The middle market in South Africa has grown significantly over the last decade. With increasing access to technology and improvement in living standards, more individuals and households are moving away from poverty into the middle market.

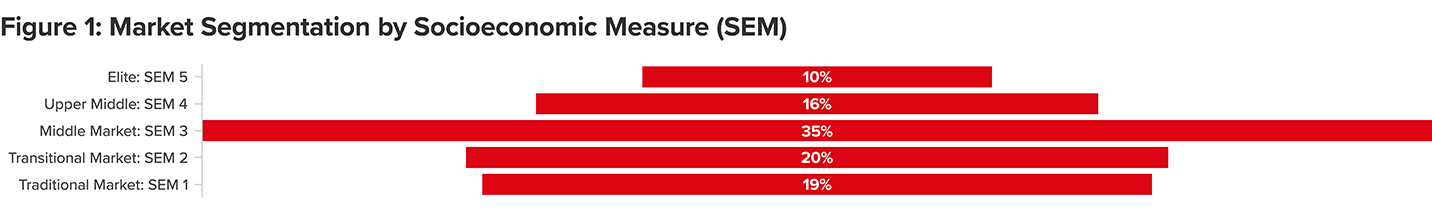

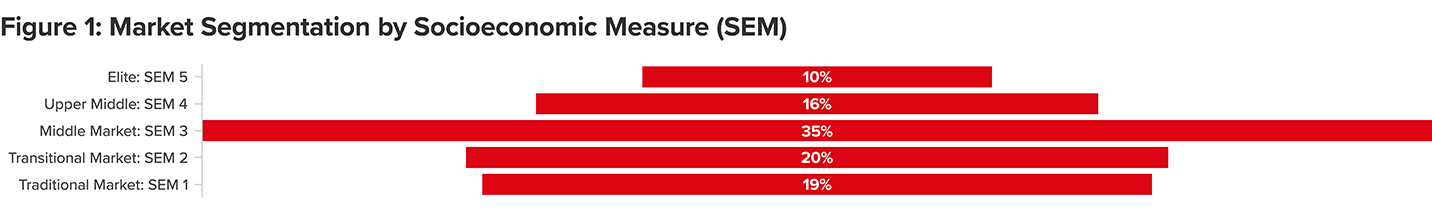

Recent research on customer segmentation shows that, when combined with a similar transitional market, the middle market, currently accounts for 55% of the total population. This segment typically earns between R3K – R10K (US$160 – US$550) per month and often moves between formal and informal financial services to seek out the best option for their needs.

Furthermore, the middle market is characterized by participation in the informal economy, which is a key source of employment, goods, and services for lower-income groups in South Africa, contributing around 6% of the Gross Domestic Product (GDP). The sector is a significant component of the economy and provides livelihoods to a sizeable number of workers and informal traders. Given the day-to-day nature of the informal economy, individuals and households in the middle market segment are often vulnerable to external shocks or adverse events, such as the death of the main breadwinner, as well as other health or economic risks, which can drive them further into poverty. Insurance could be an effective risk management tool for middle-market consumers; however, millions of them remain underserved and do not have access to formalized protection products.

So, why aren’t insurers targeting this market?

RGA recently conducted a snap consumer survey to better understand the insurance purchasing decisions of middle-market consumers, especially in the current economic climate. A total of 200 individuals were surveyed, with responses split equally amongst those earning less than R10K per month (middle-to-low-income consumers) and those earning more than R10K per month (upper-middle-to high-income consumers) for comparison. The survey sample was targeted to broadly reflect the demographic (age and gender) profile of South Africa.

Key findings

Insurance gap

The survey results show (Figure 2) that over half of the respondents in the middle market (under R10K per month) have funeral insurance; however, there is low uptake for non-funeral products. The high penetration of funeral products can be attributed to the cultural importance of a dignified funeral. On the other hand, the low penetration for non-funeral products may be linked to a lack of awareness and affordability, providing an opportunity for insurers to improve product pricing and customer education around the benefits of these products.

Affordability

Obtaining access to affordable products continues to be a key challenge for consumers in the middle-to-low-income market. Seventy-seven per cent of the respondents earning under R10K per month cited affordability as a key barrier to insurance uptake. The pricing of these products is typically linked to the level of income and other rating factors, and the results highlight the need for insurers to review product pricing methods for middle-market consumers. For example, flexible premium payments or a tapered approach where cover is reduced or increased monthly based on affordability offer potential solutions.

Importance of family coverage

Around 44% of all the respondents report having recently purchased insurance, despite the tough economic climate, and they cite providing coverage for the family as the main reason for purchasing additional coverage, particularly among those earning under R10K per month. This is an important consideration for insurers in designing products for the middle market, especially where the cultural definition of family extends beyond blood ties.

High perceived value of insurance

The impact of the pandemic and subsequent rise in interest rates and inflation has resulted in a tough economic climate for consumers in both the low-and higher-income spectrums. Most respondents indicate their income has significantly decreased or the cost of living increased over the last two years. Interestingly, reducing entertainment and grocery spending is cited as the main way respondents have managed monthly costs. Furthermore, the demand or value for insurance seems to be unchanged, even during tough economic times. Only 6% of the total respondents indicated reducing insurance coverage to manage monthly costs. Furthermore, only 21% of all the respondents indicated that they have recently cancelled their policies or plan to do so in the next year. These results could be attributed to cultural factors or higher perceived value of insurance, especially after the COVID-19 pandemic.

Potential solution: embedded insurance

From a behavioral science perspective, selling insurance can be compared to selling sprouts. Sprouts are good for you, but they certainly are not very exciting. Insurance operates the same way, and is therefore usually sold, not bought – more so for the middle market where affordability is a key challenge. Integrating insurance into the purchasing cycle of existing products and services, commonly known as embedded insurance, could be a viable solution for insurers to reach underserved, middle-market consumers.

A typical embedded insurance ecosystem comprises customer aggregators, such as banks, retailers, and mobile network operators; an insurtech (providing the platform to administer policies); and an insurance partner underwriting the risks. The key difference between embedded insurance and the traditional affinity model is the use of technology, data, and artificial intelligence tools to create a seamless customer journey.

By utilizing data from customer aggregators to build personalized solutions, and integrating insurance sales into existing processes, embedded insurance could significantly lower acquisition costs for insurers and, in turn, improve the affordability of products for the middle market.

Summary

The middle market segment in South Africa remains relatively underserved by insurers despite its significant growth and contribution to the economy. RGA's snap survey highlights the insurance gap and the opportunity for insurers to educate and build products relevant to middle-market consumers. Given the tough economic climate, affordability continues to be a key challenge, and embedded insurance could be a way to simplify the purchase process and provide better coverage for middle-market consumers.

At RGA, we are eager to engage with clients to better understand and tackle the industry’s most pressing challenges together. Contact us to discuss and learn more about the RGA capabilities, resources, and solutions.