Idea in Brief

One of the most vibrant and fastest-growing insurance market niches worldwide is the market for high-face-amount universal life (UL) insurance products.

Universal life insurance has been available in a variety of permutations since its creation in the late 1970s. Today, policies with death benefits in excess of US$10 million are purchased exclusively by customers with more than $1 million in investable assets – that is, high-net-worth individuals (HNWIs) – and play vital roles in estate planning and asset allocation strategies.

When combined with private bank-originated premium financing, these policies provide not just cover, but also a low-risk investment yield that is typically in excess of the premium financing.

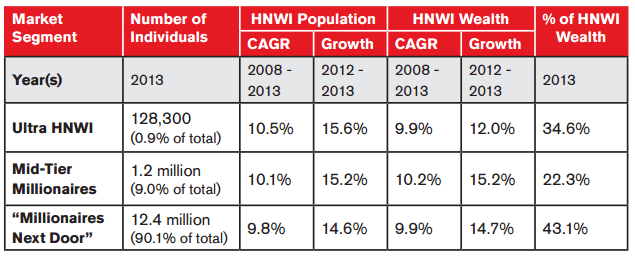

HNWI assets under management have been growing rapidly on every continent. Capgemini’s World Wealth report 2014 notes that assets of ultra-high net-worth individuals (UHNWI), defined in the report as possessing investable assets in excess of US$30 million, grew 12% from 2012 to 2013 and totaled more than 1/3 of the available assets, making this an essential segment for insurance executives to monitor.

This report aims to show how primary life insurers can explore or strengthen their existing presence in this brokered international market by developing successful strategies that can optimize market presence and penetration. These perspectives were derived from RGA’s proprietary research and data on this market, stemming from our role as one of the leading global providers of insurance solutions and capacity for carriers serving the HNWI market.

The High-Net-Worth Market

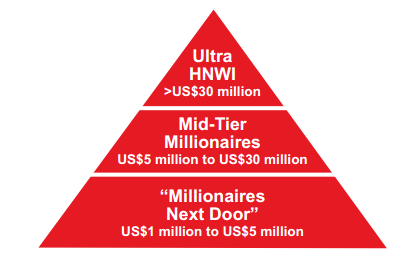

The global high-net-worth (HNW) market currently consists of individuals with at least US$1 million of investable assets exclusive of their primary residences. Approximately 12.4 million people worldwide fit this description.

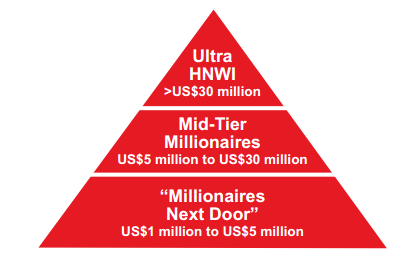

The wealthiest market segment, ultra-highnet-worth individuals (UHNWIs), number just under 129,000 and have investable assets in excess of $30 million. UHNWIs and Mid-Tier Millionaires (Figure 1) are the main buyers of high-face-amount universal life policies.

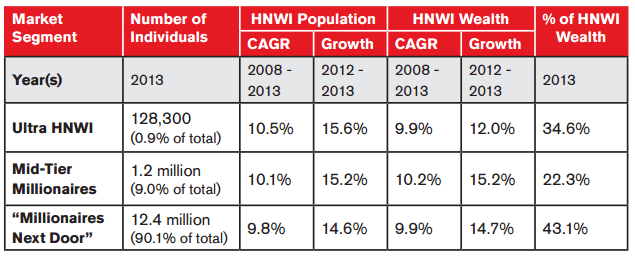

The UHNW market is growing quickly in terms of population and investable wealth. Figure 2 shows that the five-year growth rate for the UHNWI segment is highest of all: in the five-year period of 2008-2013, the world’s UHNWI population increased by about 11% and its investable wealth by about 10%. Although Mid-Tier Millionaires have ten times as many members as the UHNWIs (and Millionaires Next Door 100 times as many), UHNWIs represent more than one-third of the HNW market’s total available investable wealth.

