Advances in machine learning (ML) algorithms such as deep neural networks have pushed artificial intelligence (AI) and its technologies to new frontiers, but AI’s current state is still a far cry from the “super-intelligence” depicted in science fiction.

Rather, it is a tool more frequently utilized to enable narrow-scope tasks such as face recognition, voice recognition and translation.

If a scope can be sufficiently defined and the AI properly integrated, better-than-human performance in certain domains can be achieved. Recent years have witnessed increasing use of AI in many industries; life insurance is no exception. AI has already been shown to improve the quality of digital products, strengthen operational efficiencies, and provide a better user experience. Personal electronic devices, for example, can respond to voice commands, security cameras can detect criminals, cars can drive themselves, and software can not only detect malware but can even write its own encryption language.

In life insurance, AI is not likely to replace humans. However, it is a new toolset that can help to make processes such as underwriting simpler and more enjoyable for both seller and buyer. AI-augmented underwriting, for example, an AI-driven process, speeds and simplifies application and onboarding processes. This article discusses the AI technologies that might be effectively leveraged in life insurance and demonstrate their potential to improve underwriting processes.

Today’s Challenges

Life underwriting is a complex and detailed process involving identity verification; collection, collation and verification of substantial amounts of information; and decision-making. It requires comprehensive knowledge not just of life and health insurance, but also of many aspects of clinical medicine and domain-specific areas such as prescription drug and motor vehicle experience.

Viewed from an information processing perspective, the challenges of underwriting come from the size and complexity of its data pools. Underwriters must work with massive amounts of unstructured data from sources as varied as PDFs, images and emails – data that is not always optimally organized for decision-making. An attending physician statement (APS), for example, may contain hundreds, or even thousands of pages of information an underwriter needs to review to find the relevant items necessary to make the right decision. Maybe information from two applicant profiles have been mixed, and the administrative team must identify the best way to separate out the information. Needs such as these require collaboration among multiple insurance company teams, including administration, IT, medical directors, and underwriters, to ensure successful operations.

Think Small

Building an effective end-to-end AI-based underwriting solution with today’s technology would be exceedingly difficult and not its most effective application. Instead, finding AI applications that would benefit specific areas of the process might be the more productive route. Underwriting’s thousands of small tasks and data points are still challenging from an AI perspective. For example, finding and then converting pertinent medical document data points to the right ICD codes still poses sizable challenges to ML algorithms.1

By thinking small, AI has found applications in several underwriting areas. Many US life insurers have launched accelerated underwriting programs (AUW) that can leverage ML to speed and simplify underwriting processes for straightforward applications.2 Early efforts to apply AI to underwriting workflows also appear promising.3 Several smaller tasks in the process can be easily improved by integrating AI technologies, such as optical character recognition (OCR) and natural language processing (NLP).

