Improving occupational duties disclosure

Assessing a claimant’s current occupational duties is key to understanding their capability and opportunity. Claims assessors need to understand what makes an RTW difficult, and how a job could be adapted to enable a quicker and safer RTW. This is particularly important for mental health claims, where issues may be caused by less visible aspects of a job. However, the information collected on claim forms is often inadequate, making the process harder and more time consuming.

Claims forms typically ask claimants to record their occupational duties using open-format questions, such as "Please describe the duties of your occupation" followed by a free-text input field. While such questions appear simple, it is a cognitively demanding task as most people have not previously considered their occupational duties.

To answer the questions, a claimant must:

- Decide what is a typical workday

- Remember what they do (their duties) during a typical day

- Mentally categorize the information into usable categories

- Decide what information is most relevant to the claims assessor and how detailed the descriptions need to be

- Estimate how much time on average is spent on a specific duty (often claimants are asked to calculate it as a percentage)

- Repeat for each duty

Many claimants, understandably, skip these complex steps and record the least amount of information they feel they can provide to answer the question. This results in extra work as a follow-up telephone call or form will be required to obtain the missing information. Figure 2 shows a typical example, taken from a genuine claim form, of how claimants sometimes respond to open-format occupational duties questions with free-text fields:

Figure 2: Example response to a typical open-format, free-text response question

- Q: What was your occupation at the time you became disabled?

A: General Practitioner

- Q. What were the specific duties of your occupation and what percentage of time did you spend performing each duty?

A. General Practitioner - 100%

RGA hypothesized that giving more guidance to claimants in the occupational duties question would reduce cognitive strain, which in turn would increase disclosure, improve the claimant experience, and reduce the need for follow-up conversations.

In a study of 8,000 people in Australia, Canada, the United States and South Africa, RGA tested alternative versions of the occupational duties question alongside the typical free-text question.

