Suicide is a tragic fatality that affects millions of families worldwide each year.

In addition to the nearly 1 million fatalities, it is estimated that 20 times as many people are injured by attempted suicide. [1] These suicide attempts, while not fatal, often result in disability or permanent impairment.

Research has shown that economic stresses are sometimes a contributing factor in suicides. In order to gain a better understanding of whether recent economic stresses may have impacted suicide rates, RGA recently undertook a study to analyze suicide rates before and after the 2008 financial crisis, using population data from four countries as well as insured data from RGA’s extensive database. In this article, we summarize the results of this study, which found that insured suicide experience was negatively affected by the economic crisis.

The Global View

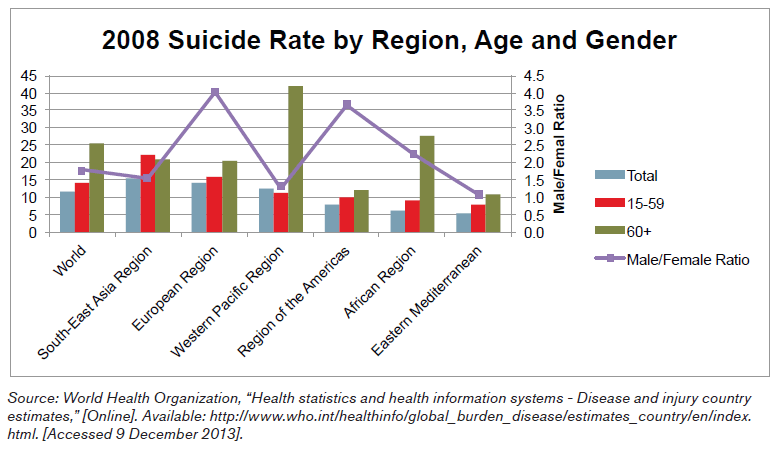

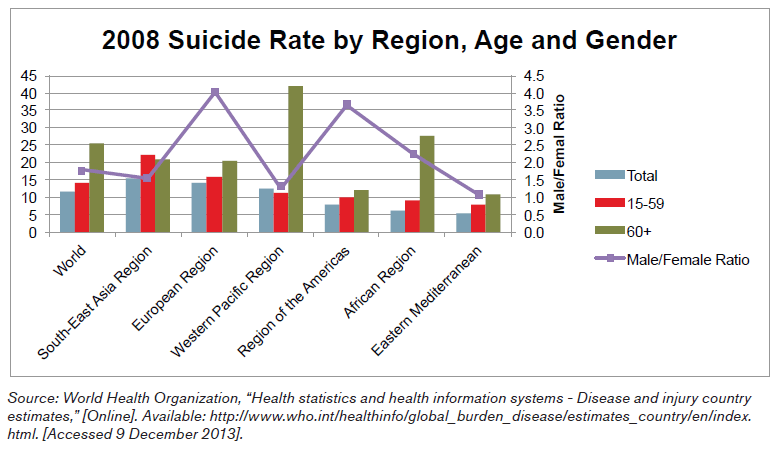

Globally, suicide is a leading cause of death; however, the experience varies greatly by region, age and gender. The Southeast Asian region has the highest suicide rate; people over age 60 have worse experience than younger people, and men are twice as likely to commit suicide as women. [2] There are many differences in preferred suicide method by region. Hanging is the most common method of suicide in every region, except the Americas, where firearms are the most common method of suicide. This experience is very different from the eastern Mediterranean region, where 0.3% of suicides are due to firearms. Poisonings are more common in Southeast Asia than in other parts of the world, while suicide resulting from falls is more common in Europe and the Western Pacific region than in other areas. [3]

