The World Health Organization defines suicide as ‘the human act of self-inflicting one’s own life cessation’.

It is a tragic event, affecting millions of families each year, as well as one of the most common non-medical causes of death worldwide. Currently, suicide stands as the 13th leading cause of death worldwide, responsible for nearly 1 million fatalities annually. In addition, an estimated 20 times as many injuries as fatalities are sustained by attempted suicides. Global suicide rates are up 45% over the past 45 years and are a high causative factor for disability and permanent impairment. Research into suicide has shown that over 90% of people committing suicide have an underlying mental illness such as depression. However, in recent years, economic stresses such as unemployment have also been shown to have relevance.

While nearly 1 million people die each year from suicide, suicide experience tends to be substantially under-reported. Causes of death can be difficult to ascertain, and the quality of data depends on the efficiency of the coroner’s office. A death can be categorized as unknown cause, accidental death, or based on the clinical cause of death. Religious and cultural beliefs, as well as financial reasons related to insurance policy language about suicide claims, may also contribute to the prevalence of underreporting suicide deaths.

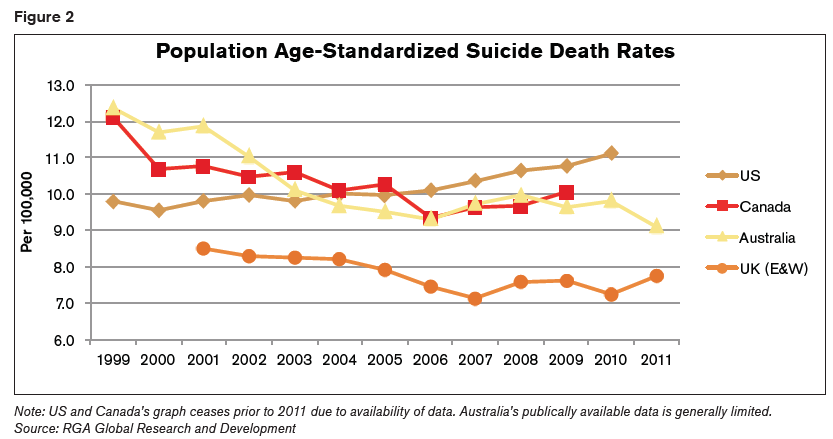

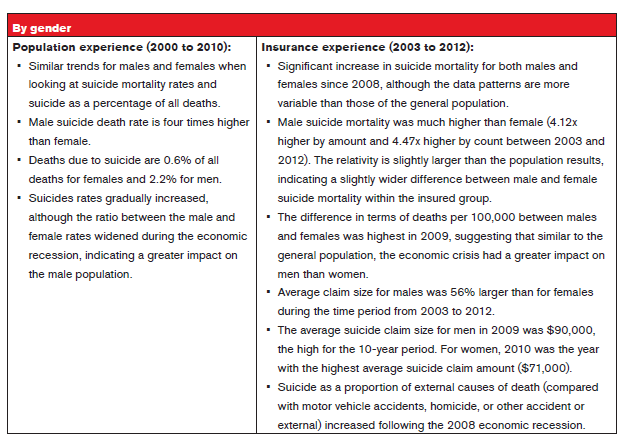

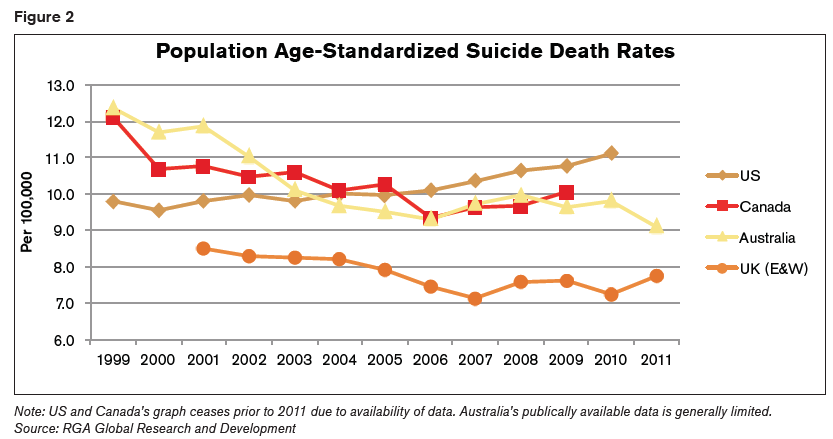

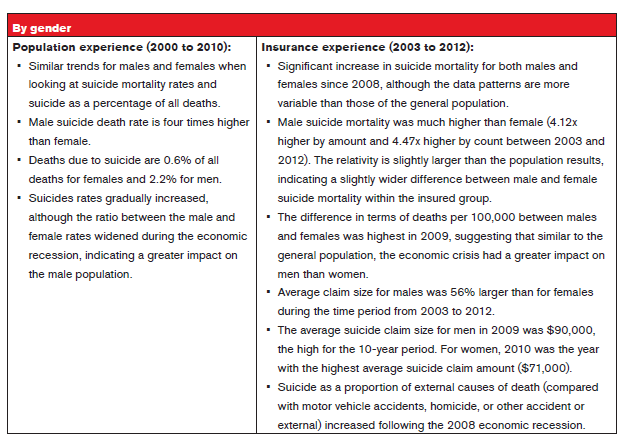

RGA’s Global Research and Development team undertook to analyze suicide rates before and after the 2008 financial crisis, using population data from Canada, Australia, the UK, and the US as well as insured data from RGA’s extensive database. The study found that insured suicide experience was negatively affected by the 2008 economic crisis, with increases seen both in frequency and severity. In Canada, Australia and the UK, suicide rates had been falling prior to the economic crisis, whereas in the US, experience had been increasing since 2000 due to the ongoing economic downturn, with significant differences evident between insured and general populations.

