"If opportunity doesn't knock, build a door." - Milton Berle

While comedian Milton Berle might not be the first place insurers look for business advice, this bit of wisdom accurately reflects the required approach to achieve growth in today’s competitive life and health markets.

Sticking with business as usual – that is, providing traditional risk mitigation products for low-risk populations – has been a tried and tested insurance strategy for years. Subsequently, in many markets, competition for healthy consumers is stiff, products are becoming increasingly commoditized, and price pressures are often immense.

Simple strategic theory dictates that to grow value, organizations should find underserved customer segments and serve them better than anyone else. With that lens, it’s hard to argue that individuals with health impairments (“impaired lives”) are not underserved today – and thus represent an opportunity to grow. For example, these individuals:

- Don’t approach the industry for coverage

- Approach niche competitors or find alternatives

- Attempt to purchase policies but are declined or priced out

- Purchase policies but lapse

From our global vantage point, RGA is observing that carriers are increasingly answering the call to be more inclusive, turning to underserved populations, and innovating within these untapped segments – in other words, building a door for people previously locked out of coverage.

Today, promising opportunities and market action can be found in the impaired lives segment. In fact, RGA’s 2017 Global Underwriting Survey revealed that one third of large and multinational insurers surveyed have created or plan to create dedicated underwriting strategies that focus on the impaired lives segment in the coming years.

So the question now is: How can insurers turn dedicated focus into profit?

Shift in Focus

Successfully targeting impaired lives requires adaptations within many aspects of the insurance business model, as well as the addition of new levels of service previously outside of the scope of most carriers (like health management). Across the world, we are seeing the industry start to shift in the following ways:

Insurer Strategy for Impaired Lives

| Old/Traditional | | Emerging/New |

Inclusivity | Impaired lives ignored | → | Inclusive strategies |

Product Focus | One-size-fits-all products | → | Impairment-specific products |

Pricing | Risk poorly understood | → | Risks quantified and priced |

Underwriting | Traditional, expensive, unnecessary | → | Data-driven, more efficient, “heads-up” |

Health Management | None | → | Consumer health engagement |

Strategic Positioning | Unfocused approached to segments | → | Micro segmentation by health status |

Distribution | Traditional | → | Targeted (including chronic illness associations) |

In making the impaired lives pivot, insurers should keep three key strategic pillars in mind as they formulate their strategies:

- Master the population health pyramid

- Choose the optimal growth archetype

- Be consumer-centric

Strategic Pillar 1: Master the Population Health Pyramid

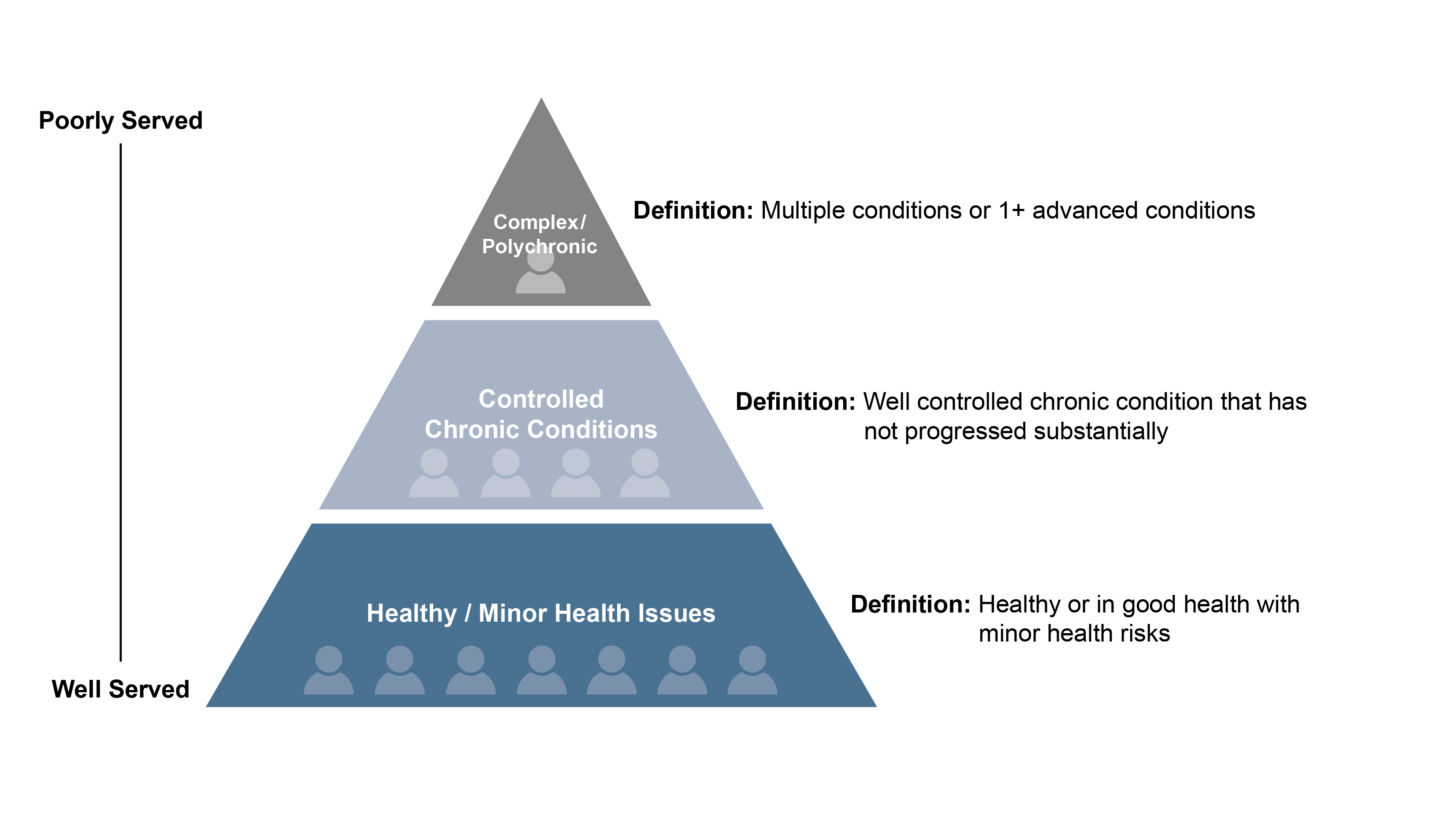

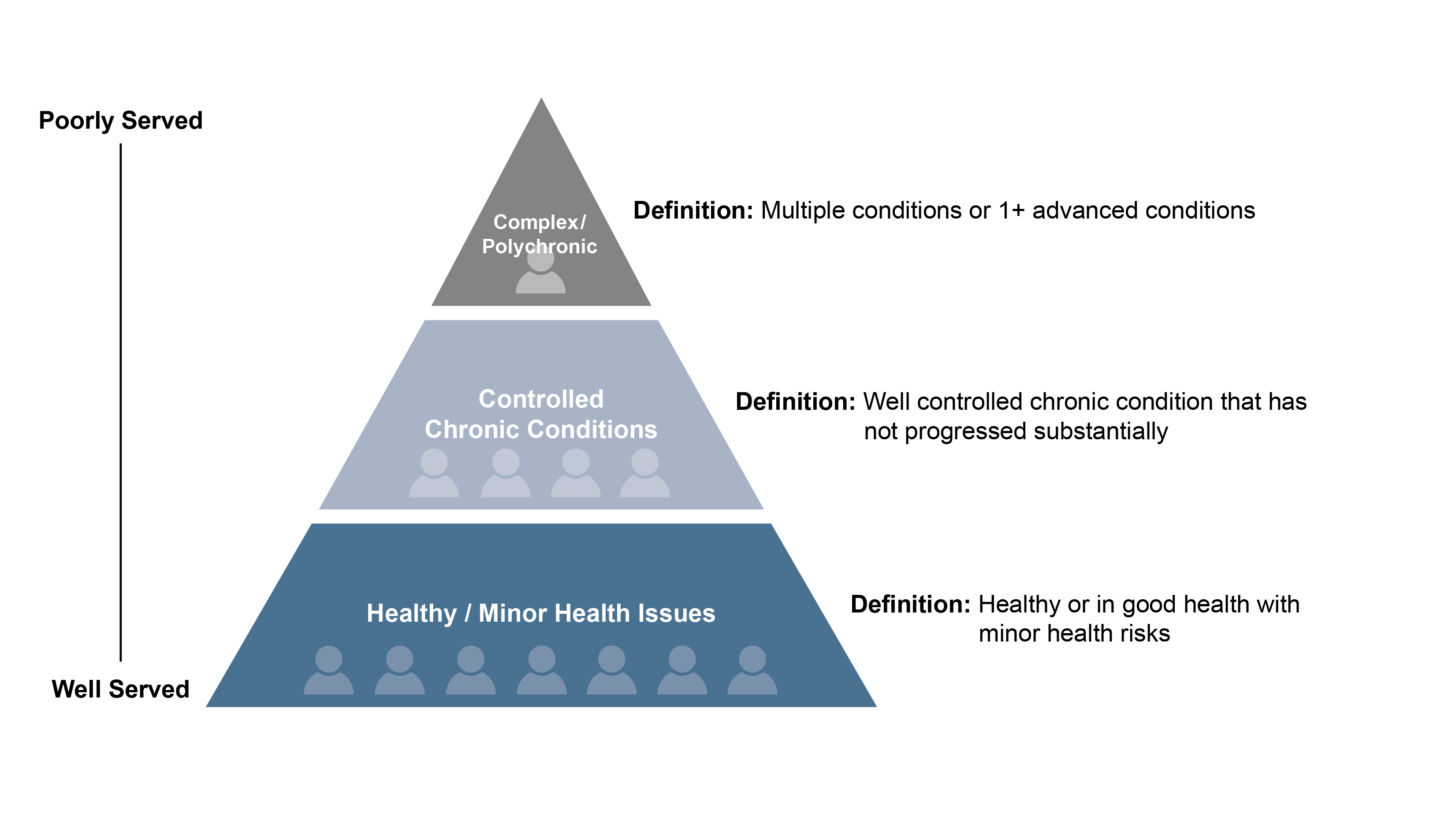

Mastering the population health pyramid is a vital first step to any impaired lives strategy. The pyramid concept is simple enough: The healthiest consumers are at the bottom of the pyramid, and as you go up, consumers become less healthy. Most people in our societies are healthy and can be found at the bottom of the pyramid. In the middle of the pyramid are those who have health issues or chronic conditions, but keep their conditions well-controlled. At the top of the pyramid are the least healthy individuals – those whose health status has progressed to the complex/systemic or polychronic level.

In most cases, people in poorer health are also more poorly served by the industry. So the paradox for insurers is this: As insurers target consumers further up the pyramid, target populations get smaller, but represent greater opportunity as they are currently more underserved.

Each market has its own health risk and condition profile, and insurers need to understand their local population as they design specific targeted strategies. While diabetes may be a prevalent impairment in one country, for example, hypertension may be more problematic in another. Mastering the population health pyramid means understanding the local health profile and identifying which impairments to target based on expected market sizes and opportunity to serve.