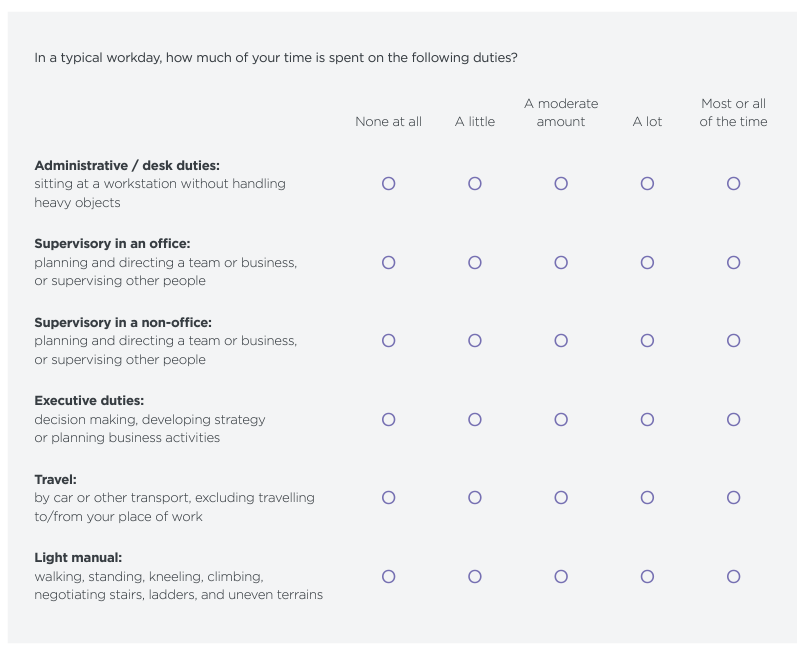

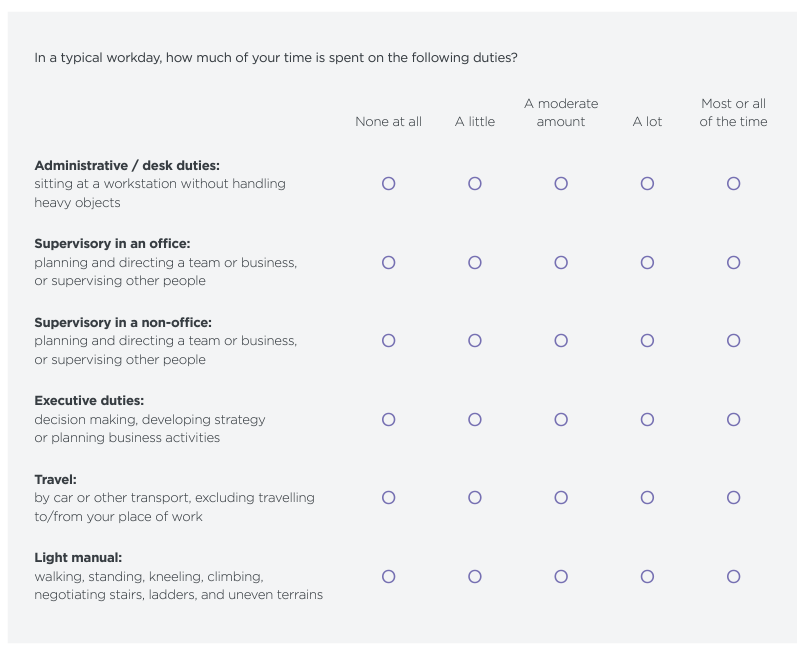

Each alternative version provided different levels of guidance to the claimant to help make answering the question easier. For example, two versions used checklists which, although making the question longer, clarified the information required and therefore reduced the amount of mental effort required to answer the question. One checklist provided a comprehensive list of relevant duties requiring respondents to record the frequency of performing those duties on a scale from ‘None at all’ to ‘All or most of the time’. Figure 3 shows the other checklist which used the same frequency scale but was shorter, grouping duties into categories.

Figure 3: Example of a short checklist

Participants were randomly assigned to answer one of the question types as part of a lifestyle survey. The question response time was measured, and the respondents asked to rate their experience. The quality of the information provided by the respondents was assessed by randomly selecting responses from each of the different versions and asking RGA claims experts to rate the value of the information provided, without knowing how the question was asked.

Short checklists were by far the most effective of the question versions tested. The results of the experiment showed that:

- Short checklists improve the quality of the occupational duties information.

Claims experts rated ‘usefulness of disclosure’ at 7/10 for the short checklists compared to only 2/10 for the freetext question, and rated the checklist response as much less likely to require a follow-up call. The results from the short checklist were rated as more useful than those from the full checklist as it was easier to synthesize the information and make judgements.

- Short checklists took a little longer to answer but were perceived as quicker to answer.

Short checklists took 16 seconds longer to complete than free-text questions – a small trade-off given the extra disclosures. Also, respondents rated the short checklist as quicker to answer even though it took more time, showing the experience felt less effortful.

- Short checklists improve the claimant experience.

Short checklists were rated by respondents as easier and clearer to understand than free-text questions. Respondents were less likely to say they omitted detail to hurry through the question when using short checklists compared to the free text questions.

This research demonstrated that checklist-based occupational duties questions, such as those in Figure 3, frequently produce better quality information for the insurer and a better experience for claimants. Therefore, applying this behaviourally enhanced questionnaire improves the effectiveness and efficiency of the claims process.

The research also shows that delivering simple processes for claimants is about more than just creating the shortest form possible. It requires an understanding of how information is mentally processed and the ability to help reduce complexity. There is a clear opportunity to apply this approach to other aspects of claims processes, for example, in medical questionnaires.