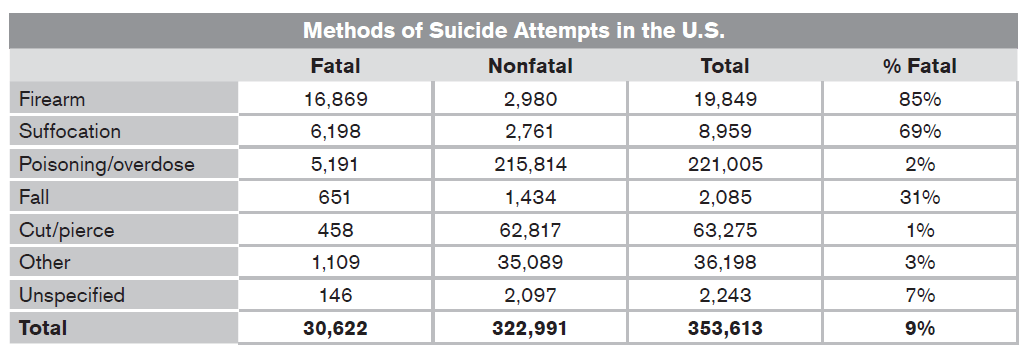

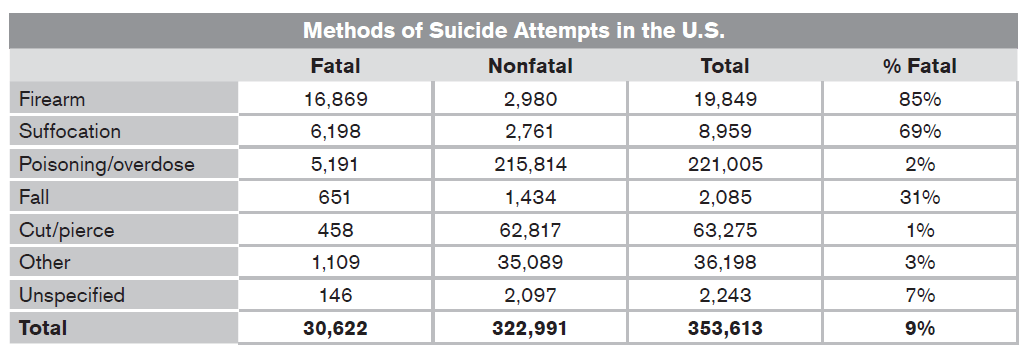

One of the main reasons for the differences in mortality rates is the method

of suicide. Groups of people who choose highly lethal means, such as firearms,

have correspondingly high fatality rates. The following table shows the fatality rates for various suicide methods in the U.S. in 2001. The overwhelming majority of suicide attempts are poisoning/overdose; however, only 2% of those attempts are fatal. [4]

Many factors contribute to suicide; however, studies have shown that over 90% of people who commit suicide have an underlying mental illness, such as depression. [5] Additionally, economic stress, such as unemployment, has been shown to contribute to suicide rates. [6]

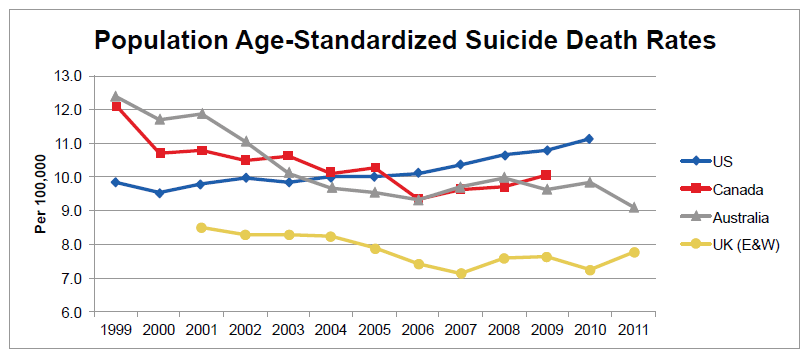

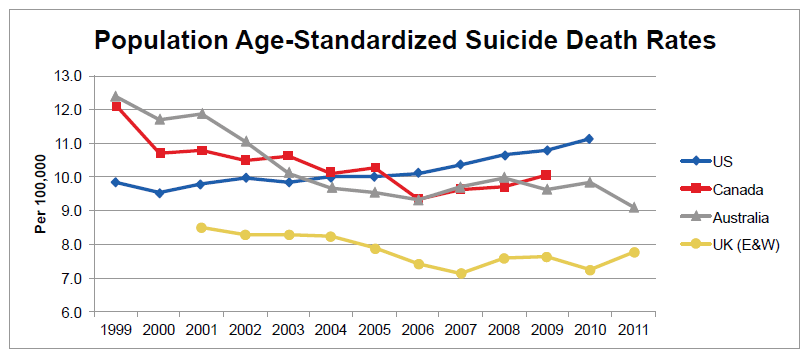

We analyzed suicide trends before and after the 2008 economic crisis using population data from four countries: Canada, Australia, the United Kingdom and the United States. Generally, suicide rates were falling for these countries until the economic crisis, and then rates increased. The U.S. experienced increasing suicide rates for the entire period beginning in 2000.

