Key takeaways

- Alcohol and marijuana pose complicated implications – some similar, but mostly different – for life and AD&D claims.

- Marijuana laws and testing protocols are less established and more diverse than those for alcohol.

- The insurance industry faces multiple challenges for both substances surrounding policy language, claims practices, consumer comprehension, and more.

The effects of alcohol and marijuana may be well-known, but they present a less understood side effect for the insurance industry.

Although a claim involving one or both substances could seem straightforward, far too often carriers encounter complications during the process. The solution tends to veer from black-and-white into gray.

Case in point

Consider this true scenario. A policyholder drowned while kayaking in rough waters and was found three days later. The blood alcohol concentration (BAC) measured 0.12%, well above the national limit of 0.08%. Believing this contributed to the accident, the carrier denied the claim. Yet what seemed like a simple closed case morphed into one far more complex.

The beneficiary argued it was decomposition that led to the heightened BAC level. Indeed, photos of the death scene and the autopsy showed noticeable body decomposition. Research indicates high blood alcohol levels may develop during decay of organic material and that a level as high as 0.2% does not necessarily indicate alcohol was consumed before death.

Also, blood alcohol levels during an autopsy are valid for up to 48 hours, assuming proper protocols are observed. Because the insured was discovered after 72 hours and the decomposition process was under way, the BAC was found to be inconclusive and the denial was overturned on appeal.

Alcohol vs. marijuana

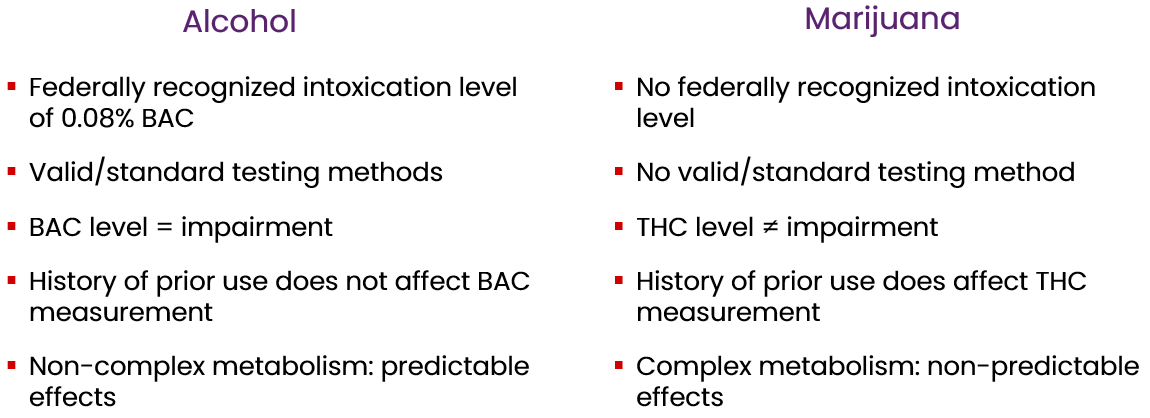

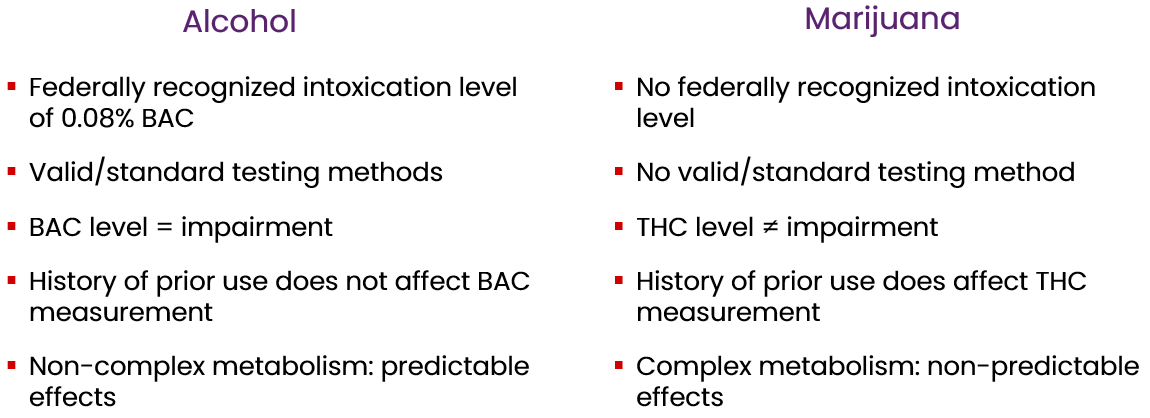

The impact of alcohol on life and AD&D claims is more defined than that of marijuana. Alcohol has been legal in the US since 1933 (post-prohibition), nearly as long as marijuana has been federally illegal (since 1937). This creates some stark differences between the two substances:

- Alcohol laws are consistent nationwide, as is a federally recognized intoxication level (0.08% BAC). The same does not hold true for marijuana. Regulations vary by state and there is no standard intoxication level.

- Alcohol has an established testing protocol to determine impairment – blood alcohol concentration; marijuana does not. The level of tetrahydrocannabinol (THC), the active ingredient in cannabis, does not necessarily equate to impairment.

- A history of alcohol use does not affect the current BAC; the opposite is true for marijuana, where prior use can affect current THC levels.

- Alcohol’s metabolic process is understood, and the effects are predictable. In contrast, the metabolism process for marijuana is more complex and its effects are unpredictable. For example, THC can be stored in body fat for up to 28 days.

Regulations for marijuana are still under development, and it could be years before there is national clarity matching what exists for alcohol.

Challenges with alcohol and marijuana claims

AD&D benefits tend to be approved when the loss is the direct and sole result of an accident with no contributing causes, such as alcohol or marijuana. Still, the industry faces a few obstacles that complicate the process.

Unclear policy language

Ambiguous policy language creates confusion for claim handling. The absence of clear language can lead to inconsistent decisions, and appeals can go in the claimant’s favor.

Inconsistent practices

Carriers across the industry have varying approaches to risk management. While some insurers strictly adhere to policy language, others may demonstrate flexibility. Even the amount of personnel used for claims differs by carrier.

Lack of direction

The claim evaluation process can be riddled with ambiguity, making the decision less straightforward. Vague policy language can contribute to uncertain claim direction.

Lack of understanding

Most policyholders and beneficiaries lack a true comprehension of policy provisions and claim processes, especially where exclusions apply.

Different state, different law

Unlike alcohol, no federal standards for marijuana exist. Depending on the state, cannabis can be illegal, legal for medical use, or legal recreationally.

Documentation is key

Obtaining the proper documentation is critical for reaching an accurate decision. Examples of records to consider include:

- Policy language

- Death certificate

- Coroner or medical examiner report

- Toxicology report

- Police report

The latter three can help determine policy exclusions for factors such as being under the influence.