The now decades-old wellness movement in insurance is gaining fresh momentum.

The now decades-old wellness movement in insurance is gaining fresh momentum. While it is difficult to incentivize healthy lifestyle behaviour change, the case for insurance-linked wellness programs demonstrates insurer value from wellness programs. Among the most important benefits for insurers: the ability to attract customers, increase consumer engagement, and improve customer retention.

While insurance-linked wellness programs were already on the rise pre-COVID-19, the pandemic illuminated the need for insurers to engage customers as partners in health. RGA’s Global Wellness Survey reported that 85% of global insurers prioritized or accelerated wellness initiatives during the pandemic as a means to help customers prevent or better manage chronic disease.

The workplace wellness space is seeing parallel trends. A 2022 Mercer Global Talent Trends Report found that employers are now seeking to safeguard the current and future welfare of their workforce by meeting their evolving wellness-related needs. A healthy workforce can produce direct economic benefits through lower rates of employee absenteeism, reduced related healthcare costs, and increased productivity.

Following the stresses of the pandemic, mental health has become a growing area of focus for wellness programs as demand for services has increased. A study by PwC reported mental health as the most important issue for employers in 2022. Approximately 70% of workers surveyed would consider turning down a job promotion to preserve their mental health. Global research published by Cigna reported that individualized mental health interventions had levels of effectiveness – revealing a 60-fold return on the initial investment. It is now nearly three years since the start of the pandemic, and mental health challenges remain; employers who implement an effective mental health component within wellness programs should see improvement in engagement, productivity, and retention.

What is wellness and why now?

By improving the overall health of customers, wellness serves as a risk mitigation strategy and a cost containment measure, reducing medical claims and disability-related absences while increasing consumer engagement and overall wellbeing. Wellness program participants are more socially connected through group activities (e.g., fitness sessions and wellness challenges) and feel more supported, which helps with stress management.

Today’s workforce is seeing Millennials overtake Boomers in the job market. Younger people are most likely to move around and change jobs, as well as seek out entrepreneurial opportunities or engage in the gig economy. In addition, the “Great Resignation” has seen a large percentage of people leave their jobs across all businesses and industries to pursue other opportunities. These transformative trends have put employers on alert with respect to attracting and retaining talent. Wellness programs could be part of the solution.

Meeting the demand for wellness

Insurance-linked wellness programs are delivered through employers in many markets. Employers of all sizes are taking the total wellbeing of their employees seriously. Health and wellness solutions rank among top priorities for businesses, with 67% providing such solutions according to a 2021 Principal survey.

Wellness is a key differentiator for employers to attract and retain new talent. Since the onset of the pandemic, employees appear to value health benefits more than ever. Mercer found that 1 in 3 employees would decline a pay increase in return for additional wellness offerings for themselves or their families.

The most important step for insurers and employers is moving toward data-driven approaches with personalized delivery based on consumer needs and requirements rather than outdated worksite-oriented approaches (e.g., complimentary fruit, exercise rewards, etc.). Mercer’s report stated, “85% of HR leaders recognize the need for hyper-personalization to ensure benefits attract and retain talent.” Achieving such personalization presents challenges. It is difficult to individualize compensation and benefits in ways that best serve all employee groups while also delivering value to the employer.

Engagement: the winning strategy

Efforts of employers and insurers to help employees and policyholders achieve and maintain optimal health will ultimately yield higher levels of engagement. Engagement leads to loyalty, and loyalty leads to retention.

Strategically implemented wellness programs need to define and measure engagement beyond frequency and interaction, but also to what degree the engagement will lead to a desired outcome: frequent or sustained behaviour(s) improving over time.

An engagement study published in 2022 by Vitality, one of the industry’s most popular wellness solutions, defines engagement (and assessment) through four dimensions:

- Breadth – the number of people the program reaches in an eligible population, including an assessment of the diversity of the participation

- Depth – how frequently participants engage

- Quality – how significant/meaningful the engagement is in the context of the program’s goals

- Momentum – how well the program sustains and improves engagement over time

The Vitality findings showed that targeted, sophisticated incentives are a powerful and necessary component for increased engagement in wellness. Integrated incentive plans and benefits had the greatest impact on engagement – such as a reported 19% increase for registered members that achieved Gold or Platinum Vitality status.