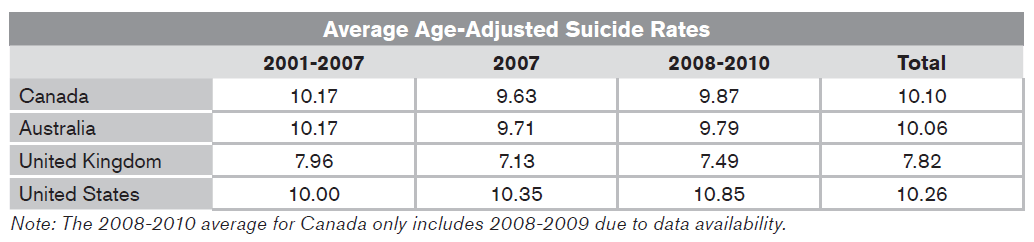

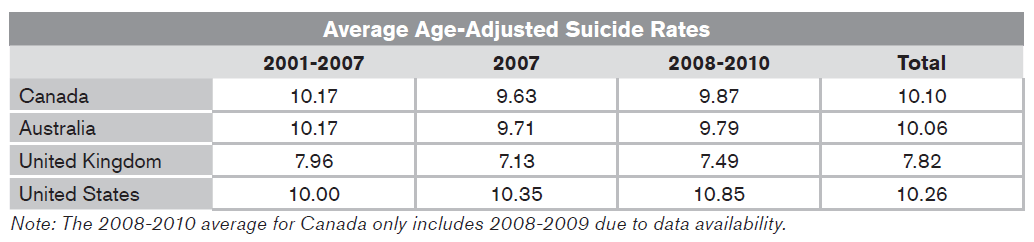

The average suicide rates for these countries before the economic crisis and subsequent to 2008 are shown below. All four countries show higher average suicide rates in the period of 2008 to 2010 relative to 2007.

The experience of the insured population is analyzed in great detail for the U.S. and is indeed different than the overall population. Key findings from RGA’s analysis are detailed below.

The U.S. View

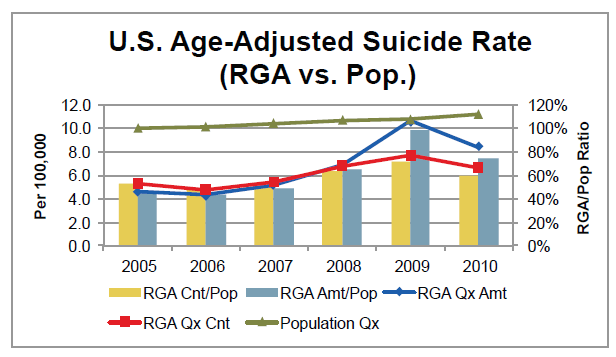

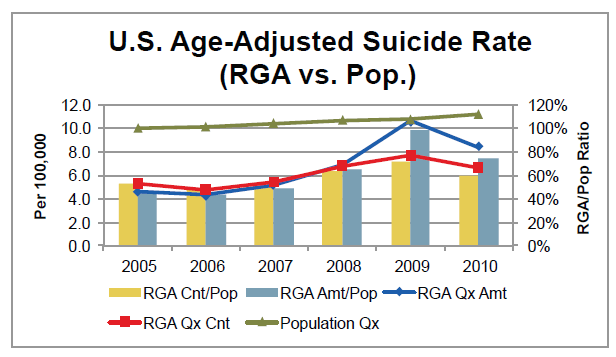

The global financial crisis had a larger impact on the insured population.

Results show that suicide mortality is generally lower for the insured population than for the general population. However, the ratio of the insured suicide rate relative to the suicide rate from the total population has increased dramatically since the recession started.

