A strategic focus on cash generation and improving capital contributions from in-force business blocks is an absolute necessity for today’s life insurance companies.

The past six years have been challenging for the industry. The global economic environment has removed most of the “easy” new business growth that, until recently, life insurers had relied upon to generate shareholder value. To maximize the value of their existing books of business, companies would do well to deploy an active in-force management program, beginning with a transparent expense allocation and retention analysis to determine the relative strategic value of blocks.

The aim of this report is to provide insights to life insurance companies to help them develop strong cash and capital management strategies for all of their in-force blocks of business, enabling them to optimize operational effectiveness, growth, profitability and shareholder value.

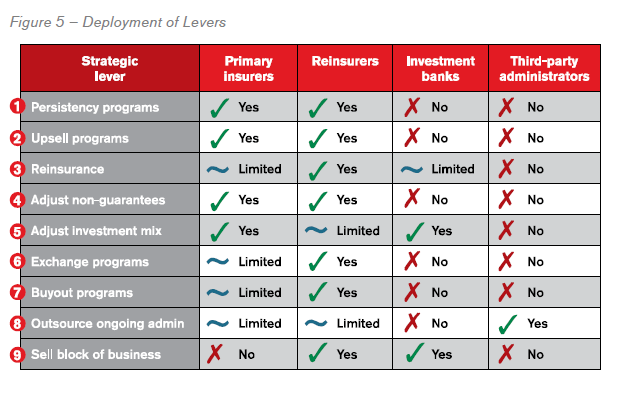

As one of the world’s largest life reinsurers, RGA has spent the past few years analyzing how life insurers can effectively mine their in-force blocks to generate value across all business areas. We see nine strategic levers which can be deployed to increase cash generation from and improve capital management of in-force blocks.

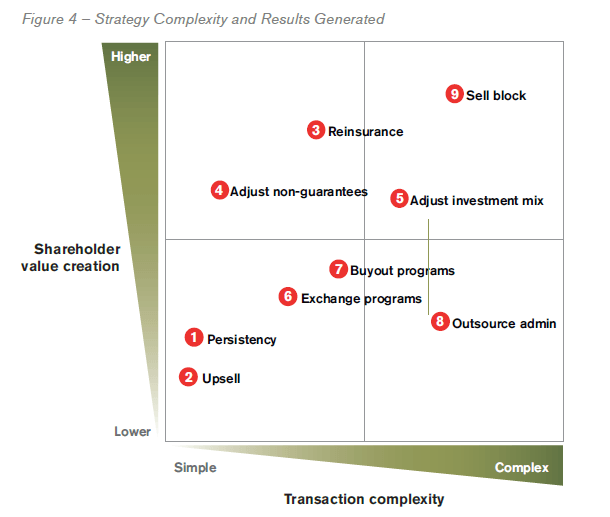

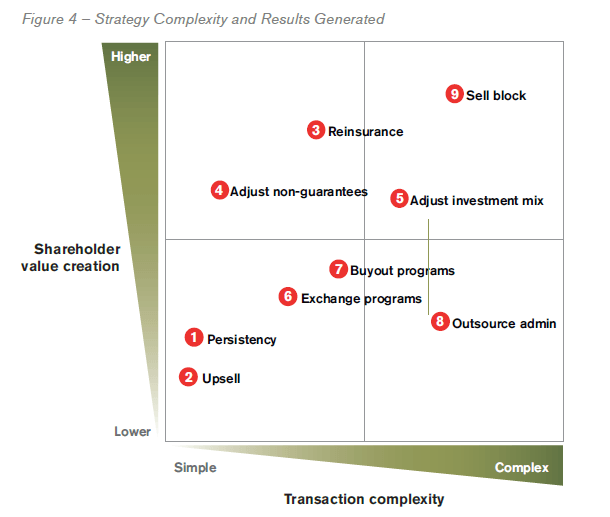

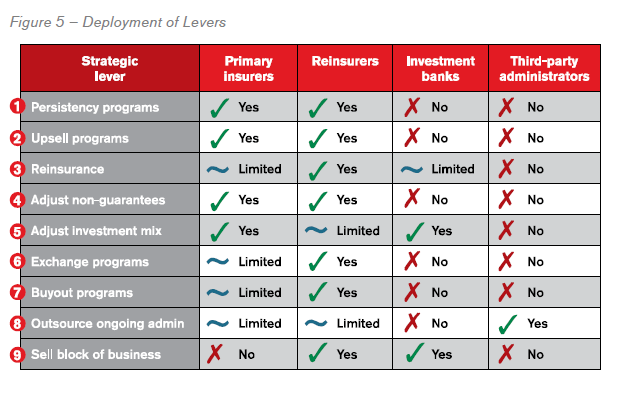

Selecting which of the nine levers to deploy, and how to do so, depends fundamentally on balancing shareholder value creation needs with transaction complexity. Reinsurers are one of many external partners life insurers can choose to augment their strategic cash management capabilities while accelerating the process of de-risking their active in-force management programs.

