How do insurers account for market demand and take-up rates?

Take-up rates for medications can vary widely depending on several factors, from the type of medication and potential side effects to patient demographics and treatment costs. Important factors affecting GLP-1 market demand and take-up include:

- The need for better long-term data on the safety and efficacy of use for the designated indications

- The rapidly expanding list of potential new indications for the drugs, including chronic kidney disease, broader cardiovascular risk reduction, metabolic liver disease, and Alzheimer's disease

- The number of similar drugs in the development pipeline

- Price point versus competition, which affects affordability and insurance coverage

- Marketing efforts of the manufacturers, supply and distribution constraints.

- Clinical practices and adoption rates among providers

- Patient compliance and adherence

Mixed sentiments abound in both the healthcare and insurance industries about actual take-up rates, with some bullish about the outlook given the hype generated both in the clinical setting and commercially. Others are more conservative due to concerns about the high costs, access issues, side effects, and lack of longitudinal data on long-term outcomes.

As for the patient base, a recent report found that 75% of patients stop taking the medications within two years, although the report did not elaborate on the causes of this decline in use, which may be partially attributable to factors such as high costs and self-funding requirements. Regardless of cause, sustainability of outcomes remains unclear because adherence to treatment, as with many other drugs, may be an issue. That said, continuous use is likely needed to maintain the positive effects of GLP-1s. A randomized trial assessing the effect of tirzepatide (Mounjaro/Zepbound) found that withdrawing tirzepatide led to substantial regain of lost weight in less than two years.

Despite unanswered questions, health insurers should prepare for increasing interest in and demand for GLP-1s. The extraordinary case of the cancer drug Keytruda® may offer insight into the potential road ahead for GLP-1s. The global Keytruda market is expected to achieve a CAGR of 8.9% from 2023 to 2032, with the valuation anticipated to reach $54 billion.2 Initially approved for the treatment of advanced or unresectable melanoma, Keytruda received its 40th FDA indication approval on June 17, 2024, with the most recent approval covering endometrial cancer.3 This notable milestone adds to a growing list of indications as more clinical trials demonstrate Keytruda’s efficacy and safety across different types and stages of cancer.

