Bancassurance – the distribution of insurance through bank channels – is a well-established and rapidly growing global business.

Over the past few years, life insurers throughout Europe, Asia and Latin America have spent huge sums to secure distribution agreements with major banks. That trend, in all likelihood, will continue.

Currently, the most successful bancassurance programs are the ones that focus almost exclusively on selling credit life insurance and savings-linked life insurance. Far fewer programs incorporate standalone protection products.

Many benefits, however, await bancassurers that market and sell standalone protection products. Chief among them are improved profits (due to the products’ higher new business margins), and for banks, stronger customer relationships and increased customer trust.

Based on our global research, bancassurers interested in launching standalone protection products, or strengthening their current offerings, should focus on five strategic work streams:

- Creating appropriate incentives for front-line sales staff in bank branches

- Proactively identifying suitable customer segments within the bank’s database

- Designing great offerings that will meet the needs of the segments

- Creating seamless advice and policy issuance processes

- Deeply integrating the operations of both bancassurance partners

By examining and implementing these work streams, bancassurers can properly manage the costs and execution risk of offering standalone protection, and strengthen their overall programs as well.

The Bancassurance Market

Bancassurance continues to be an attractive strategic option for life insurance companies seeking to quickly maximize their distribution scale. A bank’s customer base, and the strong relationships banks traditionally have with their customers, can provide sizable pools of potential buyers for life insurance products.

Life insurers around the world are spending substantial sums to secure exclusive and non-exclusive multi-year distribution arrangements with large retail banks. In one headline-grabbing 2013 deal, Hong Kong-based AIA reportedly paid Citibank $800 million upfront as part of $4 billion deal for the exclusive rights to distribute life insurance products for 15 years throughout Citibank’s Asian and Pacific branch network. Many smaller and local bank-insurer partnerships are also being formed. A few years ago, the Spanish insurer MAPFRE agreed to develop a range of insurance and pension products with a local Spanish savings bank, Caixa Catalunya. The deal, worth €445 million, was at the time the third largest bancassurance deal in Spain’s history.

