The insurance industry has long had a well-deserved reputation for being slow to innovate. For the past few years, however, outsiders have taken a keen interest in InsurTech as the means to disrupt the industry’s traditional business model.1

According to venture capital (VC) database CB Insights, in 2014 alone, VCs invested $740 million in InsurTech startups. A year later, that figure jumped to $2.7 billion. Let that sink in: In just one year, almost $3 billion were invested in InsurTech — in de novo technology and in the brains driving it.

One only has to do a quick scan of the industry to unearth successful InsurTech startups and realize the capability they have to build, launch, and scale new businesses that focus on the insurance value chain — and do so in a fraction of the time of established companies.

These startups include health insurers Oscar and Clover, and Zhong An, China’s first online-only insurer. They are all less than seven years old.

That InsurTech startups are reporting private market capitalizations of more than $1 billion shows that the insurance industry is in the crosshairs of entrepreneurs intent on building disruptive new businesses in this market. The emergence of these new companies may eventually have an impact on incumbent talent recruitment and retention strategies, as young, smart, and capable individuals might see InsurTech firms as a “finishing school.” That is, they are workplaces where they can be paid to learn the industry’s intricacies before leaving to launch their own startups or work at nimble companies.

By now, a few questions might have risen to the surface:

- Why should insurance industry insiders or incumbents care about InsurTech

- What impact might InsurTech startups have on the life insurance product value chain?

- What pending revolutions might have a good chance of reshaping the life insurance landscape?

The Life Product Value Chain

When I ask incumbents to describe their customers, many respond in vague demographic terms. For the most part, they cluster their customers into broad age or income bands. Indeed, at many companies, the roughly 12 million 25- to 45-year-olds with a household income greater than $65,000 are considered one homogenous group! Typically absent are any defined segmentation, pertinent anecdotal heuristics, or quantitative insights into customer habits and behaviors.

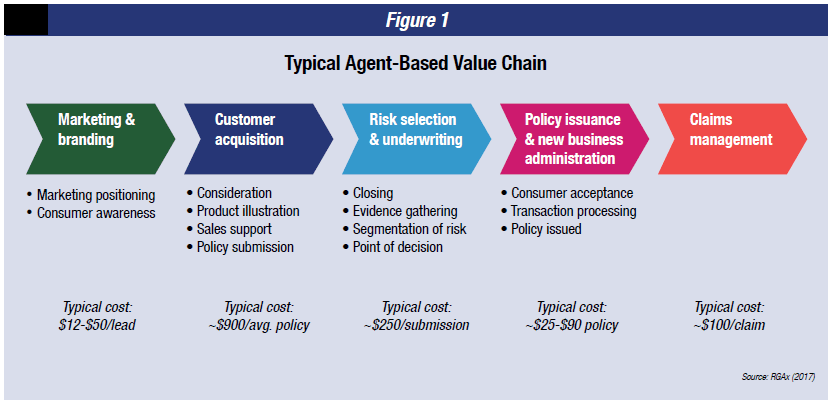

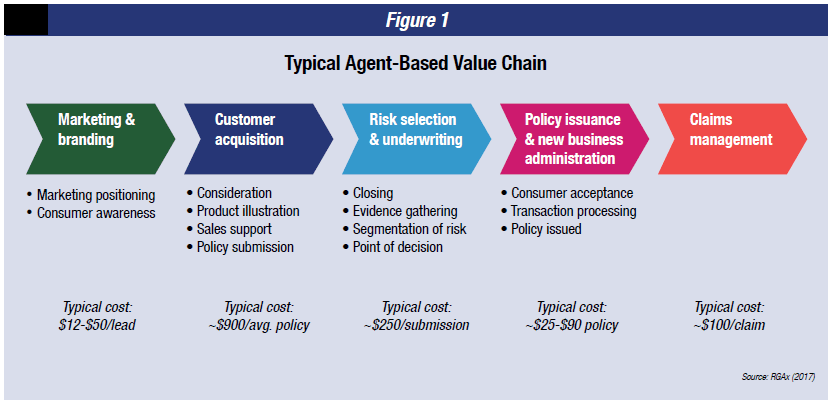

However, if the conversation drifts to distribution, anecdotal heuristics abound. This might not necessarily be a bad thing, but I would argue it has played a role in maintaining an industry culture that continues to focus on optimizing, prioritizing, and protecting the agent-based value chain (Figure 1).

A key aspect of the existing agent-based value chain is that, given its large variable costs and its sequences, a logical incentive exists for incumbents to prioritize distribution process optimization and efficiency. This implication can be anecdotally confirmed by straw polls we conducted during product development sessions at two recent conferences, both of which are well-attended by incumbents.2 When asked which technology-enabled factor is most important in their organization’s product development strategy, a clear majority at both events responded “simplified issue/accelerated underwriting.”

One of the hottest technology topics today that affects the traditional agent-based value chain is how to leverage these simplified issue and accelerated underwriting capabilities. One key enabler for underwriting innovations is the use of alternative data sources.

Alternative data sources are being actively explored as sources of evidence to strengthen underwriting. In the property-casualty world, for example, InsurTech startups are conducting pilot programs to incorporate geospatial information, either from drones or satellites, to improve underwriting granularity.