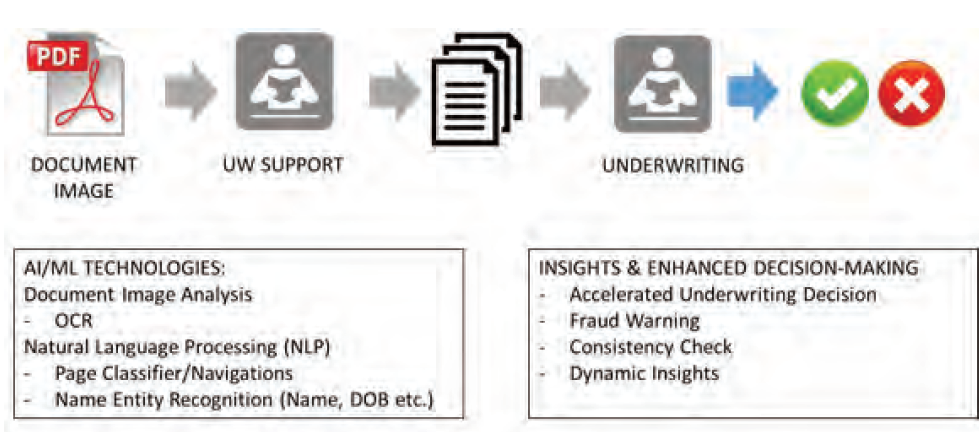

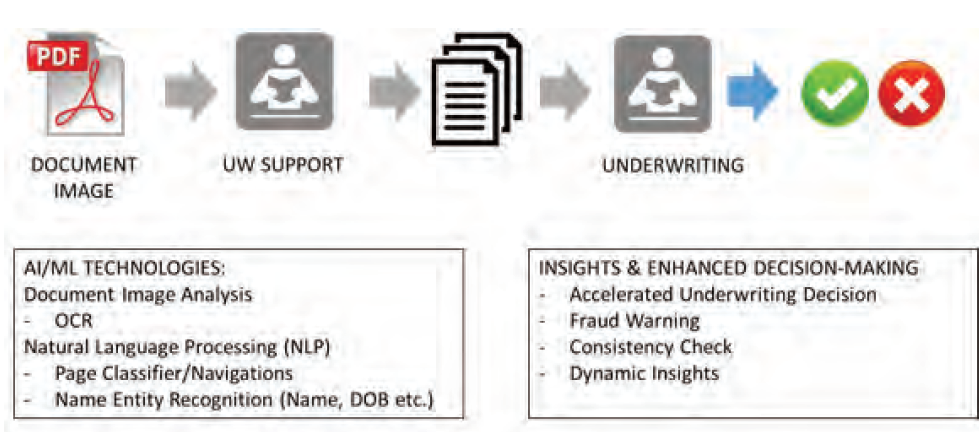

Figure 1. Underwriting Workflow Incorporating AI

OCR processes images into data. OCR is already in use – Google Translate uses it, and OCR also helps route mail at post offices and reads license plate numbers on cars to aid traffic movement and help law enforcement. Since significant amounts and types of life underwriting data are presented in image format, OCR can fit naturally into the processes by converting data images into searchable text, and enabling tools, such as keyword search, to retrieve information.

However, the current limitations of OCR technology need to be kept in mind. Problems including sloppy handwriting, for example, remain an unsolved image recognition problem. Although recent advances like integration of deep neural networks are improving matters, it is still not clear if deep learning-based recognition algorithms might lead to any meaningful improvement of the accuracy of character recognition when it comes to handwriting.

One of the main challenges with underwriting is its highly specialized language. Underwriting language contains words and phrases that are defined considerably differently when compared with standard English. The languages of underwriting and medicine are inherently difficult due to their subtleties and complexities. Interpreting the severity of medical conditions via language is even more difficult. However, determining if a page of content contains medical notes or diagnostic information is more straightforward.

NLP algorithms have a very high level of accuracy tagging pages that appear to contain medical information using classification techniques, which can help underwriters navigate quickly to pages with relevant information. One NLP algorithm, known as named entity recognition (NER), can identify names of individuals, organizations, locations and more in free text. The NER algorithm can be tailored to extract simple application information such as signature dates, names, face amounts, and other insurance-related information, and then have the information autofill an underwriter’s worksheet.

NLP algorithms can also find and extract medical information including visit dates, lab test metrics and prescription drugs. As an example, extracting doctor visit dates can help sort disorganized APS documents into chronological order, further improving an underwriter’s workflow efficiency. In addition, the ability to quickly identify alarming entities such as markedly elevated blood pressure numbers or cancer diagnoses can also speed an underwriter’s decision-making process.

Insights and Augmented Decision-Making

Information extracted from unstructured data sources can help underwriters gain additional insights. ML can serve as a powerful analytical tool, enabling underwriters to understand an applicant’s health dynamically, that is, its changes over time (e.g., doctor visit dates). Underwriters can also use ML to leverage information from several unstructured data sources in order to check application inconsistencies and spot potential fraud.

