Bancassurance is a dominant global distribution channel for life insurance sales, projected to grow in key markets at a rate four times that of general life insurance salesi

From 2011 through 2017, bancassurance surpassed all other channels in insurance premium growth for both life and non-life products – with a recorded compound annual growth rate (CAGR) of 5.8%. Since then, life products have continued to grow (6% CAGR over the same period)i, even as non-life product growth has decelerated.

In support of client initiatives and growth, RGA conducts market surveys globally and in specific markets, and often draws on analysis from public and secondary sources. One central finding: Many of the forces driving this expansion are familiar:

- Aging populations seeking health, life, and retirement and/or family estate planning products

- Economic expansion offering increased access to large customer retail bases

- Rising use of internet-based and mobile devices, which directly influence consumer behaviors and purchasing patterns

Yet a more fundamental force may also be at work. International insurers, in particular, are seizing growth opportunities via the bancassurance channel as a means to rapidly increase market reach, expand the industry’s consumer base, and respond to a persistently low interest rate environment.

A Structural Advantage

Insurance products being sold through the bancassurance channel are often closely related to other financial products, and banking institutions with access to clients’ personal financial data can apply this insight to product design. Life policies with built-in cash value as an alternative investment with tax benefits can readily complement other customized financial products. Banks also receive a higher return on equity for bancassurance products.

These advantages are only magnified when bancassurers forge exclusive, longer-term distribution agreements, which tend to generate substantially more revenue than less definitive deals.