Overall, Vitality’s approach of offering individualized programs to support mental, physical, and financial wellness has proven effective. The Vitality study cited a 30% industry average for participation in wellness programs while Vitality achieved an average of 63% of eligible members registered for the program, website, and app. Once registered, 82% of Vitality members continued with participation over the next year, many of them using the apps or programs progressively more as part of sustained engagement.

User experience for wellness programs such as Vitality is central to engagement. Taking it a step further, respondents to RGA’s Global Wellness Survey agree that a compelling digital experience is more likely to help both prevent health issues in at-risk customers and maintain the health of already healthy customers. Health impact is cited as the main objective for wellness programs among respondents in North America, Latin America, and Asia Pacific. In EMEA, brand loyalty is the key driver for a wellness solution. Both objectives are inextricably linked to customer retention fuelled by effective digital engagement.

Conclusion

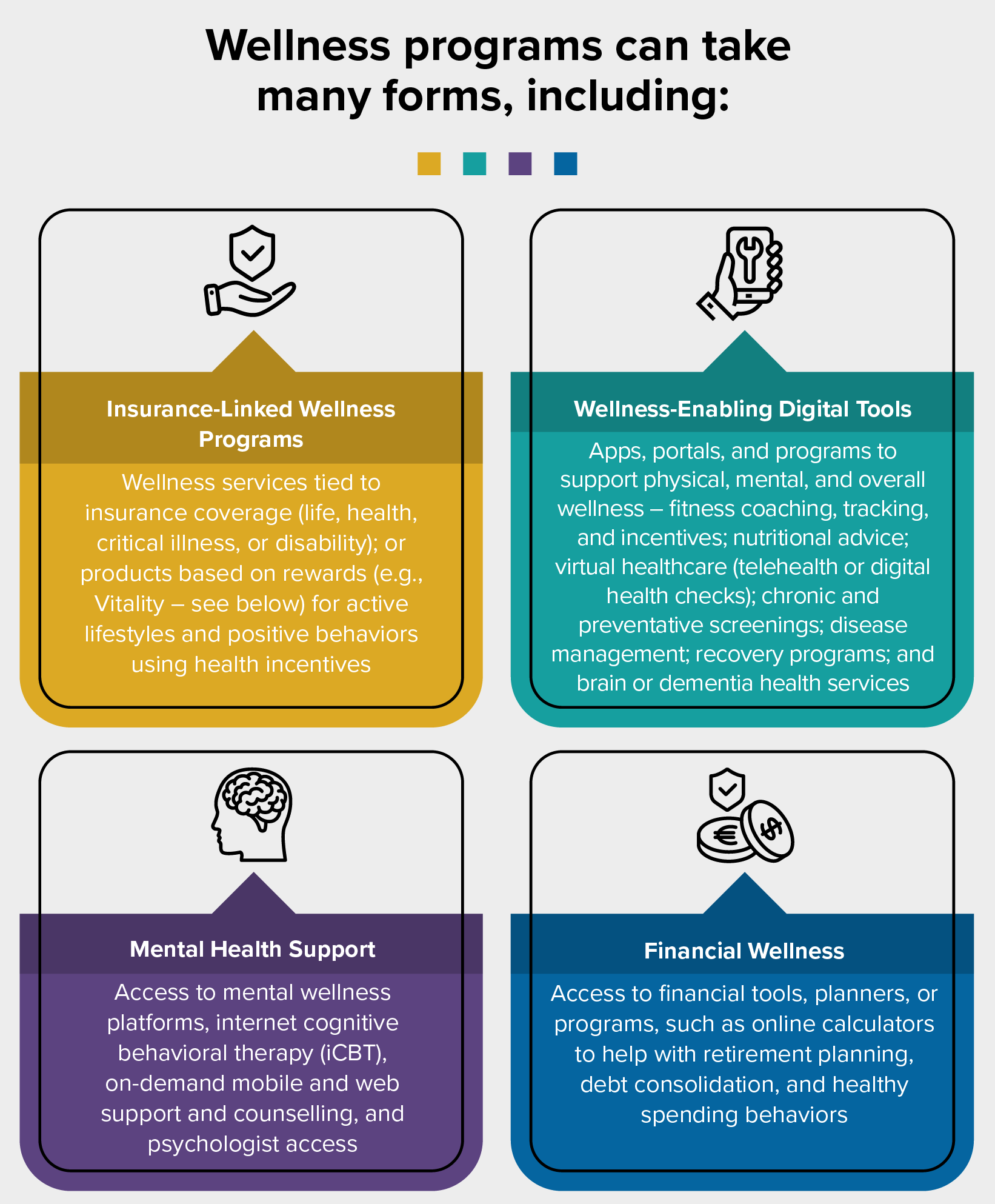

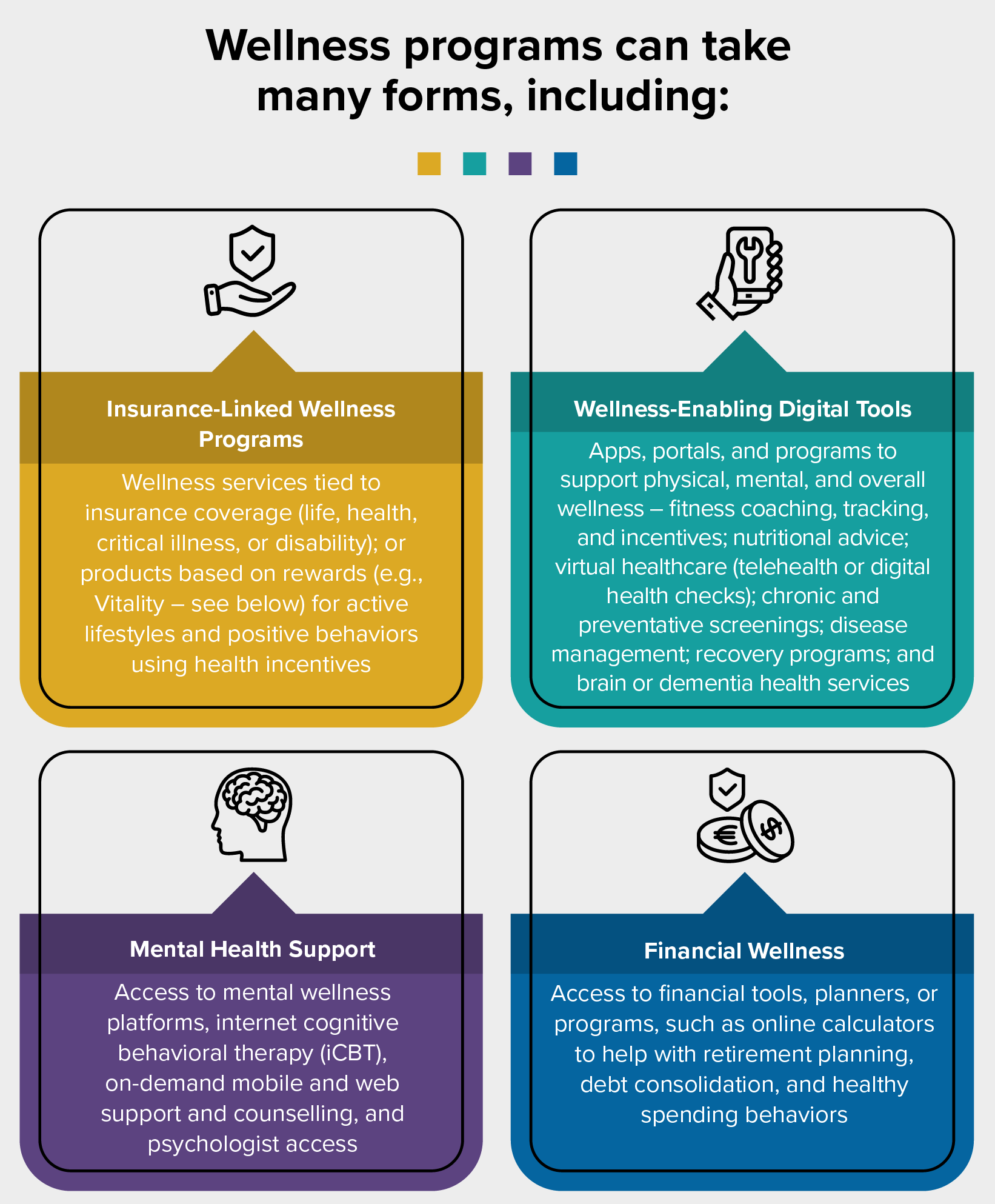

In the post-pandemic marketplace, insurers and employers are tasked with attracting and retaining customers and employees through value-added services. Among the most in-demand are wellness programs that provide ongoing support for physical, mental, and financial health. By delivering a customizable portfolio of wellness products and services, insurers and employers can meet current demand and adapt to changing market needs to build on healthy behaviours and loyalty in the long term.