When it comes to digital life insurance distribution, insurers are increasingly discovering that the customer online journey itself is the product – a new mindset that is bringing new opportunities but requiring new ways of delivering.

For better reach, better results, and more rapid growth, insurers must strive to become solution architects for the entire buying experience, reacting in real-time to customers’ constantly evolving expectations and responding with engaging innovations. Efficient and reliable innovations in digital distribution require solving the right problems through the right processes.

In this article, we describe our process for repeatable, effective innovation and then show it in action with a case study.

Life Design Sprints Bring a New Way to Innovate

The innovation process often starts with traditional brainstorming. Brainstorming as a business tool has been around for decades because people are believed to be smarter together than on their own. However, research shows that these sessions often are not effective and fail to produce a lasting, positive impact.

Pitfalls of traditional brainstorming may include:

- The loudest voice often dominates the room, making quieter, more reflective participants reluctant to offer ideas.

- It drives convergent thinking because people generally want to avoid conflict and to agree with each other.

- Most sessions last only long enough to come up with ideas and not long enough to flesh them out. Those ideas can later easily morph back into something that closely resembles business as usual.

- There is a tendency to defer to the most experienced person with a rare skill set, rather than data or facts about what customers really want or do.

- Because the process is traditionally verbal, a lot of the ideas and outputs explored get discarded and lost into the ether.

See also: Beat the Brainstorming Blues

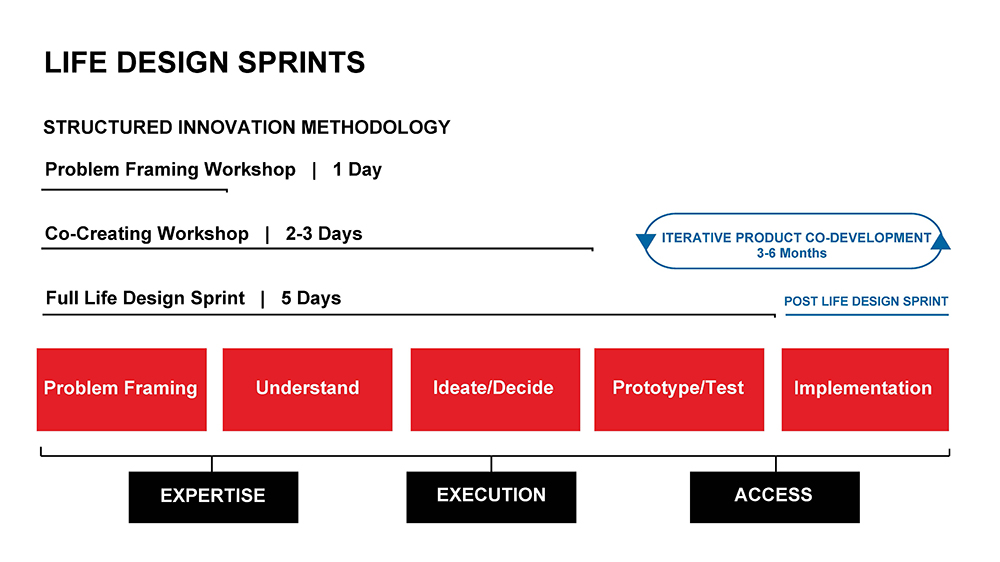

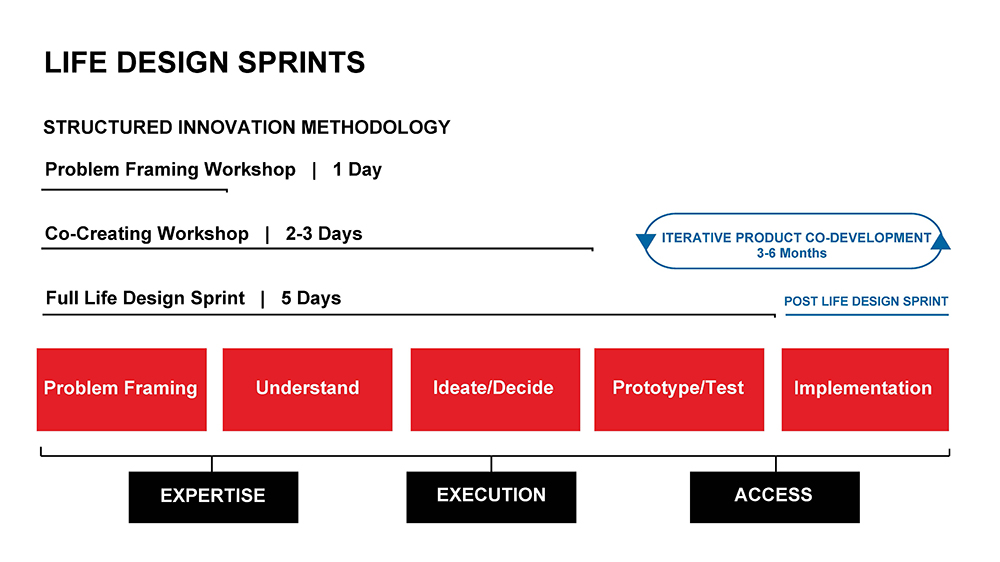

To avoid these pitfalls, RGAX has developed a highly configurable toolkit and an alternative approach to innovation tailored to life insurance: Life Design Sprints, focused innovation sessions designed to conceive new ideas, select those most likely to work, build prototypes for testing, and learn from results with real customers. By bringing people together in a proven, structured process, Life Design Sprints provide each individual the opportunity to contribute, maintain focus on topics that are most important to the customer journey rather than the most comfortable, and produce remarkable results.