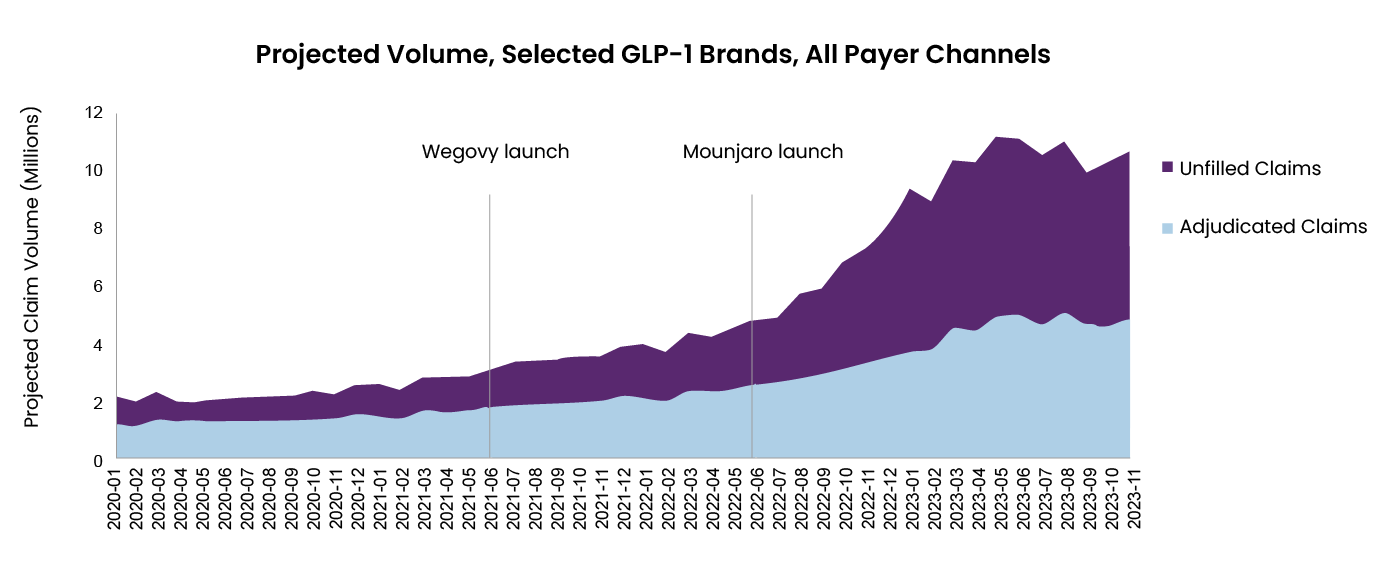

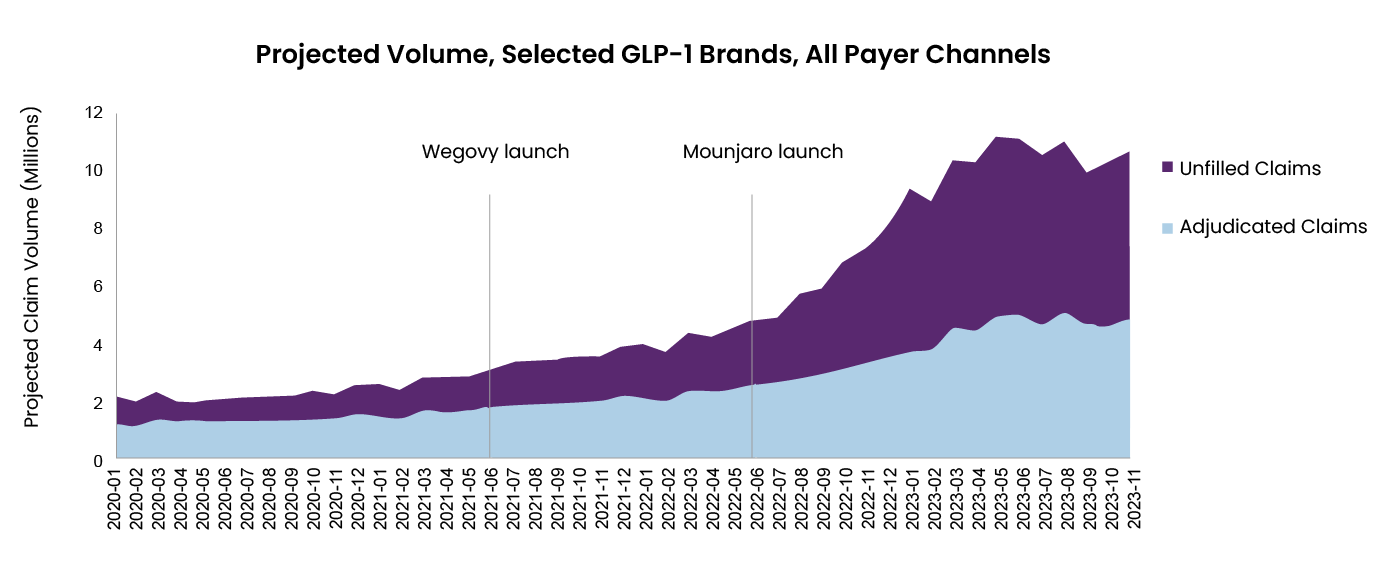

Could GLP-1s follow similar approval trajectory and commercial growth? Figure 1 shows shows the dramatic increase in prescription volume following the launch of Wegovy and Mounjaro. A recent report suggests the global GLP-1 market is likely to grow from $49.3 billion in 2024 to $157.5 billion by 2035 – a CAGR of 11.1%.

Figure 1: Projected volume, selected GLP-1 brands, all payer channel

Note: GLP-1 brands include Victoza, Trulicity, Saxenda, Ozempic, Rybelsus, Wegovy, and Mounjaro

Source: https://www.iqvia.com/locations/united-states/blogs/2023/08/new-demand-in-an-old-market

Will improved outcomes offset the cost of treatment?

Drug prices vary significantly by market, and in general tend to be higher in the US than in other countries. This is no different for GLP-1s. In the US, the monthly cost of treatment with GLP-1s is approximately $1,000, and in other advanced markets it is $100-$500.4 While the introduction of generics promises to reduce costs, this remains several years off, and a strong pipeline of original drugs could keep prices high for some time.

Given the relatively high monthly cost of GLP-1s in the US, as well as the prevalence of obesity in that market, GLP-1s have attracted particular attention. While costs in other markets may appear lower, the drugs’ cost relative to existing treatments and potential health expenditure savings from improved health outcomes will determine how health insurers are affected by their increasing use.

Published evidence comparing drug costs to outcome measures for health insurers/systems remains sparse, but one study compared the treatment of type 2 diabetes with insulin versus treatment with GLP-1s and found that the higher drug and outpatient costs associated with GLP-1 treatment were offset by a reduction in healthcare costs from emergency visits and inpatient admissions.5 For diabetes at least, GLP-1s may therefore be cost-neutral to health funders. Further evidence is needed to accurately assess other applications of the drug class. The long-term data on health outcomes for patients with obesity, in particular, is being watched very closely for potential downstream effects of treating the condition.

What actions can health insurers take now?

In the absence of any negative findings from the research and utilization of GLP-1s, the demand for this class of drugs will likely continue to increase, potentially resulting in a significant cost burden for the economy. Health insurers will be well served to begin quantifying GLP-1s’ cost impact on the portfolio for the short and long term, which will vary by market and product, to determine any necessary premium adjustments or changes to underwriting philosophy.

Insurers should also review their product coverage. If a health product covers GLP-1s, the insurer should consider means to ensure proper utilization by clearly outlining coverage and, where applicable, prior-authorization criteria. This will help to control the off-label use of the drug, which is a significant cost driver.

Health insurers can also proactively engage with patients to provide counselling on treatment, administration, and possible side effects. and support them in their journey. This active case management strategy will help to ensure a high compliance rate and thereby reduce waste.

Lastly, in markets where appropriate, insurers can also engage with pharmaceutical companies or pharmacy supply chains to ensure optimal pricing and value for the drug.

Conclusion

Health insurers are likely to be or have already been exposed to the rise of GLP-1s, and the exposure is expected to expand with approvals for new indications in the pipeline, as well as a projected increase in take-up rates. While the theoretical long-term benefits to health outcomes are welcomed, the short-term cost impact to health insurers must be considered. As an important stakeholder in healthcare, health insurers should play their part in ensuring that GLP-1s, like all other treatments, are being utilized responsibly and at prices that enable financially sustainable treatment plans for the ongoing benefit of all.

RGA health insurance experts are actively engaging with insurers to help determine optimal paths forward in addressing GLP-1 challenges and other emerging issues. Ready to join the conversation? Contact RGA.