New generations of SI products in the early 2020s: Industry at a crossroads due to excessive competition and market saturation

Since the huge success of SI products, both life and non-life insurance companies have strived to differentiate their offerings competitively. The first-generation SI products were quite simple, covering only a few health benefits, such as hospital cash and surgery cash. However, the new generation of SI products is DIY (do-it-yourself); applicants design their own products by selecting from among 50 to 100 optional riders based on their needs and preferences.

Particularly within the non-life insurance sector, which has dominated the accident and health insurance market since 2017, there has been active development and differentiation of SI products. Coverage has expanded beyond simple hospitalization, surgery, and the 3CI (cancer, acute myocardial infarction, and stroke) diagnoses to cover mild illnesses. Given the favorable loss ratios of early SI products and intensified competition in the SI space, some non-life companies became more aggressive by extending the maximum entry age to age 90 and providing a rate guarantee of up to the insured’s lifetime. (See Table 2 for the comparison of new generations and the first-generation SI product).

Figure 10 – History of senior products in Korea Across Four Generations

Table 2 - Comparison of new SI generation to first generation PRODUCTS

The initial differentiation strategy for this product started with expanding the entry age, coverage period, and maximum sum assured, followed by coverage differentiation, such as covering various milder diseases and increasing the number of riders attachable to the base policy. Then, in 2018, new SI products such as simplified issue dementia insurance and senior dental insurance were introduced to the market for the first time. As a result, a wide range of senior products have been available in the market, allowing each senior to choose the solution that best meets his or her diverse needs.

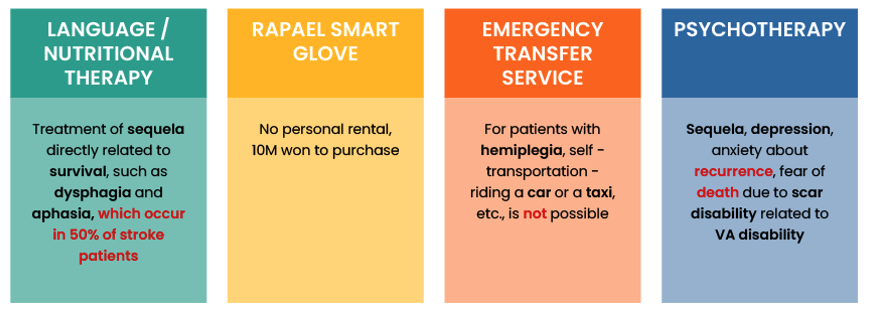

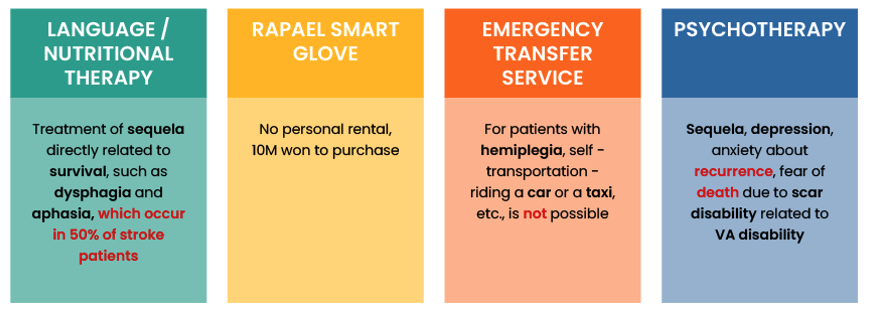

Over time, as competition became more intense, some insurers began to modify existing underwriting questions, resulting in many variations of SI questions from different insurers. Notably, in 2019, the first cancer insurance product to ask only one question (called 1Q cancer) was introduced to the market, but many companies didn’t join the trend due to risk concerns. Some non-life insurers have also launched products offering in-kind services such as speech and nutrition therapy and psychotherapy, in addition to cash payouts in the event of a critical illness, such as a stroke.

