For those looking forward to retirement, we live in interesting times.

Few have the privilege of a generous defined benefit plan to fund their retirement. Whereas in 1975, 33.1% of U.S. private pension plans were defined benefit plans, in 2015, only 6.6% of U.S. private pension plans provided defined benefits. This trend is a global phenomenon with similar experiences in developed countries around the world.

Increasingly, the burden is on individuals to plan for and fund their retirement themselves. Not only must they accumulate sufficient funds at retirement, they must also achieve an adequate investment return after retirement on their accumulated assets to ensure they do not outlive the drawdown of these assets to provide their retirement income.

Investment Returns Pre-Retirement

Let’s consider investment returns first. With interest rates at historic lows, securing sufficient funds to sustain a fulfilling lifestyle post-retirement looks challenging. Low interest rates may have acted to inflate the value of accumulated assets, but the ability to rely on future fixed income cash flows as a source of retirement income looks grim. More and more, retirees are faced with a reliance on more volatile investment income such as dividends and equity appreciation to provide for their retirement needs.

The shift to defined contribution plans requires individuals to take much more of the investment management burden upon themselves. In a low interest rate environment, professional management fees can absorb a large proportion of the available investment returns. Furthermore, whereas defined benefit plan sponsors are able to take advantage of the illiquid and long-term nature of their pension obligations to pursue less liquid investments with their potentially higher long-term needs, individuals often have difficulty accessing the same resources. What’s more, individuals should not pursue an illiquid investment strategy without the benefit of the pooling of risk provided through defined benefit plan sponsorship or an insured product.

The time is right for insurers to step up to the challenge. Variable annuities with lifetime guarantees have provided the opportunity for individuals to share the risk of volatile investment returns with an insurer. Equity release or lifetime mortgages, most notably in the U.K. market, have allowed individuals to access the value of an illiquid asset (their home) as a way of financing their retirement. Perhaps it is time to consider new insurance products that allow individuals to participate in the private equity and illiquid asset investment strategies of insurers and private equity firms active in the pension de-risking market so they can gain access to higher investment returns in a low interest rate environment.

Investment Returns Post-Retirement

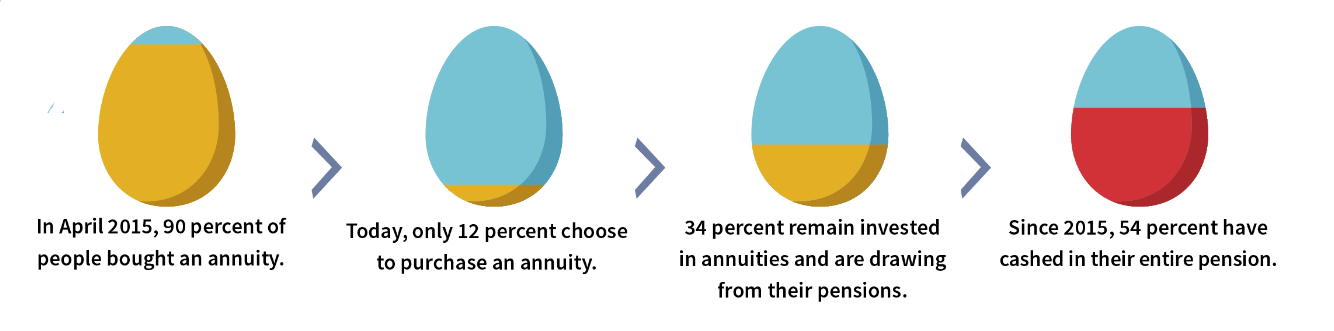

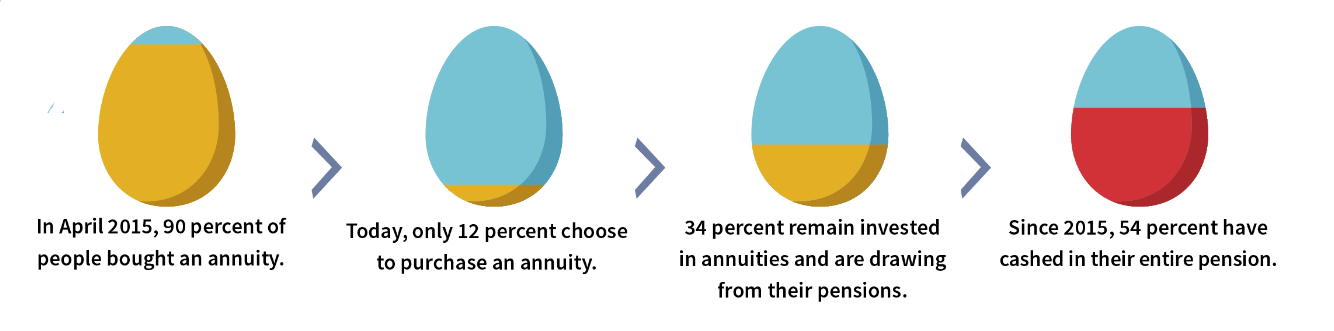

Turning to the challenge of outliving one’s funds, individuals often underestimate their future expected lifetime. To illustrate just how little value at-retirement consumers place on a lifetime annuity today, let’s look at the abolition of compulsory annuitization in the United Kingdom in 2015. While about 90% of people bought an annuity in April 2015, now a mere 12% are choosing an annuity, 34% are remaining invested and drawing from their pension, and 54%(!) are cashing in their entire pension.1 So some portion of one’s retirement funds should go toward the provision of lifetime income depending on survivorship (see Figure 1).

Figure 1:

The U.K. Annuity Market After Abolition of Compulsory Annuitization

Two developments in Canada’s 2019 federal budget are worth noting. To improve the flexibility offered to those with registered pensions savings, individuals can now elect to have a portion of their accumulated pension savings used to purchase an Advanced Life Deferred Annuity, which is essentially a life annuity where life annuity payments can be deferred until the end of the year in which an individual reaches age 85. The idea is to provide a backstop on longevity risk, thereby allowing the retiree to manage their investment strategy to a defined time horizon rather than an uncertain one (which is an easier problem to solve).

In addition, the budget introduced the concept of a Variable Payment Life Annuity (VPLA). A VPLA allows an individual to continue to retain their funds in a defined contribution plan while sharing both investment risk and survivorship with other plan members, thereby allowing the pooling of risk without the burden of capital required by a fully insured plan. For example, a plan may offer a choice of interest rates (say, 3% and 6%) with payments defined using this assumption. If investment income is in excess of the selected interest rate, then future payments are increased. If investment income is less than the selected interest rate, then future payments are decreased.

The benefits of survivorship are similarly shared through a survivorship adjustment that adjusts benefit payments based on the comparison of actual mortality experience to an underlying assumed mortality that was used at the time the VPLA was purchased. The adjustments depend on the ages and annuity amounts of the surviving retirees. This design is similar to variations of tontine and participating product designs that have emerged in other markets to achieve some element of risk sharing without requiring the use of a fully insured product with the resultant cost of capital.

The time is ripe for creative solutions that address the shift in the burden of responsibilities from pension plan sponsors to participants as plans have moved from defined benefit to defined contribution. More effective use of alternative investment strategies and the sharing of longevity risk will allow individuals to enhance their retirement income in a measured and cost-effective manner.