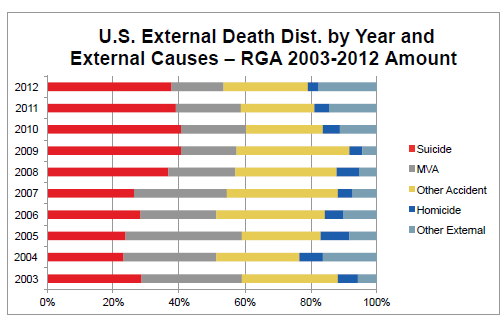

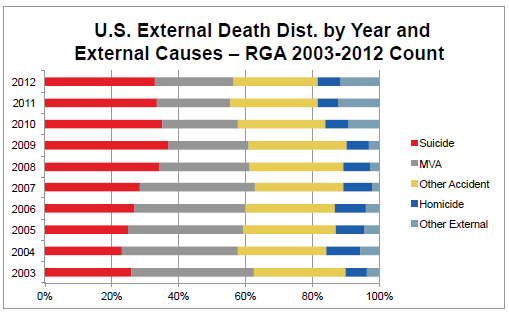

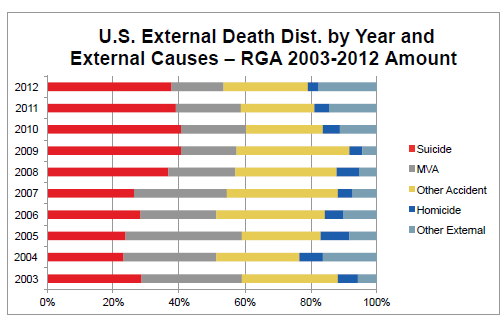

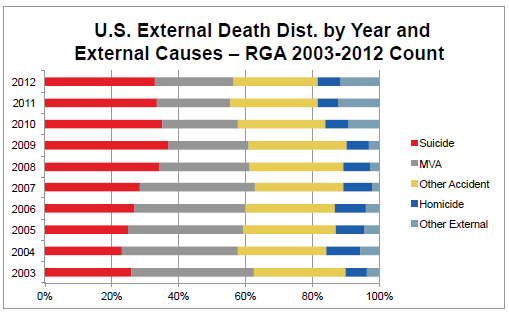

After the recession, suicide became the most common external cause of death.

The following cause of death analysis compares suicide with other external causes of deaths. Beginning in 2008, suicide became the most common external cause of death, surpassing motor vehicle accidents and other accidents.