Global Trends for In-Force Management

External factors

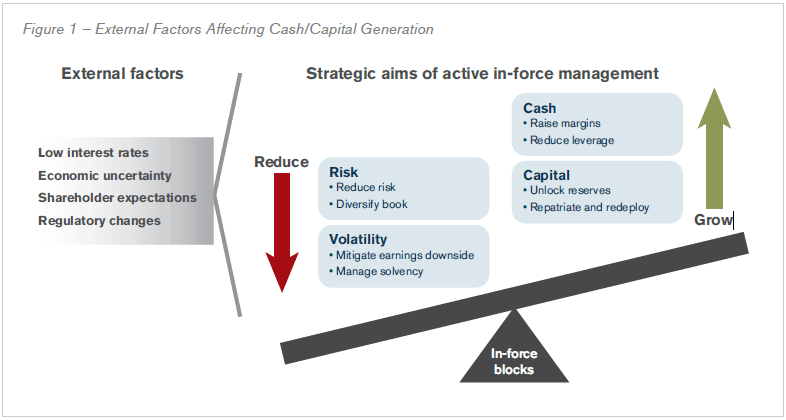

Over the past six years, life insurance company interest in using active in-force management to drive cash, capital and shareholder value growth has surged. This surge, driven primarily by the fallout of the 2008 global financial crisis, has been heightened by the continuing economic environment, where economic uncertainty and ongoing low interest rates are sharpening the focus on maintaining and growing capital and shareholder value. The regulatory changes stemming from the financial crisis are also a factor, as they could prove costly to insurers in the future.

Economic uncertainty has become business as usual for the world’s economy. Nielsen’s most recent global report on consumer confidence (issued in 2013’s fourth quarter), which examines consumer confidence trends in 60 countries, found that low global consumer confidence levels continue to persist. The report describes consumers around the world as “pessimistic about the economy,” “worried about its fragility due to the slow rate of recovery,” and continuing to feel “mired in recession”.

Central banks around the globe have sought to provide greater support to national economies and stock markets through a range of programs such as quantitative easing, which aims to keep interest rates – and the cost of money – as low as possible.

RGA recently conducted an analysis of Dow Jones U.S. Life Insurance Index returns benchmarked against the Standard & Poor’s 500 index since the onset of the global financial crisis six years ago. This analysis revealed that the ability of U.S. life

insurers to create shareholder value has been highly volatile over this time period, primarily due to the low interest rate environment stemming in large part from the crisis.

For life insurers around the globe – especially those that have large in-force blocks with high guarantees (such as annuities and long-term savings products) – low interest rates have made asset-liability matching far more challenging in terms of both cost and risk due to the necessity of finding investment instruments that generate long-term value. Life insurers have responded by shifting their financial management strategies to capital preservation, primarily focusing on de-risking product portfolios and preserving cash with the aim of growing shareholder value.

Regulatory changes stemming from the financial crises of 2001 and 2008, including the European Union’s proposed Solvency II Directive (due to take effect in 2017), changing local capital requirements in many of the world’s markets (such as Canada and several Asian countries) as well as the creation of the designation of Global Systemically Important Financial Institutions (which currently applies to several multinational insurers) have the potential to change cost-benefit calculations of many life products. As governments and global policy experts continue to develop these and other regulations to ensure more robust financial markets, early indications are that life insurers will have to be more selective when deploying capital in pursuit of specific business opportunities.