The Rising Price of Partnership

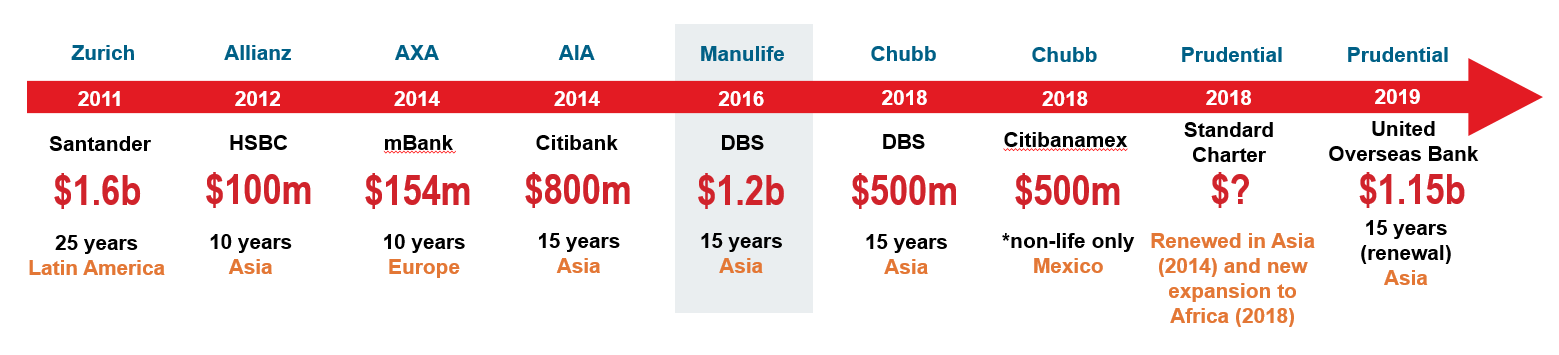

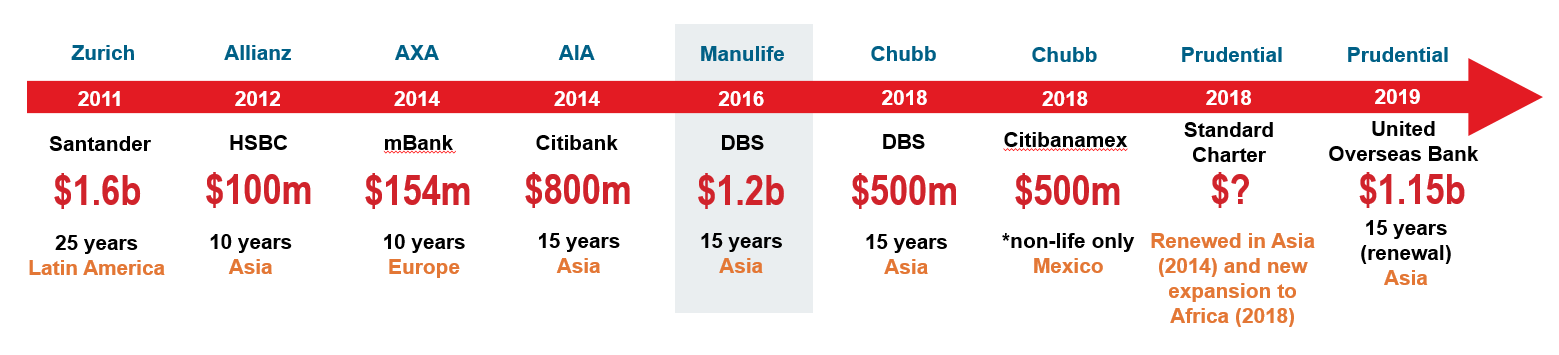

Intense competition among international insurance groups for exclusive bancassurance partnerships has contributed to rising costs (see Figure 1). Asian markets offer a convincing case study: The concentration of high-cost agreements throughout the Asia-Pacific region can be attributed to the lure of large existing retail, wealth management, and small-to-medium enterprise banking customer populations, including millions of mobile banking consumers.

Figure 1:

The Rising Cost of Exclusive Agreement

Source: RGA analysis of public records.

Latin America Leads for Bancassurance Growth

However in recent years the greatest potential for bancassurance has emerged far from Asia. Between 2011 and 2017, Latin America reported 12% premium growth, outpacing other regions. The growth in Latin America can be attributed to several regional drivers that include:

- Growing middle class populations

- Increased economic growth for the last two decades resulting in increased disposable income, and enhanced appetite and buying power for insurance products

- Banks focusing on insurance as a key source of profits

- Favorable consumer tax laws

- Financial deregulation

It is worth noting that bancassurance is one of the lowest-cost product development models. RGA forecasts that other distribution channels could diminish significantly, partly driven by increased costs and capital requirements. An established bank is often in an enviable position to navigate regulatory shifts and reduce cost-to-market.

A Shift Toward Digitization

Digitization also appears to be driving much of bancassurance’s growth for both life and non-life products across the Asia-Pacific region. In Asia, bancassurance premiums grew 9.2% between 2011 and 2017, the second strongest global performance after Latin America with two-thirds of that growth being attributed to China.

Indeed, the need for digital strategy development appears to be growing more urgent. Online banking and related technologies have reduced the number of consumer transactions in bank branches. This trend has serious implications for the traditional bancassurance sales model, which has been heavily reliant on face-to-face interactions in the branch or telesales marketing.

The percentage of consumers citing digital banking tools as the primary factor for choosing a bank is increasing year-over-year, as the percentage citing "convenient bank locations" is declining – and this is happening at every level of incomeii. Initially, millennials were targeted as the primary demographic for digital banking, but now additional consumer age groups are demanding simple, seamless digital experiences. A growing number of banks are offering digital channels for an improved customer experience, and many are shifting to end-to-end digital delivery. As a result, in some markets bank branches are closing due diminishing client visits. This disruption directly impacts insurance sales and the need to implement digital strategies as part of an omni-channel bancassurance model. In the U.S., the big banks – J.P. Morgan, Wells Fargo, and Bank of America – have shut approximately 1,915 branches between 2014 and 2018. South Africa-based Standard Bank announced the closure of 91 branches in 2019 due to the shift in customer behavior.iii

Millennials – defined as individuals born between 1981-1996 – are a generation of digitally savvy and socially conscious consumers accounting for 31% of the global population.The largest populations are in China, the U.S., Germany, and Japan. Research suggests millennials are delaying key life events longer and demanding a different type of customer experience, particularly for purchases such as life and health insuranceiv. Traditional branding, with its intensive focus on marketing and a dependence on established long-term relationships, has proven less effective in influencing the group’s purchasing decisions. Instead, millennials are primarily influenced by peer endorsements and overall experiences.