Figure 11 – Examples of in-kind services in SI products

Source: 보험상품 변천과 개발 방향” (The Evolution and Development Direction of Insurance Products) from the Korea Insurance Research Institute (KIRI) by Sukyoung Kim, Seyoung Kim and Sunjoo Lee, 2018

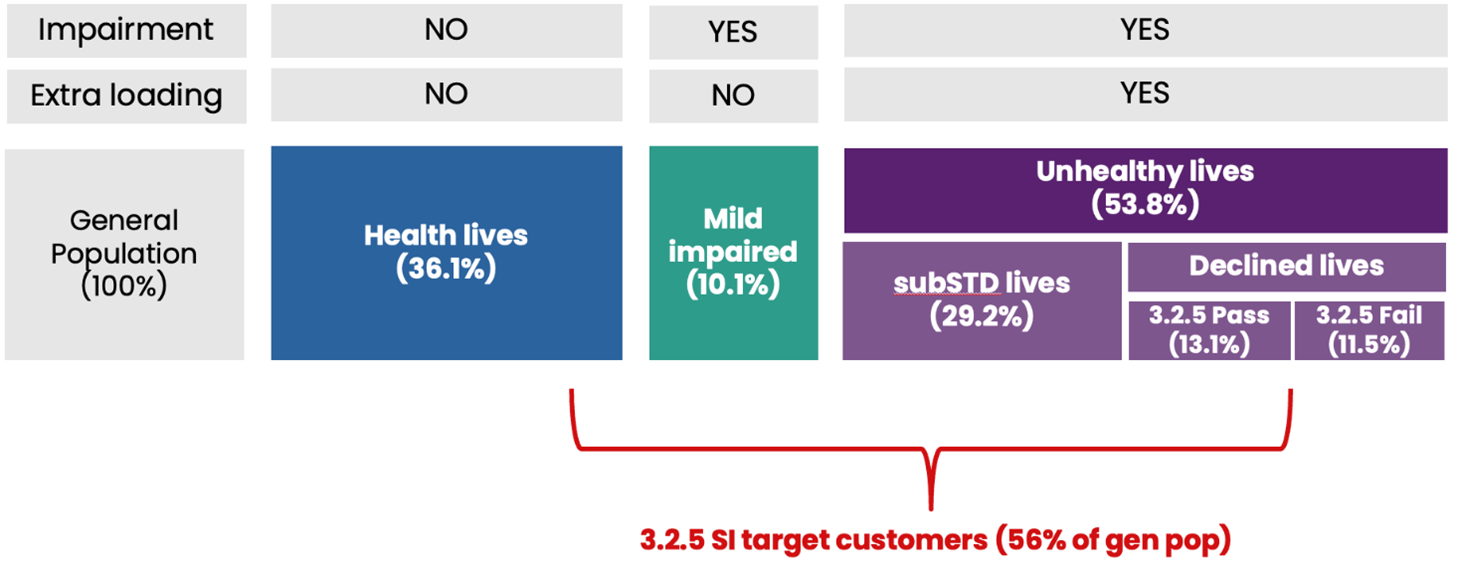

In the early 2020s, the industry faced limitations in differentiating through diversifying questionnaires and expanding coverage. In addition, consumers have become more price-sensitive as the Korean economy has slowed following the shock of COVID-19. To address these factors, Dongbu Fire & Marine, a major non-life insurance company, launched a new SI product called 3N5 SI, which includes five plans: 315, 325, 335, 345, and 355 SI. This product categorizes an applicant’s impaired health status in detail and offers customized rates corresponding to each risk. It features a system that divides customers with a history of hospitalization or surgery within the last five years into five risk groups, each with a risk level ranging from one to five years depending on how long it has been since treatment.

Each risk group is then charged a different risk premium, with impaired individuals with no recent history of hospitalization or surgery paying a lower premium. For example, 355 SI (no hospitalization/surgery in the past 5 years) is around 30-35% less expensive than the existing 325 SI (no hospitalization/surgery in the past 2 years).

The product has been very well received in the market, leading many other insurers to follow suit, and making this product a new norm in Korea. However, contrary to the original intention, this offering has triggered some churn in the market with existing 325 SI policyholders switching to the new, more affordable SI product.