Strategic Pillar 2: Choose the Optimal Growth Archetype

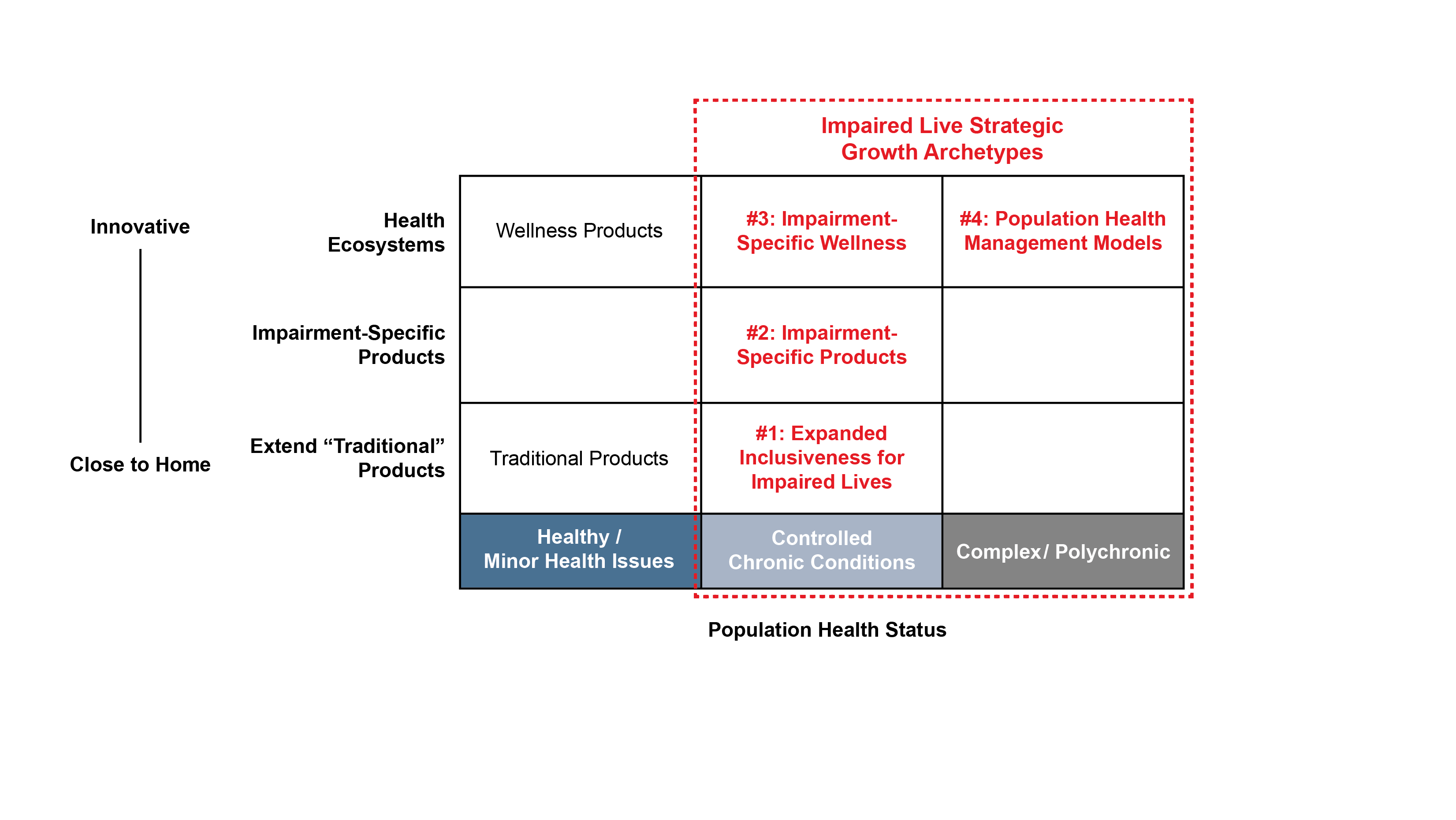

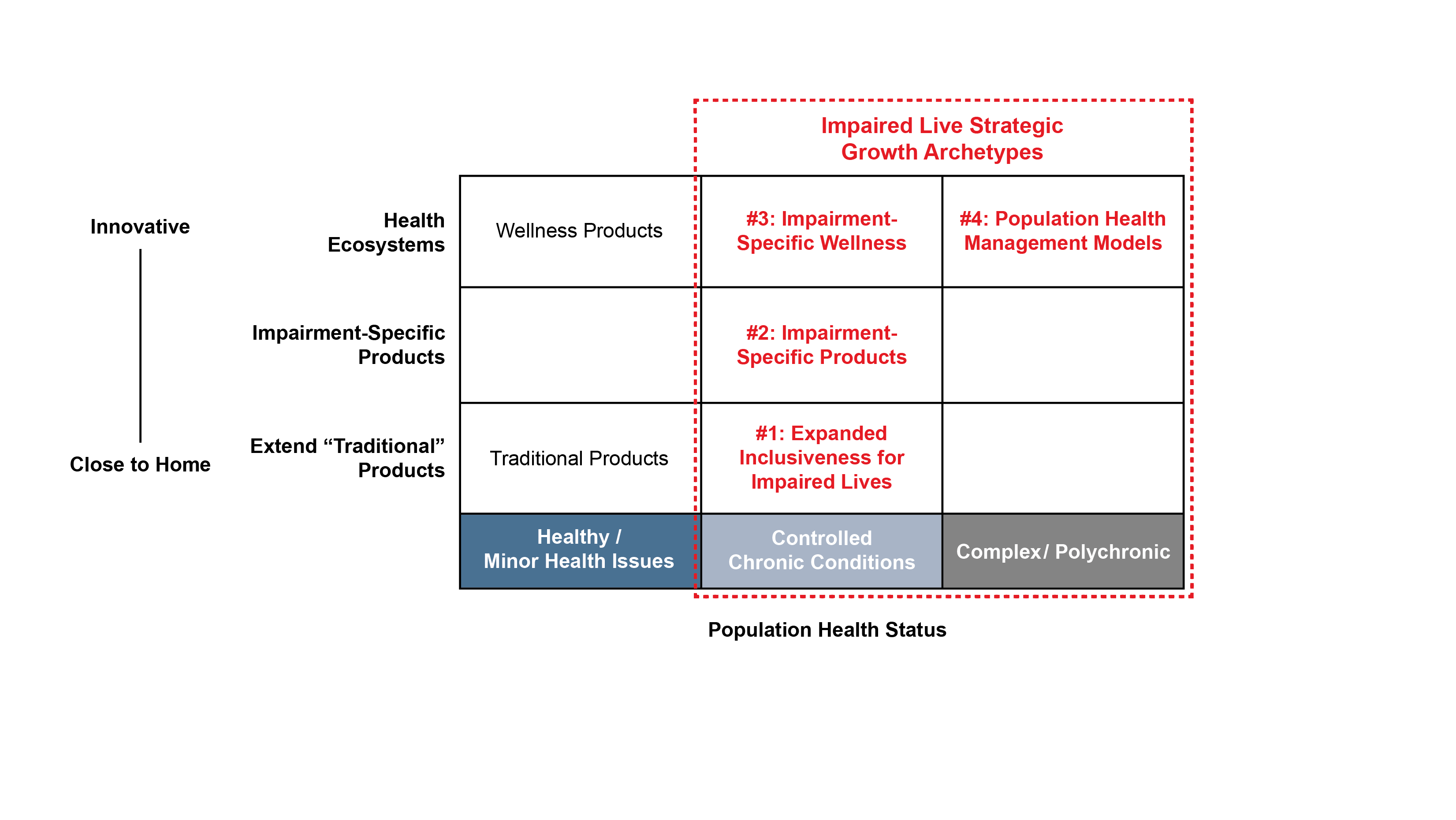

To succeed in targeting the impaired lives segment, insurers are sharpening their focus to meet target market needs. A wide array of approaches are emerging to serve the needs of individuals with impairments – and can typically be grouped into four strategic growth archetypes (below in red):

Archetype #1 is the most entry-level approach. It requires adapting existing in-market products to make them more inclusive for those with impairments. Typically this involves adjusting underwriting rules, optimizing pricing, etc. to cast a wider net. Incrementally this can involve educating distribution networks about products in market today that accept individuals with well-controlled conditions (with a loading).

Archetype #2 refers to impairment-specific products, where an insurer goes beyond just expanding inclusiveness of existing products and develops new products targeted directly at those with an impairment. In some cases, insurers are partnering with disease associations to offer tailor-made health insurance products offered at fair rates for individuals. Here we are now seeing market activity around products specifically for people with controlled diabetes and HIV.

With Archetype #3, insurers take it a step further by adding a “health ecosystem” to the product. This requires partnering with clients in the management of their health and wellbeing through impairment-specific wellness and disease management services. Diabetes products in various markets around the world provide good examples, with many offering structured managed care, wellness incentives, treatment plans and/or additional support services. In Archetype 3, the insurer becomes a true health and wellbeing partner to the consumer.

Even at the top of the population health pyramid, among the most at-risk individuals, we are seeing innovation through health ecosystems (Archetype #4). Comprehensive health insurance offerings for seniors, for example, deliver services to help people stay healthier longer, including nutrition counseling, homecare, medical transportation, health coaching, and access to a care team. In the United States, these approaches have been refined significantly under the Medicare Advantage banner.