Effective RTW goal-setting

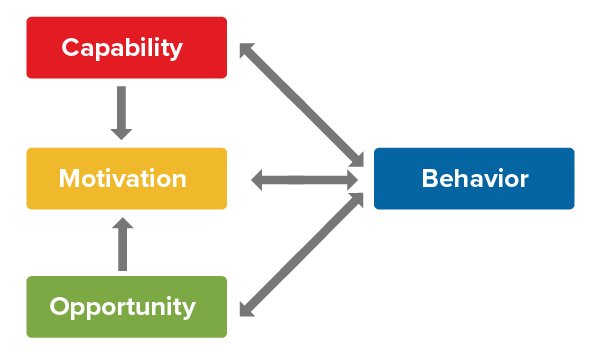

Obtaining comprehensive and accurate occupational information is a crucial part of assessing capability and opportunity. Motivation is then needed to regain capability, take opportunities and, ultimately, return to work. This is particularly important in mental health claims, where the condition itself may be impacting motivation.

Many insurers already try to identify claimants’ RTW motivations within their claims processes, but rarely is the approach complete and comprehensive. By following simple best-practice behavioral science approaches, many insurers could significantly improve the effectiveness of what they are already spending time trying to do – help claimants recover and, ideally, return to full functionality.

One significant source of motivation for all behaviors is the existence and pursuit of goals. Goals can help people assume ownership of objectives and focus their attention. A high level of commitment is attained when an individual is convinced their goals are important and attainable.

For that reason, helping claimants set the right goals can be crucial. Insurers who employ goal-setting techniques typically focus on setting a RTW date. Our experience shows that this goal, if appropriate for the claimant, can benefit from considering the wider benefits of RTW, such as the desire to meet colleagues again and receive validation from work. An additional effective strategy can be to combine this RTW goal with a claimant’s personal, non-work-related goals. While these may not be specific to RTW, our research shows they may help its facilitation. For example, a goal to play sport again may help to overcome an illness or injury which ultimately facilitates a RTW.

Setting a goal is rarely enough on its own: a plan for achieving that goal is needed, particularly where there may be a perceived lack of capability. This is where goal-striving techniques come into play. Identifying stumbling blocks and barriers and deciding in advance how best to overcome them is key. One technique that works well is the use of ‘if/then’ plans, where claims assessors help claimants identify that ‘if’ a certain challenging event happens, ‘then’ they will respond in a prepared way designed to overcome their usual habits in these situations.

Goal-setting and goal-striving techniques have been used successfully to aid RTW. In 2016, a trial by the New South Wales Government involving more than 1,700 workers found that behavioral science techniques to improve goal-setting and simplify customer communications meant claimants were over three times more likely to return to work within 45 days (NSW Government, 2016). However, insurers often find it hard to implement these techniques effectively into claims processes, as they must be embedded throughout the process. Claims assessors play an important role in their delivery.

RGA has developed and tested ways to embed goal-setting and goal-striving techniques into claims processes to maximize their potential. Behaviorally enhanced claims forms, telephone interview guides, and email communications have been designed that make the process easier to use for claimants and claims assessors.

These goal-setting and goal-striving techniques do not replace medical treatments and plans, especially specialist mental health counselling, but they do enhance the support that insurers can provide.

Trials with insurers around the world have demonstrated the success of the approach. For example, in a recent trial, three-quarters of claimants set themselves motivating goals that were aligned with RTW outcomes. Feedback from claims assessors indicated that their satisfaction and engagement levels were very high, and they felt the process was improving claimant engagement and return to work outcomes. The goal-setting approach has now been permanently adopted.

Future areas of focus

The results of RGA’s trials have shown that, for a small investment of time, behavioral science can be successfully incorporated into key phases of the claims process, from filling out claims forms to setting goals and making recovery plans.

However, there is more still to be done. In RGA’s mental health survey, the top-rated challenge regarding the assessment and management of disability claims was ‘difficulty receiving support from the attending physician in facilitating return-to-work support’. Can behavioral science help us better engage with medical professionals and make their involvement easier and more impactful? RGA is planning new research in this area, and we look forward to sharing our findings