Next Steps and Future Direction

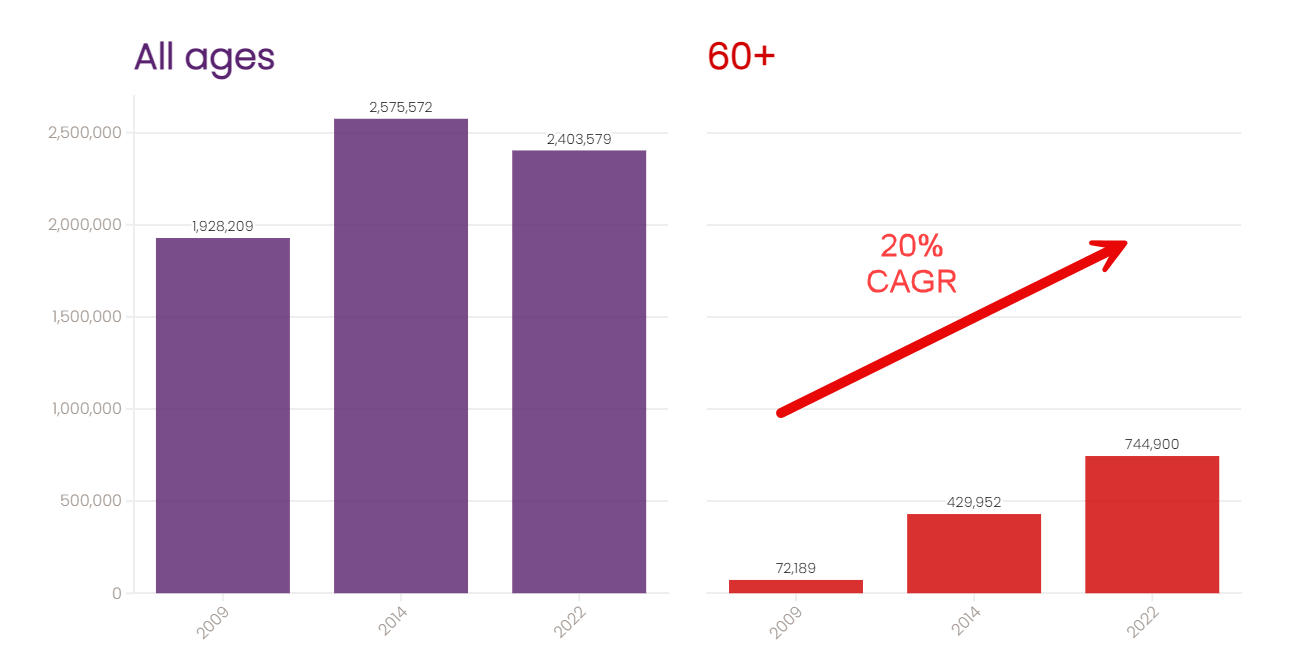

As mentioned earlier, around the mid-2010s, the Korean insurance industry reached a saturation point and faced a severe growth slowdown. Demographic changes, such as an aging population and a declining birthrate, also severely affected the industry. However, insurers have turned this crisis into an opportunity by significantly lowering the barriers for elderly individuals to purchase insurance through simplified issue products, successfully tapping into the senior market.

Despite this success, intensified market competition has led to a focus on aggressive product design and pricing rather than stressing customer value creation. This has resulted in shorter product life cycles and negative effects on profitability, steering the market in an undesirable and unhealthy direction.

To reverse this situation, the industry needs to adopt a multifaceted approach and move beyond simply selling life insurance products to offer customized solutions that serve the diverse needs of the elderly over the long term. Examples include covering the costs of senior care services such as nursing homes and senior living communities; managing retirement assets; and offering coverage for in-kind health promotion services, such as AI-based health monitoring systems and telemedicine.

As the elderly population grows, the number of people with dementia and mild cognitive impairment is on the rise, intensifying the interest in early detection and prevention. In response, insurance products that focus on early prevention, such as providing in-kind services while covering mild dementia or cognitive impairment, have recently emerged to increase customer satisfaction and provide more comprehensive coverage. Table 3 offers examples of those products.