While the incorporation of alternative data into life insurance has not yet included geospatial information, data from consumer credit providers is starting to have an impact on the industry. Credit bureaus are empowering insurers to use proprietary data and models during underwriting to segment and stratify applicants. Credit-based insurance scores provide new and unique insights to policyholder credit-based behaviors, and they can greatly segment mortality and lapse. Models such as TransUnion’s TrueRisk® Life are just the beginning when it comes to alternative data and underwriting innovation, as many carriers begin to examine four key areas:

- Dynamic underwriting — Lead applicants through different underwriting journeys with varying evidence requirements

- Risk segmentation — Appropriately classify risks beyond the traditional underwriting evidences

- Batch segmentation — Identify leads that may be preapproved for new, firm life offers

- Cross-sell and upsell — Effectively identify which existing customers should receive firm offers of insurance

Potential Revolutions

RGA recently created a dedicated subsidiary focused on accelerating the development and launch of new insurance ventures. The new venture, called RGAX, has taken a portfolio approach: Multiple initiatives are seeded, each of which has its own time horizon and potential impact. Many of the initiatives to date have involved innovating around the traditional agent-based value chain.

However, to accelerate our efforts to build businesses that let us “look around the corner,” we are actively quantifying and investigating approximately a dozen potential tech revolutions. These initiatives are neither trends nor fads, but rather truly revolutions — initiatives that, if they succeed, could completely change the industry landscape and render traditional agent-based value chains irrelevant.

Here are brief descriptions of two potential revolutions that might help spur some thinking:

ElderTech and Increasing Longevity

In North America, more than 20 percent of the population will be age 65 or older by 2030. Other markets, especially in Asia, are already experiencing the economic and social impact of an aging society. The implications to the macroeconomic environment are striking. Only look to Japan to see the potential strain that a rapidly aging population is likely to place on health care systems, Social Security, public infrastructure, and labor forces.

Recently Fukoku Mutual Life (FML) announced it is spending nearly $1.8 million to implement an artificial intelligence (AI) system based on IBM’s Watson Explorer to automate its claims processing. In doing so, FML intends to reduce its claims analyst headcount by 34. In populations such as Japan, which has been experiencing high levels of youth unemployment, it is hard to imagine a company bragging about making humans redundant with AI. However, in a country with a rapidly aging workforce, automating human labor is a structural reality.

On a microeconomic standpoint with respect to ElderTech, an immediate question for incumbents is whether life products can be adapted to markets facing increasing consumer longevity. Actuarial assumptions may need to be revisited. For example, would post-level term conversion lapse rates be simi-lar for populations where more people are living into their 90s — versus those for which age 70 is considered old?

Further, does increased longevity decrease a consumer’s desirability as a market for life insurance? If beneficiaries have to wait until age 55 to receive proceeds from a former guardian’s whole life policy, would human impatience render the death benefit virtually meaningless? These questions have led RGAX to enter strategic partnerships with startups that are aiming to help the industry make positive contributions in rapidly aging countries.

One such partnership is Everplans™, a New York-based startup, which has built a life and legacy planning platform. Their platform helps people gather, organize, and store their most important estate planning documents, as well as final wishes and other information their families would need if something were to happen to them. Everplans provides individual consumers with a digital vault — not just for wills and insurance policies, but also for health and household information, right down to favorite photos and social media passwords.

A second partnership is with K4Connect. This North Carolina-based startup provides software and Internet of Things sensor technology integration to senior living facilities and consumer homes to help elderly residents retain some independence.

Indeed, one can imagine a not-too-distant future where an InsurTech startup’s product or service might be the dominant feature of a living benefit rider.

Blockchain and Distributed Ledger Technology

Given the all-time high in valuation of the Bitcoin cryptocurrency, another potential revolution is its underpinning technology — namely blockchain, or distributed ledger technology. A blockchain is a public database of transactions. It enables parties to trade and transact business safely without needing to go through a central third party. This is revolutionary in that the database is maintained and transaction validation achieved through a crowdsourced consensus, allowing for greater provenance and, potentially, immutability.

The main advantages of block-chains are the creation of a single source of truth and autonomous self-executing applications (commonly called “smart contracts”), which can remove operational expenses and process bureaucracy.

When thinking about the impact, here are three examples of non-obvious prototypes that can change the traditional agent-based value chain:

- Provenance in blood supply — Potentially creating a blockchain with an immutable audit log that can allow users, phlebotomists, and underwriters to easily detect counterfeit or contaminated blood

- Customer fraud warning system — Potentially using blockchain’s cryptographic security features to create smart contracts that can issue push notifications alerting consumers to potential fraudulent identity updates

- Decentralized agent recruitment — Potentially levera ging a blockchain’s decentralized marketplace to allow prospective insurance agents to individually design attractive compensation plans (e.g., paying off student loans) and have it self-administer via smart contracts

To further explore blockchain in a collaborative effort, the B3i consortium — a group of 15 global insurance and reinsurance groups — is exploring the ability of distributed ledger technologies to increase efficiencies in the exchange of data between reinsurance and insurance companies.

Three Takeaways

If you only take away three things from this article, remember these key points. First, InsurTech startups are well-funded. Second, underwriting will likely be the first place incumbents begin to implement innovative solutions. And third, technology revolutions such as ElderTech and blockchain present both incumbents and startups with the opportunity to dramatically redraw the life insurance industry. All of these signs point to life insurance products that are not likely to look or work as they had before.

Reprint permission granted by LIMRA MarketFacts Quarterly 2017, www.limra.com.