Figure 1:

The HNWI Pyramid

Source: Capgemini – World Wealth Report 2014

Figure 2:

HNW Market Size and Growth

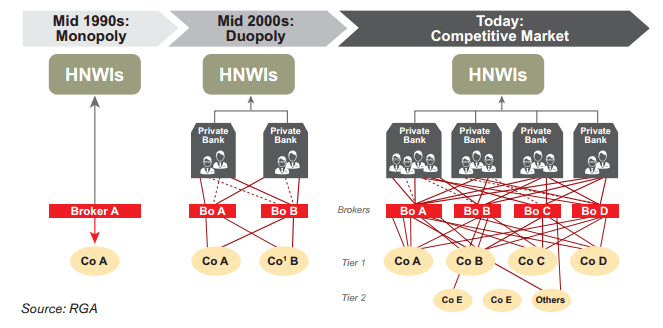

Evolution of the Marketplace

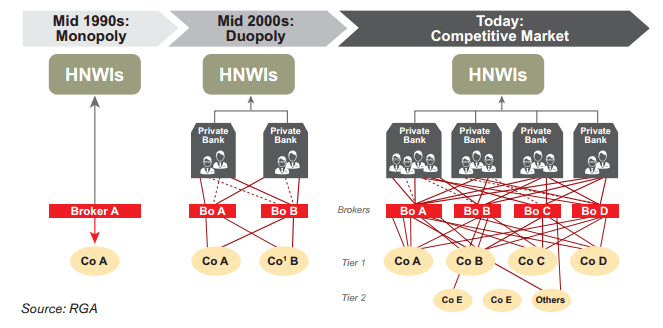

Life insurance began to emerge as a cost-effective component of estate and asset planning for HNWIs in the mid-1990s. This sparked sizable growth in the sale of highface-value life insurance policies. Specialist global insurance brokers such as R.E. Lee International and Charles Monat Associates pioneered this market, working directly with HNWIs to identify their estate planning needs and structure the massive insurance policies required for these needs. The policies were then issued offshore by Bermuda-based insurers, which at the time were among the few with the capacity to do so.

By the mid-2000s, Asia’s HNW market was evolving rapidly, with life insurance assuming an increasingly important and visible role in asset diversification and preservation, tax efficiency, and inter-generational estate planning needs. Asian insurers, recognizing considerable opportunity in the rapid growth of absolute and year-over-year premium volumes, began providing greater support for UL product sales through HNW brokers. Several firms established specialized onshore underwriting units for this business. During the same time period, private banking institutions moved actively into managing HNWI assets and estate and trust planning needs.

Figure 3:

Monopoly to duopoly to competitive market

Since the global financial crisis of 2008, this shift in the distribution paradigm has

continued to strengthen. Investment banks have sharpened their strategic focus on private banking and wealth management, and the role insurance can play. This focus, combined with the increasing number of specialized brokers and primary life insurers involved with or contemplating entering this market, has led to a crowded and highly competitive arena, especially in Hong Kong, Singapore, and the United Arab Emirates, where the world’s newest wealthy individuals live and transact business.

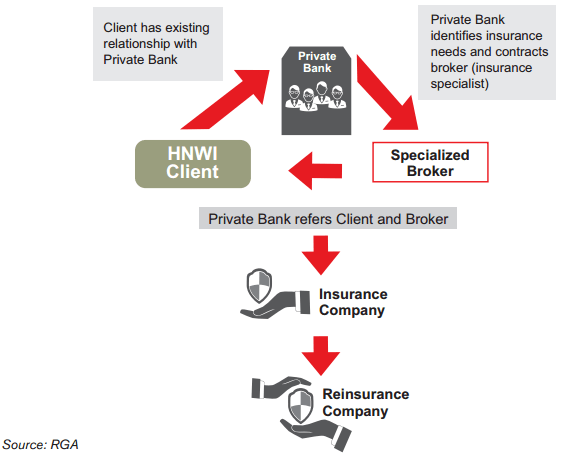

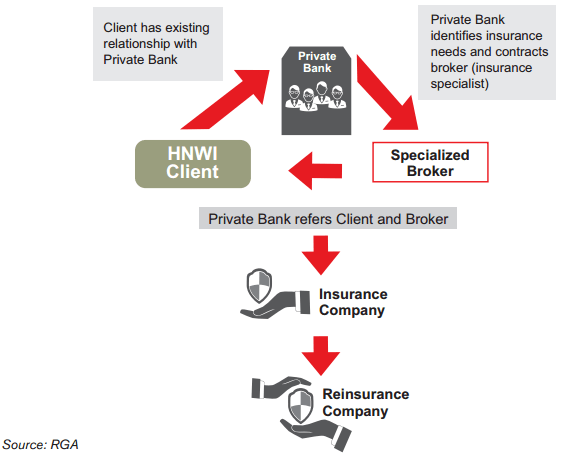

Today, the main product serving the HNWI market is single premium UL, with premiums financed by private banks. Not surprisingly, these private banks, whether standalone or part of global banking institutions, have become the principal source of client referrals to the insurance brokers that specialize in this market. The role of life insurers, meanwhile, has evolved from a pure product underwriter/provider to one that also incorporates sales support to the specialized brokers and marketing support to the private bankers.