Table 3 – Recent innovative ancillary services in senior products

The recent regulatory changes by financial authorities aim to promote the integration of financial and non-financial sectors and enhance synergy. Regulations have been relaxed, allowing insurance companies to provide healthcare-related platform services. This creates a favorable environment for insurance companies to enter the digital healthcare service and senior care service market. Recently, some insurers have been actively entering the senior care service industry. Companies like KB Insurance have already established subsidiaries to provide premium life care services, including urban senior care facilities and daycare centers. Other major insurers, such as Shinhan Life and NongHyup Life, are also exploring opportunities in this sector. These developments align with government efforts to lower barriers for insurers to enter the senior care service business and provide a wider range of services to policyholders.

The insurance industry should view this regulatory easing as an opportunity to secure new revenue models, enhance long-term competitiveness, strengthen data-driven strategies, and establish preventive healthcare services. Insurers should consider expanding into areas such as digital healthcare services, which focus on disease prevention and management, or long-term care services, which focus on post-care management. By doing so, they can create synergy with their traditional value chain. To succeed in these new ventures, insurers should prioritize creating excellent customer experiences by promoting consumer health through a synergy between healthcare, insurance, and long-term care services. Additionally, they should maximize the effectiveness of insurance products through close integration with healthcare and long-term care services while enhancing sales efficiency and profitability through cross-selling. Insurers should also seek partnerships to improve slow execution, lack of business know-how, and digital capabilities. Emphasis should be placed on developing collaborative services that leverage data from different industries such as healthcare providers, financial institutions, and tech companies, connecting new value-added services through partnerships and cooperation. Ultimately, insurers should aim to create a comprehensive lifestyle health management platform to differentiate customer value and secure long-term growth. This platform should seamlessly integrate preventive healthcare services, insurance, and post-care (long-term care) services into a one-stop solution, extending beyond traditional roles of risk underwriting and coverage.