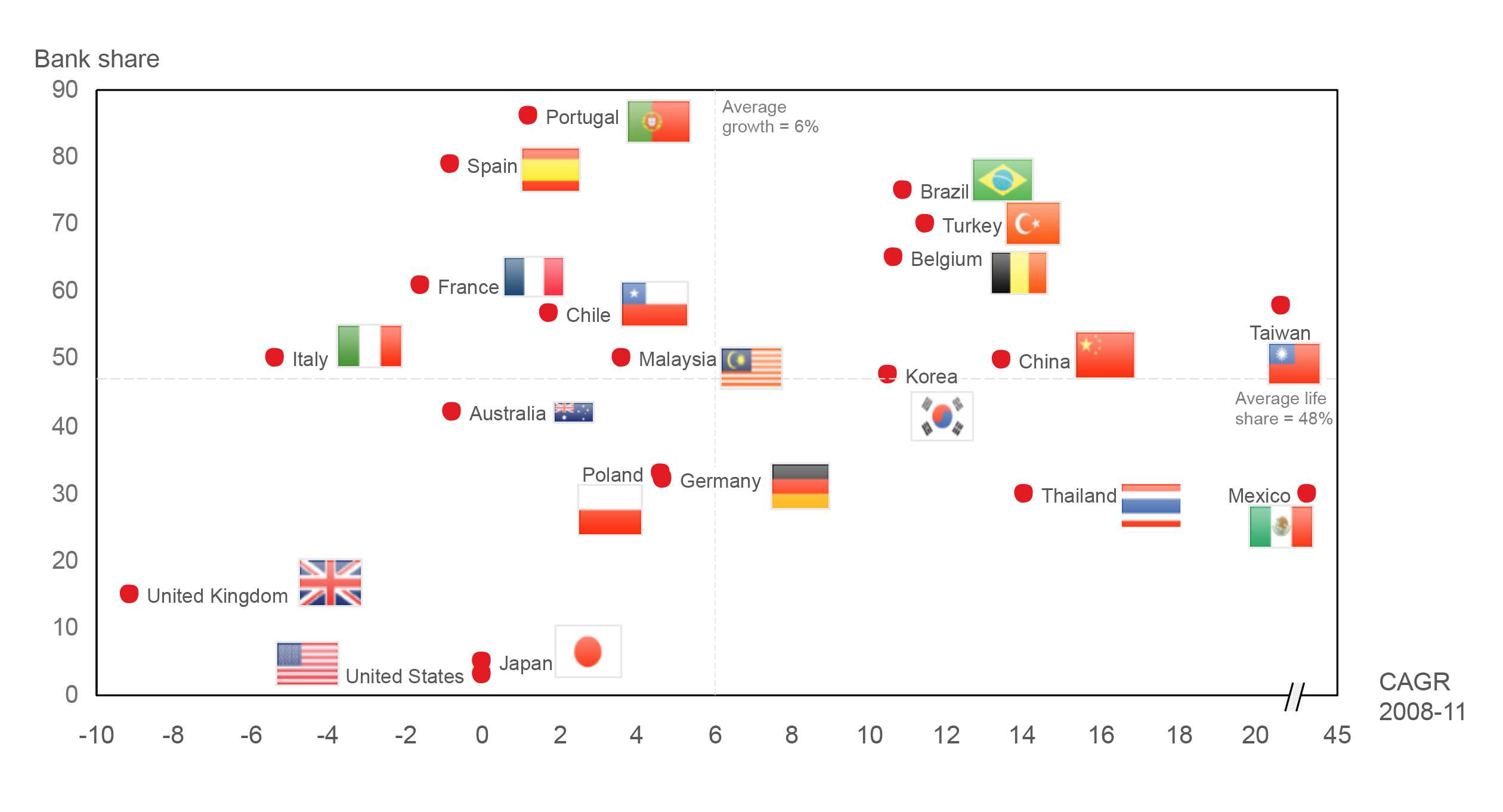

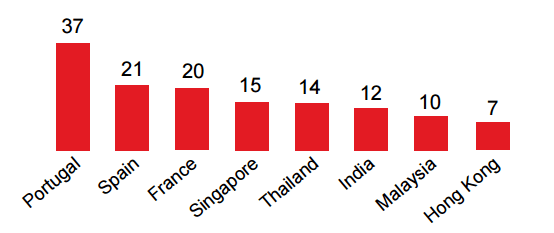

Today, the bancassurance market is both extensive and respectable. As Figure 1 shows, in several countries around the world, banks distribute nearly half of all life insurance premium. The channel is also growing quite fast: on average, insurers’ premium through bancassurance grew by 6% during the three-year period ending in 2011 (the latest year for which credible figures are widely available) – nearly four times faster than comparable general growth rates for life insurance sales in many of the world’s markets.

Bancassurance Product Types

Banks currently distribute four main types of life insurance products:

Savings products: Unit-linked insurance plans or participating endowments, where the main policyholder benefit is the cash surrender value accumulated. The protection component is minimal.

Credit protection products: Insurance products bundled with bank loans or credit cards that are specifically designed to pay the customer’s liability (e.g. mortgage) in the event of his or her death. These products typically have little or no cash surrender value.

Non-retail products: These products target the needs of a bank’s commercial clients (e.g., small to medium enterprises or business owners). Examples of non-retail products include key person and group life coverage. These products are often sold with commercial banking solutions such as cash management or revolving capital loans.

Standalone protection products: These products provide protection to beneficiaries in the event of a policyholder’s illness or death, and are frequently presented to customers as part of a comprehensive needs-based financial plan. Examples include term life, whole life and living benefits (long-term care, critical illness) insurance.

Protection products are still seeking a foothold in bancassurance. The majority of programs currently focus on distributing savings and credit insurance products. Penetration rates for standalone products range on average from 2% to 15% – far below the penetration rates for core banking products such as wealth management, credit cards or secured loans.

Standalone Protection Penetration, Advantages

Although standalone protection products represent just a small percentage of current total bancassurance premium worldwide, they offer strong growth potential for bancassurers.

