According to recent data from the Australian Institute of Health and Welfare, around 50% of Australian males will be diagnosed with cancer before their 85th birthday. The number is 30% for females. In 2014, cancer accounted for 30% of deaths in Australia.1

In Australia and across most of the world, cancer and/or the related care is usuallyinsured as part of critical illness products, one of several conditions covered underthese offerings. However, in a few Northeast Asian markets (such as South Korea,Japan and Taiwan), cancer is insured in stand-alone products.Coming to Australia after having worked in health product pricing and research anddevelopment in the Japanese market, I was surprised to see that cancer productshad not made their way “down under.”In Northeast Asia, cancer insurance usually covers treatment for cancer andoccasionally carcinoma-in-situ (CIS). Benefits can be paid out upon diagnosis,death caused by cancer, and cancer-related surgeries. Some products alsofeature additional coverage such as cancer hospitalisation (nursing care), radiation/chemotherapy, rehabilitation and other minor ancillary benefits.

Cancer products are popular and important segments of the market in NortheastAsia. The annualised new business premium of cancer products in the Japanesemarket in fiscal year 2014 was almost ~AUD1.5 billion, with 1.8 million newpolicies accounting for 12% of all new retail policies.In recent years some companies in other Asian markets have begun offeringcancer-only products to differentiate their offering from conventional critical illnessproducts. These markets have seen growing interest in cancer insurance, possiblybecause of insufficient coverage from existing critical illness insurance and aconsumer perception that cancer-only products are better aligned to their needs.In these markets, cancer accounts for the majority of critical illness events anddiagnoses, 60-70% for males and more than 80% for females.

Cancer incidence factsheet

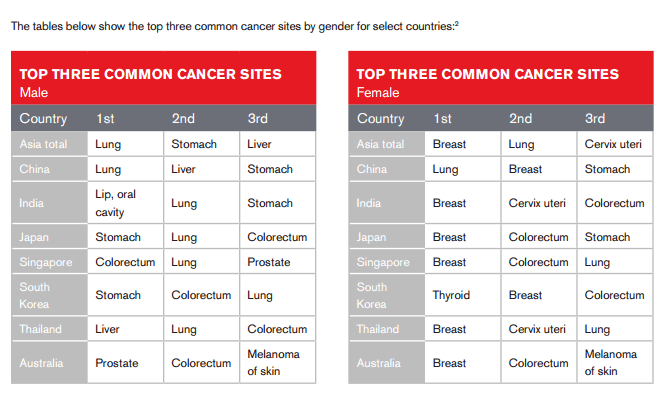

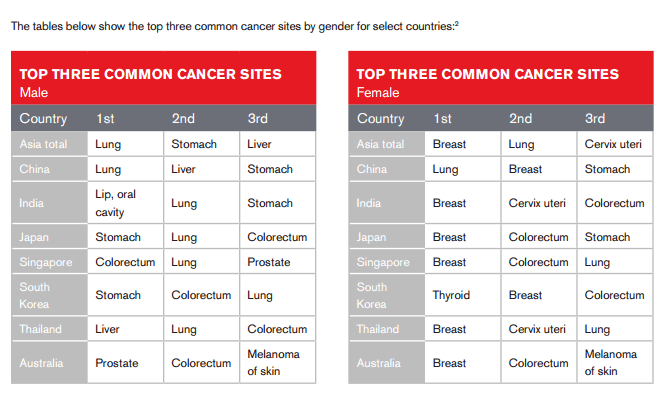

The level of cancer incidence by site varies by country/region depending ondemographic, geographic, diet, lifestyle and other factors.The tables below show the top three common cancer sites by gender for select countries:2

Cancer incidence rates have been increasing in most Asian countries. This is mainly due to:

- Medical advancements that lead to quicker and more accurate detection of cancers

- The adoption of a Western diet and other related lifestyle changes

- Aging populations – lower rates of death and illness from other causes, leading to higher rates of age-related cancer

- Better access to medical treatment, leading to more diagnoses

- Improved cancer screening, with governments in some countries leading the charge in mandating or encouraging screening

Importantly, medical advancements sometimes appear to bump up the cancer incidence rate. In South Korea, for example, the number of thyroid cancer diagnoses increased sharply because of the introduction of ultrasound screening that was encouraged by the government. The tables above show that this has contributed to thyroid cancer being the most common site for females in South Korea.

The history of cancer products

In Asia, cancer insurance was first launched to the insurance market in Japan in the 1970s, before spreading to South Korea and Taiwan in the 1980s. At that time, the benefits were mostly offered as a death benefit, in the form of a rider to conventional life and medical products. In the 1990s, lump sum benefits paid upon a cancer diagnosis entered the market and gradually gained in popularity as customers also wanted coverage for the expensive treatment required for cancer.The rapidly developing cancer insurance market in the Asian region sometimes faced a number of different hurdles.

