- Electronic Health Records (EHRs), long in development, are nearing a tipping point of acceptance in the U.S

However, challenges are still cropping up in terms of several issues, ranging from interoperability, structured and unstructured data, and most important, determining how best to develop a system that will allow all of the essential data to go to the right places. This article discusses the current state of EHR, its advances and challenges, and the insurance industry’s role in making it work.

Overview

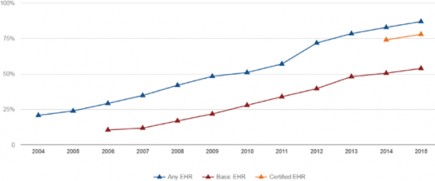

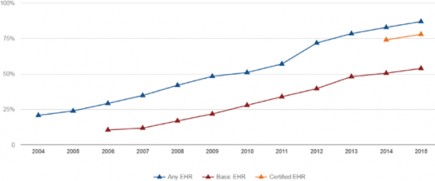

Electronic Health Records (EHRs) are currently experiencing widespread adoption in the U.S. Fueled by government involvement and funding, consumer engagement, physician comfort with the maturing technology, and overall evolution of the Health Information Technology (HIT) landscape, U.S. EHR adoption by healthcare providers more than doubled, from 42% to 87%, from 2008 to 2015. Currently, at least 84% of

U.S. hospitals have adopted EHRs – a nine-fold increase since 2008.1

Figure 1:

U.S. EHR adoption

Source: ONC Health IT Dashboard

These numbers certainly indicate good news for EHR, but challenges remain. First, although adoption is high, interoperability – that is, the ability of various systems to communicate easily with one another – is still low. Second, although consumers like to be in control of their medical information and still contribute patient-generated information from wearables, home testing kits, diagnostic apps, and the like, many healthcare providers simply do not yet know how best to utilize the information.

Then there are the issues of EHR utility and usability, two fundamental and opposing needs. EHR usability has to do with the quality and completeness of data life insurers see during underwriting and claims adjudication, while utility has to do with ease of access and use.

Enterprises need structured, coded data-capture capability, whereas physicians need utility – that is, they need the data in a form that can facilitate fast and easy creation of clinical notes.

EHRs are collections of standardized files specified by the HL7 Electronic Health Record-System. HL7 is the international standard for transfer of clinical and administrative data between software applications used by various healthcare providers.

EHR files utilize reusable templates and set formats. Data is arranged chronologically, according to episode of care, and documents the patient profile, visit and encounter information, health status (symptoms, signs, test results, etc.), diagnoses made, treatment plans, and communications between care providers.

Structured EHR data is represented by several medical coding vocabularies (see Figure 2), each of which consists of thousands of codes that are used to represent diagnoses and symptoms in Problem Lists and Procedures. For example, there are nearly 95,000 ICD-10-CM codes alone, and ICD-10 is just one of many standardized code systems used in health care.

Unstructured data, on the other hand, represents roughly 80% of the data currently in EHRs. Unstructured data includes: notes and care plans (narratives); images of historical data; radiology and EKG reports; and more.

The Health Story Project, an initiative of the Healthcare Information and Management Systems Society (HIMSS), estimates that some 1.2 billion clinical documents are produced in the U.S. each year, and about 60% contain valuable patient care information. However, that information is trapped in an unstructured format.2

EHR Data Acquisition

There are four dimensions of data acquisition: data origination; data source(s) (EHR/medical claims); data aggregators and transmitters; and those who can alter the data.

Figure 2:

Standardized codes used for medical report sections

SECTION | STANDARDIZED CODES |

Demographics | HITSP harmonized code sets for gender, marital status |

Problem list | ICD-9/10-CM or SNOMED-CT |

Procedures | CPT-4 or ICD-9/10-CM |

Medications | RxNORM |

Allergies | UNII for foods and substances, NDF-RT for medication class, RxNorm for medications |

Immunizations | HL7 CVX |

Vital signs (height, weight, blood pressure, BMI) | SNOMED-CT or LOINC |

Progress notes and other narrative documents (history & physical, operative notes, discharge summary) | CDA templates |

Departmental reports (pathology/cytology, GI, pulmonary, cardiology, etc. | SNOMED-CT |

Lab orders and results | LOINC for lab name, UCUM for units of measure, SNOMED-CT for test ordering reason |

Microbiology | LOINC for lab name/observation |

Administrative transactions (benefits, referrals, claims) | X12, CAQH CORE |

Source: RGA

Insurers acquire consumer data as follows:

- Patient Portals: Consumers share credentials for their patient portals with their life insurers or other intermediaries, enabling them to retrieve the data. The health care provider controls and maintains the patient data at the source. This is structured EHR data.