Strategic aims

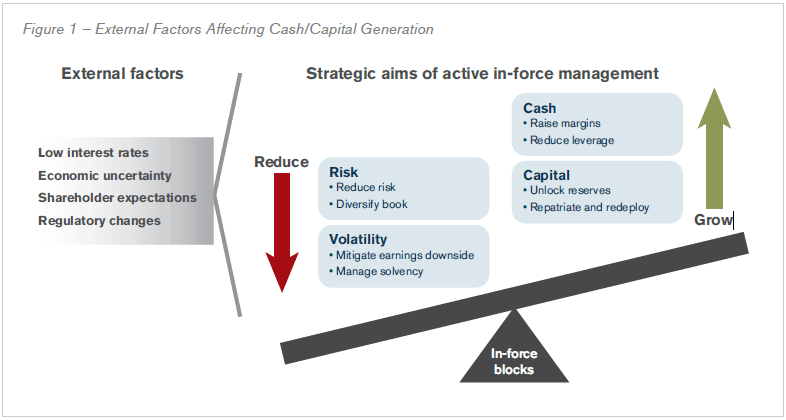

Going forward, life insurance companies must actively manage their in-force blocks of businesses in order to maximize and sustain shareholder value. We currently see two effective strategies: the first is strengthening the cash generation capability of these business blocks and optimizing their capital management; the second is reducing the full in-force block’s risk profile and volatility (Figure 1).

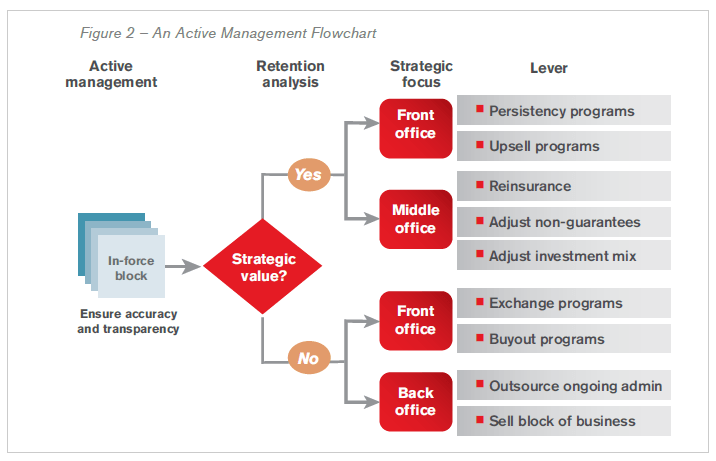

Shareholder Value Creation

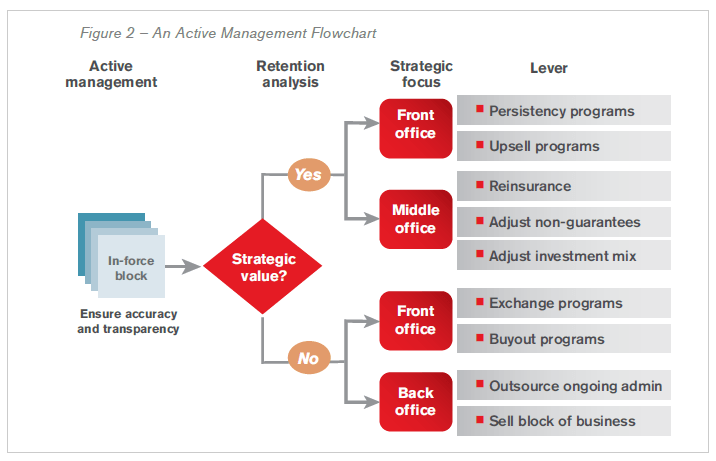

Growing shareholder value requires an active approach to managing in-force blocks (Figure 2). Before taking steps to enhance the value of individual blocks, however, life insurance companies need to ensure an accurate, transparent methodology for expense allocation across all business blocks, given the mixture of products, terms, and natural emphasis on new business. Once this is completed, a rigorous retention analysis can be conducted to establish clearly each block’s present and future strategic value.

For blocks determined to be strategically valuable, shareholder value optimization efforts are best focused on front and middle offices. The five levers that focus on increasing the value of in-force policies are persistency programs, upsell programs, reinsurance, adjustment of non-guaranteed elements and adjustment of the investment mix.

For blocks that lack strategic value, different levers can be employed. These levers would target front and back offices. Front office (or policyholder) initiatives focus on reducing risk in these portfolios by providing incentives to policyholders to move away from their existing contracts, and include levers such as exchange or buyout programs. Back office (or operational) levers focus on outsourcing ongoing administration and the outright sale of selected blocks.

Focus: Strategically valuable blocks

The five levers outlined in this section are useful when an insurance company determines that an in-force block of business is strategically valuable, and wishes to reduce the block’s risk and increase its value in order to maximize the cash and capital that can be generated for shareholders.

Lever 1: Persistency programs

Life insurers may want to consider using programs to enhance the persistency of in-force blocks where policyholder lapse experience is high for its local market and distribution channel experience.