Figure 4:

Typical life insurance distribution process to HNWIs

Factors Impacting Business Placement

As private banks and brokers have become familiar with premium-financed UL, they have successfully pushed for its standardization and commoditization. Life insurers, to maintain strong competitive positions in this market, need to offer competitive headline premiums, effective underwriting practices and reliable post-issuance services.

The three main factors that influence the successful placement of business with a particular insurance carrier are product pricing, underwriting service, and underwriting appetite.

Product Pricing

Many of the leading brokers and private bankers serving the global HNW insurance

market view headline premium (i.e., the dollar amount of premium that will secure a specific sum assured) as the main indicator of an insurance product’s competitiveness.

For primary life insurers, providing competitively priced headline premium for HNW cases is an absolute requirement. To demonstrate good fiduciary faith, brokers will typically show clients at least two comparable options. A 50-year-old male, for example, can currently expect to pay a headline premium of between US$3 million and US$5 million for a US$10 million sum assured single premium UL policy offered by a rated carrier with an established track record in this market.

Underwriting Service

Throughout the underwriting process, insurance brokers act on behalf of the private

bankers who referred the client. The private bankers, in turn, act on behalf of the HNWI clients they referred. Both the brokers and the private bankers require insurers to provide seamless, efficient underwriting processes for the end client.

HNWIs are accustomed to “white glove” service — i.e., service that is meticulous, seamless and anticipates every possible need — in many aspects of their lives. Primary insurers seeking to strengthen their shares of the HNWI market must provide such service and manage expectations carefully at all points during the sales process. This means providing realistic underwriting decision timelines as well as managing the number of medical requirements and the number and nature of financial disclosures needed. It is crucial for life insurers to ensure their new business and communication processes produce a seamless experience for the broker, the private bank and the HNWI.

Insurers can differentiate themselves positively in the underwriting space by providing rapid decisions and by optimizing the frequency and clarity of underwriter communication to brokers. These items can influence a broker’s perception of an insurer’s underwriting quality, creating a strong impression of reliability and directly influencing consumer satisfaction levels.

In any competitive marketplace, fast turnaround times and speedy, clear communication are always important, and for the HNW market, they are crucial. The amount of time HNWIs can spare, especially those who are entrepreneurs, is limited. Their hectic global travel schedules make it impractical for an insurer to request additional procedures, as their time on the ground might be limited and they might not wish to perform repeat medical tests.

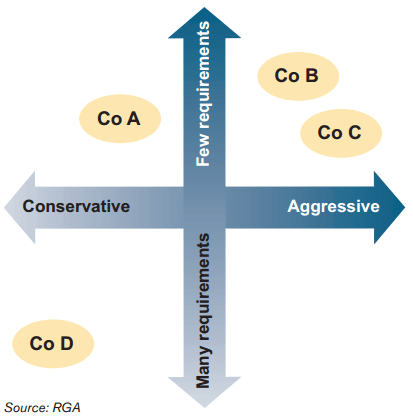

Underwriting Appetite

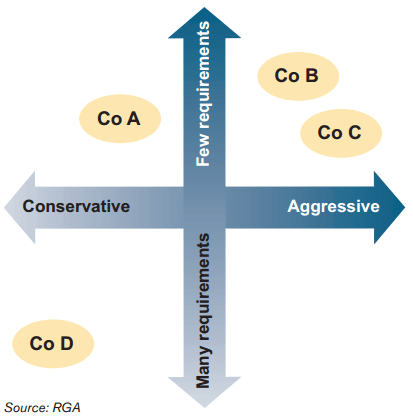

To have a successful presence in this market, projecting consistency in underwriting appetite is essential. Appetite, in this market, is a function of an insurer’s underwriting and rating practices. In Figure 5 (below), the X-axis refers to a broker’s perception of an insurer’s aggressiveness or conservativeness when it comes to individual cases. Aggressiveness refers to the accept, rating, postpone or decline decisions a carrier might issue. In the highly concentrated international HNWI market (currently less than 200 active brokers), brokers will be aware which carriers might be more likely to decline a given case as well as those that might be more likely to issue an accept (or even preferred) rating for the same type of case. Carriers considered more likely to decline will place on the conservative arm of the X axis, and those more likely to accept will place on the aggressive arm.

