Behavioral science techniques can help facilitate return to work after a temporary disability

However, insurers often find it hard to effectively implement these techniques into a claims journey. They must be embedded throughout the process, and claims handlers play an important role in their delivery.

RGA recently partnered with the Group Assurance and Behavioral Economics teams of Old Mutual, South Africa, to conduct a trial on the topic. The results clearly showed that, for a small investment of time, best-practice behavioral science techniques can be incorporated into every phase of the claims process, from filling out claims forms and triaging cases to communications, whether on the phone or via email and SMS (text) messages, between claims assessors and claimants.

A challenge faced by any return-to-work initiative is the length of time needed to observe results, as claims can extend for months and sometimes even years. Our focus was therefore on confirming that behavioral science techniques could embed successfully in the claims process, thereby establishing the ability to observe long-term impacts.

The trial proved successful in many ways: approximately three-quarters of disability income claimants set goals in their claims forms, and claims assessors reported the extended process had a positive impact on claimant engagement and return-to-work motivation. As a result, the approach is now being permanently rolled-out across Old Mutual’s Group Assurance claims team.

There are clearly lessons here for the wider disability income insurance industry. Disability claims handlers who are equipped and motivated to apply behavioral science techniques can make a real difference for claimants and for the industry. Many insurers already try to identify claimants’ return-to-work motivations within their claims processes, but rarely is the approach complete and comprehensive. By following simple best-practice behavioral science approaches, many insurers could significantly improve the effectiveness of what they are already spending time trying to do – help claimants heal and return to full functionality.

By following simple best-practice behavioral science approaches, many insurers could significantly improve the effectiveness of what they are already spending time trying to do – help claimants heal and return to full functionality.

The Thinking

Disability Income (DI) insurers have a responsibility to, where possible, help the people they insure return to work safely and in a timely manner. DI is an important product that protects workers and their families in times of need. For most claimants, the insurance provides temporary supplemental financial support during a longer-term period of illness or injury before they regain the capability to return to work.

It is widely recognized that long-term absence from work can be harmful to an individual’s physical and mental well-being.1 Returning to work benefits the claimant, their families, and their employers, as well as keeping disability income insurance affordable for others. However, claimants sometimes need help finding the motivation to recover sufficiently from their illnesses and injuries to enable their return to work.

It is widely recognized that long-term absence from work can be harmful to an individual’s physical and mental well-being.

Governments, employers, and charities around the world are engaged in efforts to help improve return-to-work outcomes, and many have turned to behavioral science to help. A 2016 trial involving more than 1,700 teachers that was conducted by the government of New South Wales in Australia found that behavioral science techniques to improve goal-setting and simplify claimant communications sped return to work by 27% within the first 90 days.2

Behavioral science can help facilitate return-to-work after a temporary disability

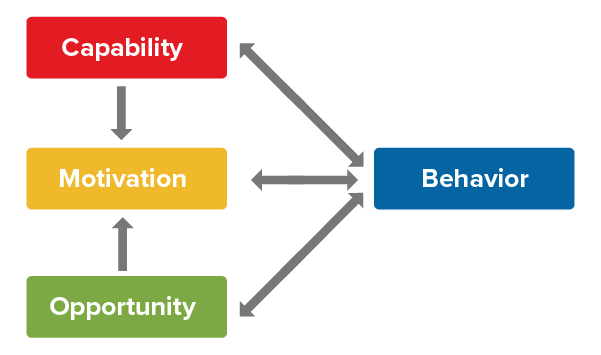

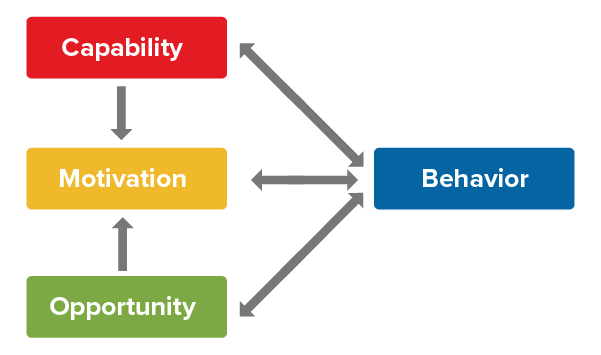

When designing behavior change interventions aimed at helping DI claimants return to work, it is important to assess whether an individual claimant has the capability, opportunity, and motivation to do so.3