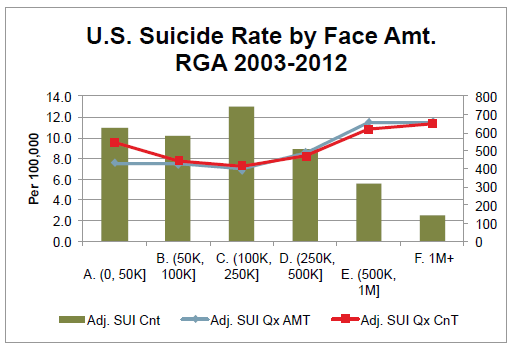

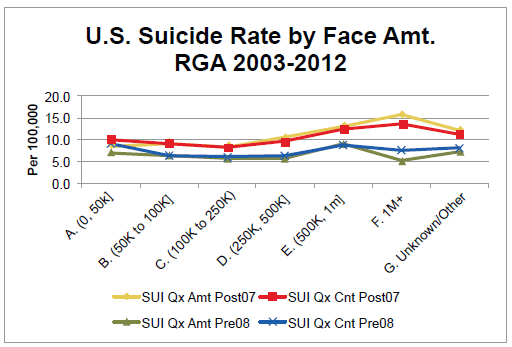

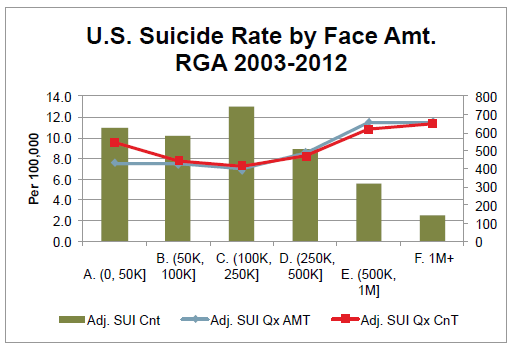

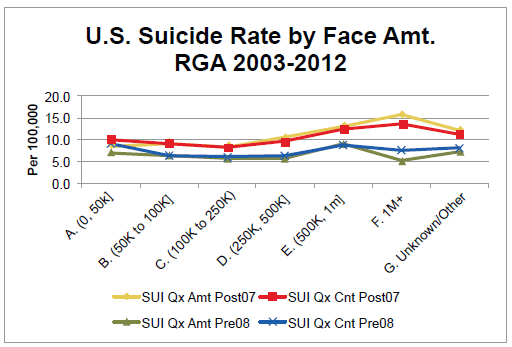

Policies with the highest face amounts, i.e., above $1 million, have the largest increase in suicide rates during the period following the 2008 economic recession.

- The groups with the highest and lowest face amounts experience the highest suicide rate. Conversely, policyholders with face amounts in the $100,000 to $250,000 range have the lowest suicide rate.

- The highest face amounts (more than $1 million) have the largest increase in suicide deaths per 100,000 during the period of the 2008 economic recession.

- Suicide percentages relative to total causes of death typically increase with face amount.

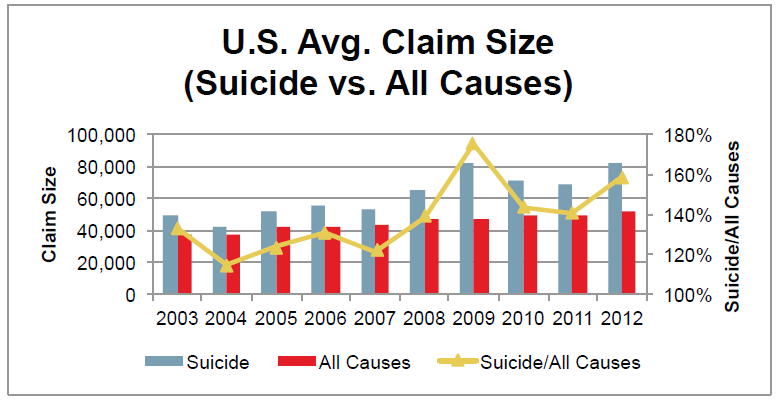

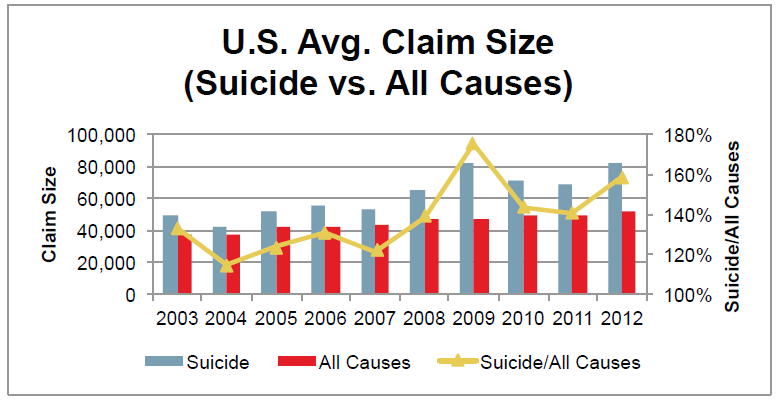

The average claim size increased following the recession.

Average claim size is generally larger for suicide claims than for all claims combined. This difference widened even more during the recession, as reflected by the Suicide/All Causes ratio. Additionally, the average suicide claim size during economic recession is larger than pre-recession. It is important to note, however, that volatility at the highest face amounts can cause dramatic swings in average claim size.

