Summary of findings

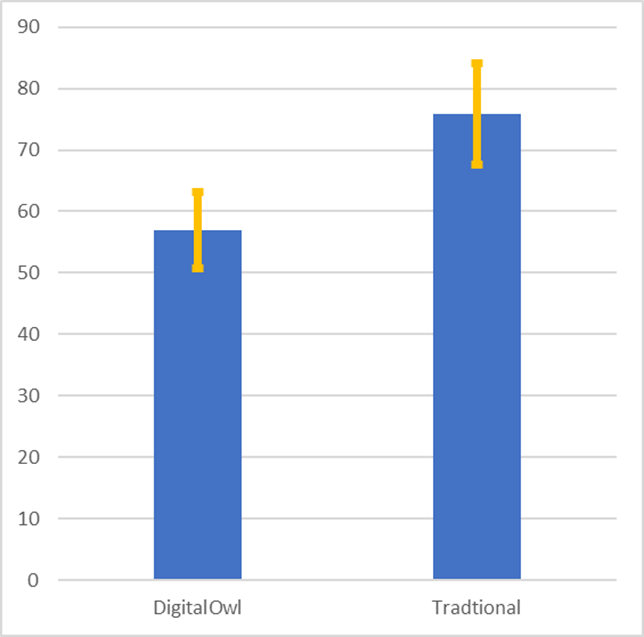

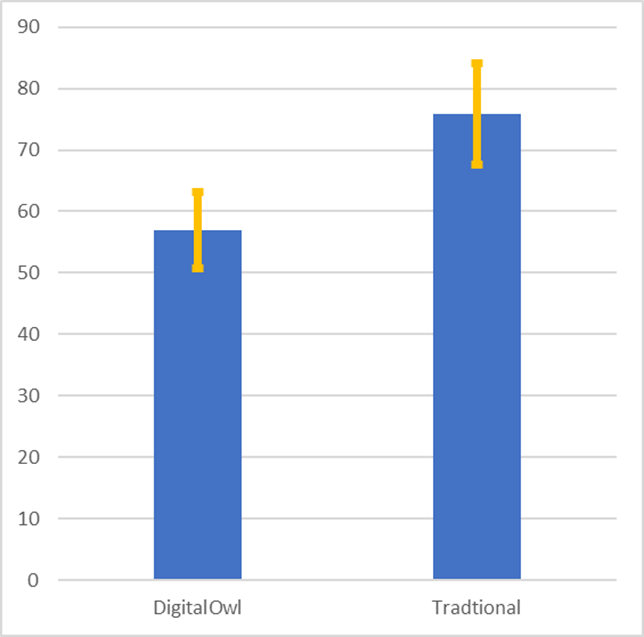

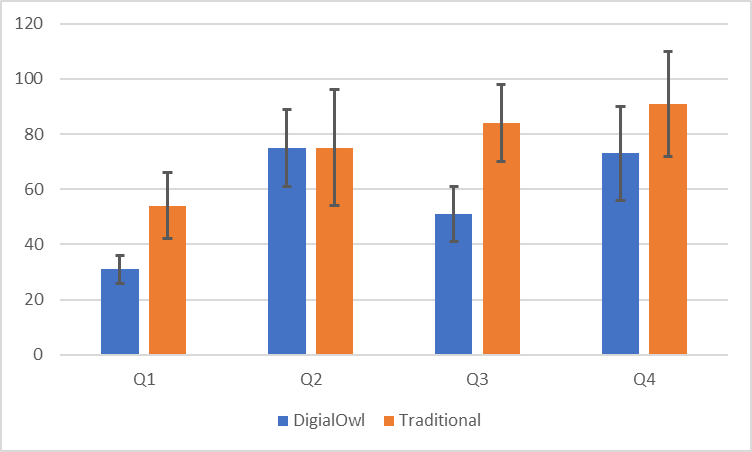

The study found an average 19-minute – or 25% – underwriting time reduction with DigitalOwl compared with traditional APS review. A statistical significance testing shows with 93% confidence (or p=0.07) this time reduction is not due to random error (Fig 1).

