Past success doesn’t guarantee ongoing success, particularly when it comes to insurance product portfolios.

Today’s evolving insurance landscape has made new product development vital to insurers’ financial strength and business growth. At a time of changing customer demand, regulatory standards, and market pressures, how do insurers bring successful new products to market?

After two years in the making and over 3,000 data points analyzed, a far-reaching product development survey conducted by RGA and LIMRA on behalf of the Society of Actuaries (SOA) sheds new light on how individual life and annuity insurers are evaluating this question. RGA and LIMRA collaborated on this study to explore product development practices in North America, adding some global markets perspectives, for the SOA. The survey findings provide an effective tool for insurers to benchmark performance, identify common challenges, and seek areas for improvement, growth, and/or investment.

Below are just a handful of insights from the more than 200-page analysis on the SOA website. Note: Page and section references in parentheses below refer to the full report.

1. Fast followers outnumber first-to-market innovators.

“We’re probably a fast follower like a lot of companies. But on the other hand, we do have some innovative things that we have done… It just takes more money and more time to do things in today’s market environment than it took us 10 years ago.”

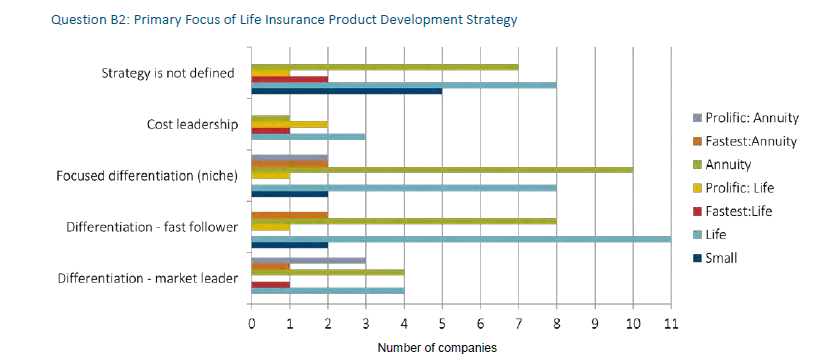

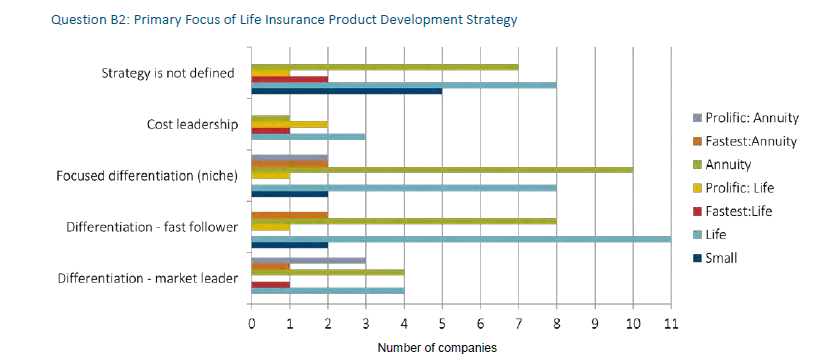

Many insurers acknowledge they do not have a clearly defined strategy for product development, but this does not necessarily hinder the product development process: The undefined-strategy companies do not report launching fewer products. Those companies with a defined strategy most frequently embraced fast-follower or niche approaches. Fast followers avoid the investment and risk of first-to-market innovation, but must work quickly to react to changes in the market and seek to improve on the design being followed. Fast-follower companies may not consider themselves highly innovative, nor do they make disruptive innovation a measure for success.

2. Greatest need for improvement: Administration.

“We always complain about the IT capacity. I think our company really made a great stride in recent years.”

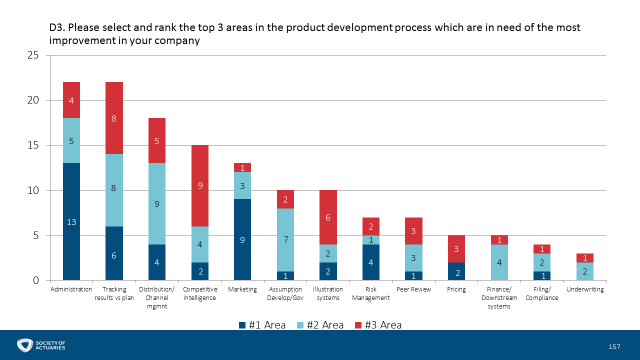

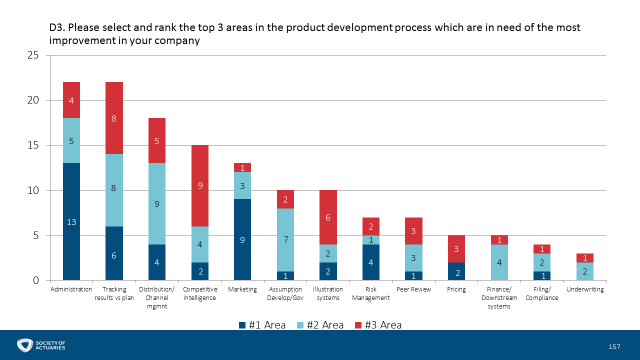

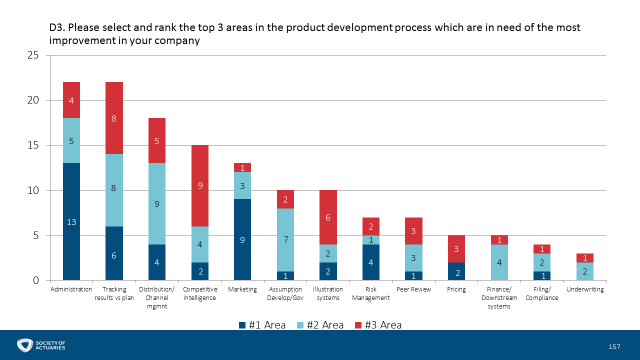

The top area identified as needing improvement was administration; however, most insurers have taken little action in the last two years to improve this significant bottleneck (page 74). Respondents stated that, budgets permitting, hiring staff and upgrading technology would be ideal capacity improvements (B16), but many companies struggle to achieve these goals. Some have realized efficiencies in their process by outsourcing (D1a & D2a).