Strategic Pillar 3: Be Consumer-Centric

In developing new products and strategies, insurers usually begin – and often end – with the risk protection element. But consumer needs are not limited to risk protection. Consumers want to optimize the use of their limited time, make good choices with better information, engage more fully in their health and lifestyle, and lead happier and more productive lives. Consumer centricity means taking all of these elements into account.

Applied to the impaired lives segment, this requires going beyond simply selling risk protection to have true empathy and assist consumers with their impairment-related health concerns. It also means making the customer experience more efficient and user-friendly. Instead of forcing an impaired applicant to go through the entire underwriting process only to discover the premiums are too high, for example, insurers could provide an indicative rating so that the individual goes into full underwriting with a meaningful understanding of potential costs. And that’s just one example – additional opportunities exist across the customer lifecycle.

Guiding Principles

So how do insurers best capitalize on the impaired lives opportunity? Like the products themselves for this segment, there are no one-size-fits-all solutions. These basic “golden rules” below, however, provide some general guidance:

- It is necessary to have considerable knowledge, skill and experience to handle impaired lives.

- Successful strategies require an investment in up-to-date analysis of key diseases.

- It is best to build comprehensive strategies across underwriting/pricing/distribution that align with target market needs.

- Balancing costs of wellness programs and consumer engagement investments against expected product payoff is essential.

5d8a64c4-40be-43b0-a692-a38f20063213.png?sfvrsn=c848acc3_3)