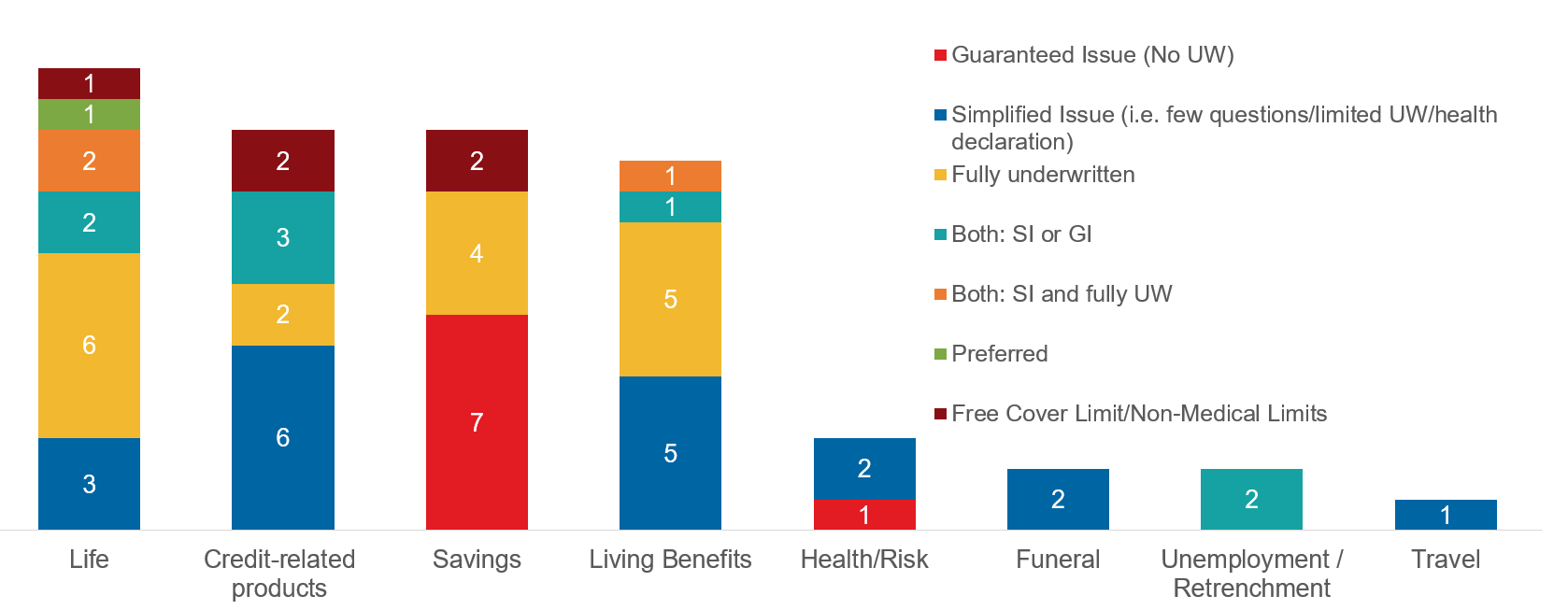

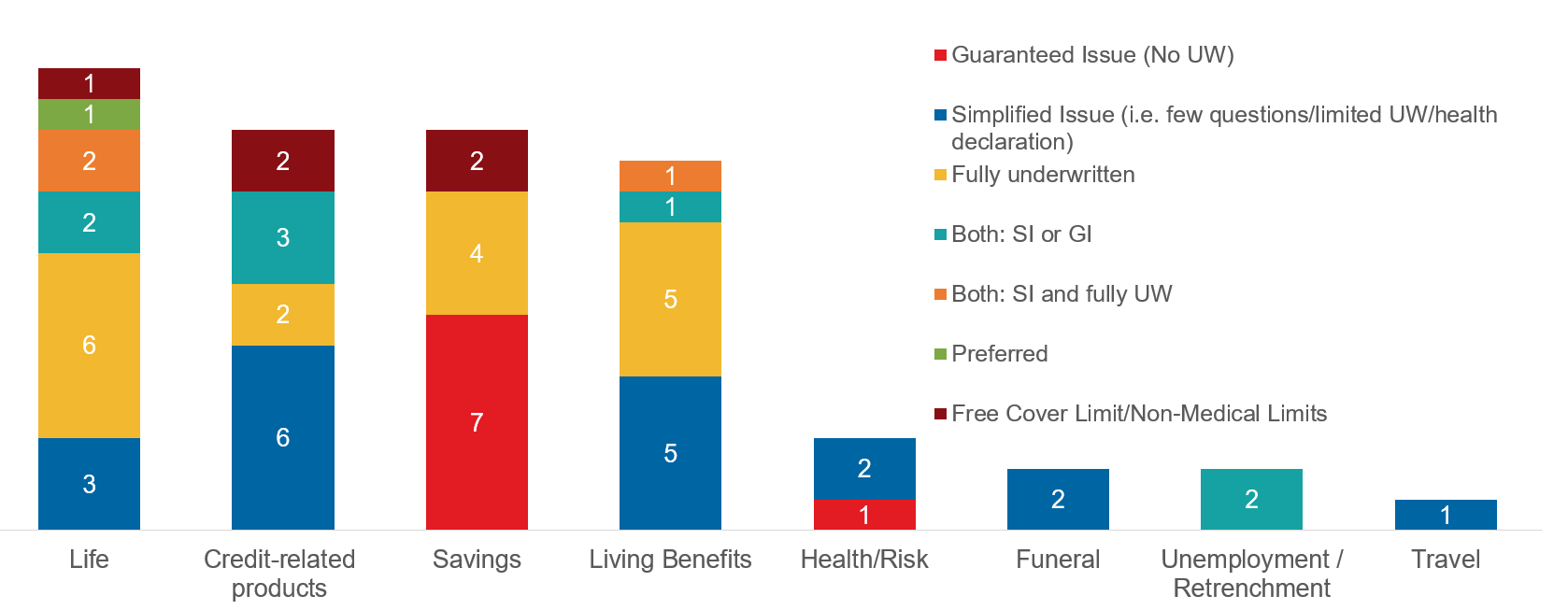

Insurers appear to be adjusting underwriting practices to appeal to customers who prefer digital formats. RGA conducted research on the top products by profitability in bancassurance globally (2019). The company found that sales approaches emphasized easier, less intrusive underwriting, even as methods varied by product type. Life, credit-related, living benefits, and some health and funeral products were sold as simplified issue (requiring a few basic questions), more limited underwriting, or use of a simple health declaration to qualify.

Figure 2:

Underwriting Method by Product Category

Source: RGA analysis. Underwriting methods varied by product type, as expected with predominantly savings products under Guaranteed Issue (GI). Life, credit-related, living benefits and some health and funeral products were considered simplified issue as they required responses to a few simple questions, some limited underwriting or required a health declaration to quality.

The Digital Journey

Banks provide an ideal avenue to reach customers. Hindered by legacy systems, insurers have traditionally lagged behind banking counterparts in using technology to speed up and simplify the customer experience. Banks can impart greater technical sophistication and help equip insurer partners with enhanced digital customer engagement strategies. RGA’s survey findings highlight several innovations that are increasing bancassurance sales, including the use of technology and predictive analytics to improve customer engagement, as well as direct-to-consumer marketing, cross-selling, and upselling of complementary products and a simplified underwriting process.

