Critical thinking is a core competency in underwriting. As junior underwriters develop their skills and work their way through various levels of the profession, they’re likely to face several challenges that impact their decision-making processes.

One of the most challenging: understanding decision heuristics and biases. As outlined in Part I of this article series, acknowledging, identifying, and addressing those biases is crucial for mastering the art of underwriting.

Understanding Heuristics and Cognitive Biases

At every level, the underwriting profession seeks to follow an objective decision-making approach – decisions are typically determined by evidence and guidelines. Yet with 98% of human mental processes being intuitive or automatic, it’s reasonable to assume underwriting decisions could also be influenced by cognitive biases. The subconscious nature of decision-making makes it harder to recognize and neutralize biases that lead to bad decisions.

To begin to do so, some definitions may be helpful:

- Heuristics are simple mental shortcuts to discover or learn something, solve problems, and pass judgment quickly and efficiently with minimal effort. Heuristics enable faster decision-making but are sub-optimal in some situations as they can lead to cognitive biases.

- A cognitive bias is a systematic pattern of deviation from fully rational judgment. Individuals construct their own subjective reality based on personal perceptions, rather than objective input, and these subjective judgements can dictate behavior. While such biases can help an underwriter, for example, find commonalities and shortcuts that speed up the decision-making process, they can also lead to errors in judgement.

No one is immune to the pitfalls of heuristics. In fact, seasoned professionals can often be the most susceptible to trusting these mental shortcuts. Consider the example of a physician who, after years of clinical practice, naturally relies on experience to reach decisions faster and rarely consults reference materials in making a diagnosis. Such use of heuristics in clinical decision-making is a well-known cause of misdiagnoses. For underwriters, it is common to work under time pressure given the volume of work and quick turnaround time required. This is where heuristics most frequently come into play: They allow the underwriter to make confident decisions based on prior experience, utilizing critical thinking and the learned ability to identify patterns. Heuristics can also lead to underwriting mistakes, however, such as overlooking certain types of evidence and subsequently making decisions that are too conservative or too liberal for the particular risk assessment.

This underscores the importance of developing skepticism and caution in risk evaluation. Junior underwriters are trained to balance these traits, particularly when working under pressure when judgment may be compromised.