Lack of capability to work – whether due to physical or mental causes – is the primary reason for a disability income claim. Illness or injury can render an insured temporarily incapable of performing their job functions. Once capability has returned, opportunity to work becomes key, especially if either the insured has either lost their job or if their working capabilities have changed to the point that they can no longer physically or mentally do their former jobs. In that case, the challenge is finding alternative employment that meets their changed capabilities.

Once capability and opportunity conditions are met, low or conflicting motivations can often be a barrier to timely return to work. Motivation is not independent of the other factors: it is partly influenced by how individuals perceive their capability and opportunity. Motivation is also needed to recover capability and maximize opportunities. Motivation and perceived capability must be the key targets of behavior change interventions.

One significant source of motivation is the existence and pursuit of goals. Goals can help people assume ownership of objectives and focuses attention on them. A high level of commitment to goals is attained when the individual is convinced their goals are important and attainable.

For that reason, helping claimants set the right goal (or goals) can be crucial. Assuming the DI policy enables their financial needs to be met, claimants may not be focused on returning to work even if evidence shows that doing so may benefit their physical and mental well-being.

Insurers who employ goal-setting techniques typically focus on explicit and non lifestyle-related return-to-work goals; for example, asking claimants to indicate a RTW date. Research has found that imposing this type of goal on claimants is less likely to get their commitment. A more effective strategy could be to focus on claimant goals that, while not necessarily specific to RTW, may help its facilitation. For example, a goal to play a particular sport again may be the motivation needed to overcome an illness or injury, or the desire to spend time with people again and receive validation may motivate returning to work.

Setting a goal is rarely enough on its own: a plan for achieving that goal is needed, particularly where there may be a perceived lack of capability. This is where goal-striving techniques come into play. Identifying stumbling blocks and barriers and deciding in advance how best to overcome them is key.

Setting a goal is rarely enough on its own: a plan for achieving that goal is needed, particularly where there may be a perceived lack of capability.

The Trial

Old Mutual knew the importance of goal-setting and goal-striving behavioral science techniques, but needed help to determine how best to embed them in the claims function so as to maximize their potential. RGA worked with Old Mutual to finalize its approach and then inspire, train, and coach the claims team. Seven assessors volunteered to participate in the trial. RGA and Old Mutual mapped the claims journey and agreed to the process shown in Figure 1:

Figure 1: Applying goal-setting and goal-striving techniques across the claims journey

Step 1: Claimant completes claims form

Old Mutual incorporated behavioral science techniques into its claims forms, aiming to guide every claimant through the first three steps of effective goal-setting and goal-striving at the outset. The form began by asking questions that would uncover the claimant’s level of RTW motivation and its source(s). Claimants were then encouraged to set goals related to leisure time activities (e.g., hobbies, exercise regimes) and then to list on their return-to-work plans the specific actions they would take to achieve these goals. Finally, claimants were asked to sign a form that indicated their commitment to these goals and plans.

For some claimants, this is as far as the goals process goes. For others, however, it can be the start of a process reinforced through focused claims team interactions.

Step 2: Identify claims that would benefit from a goal-setting conversation

RGA and Old Mutual created a guide that uses existing claims categories to focus on those claims for which goal setting might be the most effective. Those triaged as having short- or medium-term expected durations with return-to-work potential, alongside several other criteria, were selected. Claims handlers were then assigned approximately two of these relevant cases per month.

Step 3: Goal setting conversation

Once claims were identified, claimants were sent a pre-call SMS (text message) to help them prepare for the call and potentially increase participation. Claims handlers then conducted a goals conversation with claimants to help them visualise and understand their recovery goals more clearly and ensure they have made specific plans and commitments to achieve them. A system was also set up to prompt claimants during the claim period with reminders and to obtain feedback on their progress. For some claimants, this process expanded on the goals they initially identified. However, for those who did not set goals, this conversation was their first engagement with behavioral science-driven goal-setting.