Programs such as premium holidays can adjust a consumer’s premiums to preserve the present value of in-force profits, while incentives such as loyalty programs can be designed to increase the likelihood of maintaining premium payments.

Before launching a persistency program, insurers need to define and then target “high-risk” customers – that is, customers identified as more likely to lapse. Persistency programs are most likely to succeed when they are deemed important internal priorities. For example, one Australian insurer concerned about persistency created a dedicated retention manager position that reported directly to the Chief Operating Officer. The retention manager was able to work across departments to improve persistency, find and sever ties with advisers with a high susceptibility to churn business, and institute proactive customer

outreach programs for the ~9% of total premiums that were identified as having a high probability of lapsing.

Predictive modeling tools are useful in proactively identifying customers and distribution channels with higher propensity of lapsation. Effective analysis of results from these models can help companies take pre-emptive actions such as contacting at-risk customers, which can broadly reduce lapsation due to premium nonpayment.

Lever 2: Upsell programs

Upsell programs for in-force customers can improve profitability of in-force blocks by enabling these customers to gain higher-margin riders for their policies, which can sometimes offset implied guarantees. These programs focus primarily on upselling living benefit riders to current policyholders for needs such as long-term care or critical illness in order to provide them with additional insurance coverage.

One effective way to do this is by enabling policyholders with material guarantees (such as high minimum crediting rates on universal life plans) to purchase new products or riders with minimal additional underwriting. Companies can actively mine their in-force databases to determine “good risk” candidates to whom additional cover can successfully be offered. The challenge is to ensure such programs are in the best interests of both the policyholder and the company.

A Hong Kong insurer deploying an upselling initiative has experienced standard life policyholder take-up rates of 5% to 7% of critical illness riders. For this initiative, the insurer worked with an external partner to reduce underwriting requirements for the riders to simplified or guaranteed issue in order to improve customer experience. Given that critical illness premiums in Hong Kong are, on average, two to three times higher than standard mortality premiums, the insurer was able to see sizable premium increases for minimal acquisition costs.

Lever 3: Reinsurance programs

Reinsurance programs can offer insurance companies a range of strategies to enhance the financial strength of their in-force portfolios via mergers, acquisitions or dividends. It is the only financing that can reduce the amount of regulatory capital required to maintain solvency margins. Reinsurance also provides a certain level of discretion not available with other financing arrangements, as unlike equity market transactions, reinsurance transactions are private and in many countries do not require any public disclosure.

Reinsurance solutions are by their very nature bespoke – customized for each insurer’s specific needs. Working within local statutory and home country regulatory constraints, reinsurance can offer capital and global diversification at comparatively modest cost, and in a much shorter time frame.

A French insurer recently deployed a reinsurance transaction to reduce its Solvency I capital requirements. In doing so, it freed €300 million of capital for other strategic purposes. This transaction was particularly advantageous to the insurer because of its simplicity, its low cost compared to other financing solutions, and the accelerated timeline.

Lever 4: Adjusting non-guaranteed elements

The non-guaranteed elements of a life insurance policy depend on the regulations of the country in which the issuing insurer is domiciled. They may include premium rates, minimum benefits, cash values, and charges not contractually guaranteed at time of issue. These are particularly prominent with living benefit-style morbidity products.

Adjusting an insurance policy’s non-guaranteed elements can involve several strategies, such as reducing dividends and crediting rates on guaranteed minimum return policies. For non-participating business, this may take the form of increased premiums or cost-of-insurance charges.

For optimum effectiveness, these conditions should be met:

- The in-force block’s experience is poor, leading to a shift in its outlook;

- The chance of consumer anti-selective mortality/morbidity behavior is low;

- The balance of local franchise value versus cash generation tilts more towards cash generation;

- The block of business is in a regulatory environment where adjustment(s) can be easily accomplished.

One effective example occurred recently in the U.S. long-term care market. After decades of poor experience, providers increased the non-guaranteed element of premiums – an action favorably received by equity analysts and shareholders.

Lever 5: Adjusting the investment mix

Investment managers at life insurance companies employ several strategies to manage and adjust the investment mixes of their portfolios to support in-force blocks and maximize shareholder value. These strategies can include incorporating non-traditional higher-yielding assets, assuming additional credit risk, increasing the duration of the fixed-income portions of the portfolios, and adding alternate vehicles such as non-fixed income investments and long-term cash-generating vehicles as appropriate, such as real estate and infrastructure (due to their stable long-term cash flows).