- Providers or Health Information Exchanges (HIEs): Consumers permit their life insurer or other health care intermediary to directly exchange their health care data electronically with health care providers and/or HIEs. The provider or HIE controls and maintains the data at the source. This is structured and unstructured EHR data.

- Healthcare Clearinghouses: These companies are intermediaries that take in health care claims data and aggregate and “normalize” it (i.e., structure it) so that it can be viewed uniformly. They then forward the normalized claims information to insurance companies. The health care provider controls and maintains the actual data at the source. This is structured claims data.

- Pharmacy Benefit Managers (PBMs): These are third-party administrators of prescription drug (Rx) programs for insurers that aggregate and normalize pharmacy data. The pharmacies control and maintain the data at the source. This is structured Rx claims data.

- Direct from consumers: Consumers aggregate their health records from providers via their patient portal(s), and store the data in a central location (Personal Health Records, apps, etc.). They control and maintain their data, and make it available to their insurers. This is structured EHR data.

New ways of aggregating and distributing EHR data are emerging. Apple, for example, recently released an app that allows patients to view their EHRs on their iPhones. The app will transfer patients’ actual medical records to their handheld devices (structured EHR data). This is but one example in a string of attempts by nontraditional players to improve health data exchange.

Many of the newer acquisition models will challenge fundamental ways of thinking. Life insurers may have to redefine chain-of-custody and their comfort level with applicant control of protected health information.

Claims vs. Clinical Data

Generally, medical claims data are broad in scope and shallow in terms of detail, whereas EHR (clinical) data are narrow in scope but deep in detail.

Claims data comes from health insurers, and contains highly personal information, such as patient demographics (name, address, gender, etc.), employment and insurance status, dates of medical service(s), diagnoses and procedures, service provider information, and charges for services. Frequently it is the only holistic view of an individual’s interactions with the health care system.

This data has several advantages for insurers: it provides a good reflection of the tests, procedures and services provided to a claimant; fills and refills of prescriptions are included, enabling underwriters to assess medication compliance; and it can reflect services from providers that do not use EHRs, or are not connected to an HIE or other health information source, as medical services received by policyholders generally need to be reimbursed.

Clinical data from EHRs, on the other hand, is much richer. Claims data holds only those pieces of information required to facilitate reimbursement to the provider, but clinical data captures the medical history of uninsured patients, including purchases and use of non- prescription drugs, vital signs, personal habits (e.g., smoking), and past as well as current problems and diagnosis lists. Additionally, a patient may not always meet the criteria for a given diagnostic code (for purposes of reimbursement).

Also, with clinical data, all diagnoses and conditions reported during a visit are coded (especially symptoms), but may not necessarily all be reported for reimbursement and reflected in claims data. In addition, claims data lists charges for lab tests and procedures performed, but not the actual results. Finally, claims data also reflects only diagnoses and services that occurred on the date the claim was submitted, and don't convey information about the past.

Challenges for Life Insurers

Accessibility. Now that EHRs, at least in the U.S., are digital, the Health Insurance Portability and Accountability Act of 1996, which governs privacy laws in the U.S., is also governing electronic transmission, specifying proper methods for de-identifying health information before sharing with outside parties (“Safe Harbor”).

While cost structures should be changing due to advances in technology, progress is still slow. Covered entities (providers) are permitted to charge reasonable, cost-based fees that cover the cost of supplies and labor costs to provide paper and digital copies of EHRs. They cannot, however, charge a fee for retrieving the records. The cost of digital feeds to external parties remains largely unknown and is unregulated.

Aggregation. This is fueled by two primary factors: record-matching and interoperability. In terms of record-matching, as there is no national patient identifier or universal health record ID in the U.S., it is nearly impossible to stitch a record together electronically for a single individual from multiple healthcare facilities and providers.

As for interoperability, in the U.S. it was originally envisioned that it would be achieved by providers signing on with government-funded HIEs that would link to a National Health Information Network. The reality is the development of these exchanges is currently struggling with sustainability as federal funds dwindle. Also, each EHR vendor has developed proprietary software and platforms. Consequently, privately-funded exchanges and vendor coalitions have emerged, which are competing successfully with the government-funded exchanges.

Normalization. Despite mandated standards and templates for EHR, this may be a ways off. More than 1,000 IT systems are currently operating in the field of health care, and each has its own platform. Many systems are customized by providers to suit their specific implementation. Users populate the records according to their own comfort and habits, making frequent use of unstructured text.