Fig 1. DigitalOwl Results in Underwriting Time Reduction

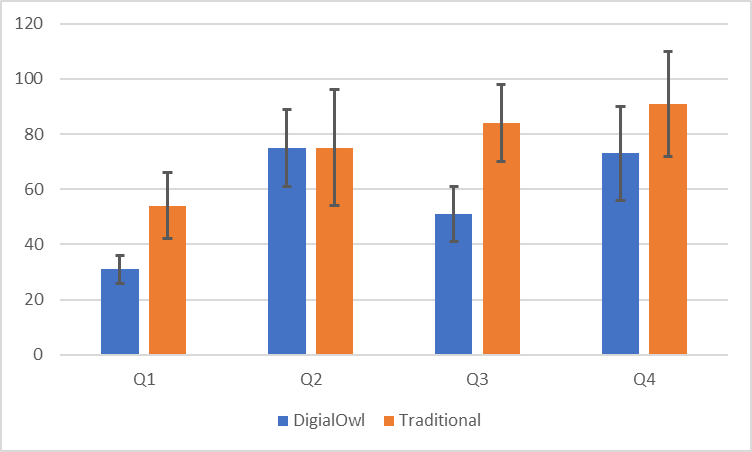

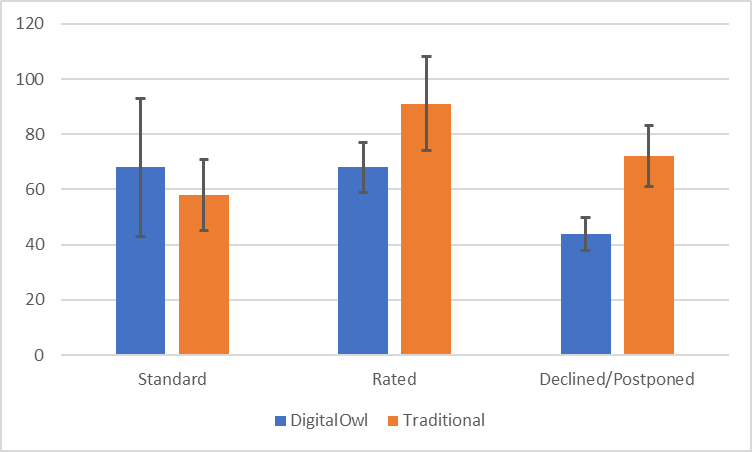

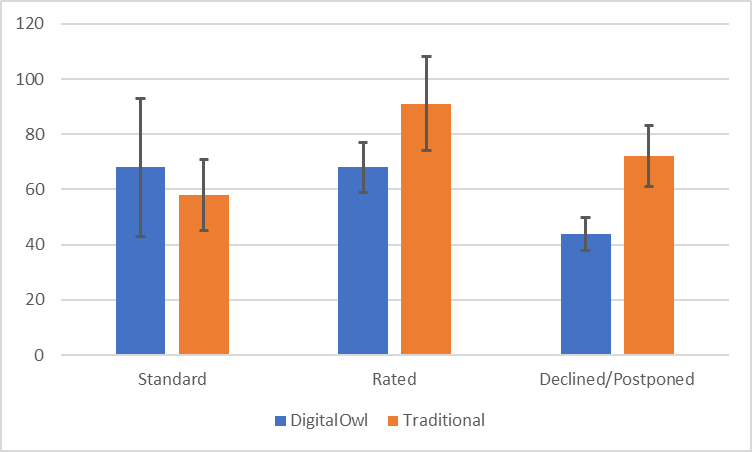

We also observed that time savings are more concentrated among cases with high page counts (fig 2) and significant impairments that resulted in rated, postponed, or declined underwriting decisions (Fig 3).

Fig 2. Impact of DigitalOwl on Underwriting Time Vary by Page Count Quartile

Fig 3. Impact of DigitalOwl on Underwriting Time Vary by Impairment Severity

We observed significant bifurcated variations by underwriters in terms of DigitalOwl effectiveness. Significant time saving was observed in four underwriters, while no time differences were recorded among the other four underwriters.

The study found some minor discrepancies in underwriting decisions reached with and without DigitalOwl. For example, three cases were “Declined or Postponed” using traditional APS while “Accepted” by underwriting with DigitalOwl. Nine cases “Accepted” using underwriting with DigitalOwl were “Declined or Postponed” with traditional APS. Further case reviews among all 12 of those cases indicated none of the different underwriting decisions were attributed to DigitalOwl per se.

Conclusion

We observed overall efficiency gains with DigitalOwl, with a magnitude of approximately 25% , although, given the small sample size, the difference did not reach statistical significance with P=0.07.

The results are notable and encouraging given the following:

1) Underwriters included in the study on average had only eight weeks of training on utilizing the summaries.

2) No direct guidance was given nor rules employed in how to utilize the tool (or defer to APS). This was solely at underwriter discretion. We believe and early data supports the tool can best be leveraged by incorporating nuance around page count, medical condition, and complexity

3) Cases were drawn exclusively from facultative referrals, known almost by definition to be among the most complex in the industry

4) The study was conducted via traditional PDF-based summary. As a web-based interface is introduced, RGA anticipates material gain efficiencies as underwriters shift from a “scrolling” approach to the more surgical capabilities provided by the online platform.

The study showed significant bifurcated variation in efficiency gains by underwriters. Multiple reasons for this can be hypothesized. This may be due to the fact that DigitalOwl adoption at RGA is at an early stage and underwriters differ in their respective levels of confidence or familiarity with the product. Alternatively, there may be subsets of underwriters who are more change-resistant and still lean on traditional APS records. This suggests that as the DigitalOwl product improves over time, along with more underwriter training inclusive of organizational change management (OCM) techniques, DigitalOwl’s expected efficiency gains will become even more significant.

The study results also support the assumption that use of DigitalOwl summaries impacts underwriting time but not the underwriting decisions.

As insurers continue to embrace AI technologies, they will unlock opportunities to streamline processes, enhance risk assessment capabilities, and deliver tailored solutions that meet the evolving needs of policyholders.

Revolutionize risk assessment with RGA and DigitalOwl. Contact us to learn more.