Pressure continues to build on maximum underwriting guidelines for group life and group long-term disability (LTD) policies in employee benefit plans in the small case marketplace (i.e., employers with <200 lives).

Small employer groups are increasingly requesting richer benefits, specifically on guaranteed issue (GI) and plan maximums. In relation to the number of lives in these plans and the corresponding low premium amounts that would be collected, these employers want to provide very high life insurance maximum face values and very high LTD monthly maximum payments. GI and plan maximum amounts requested are not just 10% above a carrier’s underwriting guidelines – many are as much as 40% or higher than the carrier’s standard practice.

What is Driving the Pressure?

RGA Group Re’s awareness of this ongoing trend comes from the high number of facultative underwriting requests we have received over the past few years for small case plans from the majority of carriers with which we work. The trend appears to be industry-wide. Indeed, of the total facultative review requests received by RGA Group Re from 2014 to 2015, 34% of group life and 44% of group LTD cases were for groups with less than 200 lives, and the two main drivers were GI and plan maximums.

These requests are not coming only from two or three carriers, and we are not seeing them as frequently from middle- or large-market employers either.

Why are carriers constantly being pressured by brokers and the competitive bid process to stretch maximums on benefit plans for small cases? There is no one clear or specific element driving this trend, but several. Here are a few possible causes:

- Employers might want to move individual executive coverage into the group plan as the cost of individual insurance increases

- Employers might want to find additional ways to offer attractive benefits to key talent and possibly offset changes to medical plans stemming from the Affordable Care Act

Brokers might want to design and negotiate richer benefit plans to add more value for their clients

These causes are yielding ”unbalanced” plan structures, where high-salaried employees at small firms are receiving rich GI and plan maximums that are not appropriate for the small case marketplace. As insurance premiums for small group plans tend to be low, it is difficult for insurers to manage the high level of exposure of a richer plan.

Managing the Risk

Most carriers only update their underwriting guidelines for GI and plan maximums every two to three years, if not longer, making it essential that the carrier’s underwriting staff carefully selects cases that fit into its risk appetite and overall portfolio.

Historically, in the group marketplace, small case underwriting was seen as more transactional and task-oriented. However, the ongoing trend in rich benefit plans has made the formulation of underwriting decisions in this space an art: it takes a truly experienced and thoughtful underwriter to decide when to support rich GI and plan maximums – and when to walk away.

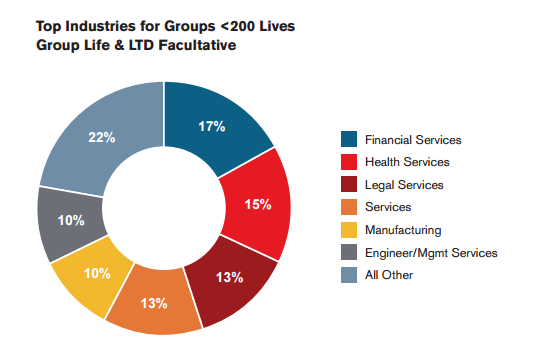

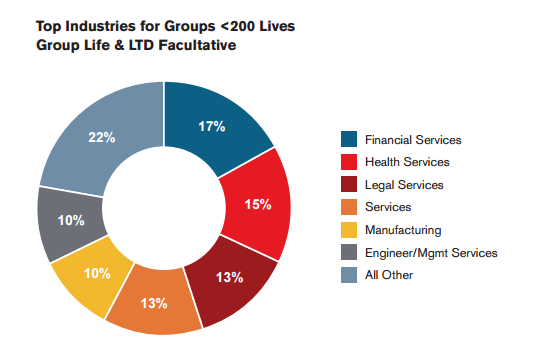

RGA commonly sees requests for rich GI and plan maximums for benefit plans from small companies in the financial, health, and legal services industries. This is due primarily to the nature of the occupations in these groups: highly paid white-collar professionals. However, manufacturing groups, where occupations are generally more weighted toward blue-collar, are also increasingly requesting rich and unbalanced plans that would only benefit a few high-salaried employees.

The chart below illustrates the top industries from which RGA sees facultative underwriting requests in the small case marketplace.

Here are some favorable case characteristics underwriters might consider when assessing an employee benefit plan with rich GI and plan maximums for companies with less than 200 lives.

These can help a carrier determine whether or not to stretch the underwriting guidelines for

such a plan.

- Matching a rich in-force GI and/or plan maximum, where all other plan elements and features are standard and meet guidelines (vs. increasing maximums)

- Good spread of risk and balanced plan design

- Favorable industry, occupations and employee demographics

- Financially strong employer with a stable outlook

- Limited risk for anti-selection due to low staff turnover and controlled plan enrollment terms

Looking into 2016

Going forward, we expect to see continued pressure on underwriting guidelines for both group life and group LTD in the U.S. marketplace. Requests for high GI and plan maximums will continue to drive facultative underwriting requests, which means carriers will increasingly have to balance competitive market pressures and underwriting decisions.