Long before the pandemic closed bank doors, consumers were digitizing day-to-day financial activities and many banks were pruning branches.

The pandemic, however, is forcing acceleration of this digital transformation. As a result of COVID-19, insurance customers in Europe contacted their providers via mobile app or website at least once a month during the pandemic, well above the global average of 37%, according to research by the consultant Accenture.

Carriers have one primary goal in mind: improving customer experience and engagement. Transformation can, in part, be achieved by improved use of data, artificial intelligence, and analytics. Banks are already armed with an arsenal of information about customers and are seeking to leverage this unique competitive advantage by making smaller, iterative changes to enrich and improve the customer experience and make targeted offers.

Demanding Digitization

Recent market research supports this strategy. In a survey conducted by McKinsey and Co., 80% of banking leaders in developed markets reported digitally active customers, with 60% of these customers using mobile apps. McKinsey estimates that 80% of simple servicing transactions and two-thirds of simple product sales could be digitally fulfilled, particularly in countries where a significant digital infrastructure already exists.

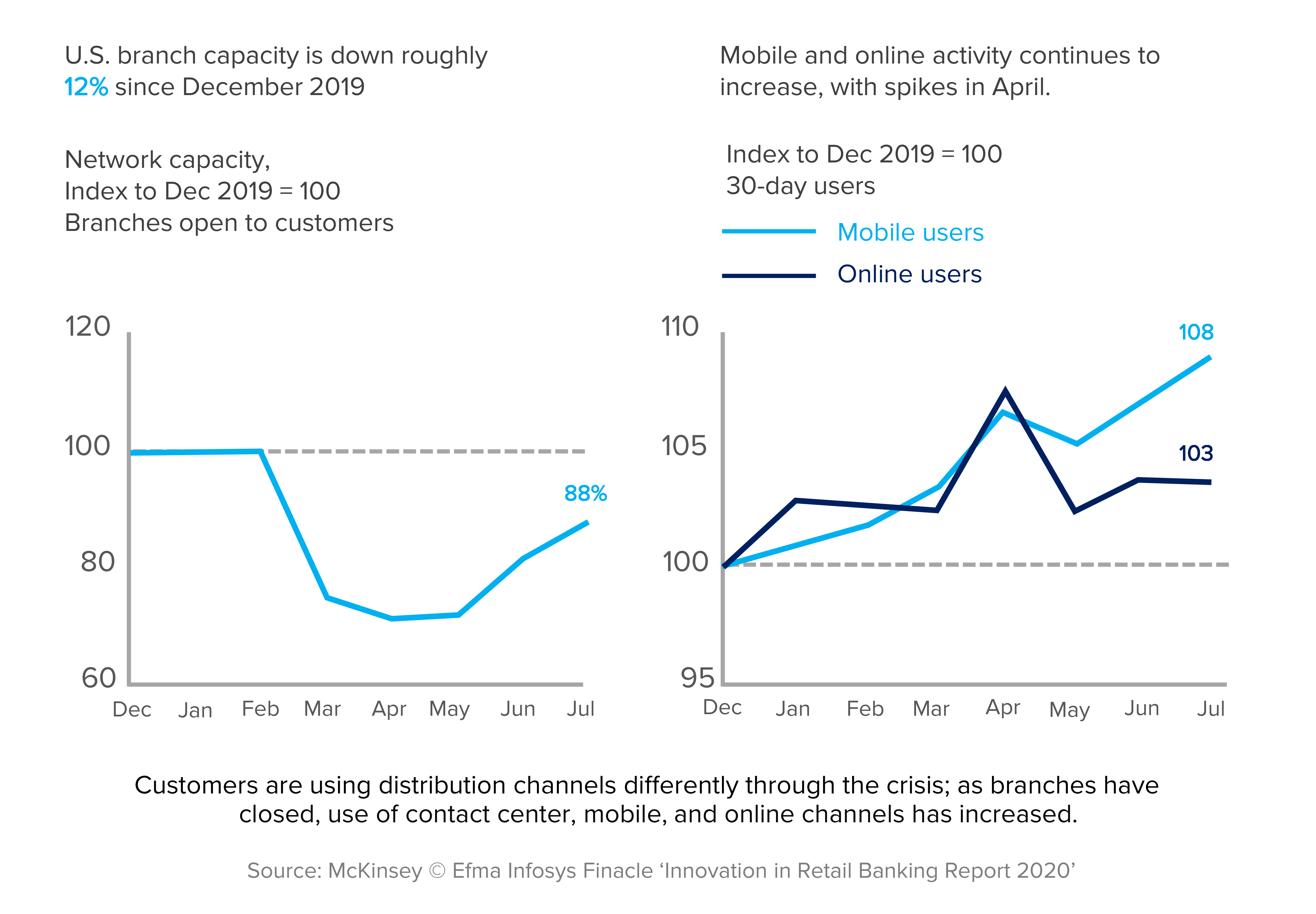

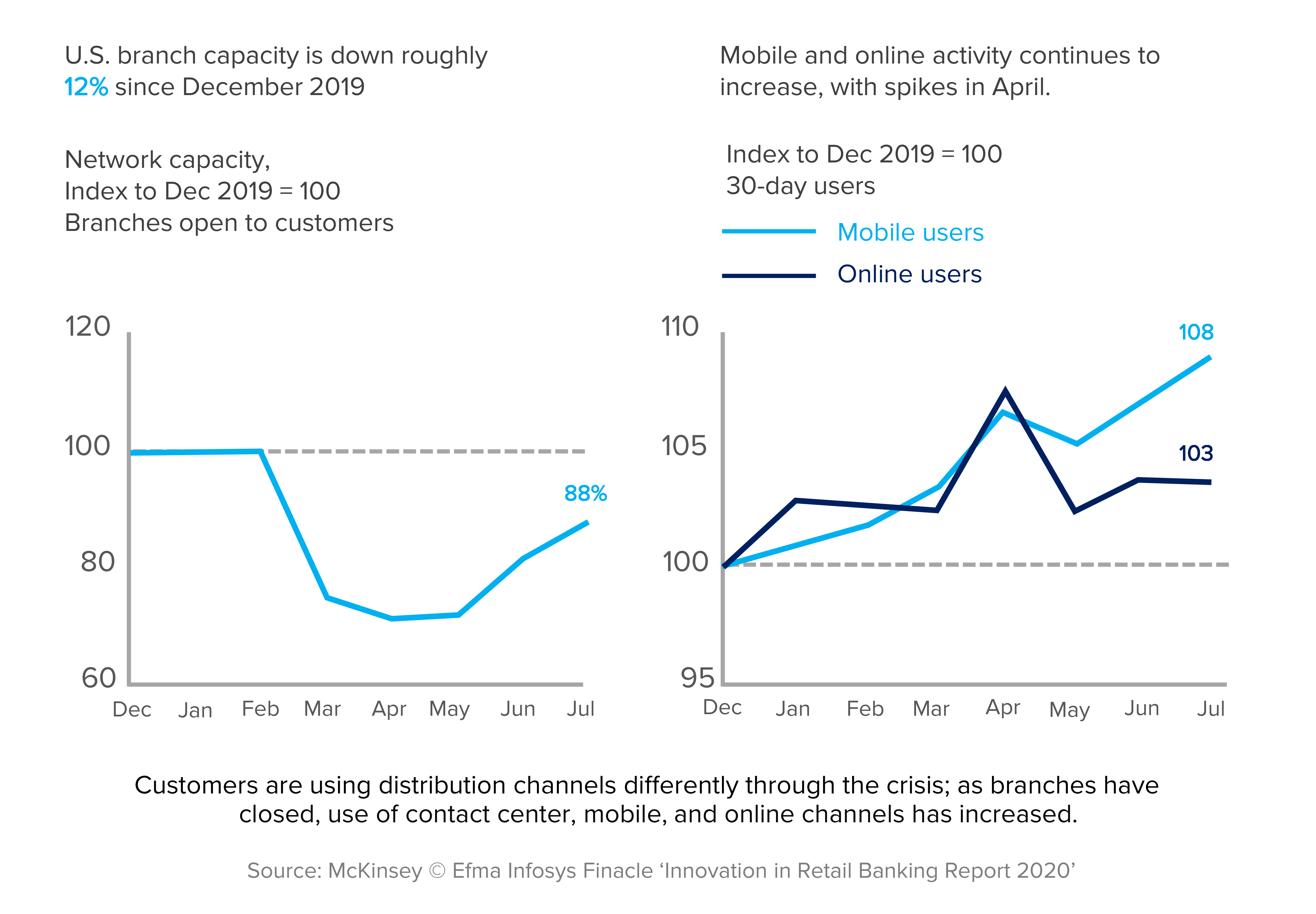

Bank branch closures have been rising in markets from South Africa to the United Kingdom and the United States, according to RGA research. While the causes are complex, they can be linked to increased adoption of digital channels and fewer in-branch transactions. In the past, digital adoption was concentrated among banking customers in younger demographic groups, but recent data indicates this is no longer the case. All age groups show increased demand for digital options both to conduct simple banking transactions and meet more complex or ad hoc financial needs. Human-centered channels will continue to evolve but remain essential.

Lockdowns and branch closures have only intensified demand for innovative, digital, cross-channel solutions that enable banks to offer their clients holistic advice to suit individual needs. RGA research suggests bancassurers and retail banks in general are increasing use of contact centers and mobile and online channels and are turning to chat and video conferences to conduct insurance consultations. In fact, McKinsey estimates that up to three years of digital preference acceleration.

Use of Banking Channels Shifted During COVID-19

Bancassurers will need to continue to streamline and optimize their internal efficiencies for distribution and sales. McKinsey estimates that the number of physical bank branches in some markets may fall by a quarter in coming years, putting additional pressure on bancassurers to find new paths to serve customers.