In Spain, for example – one of the largest bancassurance markets in the world – insurers derive approximately 80% of all life premiums from bancassurance. However, only about 25% of that amount comes from standalone protection. South Korean insurers derive approximately 50% of life premium from bancassurance, and only about 40% of that from protection products. The most dramatic example can be found in the United Kingdom. Due to regulatory changes, bancassurance premium has dropped to about 15% of the general market, and just one percent of all bancassurance premium comes from standalone protection.

In a bancassurance program, standalone products can:

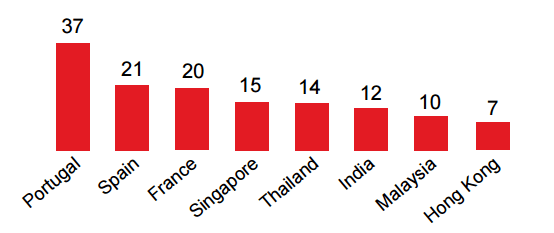

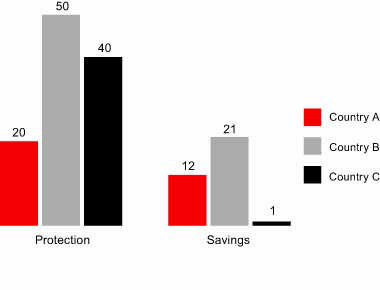

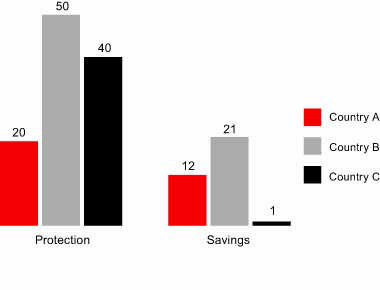

- Improve profit margins: As Figure 2 (below) indicates, new business margins for standalone protection in nearly every market worldwide are significantly higher than those for savings products.