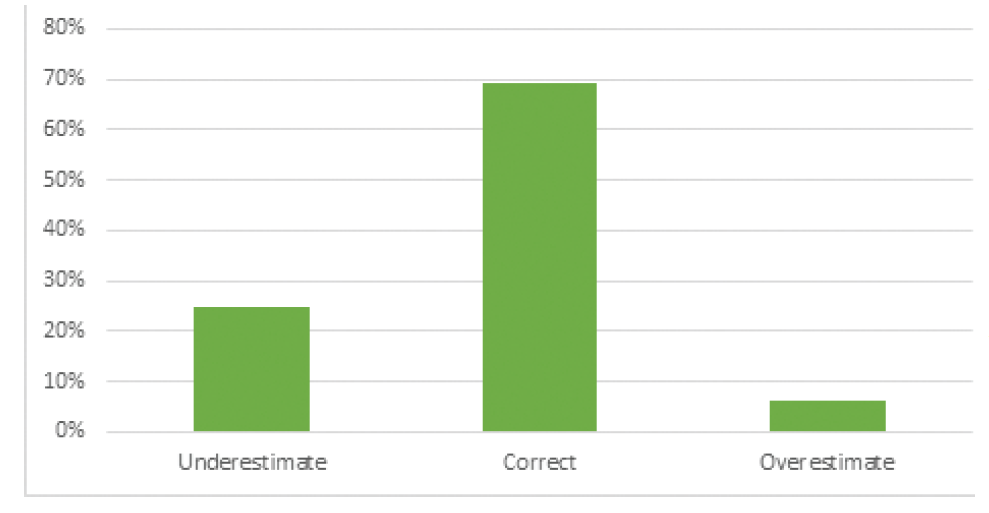

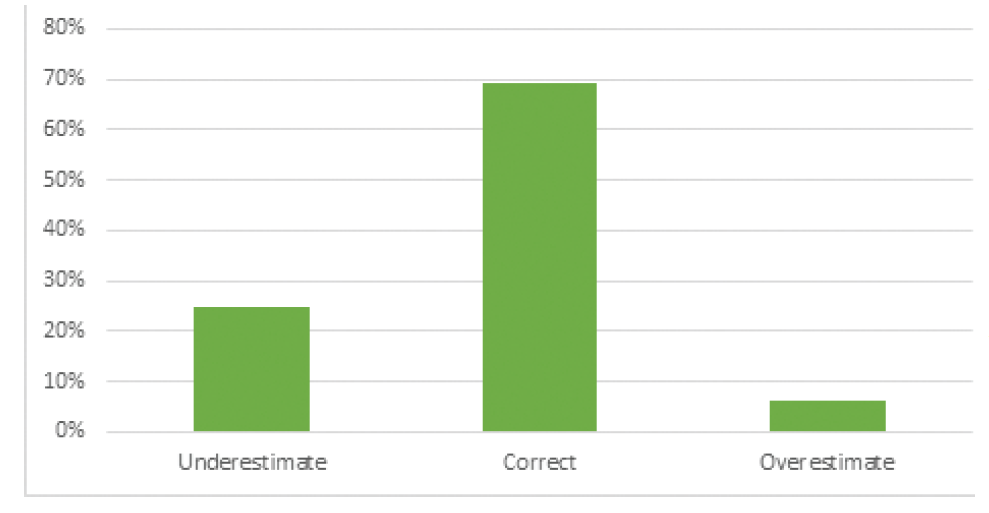

Figure 2 (below) shows one such application. It is a bar graph comparing self-reported and lab-measured body weights, pulled from unstructured images data, for 705 life insurance applicants in the US. Overall, 69% of the applicants reported their weight within 5 pounds (+/-) of the lab-measured value, 25% underestimated their weight, and 6% overestimated. This type of analysis does not necessarily imply the presence of fraud, but rather provides a consistent way of looking at biometric data. It also provides a quantitative measure for understanding the variations that can exist for applicant self-reported weights.

Figure 2. Comparison of Body Weights

Users and application developers still need to understand fully AI’s current limitations in order to avoid over-promising on deliverables. Depending on the use case, AI technology could be a must-have, a good-to-have or a do-not-have – of no real value at all. Right now, it might be more fruitful to look at using AI for small-scale process improvements that could bring substantial short- and long-term value. More importantly, insurers would do well right now to see AI technology as a tool that can support better customer experience and improve goodwill.

Summary

For life insurers, AI adoption is still at a very early stage. Insurance company interest in understanding the technologies, as well as discussions around how the technologies can be used, has been rising. AI’s growing capabilities, especially in document image and language processing, seem to promise positive developments ahead.