In-force blocks weighted towards longer-term and more persistent low-cash-value products such as long-term care, lapse-supported universal life or level premium insurance are good candidates for adjustments in the investment mix. These policies require less liquid investment assets, which can present opportunities to hedge downside risk to mitigate investment volatility. Companies utilizing this strategy successfully would require a certain amount of local scale, especially if looking at real estate and infrastructure, to be able to deploy capital in long-term asset purchases.

In the U.K., a life insurer recently earmarked nearly £500 million of its capital to invest in domestic infrastructure. The company plans to invest in non-liquid projects in industries such as transportation, hospitals and utilities, with the goal of long-term inflation-indexed returns to match the substantial long-term liabilities on their pensions and life insurance policies.

Focus: Non-strategically valuable blocks

The following four levers are useful when an insurance company determines that an in-force block of business is not strategically valuable and wishes to maximize the amount of cash and capital that can be generated for shareholders upon

reduction of exposure.

Lever 6: Exchange programs

In exchange programs, insurers facilitate an exchange of in-force policies with new contracts via novation agreements. This differs from upselling, as the policyholder receives an entirely new contract, frequently with lower guaranteed benefits and higher potential upsides, whereas in upselling, the in-force contract remains in place. These programs, which are generally conducted discreetly, can also encourage healthy customers to exchange current policies for policies with higher levels of insurance coverage with minimal underwriting.

As with upsell programs, client interests must be carefully considered when developing such programs.

Exchange programs would need these conditions met:

- The in-force block is experiencing an undesirable risk profile;

- The insurer is comfortable with potential reputational risks;

- The insurer understands potential increases to insurance risk if

policyholder coverage levels are increased; - Customers are led to see value in exchanging their policies.

One major insurer in Taiwan offered policyholders the opportunity to improve the value of their coverage by exchanging local currency policies for ones denominated in China’s renminbi (RMB) currency. The new policies maintained the original policy’s guarantees, interest rates and surrender values. This produced a win-win scenario, as the insurer was able to de-risk its investment guarantees and achieve better profitability while customers bullish on China’s currency gained RMB-denominated policies.

Lever 7: Buyout programs

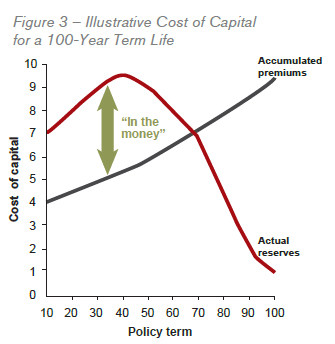

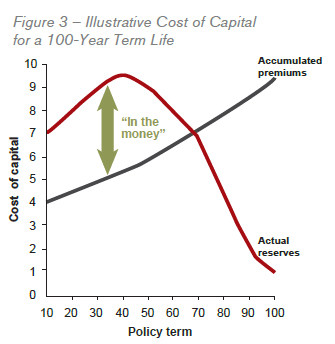

In buyout programs, insurance companies actively seek to buy back in-force policies from policyholders. This strategy is most effective when the cash values (accumulated premiums) of the targeted policies are lower than the insurance company’s actual reserves (See Figure 3).

Buyout programs are most useful when an in-force block is lapse-supported or deeply “in the money;” that is, when a policy’s market value is higher than the buyout incentive offered. For policyholders experiencing significant financial duress, such as sudden high medical expenses, ballooning mortgage payments or other debts or obligations, a buyout can be a great opportunity to maximize the liquidity available in an in-force policy. To implement an effective buyout program, insurers must be able to offer a sufficient incentive as well as publicize the option effectively while minimizing and mitigating anti-selection and reputation risks.

In South Africa, a leading insurer implemented a successful buyout program that offered free critical illness riders to holders of in-force term-type policies, The riders permitted policyholders to monetize their mortality sum assureds (face amounts) if specific pre-approved needs could be shown. Policyholders who accepted the riders could either terminate their entire policies or accelerate a discounted partial payment of the sum assured.

Lever 8: Outsourcing ongoing administration

Outsourcing ongoing administration of a block of business to one or more third parties can be effective whether or not the block in question is deemed to be of strategic value, but has particular value for non-strategic blocks. Third-party administrators can offer several advantages to an insurer: they can assume ongoing maintenance, provide economies of scale, and take advantage of the ability to arbitrage labor costs via their offshoring delivery centers.

Outsourcing is an option insurance companies should consider when assessing whether to move between a predominantly fixed-expense basis and a more variable basis. Whether companies seek to lock in expense factors, reduce multiple legacy administration systems or access extra capabilities, successful outsourcing requires effective governance and oversight of the outsourcing provider to maintain customer service quality.