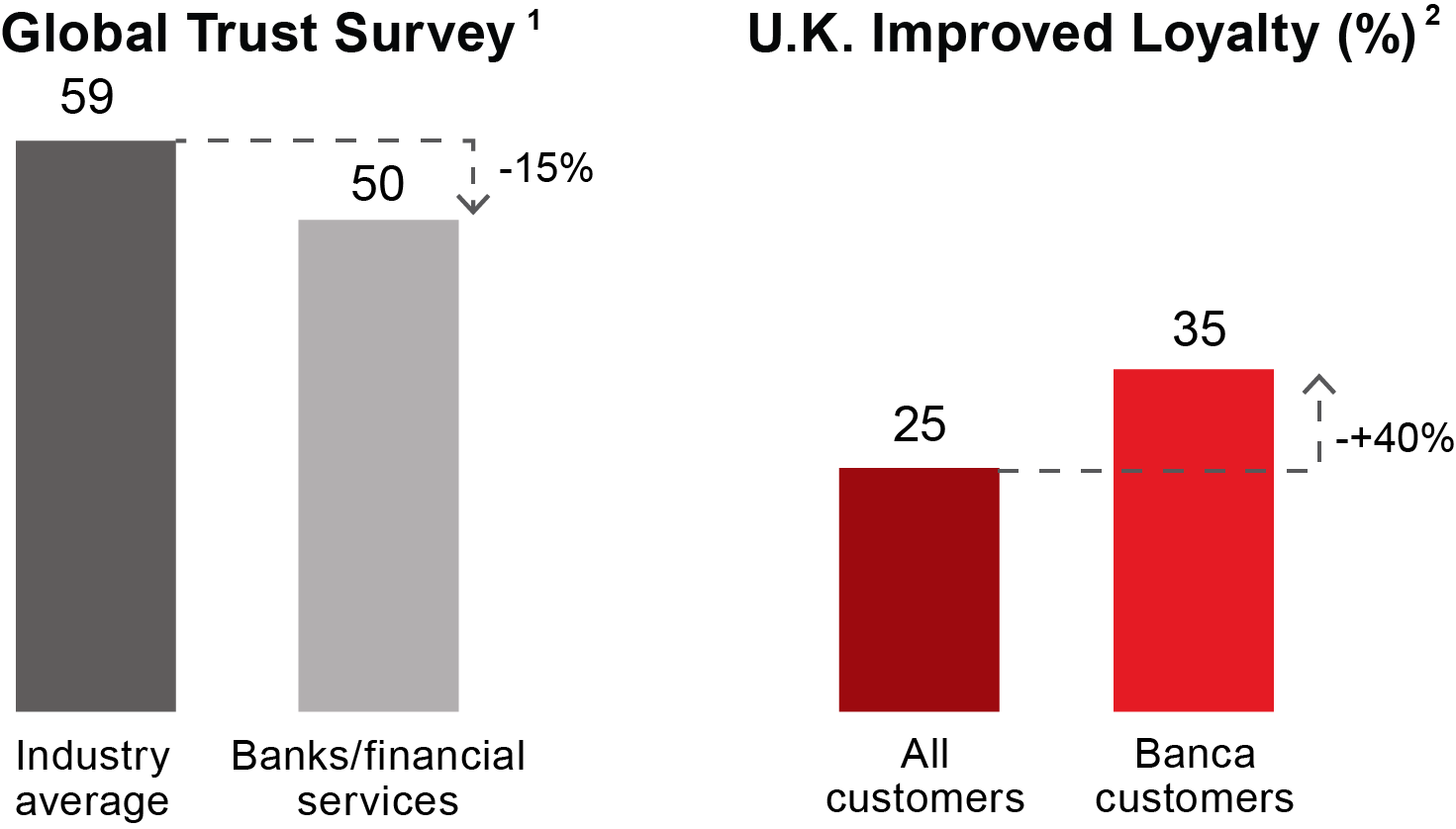

- Improve consumer trust: Global surveys (see Figure 3, next page) have shown that consumer trust in banking and financial institutions lags trust of other businesses by about 15%. Offering life insurance, however, can improve bank customer loyalty: approximately 35% of U.K. bancassurance customers have been shown to be willing to pay more for personalized assistance, and are more likely to be repeat purchasers of financial products (including insurance) from their banks.

- Strengthen long-term risk profiles: Mortality and morbidity protection products are not correlated with investment, macroeconomic or other forms of market risk, which minimizes balance sheet risk. Additionally, protection products, unlike deposit replacement products, do not risk cannibalizing customer assets.

- Improve scale and efficiency: Bancassurance programs can provide insurers with a launch platform for new products that enables manufacturing scale to be achieved far more quickly than if launched through traditional distribution channels.

Figure 2:

Life bancassurance penetration (%)1

1. Market estimates based on life bancassurance policies / bank clients

Source: Milliman, RGA

Figure 3:

Average Value of New Business Margins (%)

Source: RGA

1. Edelman 2013 Trust Barometer

2. RGA, Edelman, Accenture, regulatory filings

Enhancing a bancassurance program to incorporate or expand standalone protection solutions can also present risks. Execution risk and higher financials costs are the largest risks, given the difficulties penetrating the bank’s customer base. The main causes of these risks are lack of access to the bank’s customer database, suboptimal lead generation, and the potential for non-needs-based advice (which can, in extreme cases, result in mis-selling).

If these risks are not managed properly, the end results can be poor sales, poor persistency, poor claims experience, regulatory sanctions, poor publicity and high acquisition costs.