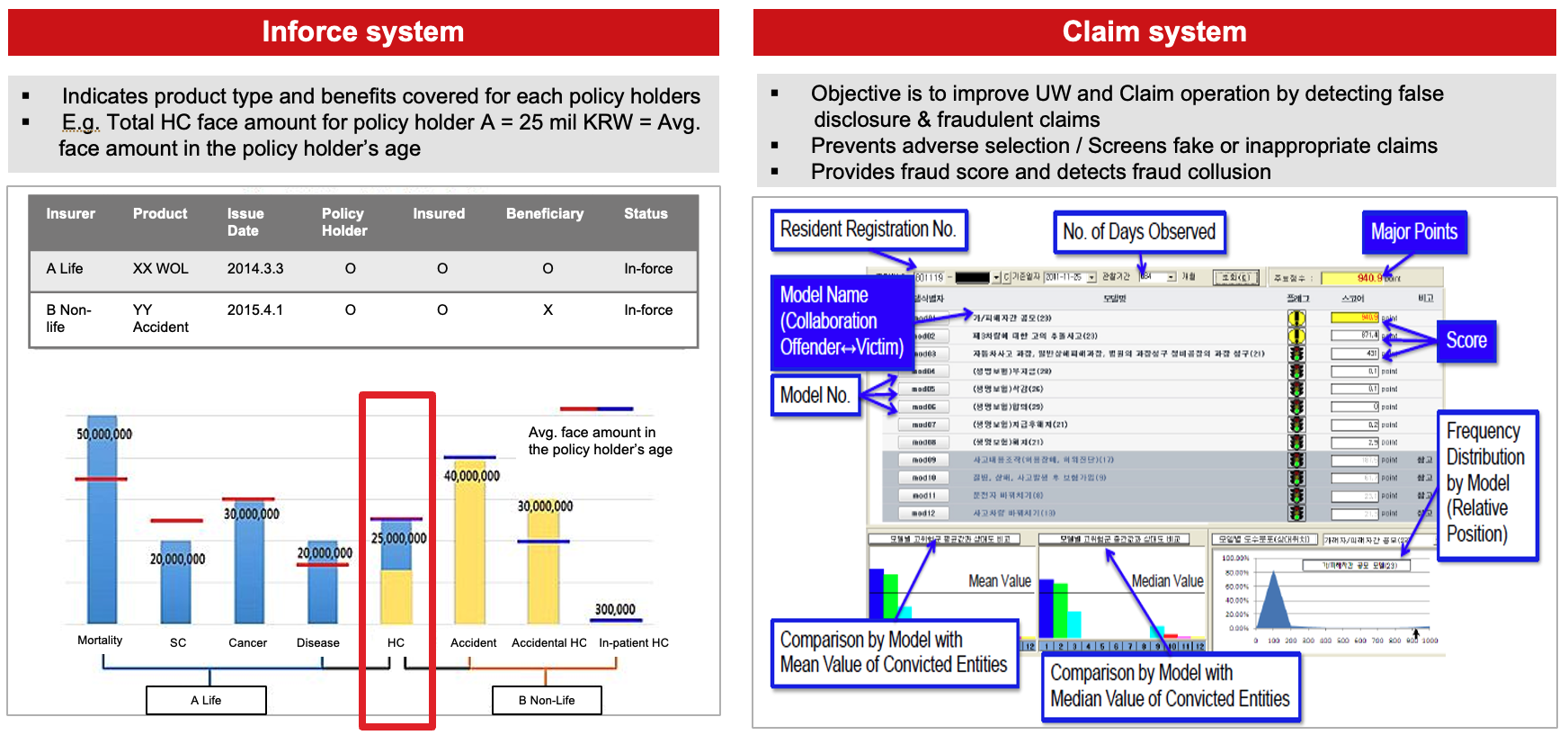

Another strategy is alternative underwriting for senior products, such as dementia insurance. Traditional underwriting relies heavily on medical records and standardized health questionnaires. However, insurers could use data on lifestyle factors, such as diet, exercise, cognitive engagement, and social activities, to assess dementia risk. The World Health Organization (WHO)3 reports that people can reduce their risk of cognitive decline and dementia by being physically active, not smoking, avoiding harmful use of alcohol, controlling their weight, eating a healthy diet, and maintaining healthy blood pressure and blood sugar levels. Additional risk factors include depression, social isolation, low educational attainment, and cognitive inactivity. Many of these risk factors are lifestyle and behavior-related. Therefore, using lifestyle and behavioral data such as diet, physical activity, cognitive engagement, social interaction, sleep, and stress to assess an individual’s risk of developing dementia can help insurers to improve access, affordability, and accuracy in underwriting decisions.

This data can be gathered from sources like wearable devices, health apps, self-reported surveys, and electronic health records. By utilizing advanced analytics and dynamic monitoring, insurers can personalize coverage and incentivize healthy behaviors that reduce dementia risk.

Advocating for supportive regulatory frameworks is also crucial to facilitate the development and adoption of new insurance products and services. To promote the healthy development of the senior market, Korean financial authorities are actively exploring various strategies. For example, the Korea Insurance Development Institute (KIDI) has recently proposed to revitalize the Korean individual annuity market by introducing impaired annuity products. This initiative aims to strengthen retirement asset security for seniors as the annuity market is shrinking every year. The impaired annuity differentiates annuity payouts based on the health status of the insured, providing higher annuity amounts to those in poor health. Developing customized application forms for the product and pricing appropriate rates based on credible data are critical steps.

Currently, KIDI is leveraging mortality data from the insurance industry and the National Health Insurance Corporation’s long-term care database to develop impaired annuity rates, with the expectation of boosting the senior annuity market. Additionally, the Financial Supervisory Service (FSS) is also taking steps to standardize long-term care (LTC) reimbursement products to prevent excessive market competition and ensure more sustainable market development.

By collaborating with various industries and regulators to approach the senior market from multiple angles, the insurance industry can achieve sustainable long-term growth. Offering not just a variety of products and ancillary services but also a comprehensive one-stop solution allows insurers to cater to the diverse needs of the senior market. Over time, this approach enables them to accumulate experience that can be leveraged to develop new products, creating a virtuous cycle.

Figure 12 – Silver Ecosystem: one-stop lifestyle management platform