See also: Behavioral Science and Insurance

Different Types of Biases

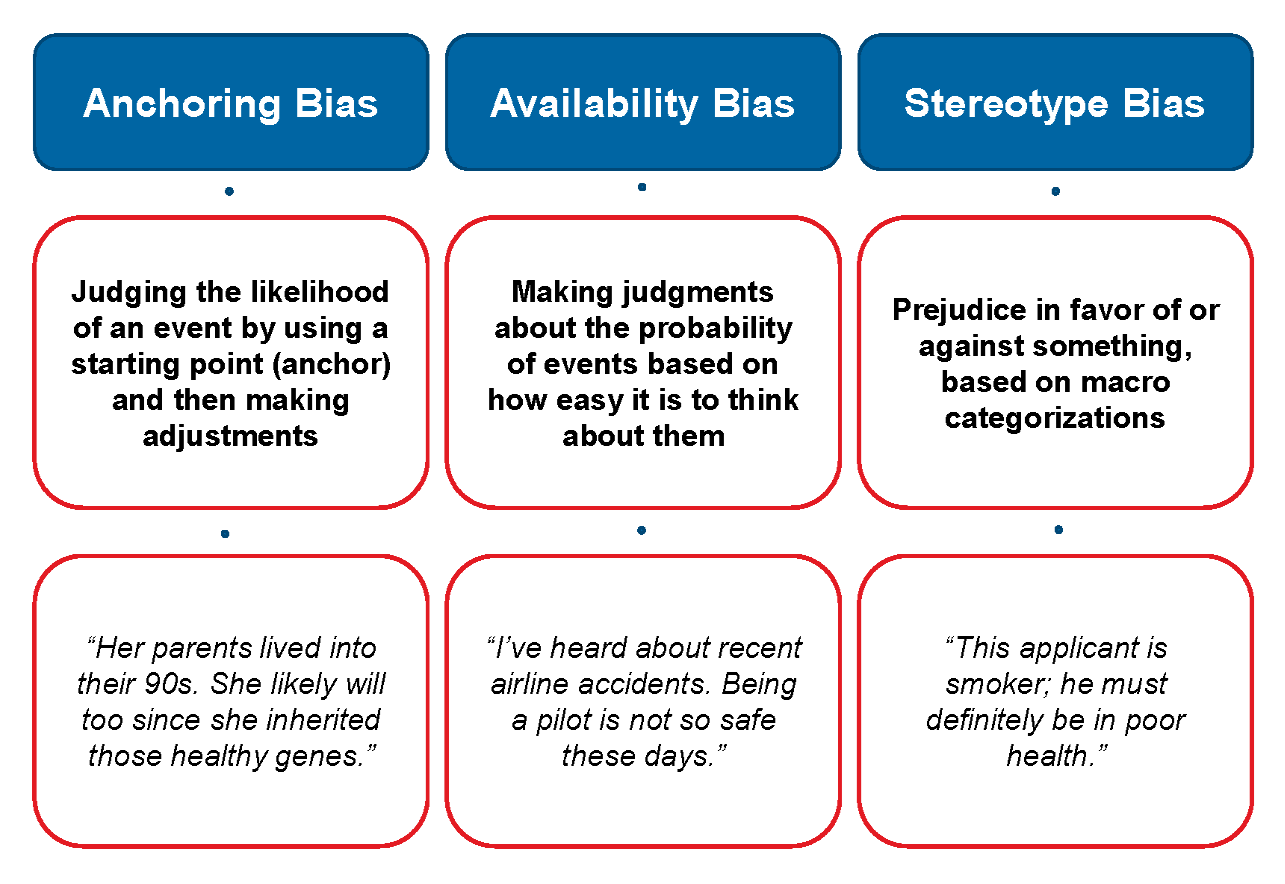

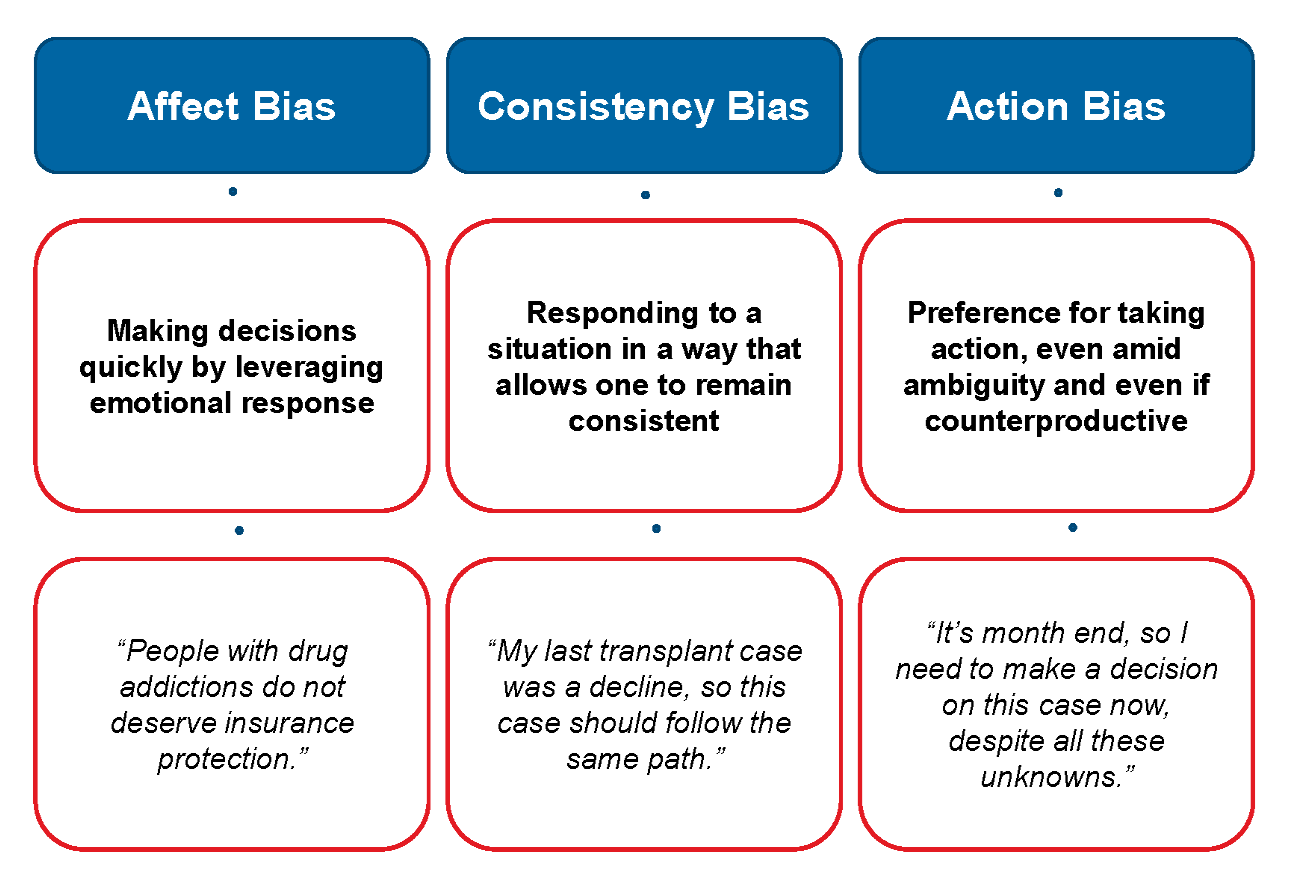

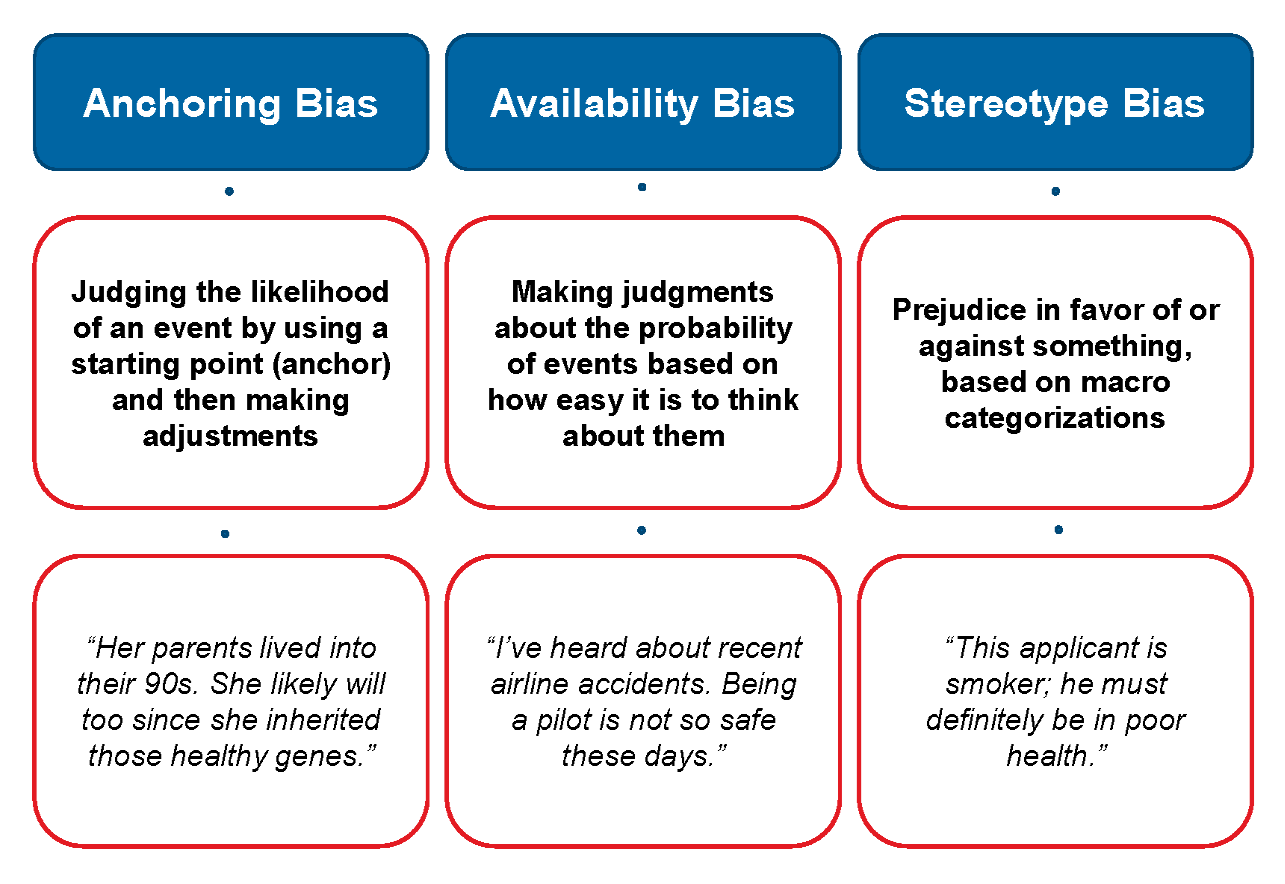

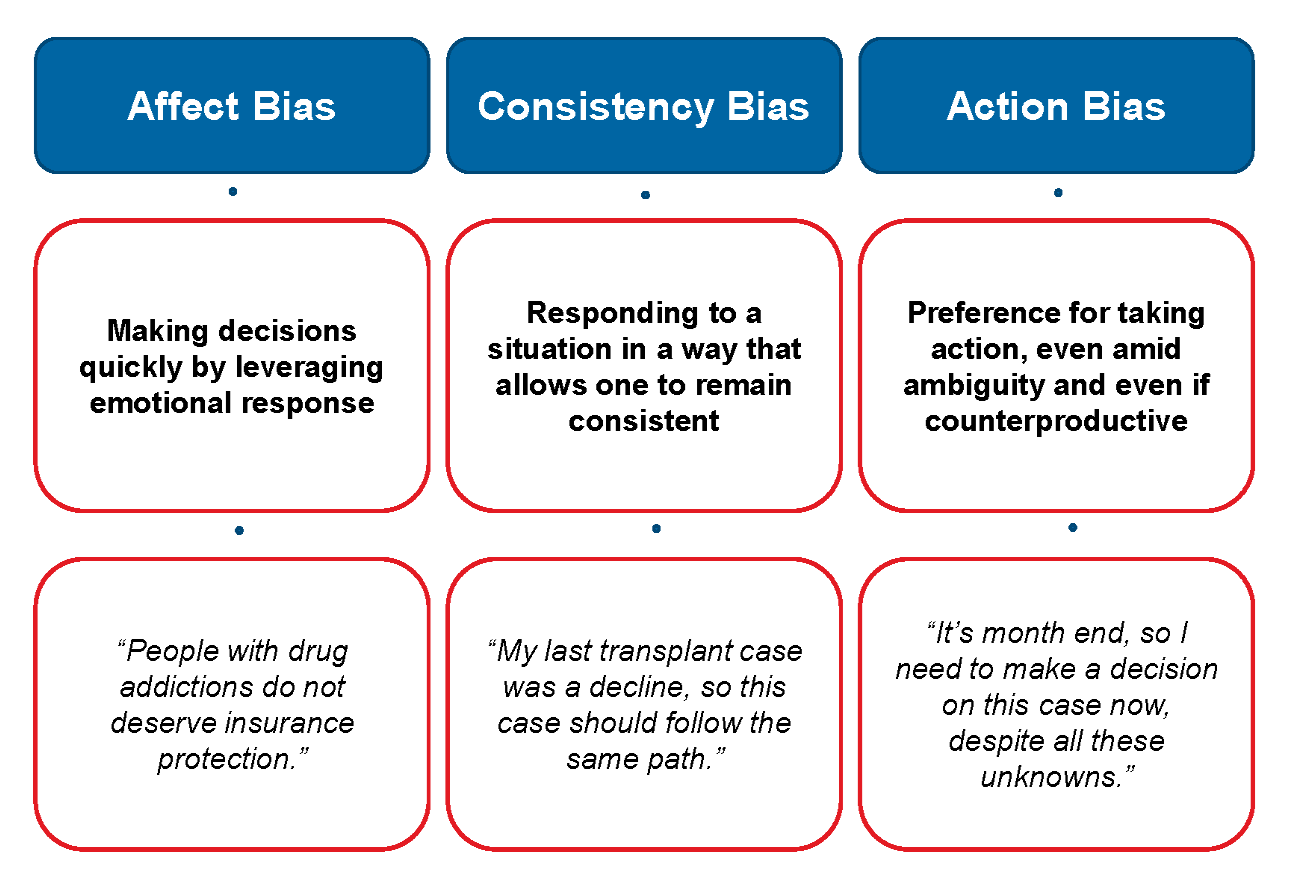

Various types of biases can impact the decision-making of an underwriter. For example, the order in which information is presented can create anchoring biases, leading to reliance on the first piece of information seen. The underwriter may end up basing the assessment on the applicant’s family history, assuming a similar life span. Judging the probability of events based on information that comes to mind quickly is called availability bias. For example, based on news about aviation accidents, one might think that a pilot has a more dangerous job than a foreign correspondent, while the occupational death rate is actually higher for foreign correspondents. Other common biases include the following:

While time-saving heuristic maneuvers are essential in the daily underwriting routine, some resulting biases may go undetected and remain inadequately addressed. The result: poor decisions that could not only hurt an insurance company financially, but also leave customers without the coverage they deserve.

See also: How Personalized Persuasion Could Enhance Protection Offerings and Reduce Underinsurance

Neutralizing Heuristics and Biases

Ensuring that underwriters understand the role of heuristics and biases in everyday decision-making can help them excel at objective and critical thinking. A good technique for boosting objectivity is to follow a regimented practice of documenting relevant facts in the case summary and then basing the decision on all facts gathered. This helps the underwriter perceive the big picture, while neutralizing any potential anchoring or availability bias. Additionally, technology can help fill competency gaps of underwriters; rules engines and other risk calculators can double-check final ratings to not only limit errors fueled by bias but also act as re-training devices.

Above all, the single most helpful underwriting practice to eliminate bias is to identify “what is not known” in the routine decision-making process. This ability to spot knowledge gaps should be cultivated at the beginning of one’s career and honed over years of practical application.

Underwriters are curious people by nature, and a continuous search for answers is perhaps the strongest defense against impulsive decisions. It leads to natural learning and inspires critical thinking, the superpower of every good underwriter.

See also: Thinking about Critical Thinking in Insurance Underwriting

The third and final article in the series will discuss the elements of critical thinking in the underwriting profession and provide pragmatic strategies to hone and improve these skills both at an individual and organizational level.