RGA also created a call guide (Figure 1) to help make this conversation easy for claims handlers.

The guide detailed how to set specific action plans, how to explore ways to help claimants see their way past possible barriers to their goals, and create if/then plans to enable them to move forward. For example, assessors could ask lifestyle questions relating to the desire to reduce anxiety about their condition or regain their social lives. If/then plans could include both work and lifestyle-related options, such as discussing types of amended RTW plans with their workplaces, or committing to see a doctor if claim-related pain has not improved (or has worsened).

Claims managers were also trained how to determine if the process was less effective for certain claimants and if so, when to discontinue the goal-setting calls.

Step 4: Record responses and strengthen commitment

During calls, claims handlers were required to record claimant responses and email them back to the claimant as a follow-up. RGA created an email template that simply required claims assessors to fill in the relevant information from each conversation and send it back to the claimant. This enabled a record of the conversations and sought to strengthen commitment and ensure reciprocal accountability.

Step 5: Email to ask claimant to reflect on recovery progress

After an appropriate amount of time (usually a few weeks) had passed since the initial conversation, claimants were reminded of their commitment and their goals, and asked to reflect on their progress.

RGA created an email and/or SMS (text) template for assessors to send to claimants in advance of follow-up conversations. The template was designed to encourage claimants to think about what has and has not worked well, and to determine whether their goals have changed.

Step 6: Feedback conversation(s) to strengthen progress and provide reminders

After the email was sent, a follow-up feedback call would then be scheduled by the claim assessor to discuss progress. This call aimed to keep claimants engaged and ensure that claimant motivations remain the center of their recovery process.

RGA created a guide to take Old Mutual claims assessors through these feedback calls. Much like the opening conversations, these follow-up conversations sought to explore the claimant’s thoughts about their recoveries thus far, and to determine whether adjustments or updates for the goals and targets would be needed. This ensured that the goals outlined in the claim remain achievable for the claimant but still sufficiently challenging. It was also an opportunity for the assessor to encourage their assigned claimant, as external feedback can be motivating. Encouragement also shows claimants that their claims assessors remain focused on their best interests.

Claims assessors could (and did) repeat this feedback conversation as often as was useful.

Results

We measured progress of claims utilizing these new behavioral science centered forms throughout the trial via regular feedback interviews and focus groups conducted with the claims assessors. These enabled us to understand the process’ impact from the claimants’ perspective and to make iterative changes as needed.

In the four-month trial, approximately 75% of claimants set a goal in the claims form and about two-thirds (63%) set a lifestyle-related goal. This enabled assessors to align claimant motivation more closely with stated RTW goals, as often the recovery level needed to achieve the lifestyle goals would be sufficient for returning to work. Assessors could also see if the lifestyle goals conflicted with RTW goals and address this early in the claims process.

Table 6: Policyholder work and lifestyle related goals recorded in the new claims form

Policyholder Goals |

Work | Lifestyle |

Doing new work; e.g., new business, farming, writing | Returning to sport, exercise |

Getting back to the job | Educating others about their condition |

| Playing the piano |

| Gardening |

| Spending time with family |

| Going on a honeymoon |

| Travel |

| Cooking |

Feedback from the participating assessors indicated that satisfaction and engagement levels were very high. Assessors reported they felt the process was making a difference: Indeed, early evidence shows some claimants have already returned to work.

Lessons Learned

Key challenges highlighted throughout the trial included: successfully making contact with claimants, identifying the best claims to use for the trial, language barriers, describing to claimants why this was happening, and overcoming skepticism about the process.

The trial has experienced some early successes, primarily in claim assessor buy-in and utilization and claimant willingness to participate. With its successful conclusion, its processes and forms are currently being rolled out to Old Mutual’s claims team. We are continuing to monitor the integration of behavioral science into Old Mutual’s claims processes. We are looking forward to seeing how it will continue to develop.