The Global Suicide Experience

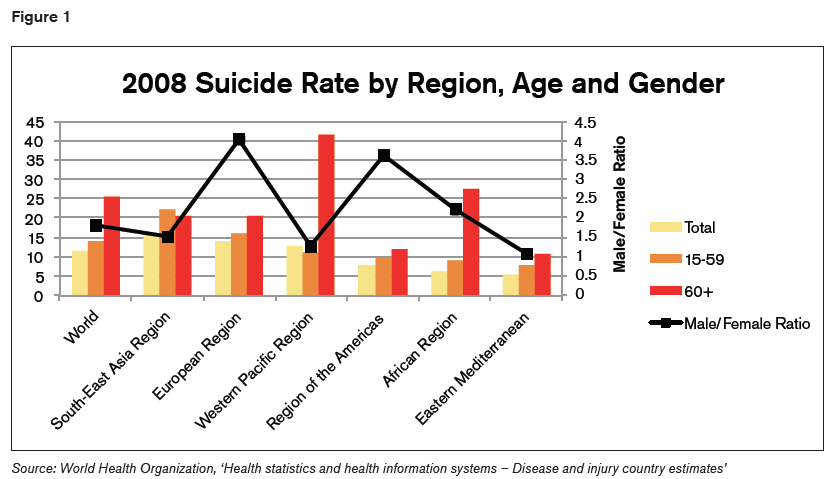

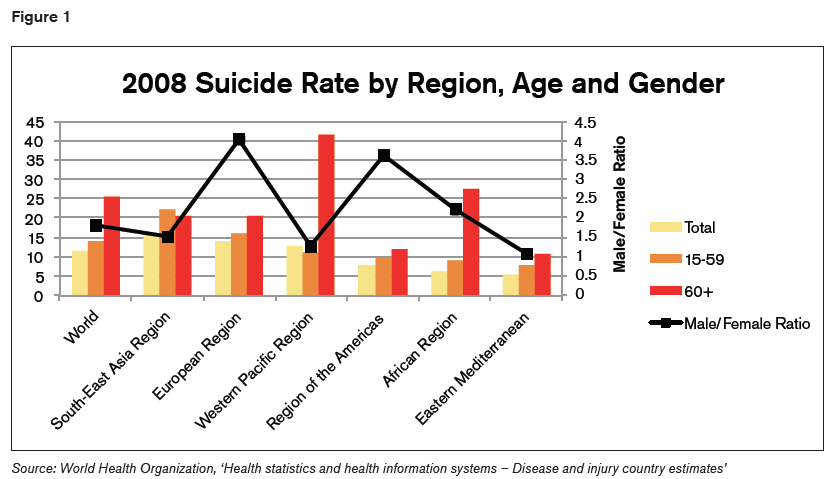

In 2008, according to World Health Organization data, the global suicide rate stood at 11.6 per 100,000, with significant differences across regions: the highest suicide rate was in Southeast Asia, at 15.6 per 100,000, compared to 5.6 per 100,000 in the Eastern Mediterranean. Suicide experience can also vary from country to country, with the principal variables being age, gender and method.

Suicide methods

The most common method of suicide worldwide, according to the WHO, is hanging. Other common methods include firearms, pesticides, other poisons, falls, and drowning: Men are more likely to commit suicide by hanging or firearm use, whereas women favor poisoning, falls, or drowning.

The preferred method also varies from region to region. For example, in the US, firearms are the most common method of suicide, especially among males. This is particularly evident in states where gun ownership is high. Poisonings are more common in Southeast Asia, and suicides resulting from falls are more common in Europe and the Western Pacific region than in other parts of the world.

Key factors contributing to suicide risk

- Means restriction. Areas with restricted access to firearms, pesticides or barriers on popular jumping locations have improved suicide experience. This is because people may substitute it with a less lethal suicide method. Additionally, suicide tends to be an impulsive decision: A study that examined suicides found that only 13% of those attempting suicide planned the event more than a day in advance, whereas more than 70% deliberated for an hour or less. Restrictions to lethal methods of suicide can improve suicide rates in part because people may be less likely to commit suicide given more time to deliberate.

- History of previous suicide attempts. People who have previous non-fatal suicide attempts have a greater risk of suicide than the general population. However, 70% of people who survive a suicide attempt do not retry, and only 7% of those who retry eventually complete suicide.

- Age and gender. These are strong experience differentiators. In the US, for example, data from the Centers for Disease Control shows that young women have 100 suicide attempts for every completed suicide, usually due to the lower lethality of the methods chosen. Conversely, the elderly have been found to have a lower rate of attempts but a much higher rate of completed suicides, possibly due to underlying physical frailty and illness.

