In a 2007 article featured in our corporate newsletter, my RGA colleague Curt Zepeda, Vice President of Underwriting, US Group Re, wrote the following:

It’s been said that the more things change the more they stay the same. To that end, group LTD benefit plans are once again becoming enriched and more liberalized in the physician market. The proverbial pendulum has started to swing. From the physician’s perspective, times are turning positive once again.

The article went on to describe a brief history of disability insurance for physicians in the U.S.:

- In the early 1980s, doctors were viewed as a pristine risk for disability insurance and showered with enriched LTD plans – discounted premiums, high replacement ratios, etc. Doctors got the coverage they desired, insurance companies wrote more business, and everyone was happy, for a while.

- In the late 80s and early 90s, the managed care movement took hold, changing financial arrangements and the way physicians were allowed to practice medicine. For some doctors, disability became an attractive alternative to the mandates placed on them at work. The rich LTD benefits provided a handsome income until retirement. LTD claims experience on physicians deteriorated and financial losses mounted for insurers. In response, the industry scaled back disability benefits and increased premiums for physicians.

- By the early 2000s, managed care had evolved, improving the economic landscape and workplace conditions for physicians. This, combined with restricted benefits and increased prices, vastly improved the financial condition of this market segment for insurers. Seeing healthy financial returns, carriers looked to write more disability coverage on physicians. And the liberalization of benefits began anew.

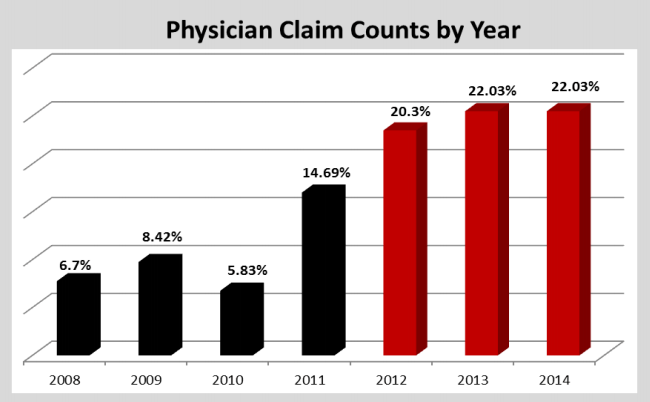

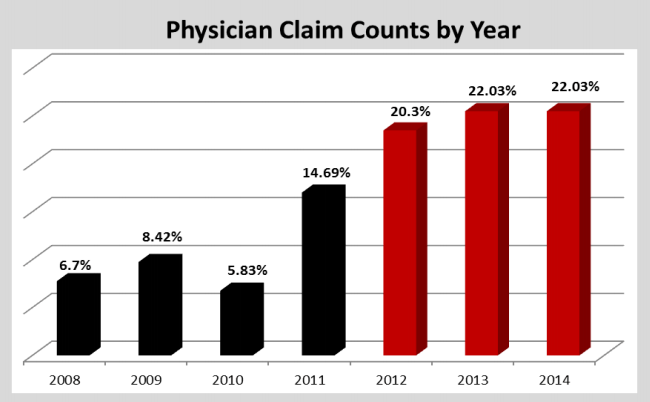

Now, a decade later, the “proverbial pendulum” has swung back again. In 2012, we noted a significant increase in claims from physicians. By 2015, we realized this increase was sustained and analyzed 500 physician-only claims to quantify the trend. The results were revealing:

The ACA Effect

So what happened to account for this dramatic increase? One contributing factor is the signing into law of the Affordable Care Act in 2010, which triggered a seismic shift in the healthcare industry. For physicians, the ACA brought more work, more uncertainty, and more desire to leave the profession. A biennial survey conducted by the Physicians Foundation shortly after enactment of the ACA in 2010 revealed changing attitudes:

- 67% of physicians rated their morale as “somewhat negative” or “very negative”

- 40% indicated they would drop out of patient care within three years

- 89% believed private practice was “on shaky ground” or “a dinosaur soon to go extinct”

Six years later in 2016, the same survey found similar trends1:

- 54% rated their morale as “somewhat negative” or “very negative”

- 49% often or always experienced feelings of burnout

- 48% planned to cut back on hours, retire, or take other steps limiting patient access to their practices

- 17% were in solo practice, down from 25% in 2012

- 33% identified as independent practice owners or partners, down from 48.5% in 2012

Given these results, it is no surprise that physician disability claims increased as job satisfaction and job security deteriorated.

Other Contributing Factors

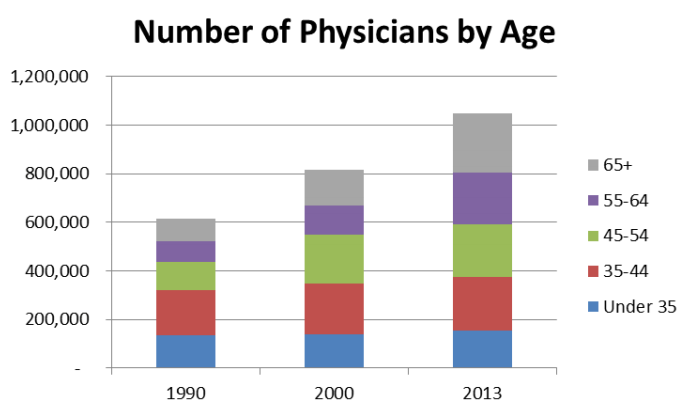

In addition to the ACA, other factors contributing to increased claims include the aging of physicians and mergers and acquisitions of physician practices.