3. Speed matters, but it may not be everything.

”We don’t necessarily want to set a date 12 months ahead of time and crunch to get it. We’d rather set the priority, get the proof of concept, get the work done, and then as we get closer start to finalize that date for all the planning.”

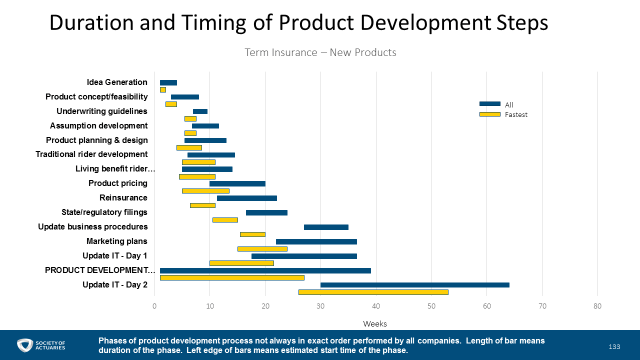

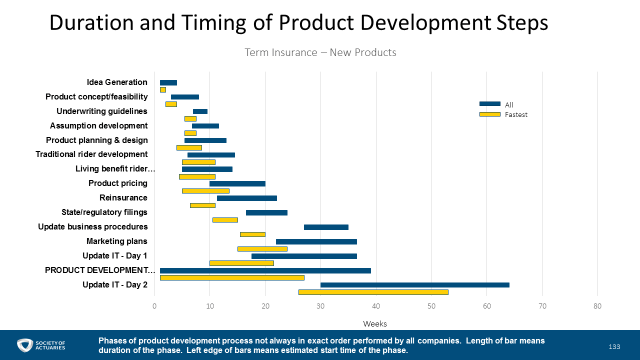

Faster companies are able to shave off weeks, even months, from certain product development efforts (pages 133-154). Insurers that navigate the development process faster tend to begin steps much sooner and alongside other steps, without waiting for completion of one task to move on to potential dependent tasks. For them, items like rider development and reinsurance start earlier in the overall process than at other providers. However, the most respected companies are not necessarily the fastest, and tend to spend more time in pricing and marketing than other insurers.

4. Leveraging predictive modeling is most keenly being sought through underwriting.

“We have a [predictive modeling] team. They don’t really work that closely with us yet… We’re starting to talk more about how we tie into the broader data and analytics team."

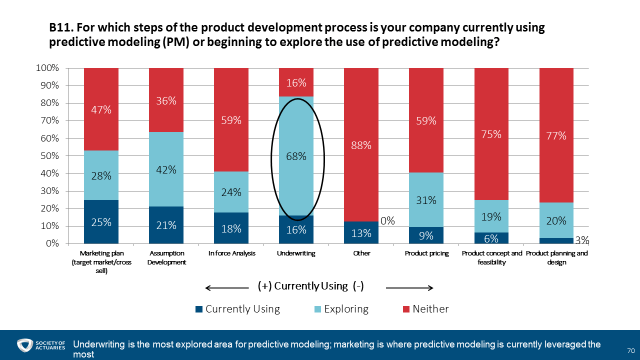

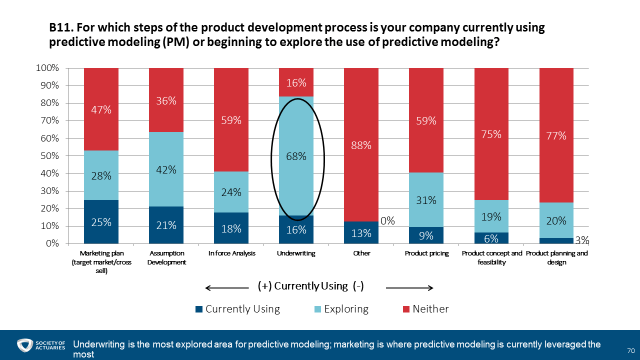

While currently used more in the marketing space, almost 70% of companies indicated they are exploring predictive modeling in the area of automated, simplified, or accelerated underwriting. This highlights the link to increased customer satisfaction, an area where market leaders and fast followers are spending a great deal of time. Through marketing plans based on predictive modeling’s ability to identify consumer needs and propensity to buy, disruptive underwriting can lead to compelling products with the right value proposition.

5. Hot trends aren’t always high priorities.

One trend is the wearables idea in the underwriting process (can and how data could be used). I think another one would just be in general what we here refer to as an ‘e-initiative,’ so an electronic application, electronic signatures, and the electronic underwriting.”

In recent years, the industry has directed a great deal of attention to and conducted extensive research on emerging trends, such as wellness programs and the use of wearable devices to collect consumer data. Yet when it comes to actual product development, bottom-line concerns such as low interest rates and meeting regulatory requirements remain the most important considerations. Interestingly, accelerated underwriting and in-force management are the only considerations out of 20 choices to be viewed as at least “somewhat important” by all survey respondents.