- Health status. People suffering from serious medical conditions (HIV and cancer) or chronic pain have been shown to be at higher risk for suicide, possibly as a means of controlling their medical situations.

- Military experience. This factor is particularly relevant in the US. Between 1999 and 2010, there was an increase in the number of suicides among US military veterans. Veterans with a history of Traumatic Brain Injury (TBI) are 1.55 times more likely to commit suicide than those without a brain injury. In addition, 2005-2012 saw an increase in suicides among active duty US military personnel.

- Mental health. More than 90% of those who commit suicide are suffering from a mental illness (most commonly depression) or a psychiatric disorder at the time of the suicide. Only 3% of suicides worldwide occur without a diagnosed mental illness. The effects of antidepressant drugs on suicidal behaviour in adults are not known, although certain antidepressants have been shown to increase suicide risk in children and teenagers.

- Stress and socioeconomic factors. These may interact with underlying mental illnesses to trigger a suicide decision. Influential factors can include financial stress due to poor economic conditions or personal / family discord. The unemployed are two to three times more likely to commit suicide, and a study published in the BMJ (British Medical Journal) about the effects of the 2008 global economic crisis on suicide found that suicide rates were higher than expected in 2009, and corresponded with higher rates of unemployment.

Suicide experience in Australia, Canada, and the UK

The impact of suicide experience on the economy was analysed in the US, Canada, Australia and the UK. These countries were selected due to availability and quality of that data. As seen in the figure below, all four countries show higher suicide rates in the 2008-2010 period compared to 2007.

Canada (data from Statistics Canada)

- 1.5% of all deaths are caused by suicide.

- Suicides account for 25% of non-medical deaths.

- Individuals over age 65 have a lower suicide rate

than younger ages. - Age group 45-54 has the highest suicide mortality

rate. - The suicide rate for males is almost four times as

high as for females.