Several aspects of an insurer’s administration can be outsourced, from back-office and IT operations to call centers and web services. Doing so reduces operating expenses, resulting in administrative cost savings that flow directly to the bottom line. The outsourcing provider must be carefully selected to minimize risk to the insurer, and if the insurer is retaining a portion of the risk, must also be audited regularly.

Lever 9: Selling the block

Selling an in-force block allows a company to exit the block completely and offload any future associated risks. Companies can either sell the block outright or sell shares equivalent to a block’s value to a third-party entity, such as a private equity fund or reinsurer. A third method is using private assumption reinsurance, where a reinsurer assumes a block’s future experience and then provides the insurer with the net present value of future cash flows.

The most successful sales are when a mutual strategic benefit exists for the buyer and the seller. For example, many large banking groups in Europe have recently made monetizing the value of their in-force life insurance a key strategic requirement, which has resulted in several reinsurance transactions to sell inforce blocks to external partners. One such transaction in Spain is reported to have been worth more than €445 million.

The Path Forward

Prioritizing shareholder value creation levers

Life insurance companies have numerous options for actively managing their inforce blocks. Typically, how the nine levers are chosen and deployed depends on the balance between shareholder value creation and transaction complexity. Insurers can prioritize their choices using to the matrix chart in Figure 4. Each situation will have its own unique set of market and client dynamics, which will change the relative advantages and positioning of each lever within the matrix.

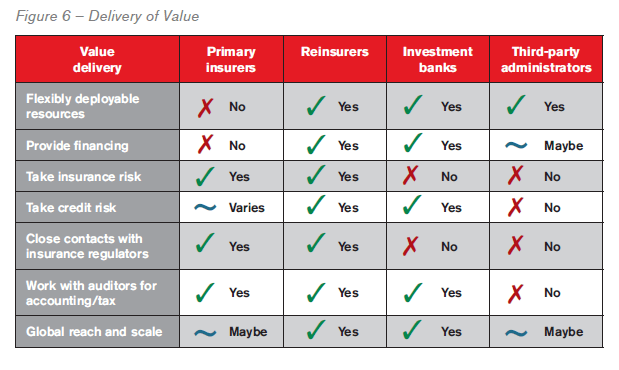

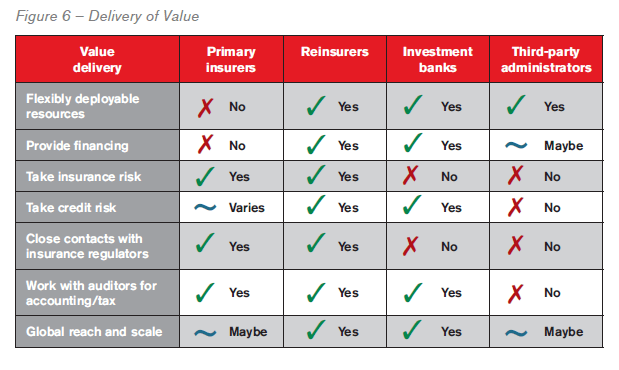

Life insurance companies wishing to effectively select and deploy value creation levers have a choice of several partners which can supplement their capabilities, accelerate the initiative and de-risk deployment. Partners can include investment banks, third-party administrators and reinsurers.

While each situation is unique, partnering with reinsurers allows life companies to tap global best practices for multiple levers with a partner incentivized solely by the insurer’s success. The main advantage of partnering with a global reinsurer knowledgeable about life insurance comes down to global reach and the ability to deliver value across many initiatives through a variety of delivery mechanisms.

A Proposed Agenda for Life Insurers

Many partners, strategies, and levers/initiatives are available to insurance companies wishing to improve their active management of in-force life blocks business. The most effective strategies will result in reduced transaction complexity and risk while growing cash, capital and shareholder value. In this post-crisis world, insurance companies should ask the following questions to determine their current positions and future potential strategic moves.

- Does your company use a consistent global basis to assess and compare performance of in-force blocks?

- Are your company’s stakeholders (shareholders, board, executive management) satisfied with the cash generation of in-force blocks as well as with investments allocated to higher-growth opportunities?

- Has your company conducted a strategic review of all material in-force blocks?

- Which of the nine strategic initiatives summarized in this report is your highest priority?

- Are the current profit margins of your in-force blocks satisfactory?

- Does your company have the right skills and capabilities to maximize shareholder value from all in-force blocks?