While Life Design Sprints can be tailored to different contexts and situations, the process steps follow the same order:

- Problem framing: Defining the problem from the customer’s perspective early on is a crucial part of making the innovation process effective.

- Understanding the problem: Having specified the problem, tools like mastermind interviews and customer maps enable greater understanding before solutions are developed. This stage identifies which part of the problem the group should focus on rather than what is most accessible.

- Ideation and decision making: Lightning demos stimulate ideas, storyboard sketches ensure that every individual contributes, and the decision-making process means every opinion is heard.

- Prototype testing: Having settled on the preferred solution, the idea is turned into a prototype to put in front of real customers and test what works and what doesn’t.

- Implementation: No sprint is complete without a plan of action. RGAX gives access to co-creation resources and co-investment opportunities, all in support of scale-up and long-term success.

See also: Formula for successful life insurance innovation

Based on experience with dozens of partners facing various alternative distribution problems in many different markets, RGAX has identified four key principles that drive successful co-creation:

- Love the problem first: Experts recognize the main problems affecting their industry, but identifying solutions is harder. It depends on context, audience, deployment, execution, and even a bit of luck. Focusing on the problem first, rather than picking a solution early, generates a much higher probability of success.

- Partner well: Almost all innovations require partnership with external companies, clients, technology firms, distributors, and more. Picking a partner that not only sees the problem the same way, but also has a mutual interest in solving it, is crucial.

- Sprint together: Getting everyone involved in the process, from exploring the problem to developing solution ideas, ensures that the whole team has a complete overview of the initiative and inevitable obstacles are easier to overcome.

- Test early: Perhaps most importantly, putting prototypes in front of real customers leads to real feedback and results.

Life Design Sprints produce concrete, tested output to address well-defined customer problems in days rather than weeks or months. The following case study showcases the output of a recent Life Design Sprint for life insurance and digital mortgage journeys.

See also: Exercises that promote creativity and champion innovation

Case Study: Seamless Integration of Life Insurance and Digital Mortgages

More and more first-time home buyers and remortgaging customers in the U.K. initiate the buying process online. While home purchases have long provided a major life event cross-sell opportunity for life insurers, selling insurance alongside mortgages in a digital environment is relatively new, so no established model exists. Furthermore, the market doesn’t have an adequate insurance solution for customers who engage with the mortgage journey digitally, nor is protection compulsory locally.

Last year, RGAX, in partnership with a global venture builder company, launched an initiative to build a demonstrable prototype of a protection sale embedded within a digital mortgage journey, using key insights from past RGAX experimentation and RGA’s behavioral science research to inform and accelerate scale partner opportunities.

The long-term goal is to design a journey that enables conversion ratios from digitally sourced mortgages to be equal to or exceed traditional sales. This will both protect existing volumes as mortgage distribution increasingly digitizes and create market growth by expanding the commercially viable distribution opportunities.

The process started with understanding the problem, determining whether there is a consistent online sales approach for mortgage providers in the market and discovering what disruptors are doing in this area. From the customer’s perspective, the team identified several pain points:

- This is an unfamiliar, complex, and lengthy process that can alienate the customer.

- The required level of customer engagement is high. They need to gather and provide information, as well as make short-and long-term decisions.

- Customers are focused on securing the mortgage. Life insurance is not compulsory.

- The mortgage process is fragmented. Sustaining and reminding customers of their need for insurance is challenging.

- Customers don’t know they have a problem or that life insurance can solve it.

Identifying the main problems early in the process helped the team come up with innovative ways to solve them. Five key learnings from the process, which can potentially be applied to other digital journeys, include:

- Minimizing customer drop-offs at the early stage is crucial: It is common to have a high drop-off rate on the very first page of the digital customer journey. By including the number of steps in the process, as well as an indicator of where the customer is in the process, feelings of stress and uncertainty can be reduced, and customers are more likely to proceed to the next step.

- Present insurance as a standard part of the mortgage journey: Previous testing suggests that customers want to feel that insurance is an important part of the process from the beginning, rather than just a bolt-on. Many opportunities to talk about insurance exist throughout the digital journey, including presenting it as just another step in the regular mortgage process.

- Psychological distance is a barrier for selling insurance: Behavioral science talks a lot about the issue of psychological distance in a digital sale. While the home buyer can immediately picture themselves living in the property they’re looking for, insurance is an abstract concept – they struggle to imagine how they, or their family, might benefit from it 15 or 20 years later. Questions about dependent children, their ages, and other relevant details make the process more personalized and relevant to the customer.

- Replay their current situation and bring to life the insurance gap: Questions about monthly expenses, utilities, gas, water, and more are a standard part of the mortgage process, and it is recommended to replay the information provided by displaying full income, total expenses, as well as what remains to contribute to the mortgage. This again makes it relevant and personalized for customers and helps make them feel connected to the process. Additional questions about life insurance (e.g., If your income stops, do you have sufficient savings to cover your mortgage?) can nudge customers that there is something else they need to consider at this point. After alerting customers on a potential problem (loss of income,) a solution (life insurance) can be offered.

- Customers committed to buying want to do it quickly and easily: When customers get to the point of buying, they want to do it quickly. It must be an easy process.

The combination of an efficient innovation process, design thinking, and life and health insurance expertise produced outputs tailored to evolving customer expectations. By thinking differently from the beginning, the team was able to define the problem, identify an opportunity, and deliver a solution.

Contact RGAX to learn more about Life Design Sprints and how our team of innovation experts can help your protection products thrive in the new digital landscape.