The survey revealed that online channels are utilized for approximately 25% of the purchases of the top five most profitable products reported globally. This can be realized through the digitization, aggregation, and segmentation of customer information sources. Ideally, bancassurers could attain the ability to gain a ”one client view” – or more complete picture – of each customer’s unique financial needs by drawing on banking data spanning multiple product lines and then customizing product offerings accordingly.

The road to a digital future is not without a few obstacles. Increased regulation continues to complicate and restrict the distribution of insurance products through banks around the world. And while RGA research suggests a winning strategy may involve a multi-channel approach to bancassurance sales – specifically, seeking opportunities to deliver greater consumer value by bundling wealth management, financial family planning, and health products – success requires significant investment and tools to create a positive customer experience.

Successful bancassurance digital strategies leverage the following four pillars for success:

- Delivery of product designs that enhance the customer journey and target financial objectives of specific customer segments

- Integration of regulatory requirements into a seamless multi-channel customer process

- Establishment of a holistic and broad-based customer dataset with the required custodian management

- Development of a digital open-standards platform with bank and insurer applications

In conclusion, RGA’s surveys and distribution research reveal that bancassurance is largely driven by regional factors such as financial deregulation, social security expenditures, tax advantages, and the optimization of relationship banking in established markets. Bancassurance growth will ultimately be augmented through digital strategies, automated underwriting and sales, and via targeted customer messaging and improved customer experiences. To achieve these goals, bancassurers must navigate a complex, varied, and highly competitive environment.

To learn more about RGA’s insights into bancassurance and alternative distribution trends, download this bancassurance presentation.