Optimizing Standalone Protection Product Distribution

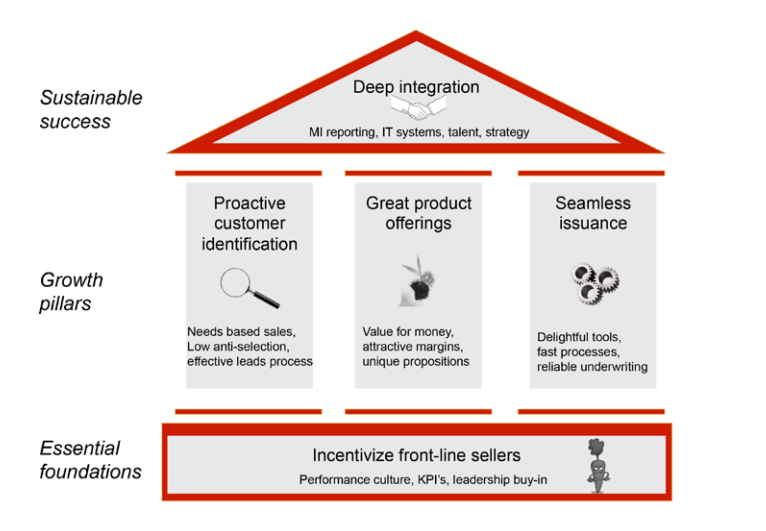

In our experience, we have found five elements that can be organized into work streams to optimize standalone protection product distribution. These elements, pictured below in Figure 5, can form a strong structure from which to launch a bancassurance program with standalone protection products, to introduce standalone solutions to an existing partnership, or to improve the success of an existing standalone protection program.

At the structure’s foundation is the creation and development of appropriate sales incentives for the bank’s in-branch sales people. The right incentives will spur the development of a well-integrated bancassurance performance culture that includes executives, in-branch sales people, and those responsible for the program’s operations.

The three pillars supported by the foundation are:

- Proactively identifying suitable customers in the bank’s captive database,

- Designing great offerings for these customers, and

- Creating seamless advice and policy issuance processes.

The roof of the structure, supported by the pillars, is the leveraging of the performance culture to achieve deep operational integration for both partners – the insurer and the bank.

Figure 5:

Framework for bancassurance protection

Pillar One: Proactively identifying suitable customers

For life insurers, banks’ extensive captive customer bases are a primary attraction. Optimizing penetration of these bases means developing effective, proactive ways to identify warm leads (i.e., customers with the highest suitability for standalone protection products).

Sifting through the many thousands (sometimes even millions) of customers in a typical retail bank’s database can be a daunting task, frequently complicated by each customer’s unique wealth, protection and biometric risk profiles. Ensuring proper consents have been obtained in order to use personal information for this purpose is also vital. For insurers, the key to optimizing penetration of their bank partner’s customer base is proactively identifying those individuals with the highest propensity to buy the products offered and the lowest propensity to file claims.

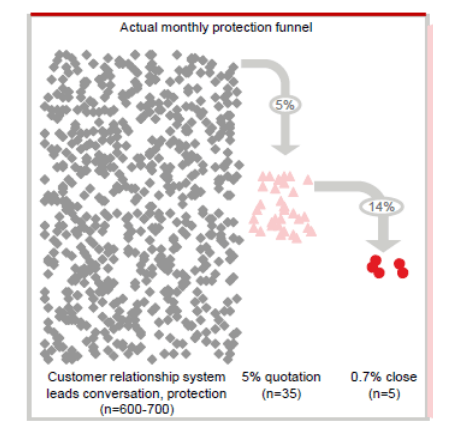

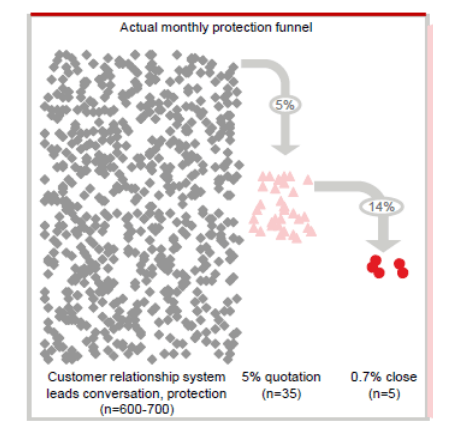

At a South East Asian bancassurer, protection conversations focused on the entire high-net-worth customer cohort, resulting in a conversion rate of only 0.7%. When the insurance partner specifically identified and then focused on the bank’s affluent and mass affluent customer cohorts, the conversion rate tripled.