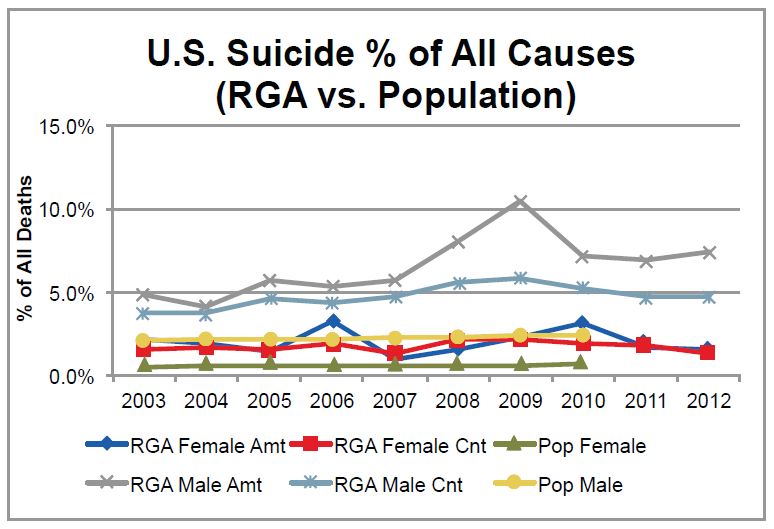

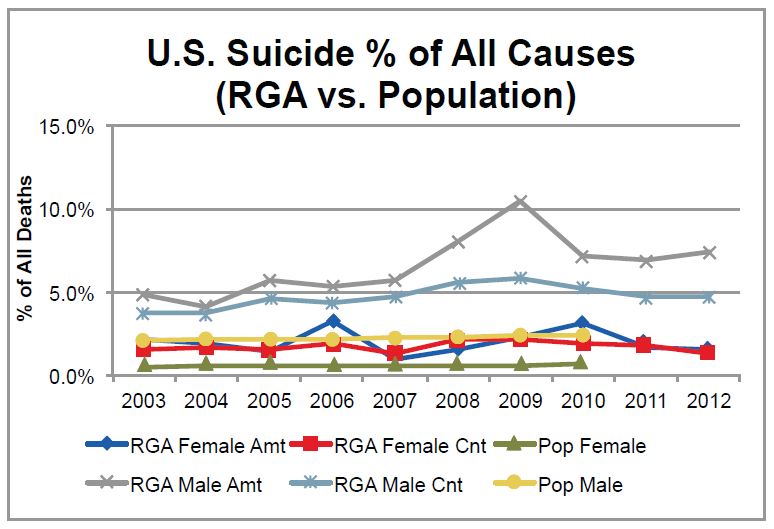

Males experienced a relatively larger impact from the recession than females.

- Males account for a much higher proportion of suicide deaths than females, both by amount and by count.

- 2009 represents the year with greatest impact on males from the economic recession.

- Generally there is a much higher proportion of suicide deaths for the insured population than the general population.

The results show a significant increase in suicide mortality for both males and females since 2008. Unlike the consistently increasing pattern of population suicide rates, insurance suicide rates exhibit greater variability, as well as a more active response to economic conditions.

