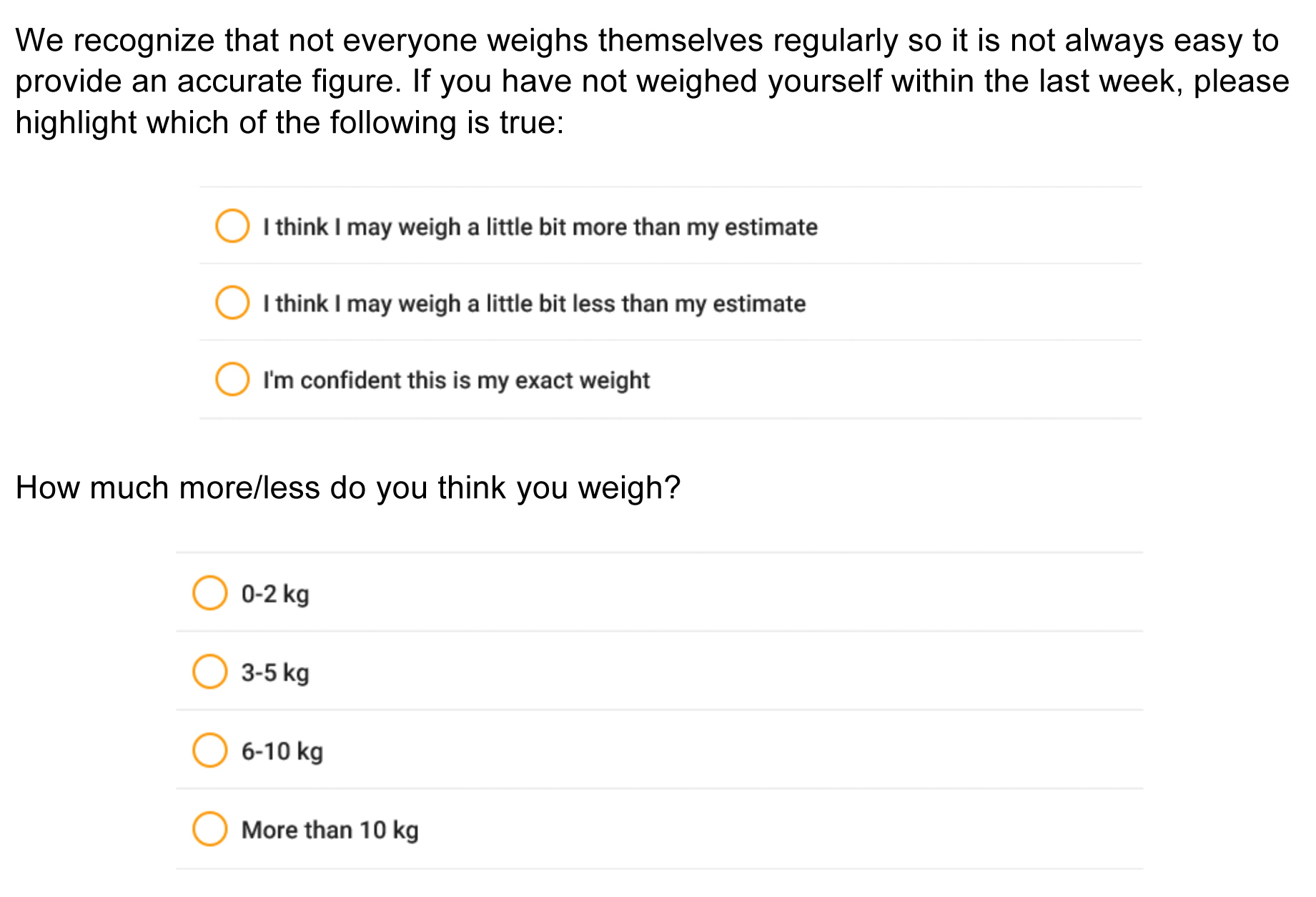

We tested the principle of asking for double-confirmation in the weight question and in asking for a commitment to honesty at the start of the survey.

Previous research has suggested that asking applicants to confirm they will answer a questionnaire honestly and accurately, usually by ticking a box, before answering questions can increase disclosure rates. We tested different versions of these so-called “honesty statements” subsequent disclosure by 5%.

One of the simplest questions might seem to be that of height and weight, but it has proven to be surprisingly difficult for many to answer accurately. Partly, it is a knowledge problem, as people generally do not measure or weigh themselves frequently. Many know or at least suspect that they weigh more or less than they should and are embarrassed to admit it, or think the chances of their inaccuracy being found out are small. Figure 3 shows the double-confirmation question that came after the initial height and weight question. It was designed to show empathy with the applicant and make untruthfulness more conspicuous, and so trigger the sentinel effect.

Figure 3: Weight — double confirmation

When asked this question, 31% of respondents disclosed that they likely weighed more than the answer they had just given and 16% indicated they likely weighed less. For those who weighed more, the average estimate of how much more they weighed increased the BMI value by 1.2.

Conclusion: Honesty is the Best Policy

This latest research shows that simple changes in the way application questions are phrased can increase disclosure significantly. This clearly has benefits for insurers and reinsurers, as more accurate responses can improve underwriting and pricing decisions. It also has clear benefits for the applicants themselves, as more accurate and personalized risk assessments can reduce premiums for those who may previously have found themselves categorized alongside poorer risks.

Over the next 12 months, RGA will continue to conduct research to determine the best ways to ask questions and structure an application form. It is clear that simply rephrasing questions so that is easier for applicants to respond accurately and honestly can make a significant difference. This is the low- hanging fruit that we can all easily reach. Unfortunately, these techniques are unlikely to change the behavior of those who are determined to misrepresent themselves. RGA is exploring other ways to address this problem.

In addition, we will focus not just on how a question is asked, but by whom. Our research to date has focused on direct-to-consumer application disclosures but often there is an intermediary in the process, and the role of the messenger can often outweigh that of the message. For example, a financial adviser could alter the impact of these strategies as insurers must rely on how these advisers communicate the questions. We are also testing the influence of different messengers and the relative merits of online, face-to-face, telephone, and artificial intelligence.

Better questions can also improve customer journeys, making it simpler and quicker to apply for cover. As our research has highlighted, creating questions that are easy to answer is more important than simply trying to decrease the number of questions. More and clearer questions can increase accuracy without increasing the time to answer. When it comes to cognitive load, sometimes less really is more.