As digital channels mature, banks and insurers must refine their partnerships to pool expertise and technology to succeed. It is far from simple to create integrated digital platforms that enable seamless customer referrals and smoother data collection, but several steps can help. The most successful bancassurers will:

- Optimize the branch footprint given an increase in digital channels

- Change branch personnel roles and incentives to align with the new consumer context, and the notion that “everyone sells”

- Build understanding of customer journeys

- Build omnichannel sales and service models with a focus on providing a seamless customer experience regardless of which channel(s) the client engages with (e.g., a mobile device, internet, or face-to-face). This approach calls for unification of marketing, lead generation, and sales strategies across channels

- Improve cross-channel marketing communications

Acknowledging a Changed Customer Context

How can bancassurers accomplish such ambitious targets? Acknowledging a changed customer context is an essential first step. Omnichannel strategies and personalization trends were evident before the pandemic and appear to have gathered force in 2020 as bancassurers seek to maintain – and build – customer loyalty. A pandemic survey conducted by Accenture reported a growing appetite for personalized services, particularly health offerings. Three quarters of respondents admitted to being more likely to buy from a company that recognizes them by name, knows their purchase history, and recommends products based on past purchases. In addition, 57% of consumers in Europe also indicated an interest in life insurance offerings that linked premiums to healthy lifestyles.

Clearly, while automation is inherent in digitized offers, consumers appear to be attracted to personalized online experiences. More than 90% of companies reported having more success in converting prospects into customers simply by personalized marketing, offering a customer’s name or recognizing an important life event, a similar survey by Econsultancy revealed.

Encouragingly, this mix of personalization and health and wellness-based incentives appears to be creating opportunity even among the most resistant customers:

- China-based Ping An Bank rolled out a new “Do It At Home” functionality to offer contactless services during the pandemic. The Ping An Pocket Bank app received more than 3 million page views and nearly 12 million transactions within two weeks. Over 475,000 viewers tuned in to online lectures related to their products or services.

- Emirates NBD sought to increase deposits while addressing the United Arab Emirates’ obesity problem. The Emirates NBD Fitness Account rewarded savings account customers with higher interest rates in return for increased physical activity, as measured by the Emirates NBD fitness app on mobile devices. In one month, they measured 53 million steps, translating into a savings of 16.07 million AED (approximately $4.4 million USD). Gulf News reported on the engaging gamification approach as “a new phase in digital banking, as it effectively combines customers’ health and lifestyle goals with their banking needs.”

Balancing Immediate and Future Customer Needs

Personalization requires bancassurers to keep a careful pulse on changing customer preferences and to rapidly (re)design personal journeys in order to fully respond to consumer concerns. Disruptions related to COVID-19 have created serious distress, including ongoing economic uncertainty and rising worries about health-related issues and income instability. The pandemic has also created an opening for bancassurers to demonstrate the value of protection products in unprecedented times.

Seizing this opportunity will require bancassurers to adapt and directly solve immediate, real-world customer problems while simultaneously helping policyholders prepare for a post-COVID-19 future. Success relies on the ability of bancassurers to sustain long-term customer relationships and demonstrate the value of protection products in tangible ways based on policyholders’ unique circumstances.

It’s a tough balancing act, RGA/RGAX have identified four key principles that can help guide bancassurers seeking to both meet current customer needs and prepare for the digital future:

- Focus on care: Reach out to customers with a focus on support, not the immediate sale. Prioritize building a community that includes employees, customers, and neighbors and stay true to a broader mission, which is to protect people.

- Adapt to new customer context: Innovate digital models to make it easier and more seamless to do business and expand accessibility to people at home.

- Plan for a post-COVID-19 world: Recognize that economic hard times will impact customer needs and migrate customers to digital channels to save money and increase satisfaction. Also, rethink bank branch processes and services to be more efficient.

- Be agile: Use social media instead of surveys for insight, get first-hand feedback from bank staff and measure and monitor to stay on top of customer signals.

Of course, principles are not enough to turn a profit. Against this backdrop of rapid innovation, bancassurers could benefit from the hard-won working knowledge of insurtech innovators who have developed effective digital propositions. Many of these startups have sought to build customer loyalty by redefining the concept of financial health. Connecting health and wealth requires data, the means to swiftly analyze and act on insights from information, and the ability to deliver improved outcomes for individuals and institutions. While banks have access to this information, insurtechs have this expertise.

See also: Stronger Together: Banks and Insurers Forming Partnerships in Japan

Summary

Innovation and transformation are deeply intertwined, as both are primarily driven by consumer needs. At a time of significant market disruption and branch closures, bancassurers who act on this reality have a significant advantage. Successful and scalable solutions to improve customer experience will require multiple, small-scale changes to different aspects of engagement, implemented rapidly and iteratively. The payoff? Improved customer loyalty and long-term growth.

At RGA, we are eager to speak with clients about any support needed as we confront this challenge together. Contact us to learn more about the resources, solutions, and services available.