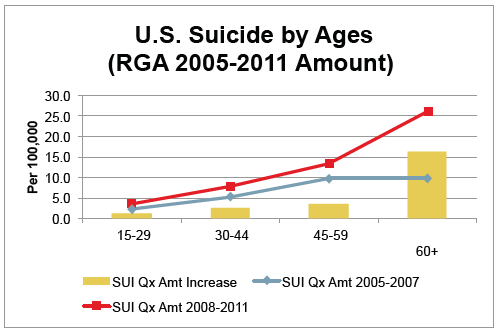

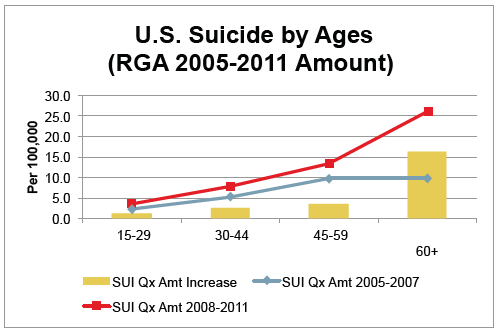

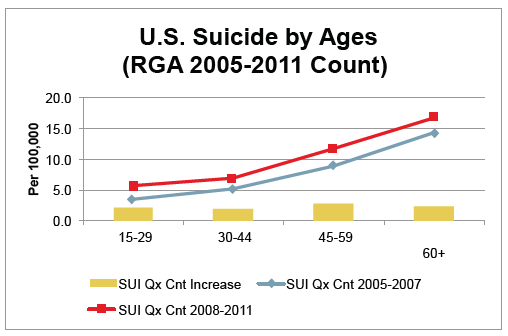

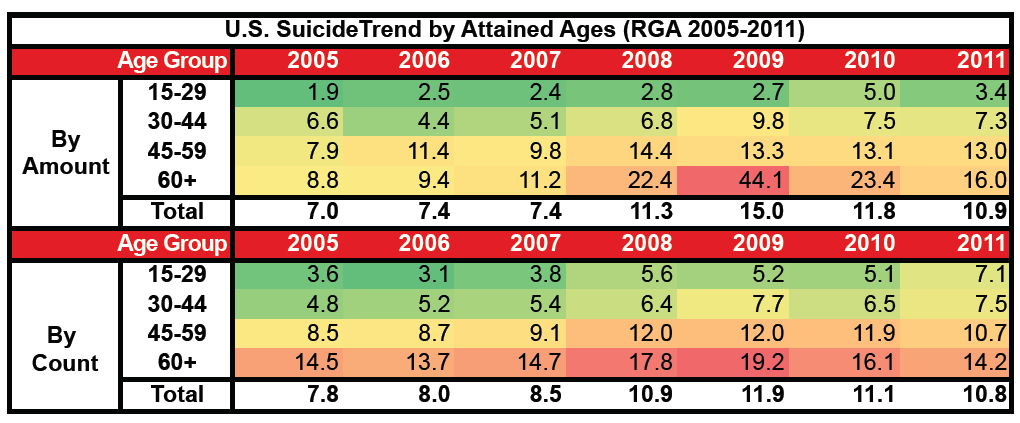

The largest increase in suicide rates during the recession is from ages 45 and older.

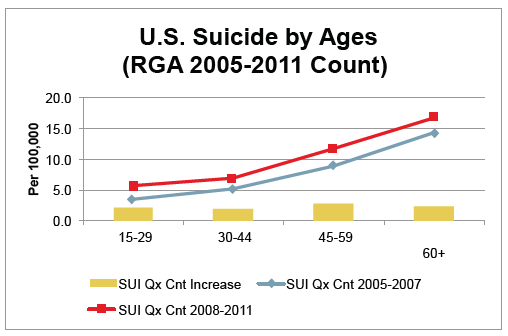

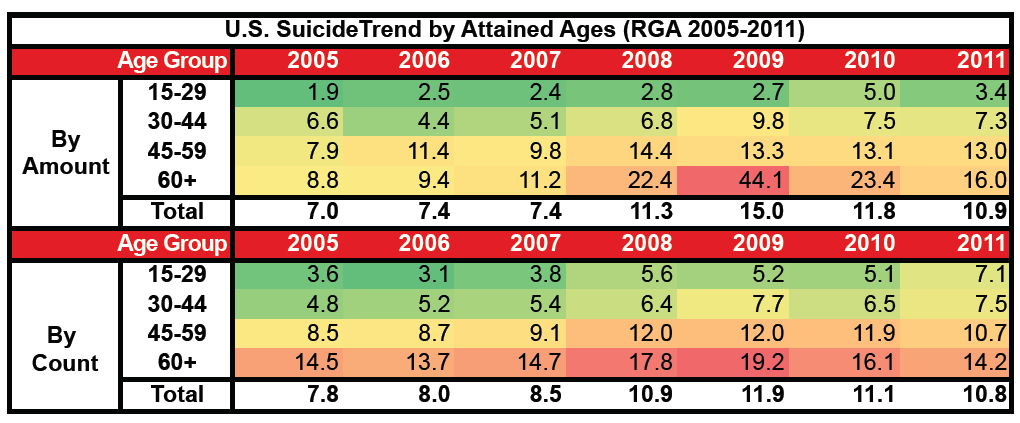

The following graphs compare insurance suicide rates prior to the recession and after 2008. Ages 45 to 59 show the greatest impact by count, closely followed by the other age groups. By amount, however, the recession had a greater impact on people over age 60 than on other groups, with a suicide rate more than double the 2005-2007 rate.

This report is provided for information purposes only, and any user will be responsible for making its own independent investigation and judgment concerning its contents.

RGA disclaims all liability for any loss or damage incurred by any third party arising or resulting directly or indirectly from any error or omission in this report. By using this report any such third party hereby releases, holds harmless and forever discharges RGA, its related entities and each of their directors, officers and employees from any and all claims, actions or causes of action of any nature whatsoever arising from its use.