American Hospital Association’s Chartbook 2015

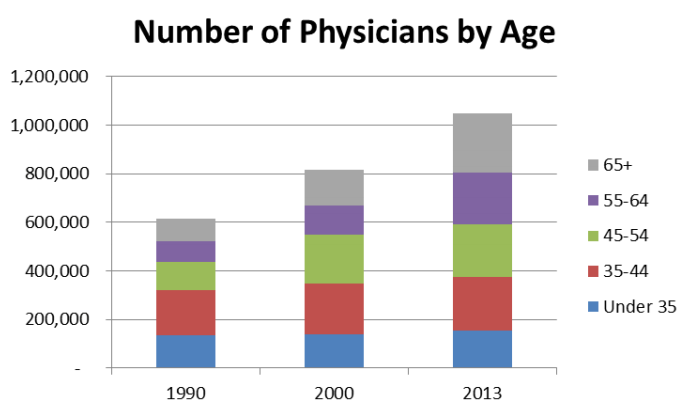

As a group, physicians are aging at a faster rate than the general U.S. population, a trend creating a workforce shortage expected to reach a deficit of up to 90,400 physicians by 2025, according to the American Association of Medical Colleges. This promises to further overextend practicing doctors and increase feelings of burnout. In addition, an older workforce tends to produce higher disability claims. In the RGA study, the percentage of physician claims were highest among groups aged 56-60 (24%) and 51-55 (21%).

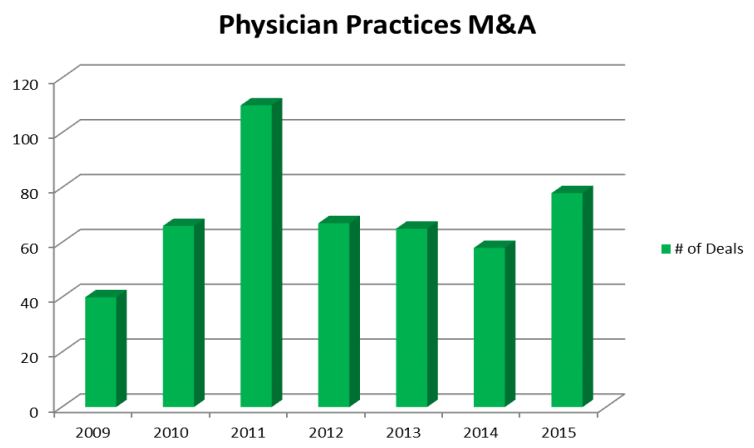

PWC publication February 2016 analyzing trends in US Health Services deals

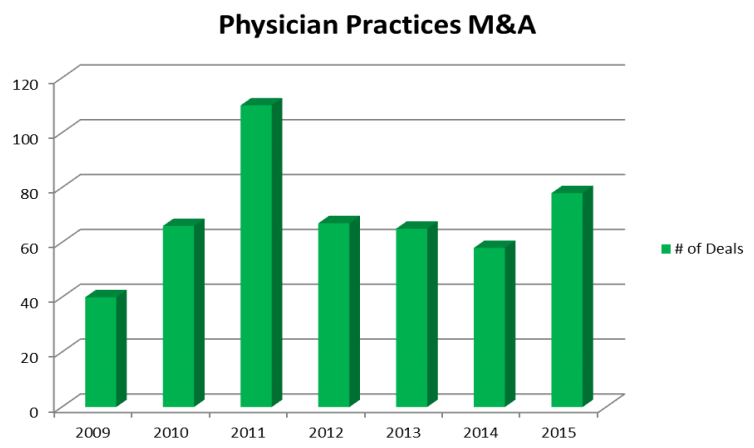

Another trend disrupting the medical field is the consolidation of physician practices through mergers and acquisitions (M&A). Between 2004-2011 hospital ownership of physician practices increased from 24% to 49%. Meanwhile, hospital M&A has also spiked as smaller hospitals look to join larger health systems to bear the costs of ACA not covered by Medicaid. Physician practice management companies acquiring complementary practices have contributed to the general consolidation trend as well. Bottom line: where and how doctors practice medicine is changing.

The Need for Discipline

Historically among virtually any group of employees, periods of disruption and general job-related duress produce higher-than-expected disability claims. Notably, we saw it across multiple industries during the Great Recession, within the oil and gas industry during big downturns in that sector, and, as noted above, in the medical field in the 90s and again today. Of course, liberal benefits packages with high maximums only add fuel to the fire.

The key is to recognize the cyclical nature of economic and political forces affecting group coverage, and to remain disciplined – especially when offering overly liberal benefit plans seems to be the only way to compete. It is when carriers get away from disciplined underwriting, rational offerings, and reasonable prices that they endanger their businesses. It is also important to avoid becoming over-leveraged in one particular industry, a risk that impacted multiple insurance companies with large blocks of physician coverage in recent years.

Moving forward, we believe carriers should continue to monitor performance in the healthcare industry and other industries that might present special risk to their business, and modify underwriting guidelines accordingly. Examination and careful consideration should be given to physician employee groups based on age, location, specialty, and plan maximums.

The proverbial pendulum may continue to swing – with physicians as well as other group disability business – but a disciplined approach can help insurers avoid being thrown off.