Australia (data from the Australian Bureau of Statistics)

- Just over 1.5% of deaths are caused by suicide.

- Suicide accounts for over 25% of non-medical deaths.

- The male suicide rate is higher than the female, and male rates have been decreasing since 2002.

UK – England and Wales (data from the Office for National Statistics [ONS]).

ONS data only refers to England and Wales and does not include Scotland or Northern Ireland.

- Suicides are the cause of 3.5% of all deaths.

- Suicides account for 27% of non-medical deaths.

- Suicide rates decreased from 2001 to 2007, but increased in subsequent years.

- The financial crisis had the largest impact on suicide rates for ages 45-54.

- Males have a significantly higher suicide rate than females, and the economic climate had a greater impact on male suicide rates.

The definition of suicide in the UK is broader than the WHO definition: it incorporates deaths with an underlying cause of intentional self-harm; or an injury or poisoning of undetermined intent. As such, the definition enables the inclusion of more deaths and may therefore artificially inflate rates and percentages.

Suicide experience in the US

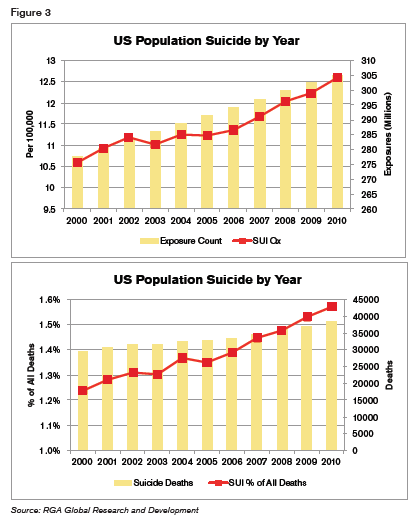

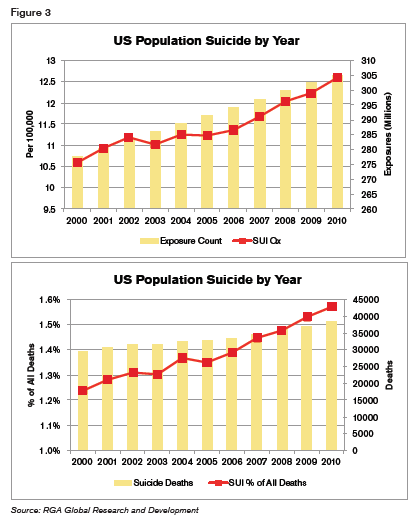

Between 2000 and 2010, the US population suicide death experience increased steadily while the total death rate per 100,000 population decreased. Suicide as a percentage of all deaths therefore increased. The consistent rise in suicides coincides with the slow growth of the economy during that period, as well as the global economic recession that began in 2008.

RGA data supports the assumption that suicide rates in US-insured populations are more sensitive to changes in the economy than rates for the total population. Suicide mortality rates have been increasing since the 2008 economic crisis. Comparing the period from 2008-2010 to the pre-recession period of 2000-2007, suicide claim volumes for the later period were 39% higher by count and 79% higher by amount, compared to a 9% increase in the post-recession period for the general population. In addition, the average adjusted claim size is 43% larger than the average claim size for the total of all causes. (All US results are net of rescinded claims due to suicide contestability during the first two policy years.)

Treatment of Suicide at Claims Stage

A separate survey of RGA’s US, Australian, Canadian, and UK offices shows similar claims experience. All offices were in consensus that suicides are generally under-reported.

The survey primarily canvassed:

- The existence of suicide clauses, and typical suicide exclusions and durations.

- Claims management where death during the exclusion/contestable period is recorded as suicide or where circumstantial evidence points to suicide.

- How suicide claims are generally handled outside of the exclusion/contestable period.

- Experience of assisted suicide or suicide pacts.

- Developments in suicide claims management.

Australia

- Suicide exclusions commonly exclude deaths in the first 12 or 13 months but can extend up to three years.

- Exclusion wording refers to no payment being made where death arises directly or indirectly through suicide or through any intentionally self-inflicted act.