Figure 6:

Bank’s average lead conversion funnel

Source: RGA

Many tools, from predictive models to customer outreach campaigns, are available to insurers to determine suitable protection product customers. These customers can then be targeted for specific solutions that would most likely meet current and projected risks and needs. In some situations, customers can be pre-underwritten, which can reduce acquisition costs and minimize the sales pipeline leakage that occurs during traditional underwriting.

Pillar Two: Designing great offerings for bank customers

Protection products have the highest probability of resonating with in-branch sellers and bank customers if they can effectively meet the customers’ real needs. Great protection products should be transparent, provide high value for the premium spend, and have a unique sales story compared to other banking products.

Combination protection products such as term or whole life products with a living benefit either built in or available as an acceleration rider can give in-branch salespeople simpler ways to discuss tangible consumer needs.

Done properly, bundling or combining protection solutions can greatly improve a program’s prospects. An Australian bancassurer, for example, provided a flexible ownership structure for simple protection plans and bundled it with superannuation contributions, resulting in sales that largely exceeded expectations. In another example, a Spanish bancassurer bundled its bank’s pension plans to its insurance partner’s risk products and discounted the packages. It recently sold approximately 200,000 policies in two months.

Banks and insurers can also collaborate to develop simplified protection solutions for complex risks such as long-term care and critical illness. In-branch salespeople can sell these products effectively as long as the sales message is easy for sellers to deliver and for customers to understand. Most in-branch insurance sellers tend to only sell savings and deposit replacement insurance products, as they are easier to understand. A few simple, well-crafted stories can help address the value of mortality and living benefits products and enable strong protection sales.

An example of how this can work comes from a leading French bancassurer, which sought to sell a fully-underwritten long-term care product. A strategy was instituted where in-branch salespeople were provided with simple sales stories. The program recently sold 30,000 fully-underwritten long-term care policies in three months.

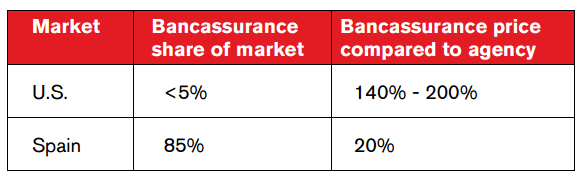

To maximize a bancassurance program’s success with standalone protection, the product must offer real value in terms of benefit for the premium paid. The product also needs to have sufficient equivalency to what is available to customers from other distribution channels. As the table below illustrates, taken to the two extremes, there is a strong correlation between market share and the amount paid for coverage through banks or through agents.

Figure 7:

Correlation between market share and seller premium

Pillar Three: Creating seamless advice and policy-issuance processes

To improve the penetration of protection products, several components are needed. Two of the most important are: improving straight-through processing rates; and reducing policy issuance timelines.

Electronic underwriting systems can provide in-branch sellers with comfort that their efforts can result in fast, transparent and reliable decisions. Furthermore, integrating protection solutions into the core banking system’s product portfolios can drive significant penetration.

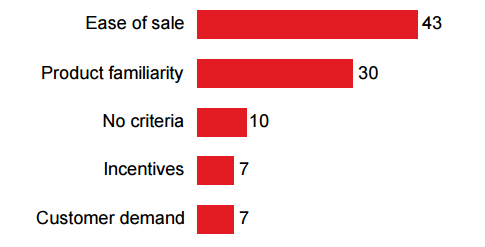

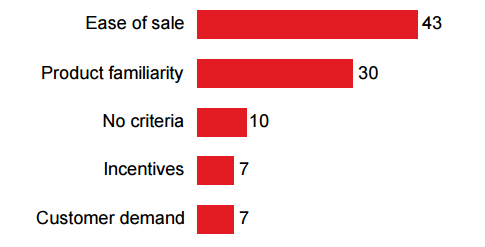

RGA’s bancassurance surveys in South Africa have consistently found that most protection products sold by that country’s bancassurers are issued with simple binary underwriting decisions (i.e., accept or reject), negating the need for loadings or follow-up requirements. Additionally, in-branch salespeople at a leading Thai bancassurer have been found to identify “ease of sales process” as the highest non-KPI criterion driving volume in its bancassurance program.