Interpretation. Once health care data access was gained, and all of the data was aggregated and normalized, one would think insurers might be home free. But it is not that easy. Putting aside the sheer volume, duplication, and extraneous data (in terms of underwriting), insurer efforts to interpret the data are becoming even more complex.

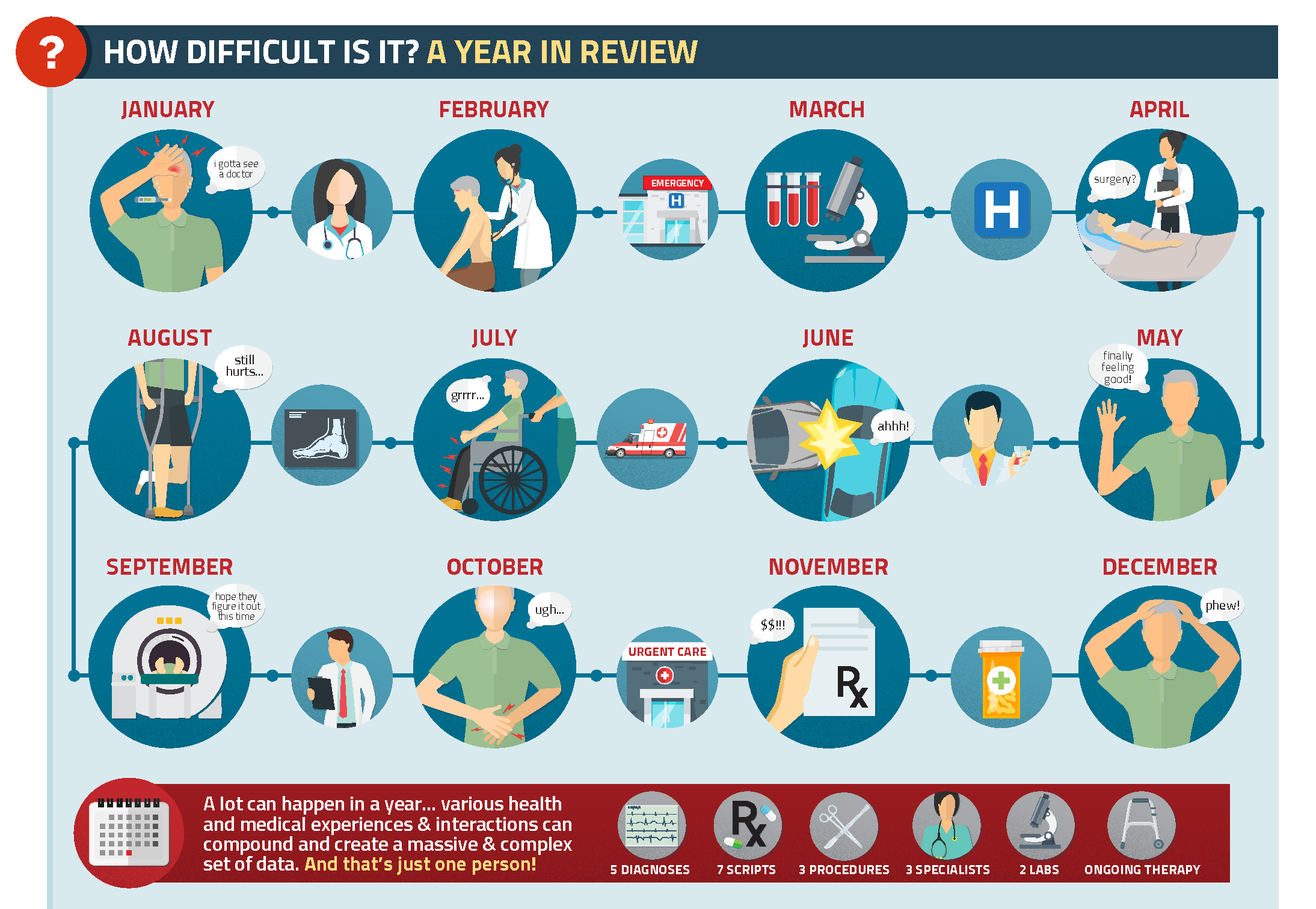

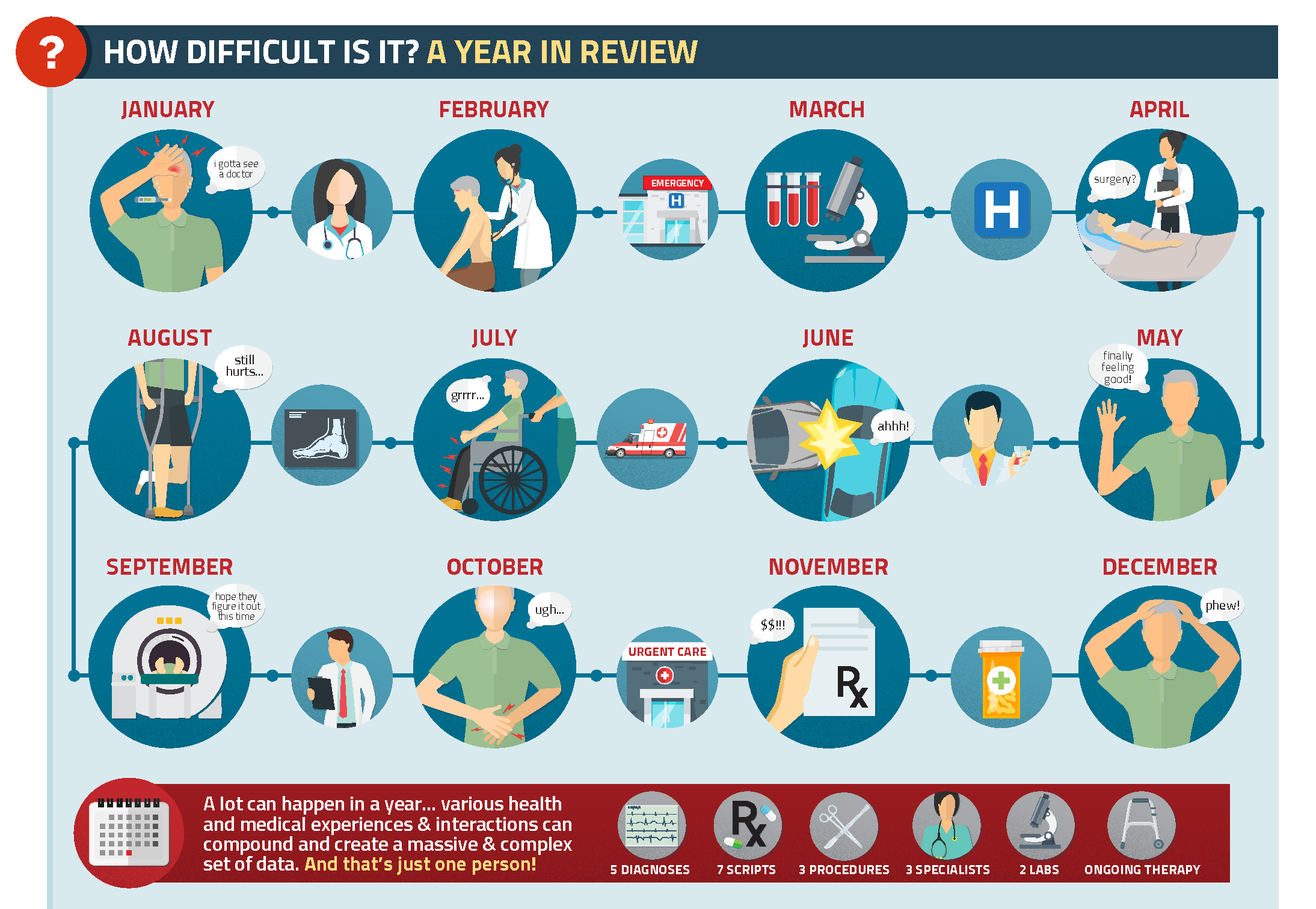

Let us take a look at the timeline in Figure 3.

Figure 3:

A year in the life of an insured

Every month tells another piece of an individual’s health care story, from conditions and tests to therapies, prescriptions, and medical equipment. All of this is important information for insureds, and will benefit from organization that facilitates interpretation.

Figure 4:

Code sets used for EHR (clinical) and medical claims data

| Claims Data | EHR (clinical) Data |

Diagnoses | ICD-9/10-CM | SNOMED CT |

Laboratory | LOINC (no results) | LOINC |

Procedures | ICD-9/10-PCD (no results) | CPT, HCPCS |

Prescription Drugs | NDC | RxNORM |

Vital Signs | None | LOINC |

Source: RGA

Conclusion

For some time now, the big question has been “When?" … as in “When will EHRs become a reality for life insurers?” The answer is today. Right now.

The bigger question, now, however, is “How?” … as in “How will life insurers use EHRs?” That question is much harder than the first.

The life insurance industry is breaking new ground in its efforts to correlate clinical data, health claims data, and patient-generated data in order to derive the complete story of an insured’s health or risk status.

The transformation of underwriting has already begun. Are you ready?