- Deaths arising from clear cases of suicide or self-inflicted acts during the exclusion period are generally not paid.

- Suicides outside of the excluded period are usually paid.

- No experience of death through assisted suicide or suicide pact.

- In response to spikes in suicides after the contestability period, there is talk of extending the current suicide exclusion period. Discussions have included enforcing blanket suicide exclusions, although no company has taken the lead.

US

As insurance in the US is state-regulated, each state can have different regulations concerning suicide provisions as well as state-specific case law experience and precedence. Therefore, experience can vary from state to state. Commonly:

- Suicide clauses are included on all life policies, typically for a two-year duration.

- A typical exclusion will require that life insurance benefits will not be paid for death due to suicide, while sane or insane, or from an intentionally self-inflicted injury.

- Claims arising during the contestable period are investigated for material misrepresentation. If evidenced, then the policy is rescinded. Otherwise, a suicide benefit is paid (premium refund).

- Claims for suicides outside the exclusion period are payable.

- Claims through suicide pacts and assisted suicides would follow the usual contestable investigation process. When chronic and terminal illness exists, recognition needs to be given to the legality of assisted suicides in certain states, as well as regulations in those states that indicate legal assisted suicides are not to affect life, health, accident or annuity policies.

- In recent years, the US market has witnessed an increase in litigation where death is ruled as a suicide, and the circumstances may involve polypharmaceutical intoxication/drug overdose, smoking cessation prescription drugs, antidepressants, and sleep aids.

UK

- The use of suicide clauses varies between providers, although nowadays suicide clauses are less prominent. Even when death from suicide occurs during the exclusion period, protection is given to mortgage lenders in cases where the policy has been purchased as security for the loan, and claims will be honored in favor of the lender.

- Where exclusions exist, typical wording is that payment will not be made if the suicide is committed within 12 months of the policy/reinstatement start date.

- When a suicide occurs within the exclusion period, the claim will usually be denied subject to protection for lenders.

- Suicide (or suspected suicide) claims, regardless of whether a suicide clause exists, will be thoroughly investigated before making a decision. Consideration will be given to non-disclosure, chance events, and whether reliance can be placed on the Forfeiture Act. Where suicide is suspected, efforts will concentrate on securing a suicide verdict from the coroner.

- Where policies do not provide guidelines for suicide claims, suicide or self-inflicted deaths are generally paid once 12 months have elapsed from policy inception/restart and are subject to misrepresentation being ruled out.

- Little experience of suicides involving third parties such as assisted suicide or suicide pacts, but insurers would adhere to the general suicide assessment process.

Canada

- Suicide exclusions exist on all policies and are usually for two years from inception or reinstatement.

- The exclusions typically refer to no benefits being paid if death arises directly or indirectly from suicide (regardless of whether the insured person was of sound mind or not). Some policies also exclude attempted suicide or self-inflicted injuries (whether or not of sound mind).

- Deaths arising from suicides during the exclusion period are an outright decline. However, in the case of a self-inflicted death during the contestable period that is not classified as a suicide, contestable investigations may be carried out, and if the suicide cannot be confirmed, the claim is paid. If the policy is rescinded for material misrepresentation premiums are refunded, and if the policy is valid, a reduced death benefit (equal to premiums paid) will be paid out.

- Non-reported suicides during the exclusion period are subject to a contestable investigation. If suicide cannot be proved then claims are paid, unless reliance can be placed on a self-inflicted injury exclusion.

- For policies where no suicide exclusion exists or the period has expired, suicide claims will generally be paid assuming fraudulent misrepresentation has been ruled out.

- No experience with assisted suicide or suicide pacts, although assisted suicide is illegal in Canada.

Conclusion

The prevalence of suicide as a cause of death throughout the world is rising, and shows no sign of subsiding in the present economic crisis. The claims assessment process remains challenging, as coroners are frequently reluctant to cite suicide as the cause of death. Consequently, this can lead to a drawn-out claims process, which becomes costly and risks reputational damage to insurers. The outcomes of suicide claims will ultimately depend on the final verdict and the robustness of policy wording.