In bancassurance partnerships, protection products and processes also need to be benchmarked in terms of simplicity and efficiency against other core banking products such as credit cards and investments. If the benefits of standalone protection insurance products are more difficult to explain and sell than a credit card or a loan, there will be lower traction with the in-branch sales staff, resulting in less penetration.

Figure 8: Non-KPI criteria for bancassurance sales (%)1

1. Sales staff interviews on ability to sell life insurance, South East Asia market n=105

Source: RGA

Crowning the structure: Deep operational integration

For sustainable success, both bancassurance program partners must commit to a deep level of integration. Executives from both institutions must truly be equals within the partnership, and must be involved in every aspect of the program: implementing shared IT systems; selling and supporting sales, marketing and underwriting processes; and developing effective management information (MI) reporting. Operational integration means having seamless technological interfaces that make all bancassurance workflows, including forms, applications and underwriting, electronically available through the bank’s core IT systems. This enables in-branch sellers to maximize their insurance familiarity while minimizing low-value training and ad-hoc paper processes.

Deep integration also means minimizing the cultural differences between insurance and bank sales and support personnel. To do this, effective sales strategies for in-branch salespeople must be developed and implemented, and the underwriting and sales talent that work hand-in-hand on each case must be appropriately rewarded.

MI reports on sales, targets and achievements should be expressed in banking language. Sales, for example, should be measured in fee income rather than annual premium equivalent (APE). In addition, MI reports should track progress in ways that mesh with how banks are structured (i.e., retail versus wholesale, product versus geographic).

A joint bancassurance program in which both partners have equity can provide a high level of integration for bank and insurance participants, systems and practices, if governance and financing principles are in accord. Exclusive multi-year distribution agreements have also successfully produced healthy long-term partnerships.

Enhancements

Offering customers greater simplicity and tangibility in how they purchase insurance can substantially enhance bank penetration of protection products. As digital banks emerge and with them a renewed focus on enhancing the customer journey, bancassurance partnerships must continue to look the future. Potential sales process enhancements could include self-service kiosks at branches, enabling consumers to undertake protection needs assessments at their own leisure.

Focusing on developing protection products as well as services that can achieve deeper integration with a bank’s underserved customers can also enhance an insurer’s bank database penetration. For example, a protection offering that targets a bank’s pre-paid consumer segment can increase customer participation.

Point-of-sale processes that incorporate the automatic generation of pre-underwritten protection scenarios can also improve sales. One U.K. bancassurer, for example, introduced a three-question tele-underwriting interview for in-branch customers. This shortened interview (the original had 42 questions) enabled underwriting time to shrink from seven weeks to seven minutes, the case pipeline to drop from 15,000 to 4,500, cancellations to reduce from 10% to 9%, the “not take-up” rate to fall from 30% to 16%, and non-disclosure rates to contract from 25% to 3.8%. With customers accepting the underwriting decision from the three questions 86% of the time, the insurer’s medical underwriting budget also shrank, from £3.5 million to £2 million. Claims experience improved as well due to lower rates of non-disclosure: customers, it turned out, were less likely to make false statements when talking directly to a person than when filling out a form.

Deploying e-solutions that increase straight-through processing and speed up underwriting can also reduce costs and improve consistency, ultimately improving the bancassurance partnerships’ value. One bancassurance partnership launched a limited e-underwriting program, and increased new life and disability policy submissions by 73% (5,000 to 45,000) over a four-year period.

The Right Support Partner

Partnering with a reinsurance company experienced in bancassurance can further maximize insurance companies’ ability to penetrate their retail bank partners’ customers.

An experienced reinsurance partner can help bancassurance programs design customer identification models, customize and optimize products, and deploy automated e-underwriting solutions to improve the issuance process. A strong, experienced reinsurance partner can also share the risk in new products, best practices and research. In addition, a reinsurer can optimize bancassurance programs with its experience in innovative financial and insurance risk solutions as well as standalone protection products.