The Y-axis refers to the number and nature of evidence requests. If a carrier asks for numerous sources of financial evidence or repeat paramedical exams, brokers will place that carrier on the lower portion of the Y-axis, and fewer exams, on the upper portion. The carrier’s perceived underwriting appetite will illustrate as the intersection of the two points in a quadrant.

Figure 5:

The Appetite Matrix

In the international HNWI market, the ability of an insurer to set a consistent underwriting appetite is important yet challenging. Given the high-stakes nature of HNW cases, brokers and private bankers want to minimize the number of variables with which they and their clients must contend. If a carrier’s appetite seems to shift every month, or worse, if various underwriters at the same carrier demonstrate different appetites, that carrier can experience a rapid loss of market share.

As the cases reflect very large face amounts and the clients’ high privacy needs, it is

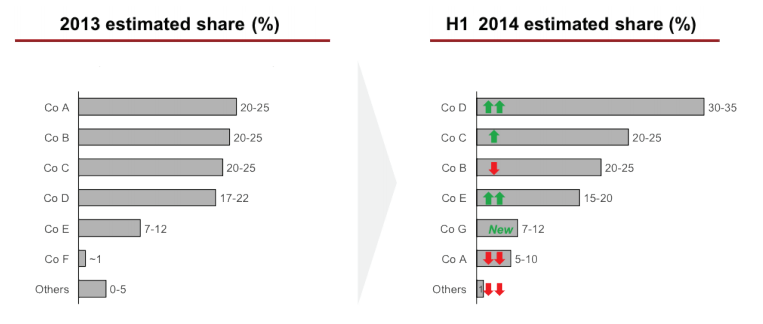

crucial for insurers serving this market to adopt a consistent company-wide underwriting appetite which balances both market share ambitions and risk management controls. The relatively small group of insurance brokers and private banks that specialize in this market is one that can respond quickly to changes by life insurers, whether to products or in underwriting appetite. The necessity for insurers to examine and provide the right responses to pricing, underwriting and appetite needs in order to drive improved business placement is evident in Figure 6 (below).

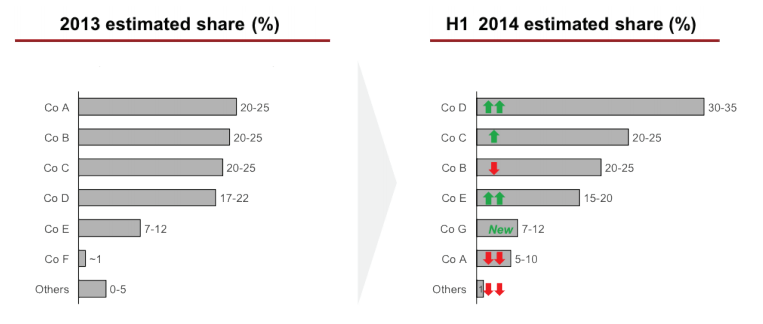

In 2013, full-year market shares for insurers in the international UL market were largely equal for the top four direct writers. In 2014, however, companies C and D took aggressive steps to implement a revised strategy that focused on improving headline premium solve and strengthening underwriting service.

Their efforts were rewarded by the brokers in terms of market share.

Figure 6:

Business placement in competitive geographies

Source: RGA and selected brokers estimates.

The Path Forward

Today’s HNW market merits close attention by insurers: it is dynamic and highly

competitive, and is growing and evolving quite rapidly, representing a sizable opportunity.

As the HNW segment’s size and wealth continues to increase, insurance carriers interested in penetrating this segment would do well to choose a strategy that will ensure appropriate market share, due to the sizable investment needed to start a new HNWI business line or strengthen an existing one.

There are many untapped regional opportunities, particularly in North Asia, Africa, and Western Europe. Historically, these regions have not been major centers for the international private bank-referred UL market. The HNWI cohort and its investable assets are growing fast.

Many private banks in the three regions cited above already have large numbers of clients in the “Millionaire Next Door” category (US$1 million to US$5 million) as well as in the lower range of the mid-tier millionaire category (US$5 million to US$30 million). Insurers may not yet have the resources to provide “white glove” underwriting and sales support service, but even so, this segment could still generate substantial premiums and growth.