In the South Korean market in the early 2000s, insurers ceased writing new business on more than half of all cancer products. This was due to sustained increases in cancer incidence rates, the inherent inflexibility in pricing brought about by the regulatory environment, a preference for longer premium guarantee periods, and insufficient underwriting that was unable to prevent customers’ adverse behaviour.In spite of some setbacks, demand for cancer products has been increasing in Asia, driven by more consumer recognition of the risk of this costly disease. Many insurers have either remained in or returned to the market and developed new ranges of cancer products that are supported by enhanced underwriting and claim management procedures, modified product design and definitions, and new features to catch up to customers’ expanding needs.

Recent development in cancer products

There have been a few notable cancer products launched in Asian markets over the last five years. I have outlined some of these below.

Hong Kong

Reimbursement Rider: This is top-up coverage for existing critical illness/cancer products. It covers end-to-end cancer treatment, including cancer diagnosis/monitoring investigation; non-surgical treatment, including chemotherapy, radiotherapy, target therapy and hormonal therapy; extended benefits, including drugs and reconstructive surgery; medical consultation benefits, including pre- and post-treatment consultation and Chinese herbalist consultation; additional caring benefits, including psychological and dietician consultation; and home nursing and palliative care. It also has a multiple cancer coverage feature.Since its introduction in 2013, this rider has enjoyed success in the Hong Kong market. It is clean and easy to explain as a top-up product, and it fills the gap between the cost of treatment and insufficient benefit payment by a conventional critical illness product.

Singapore

360° Cancer Care: This provides cover for end-to-end cancer treatment in one product, even before an insured is diagnosed with cancer. The cover includes preventive care and medical assistance benefits. If the insured is diagnosed with cancer, the cover provides three layers of benefit instalment payments. The layers are relative to the sum insured, with 20% for diagnosis, 40% for treatment and 40% for surgical. The cover also has a cancer relapse benefit that provides an additional 20% of the sum insured payable on relapse of cancer within five years of first diagnosis. There are also a wide variety of ancillary benefits, including an aftercare benefit and a death benefit.

Unlike the product in Hong Kong, this offering has not been well accepted by the local market. The reason for this performance may be less about product design and more about Singapore’s well-organised public health care system, where customers may not need holistic coverage from private insurance.

South Korea

Silver Cancer: This product targets people between the ages of 61 and 80. The key differentiator is that applicants are not asked underwriting questions related to the risks of hypertension and diabetes, while the other underwriting criteria are similar to that for conventional cancer insurance. Therefore, more members of this older market are accepted as standard lives and can purchase the policy. Since the correlation between hypertension and/or diabetes and cancer is not significant, the premium is approximately 115% of the premium of conventional cancer products. The policy duration period is five or 10 years, and it can be renewed up to 100 years old.Launched in 2012, this product has become quite popular in the market due to how the unique type of relaxed underwriting has expanded the pool of potential customers who are eligible to purchase the cover.

Thailand

Cancer Protection – Simplified: This cover is sold as a rider packaged with regular life products. It aims to address the gap caused by the absence of public health insurance. The product helps the life insured to protect against the financial burden brought about by cancer. Customers in Thailand generally prefer simpler products, so the product design is simple; it provides a cancer diagnosis lump sum and daily hospital cash benefits, with amounts based on the severity of the cancer.This product has sold quite well, particularly to customers with higher incomes.

Can our market learn from the development of cancer products in Asia?

When it comes to the local market, would new types of cancer products be suitable and of potential interest to customers? Given the high rates of cancer incidence, the cost of treatment and the dominance of yearly-renewable-premium business, there seems to be some room for other cancer products in our market. Generally, the advantages of cancer-only products over traditional critical illness products are:

- Cancer products are more price-competitive but still cover a majority of critical events, bearing in mind that cancer accounts for more than half of all critical illness conditions.

- They are easier for customers to understand – no need to look at 50+ critical illness definitions.

- Various cancer ancillary benefits may be added to appeal to the customer. If insurers are considering developing such products locally, it would be of value to also learn from the past experiences of those in the North Asian markets. Some of those key learnings are summarised below.

- Cancer incidence can surge by external forces such as medical advancement and government policy changes, thus consideration of longer guarantee periods may be a risky bet.

- The products, particularly those that include treatment benefits, if this is allowable under local legislation, can be costly and total benefit amounts may need to be capped at certain levels.

- Rigorous underwriting and claim management are necessary to minimise adverse risk selection and behaviour.

There is a factor that might make selling cancer-only products more difficult in Australia and New Zealand: This is the risk that product comparison websites might rank cancer-only products poorly against products with a broader benefit offering without factoring in some of their advantages.Even so, the Asian market has demonstrated that there is a place for these cancer-only products in the insurance universe and that consumers will respond favourably. As long as insurers keep in mind some of the elements that can influence whether a product will be successful, such as underwriting or regulatory considerations, they can develop an offering that provides real value to insureds at what is undeniably one of the most difficult times in their lives.