The treatment of taxes, either through Deferred Tax Liabilities (DTL) or Deferred Tax Assets (DTA), has significant impact under Solvency II.

The consideration of taxes in the context of Loss Absorbing Capacity of Deferred taxes (LAC DT) can reduce the SII capital requirements substantially. Under certain circumstances effective use of reinsurance offers some advantages, and this article explains how this can work.

DTA / DTA and LAC DT under Solvency II

Solvency II is a post-tax framework that is very different from the valuation principles for local tax calculations, which differ for each European country. With the SII rules on the one hand, and the local tax rules on the other hand, temporary differences between the profits originating from the SII balance sheet and under the tax regime are expected. Over the full life-time of the policies, though, overall (tax) results would be the same.

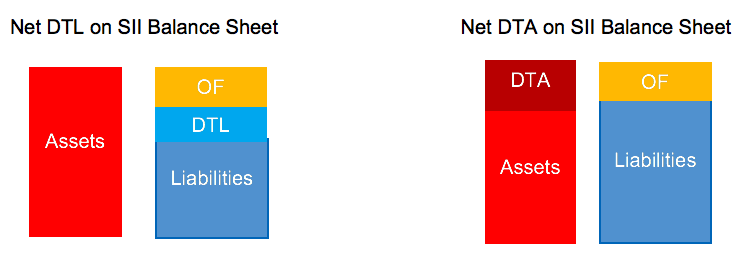

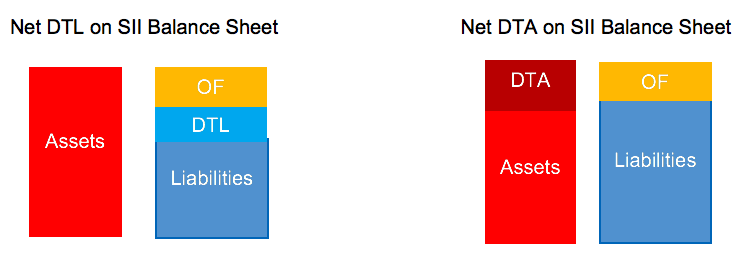

Temporary differences between SII and the local tax valuation lead either to Deferred Tax Liabilities (DTL) or to Deferred Tax Assets (DTA).1 DTAs and DTLs are netted together on the SII B/S, so that companies have either a net DTA or a net DTL on their SII B/S.

SII requires a demonstration of DTA and DTL utilisation. The requirements are very different if any DTL or any DTA will be used. DTL are liabilities (to pay future taxes) which can be fully recognised as liabilities on the SII B/S and don’t require any further obligation to prove.

DTA are recognised as assets if carry-back and carry-forward possibilities under the tax rules allow offsetting against existing DTL or, in case of net DTA, if sufficient future taxable profits are available for its utilisation. The requirement to demonstrate that there are sufficient future profits available results in complex projections and calculations which are based on a high level of subjectivity. Due to the large potential impact of any DTA / DTL on the solvency ratio, EIOPA aims for increased harmonization and common guidelines for the projection of future profits.2

Net DTA on the Solvency II balance sheet count as tier 3 eligible Own Funds, which can be recognized to cover the SCR up to 15%.

Taxes under SII can have a significantly positive impact on the SII balance sheet:

- Recognition of the DTA on the SII B/S, resulting in an increase of Own Funds

- Reflecting the LAC DT in the final calculation of the SCR, resulting in a decrease of SCR

LAC DT (Loss Absorbing Capacity of Deferred Taxes):

Within SII the impact of LAC DT is reflected in the SCR calculation. LAC DT is the mechanism which enables companies to transfer a portion of the losses in the shock scenarios to their tax authorities, which reduces the loss of Own Funds compared to the original loss of the shock. Conceptually, the loss under SII in any shock scenario results in loss of taxable income which results in tax reductions, if taxable profits are available to offset these tax losses.

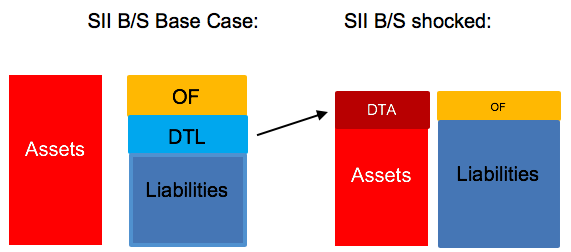

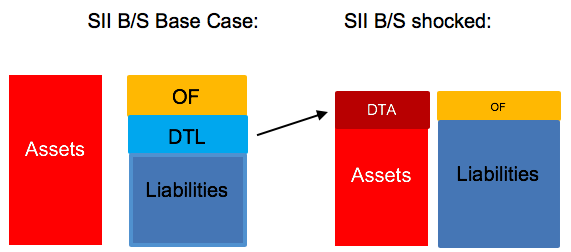

LAC DT corresponds to the change in taxes after the shock loss either resulting from a decrease in net DTL, or an increase in net DTA. If a company has a net DTL on their (base case) on a shocked SII B/S, this net DTL will either change in a smaller net DTL or, if the LAC DT corresponds to the change in taxes after the shock loss either resulting from a decrease in net DTL, or an increase in net DTA. If a company has a net DTL on their (base case) on a shocked SII B/S, this net DTL will either change in a smaller net DTL or, if the change in DTL exceeds the net DTL in the base case, it might transform in a net DTA. The latter is shown in the picture:

A decrease in net DTL is directly reflected on the SII B/S through decreased liabilities, whereas an increase in net DTA is also shown on the B/S, but requires demonstrating that this can be utilized by means of sufficient future profits.3 The impact of LAC DT with respect to a reduction of BSCR (which is the SCR after consideration of operational risk and the impact through LAC Technical Provisions), is significant: the BSCR can be reduced by more than 20% as observed in some countries (see picture in section 2).

LAC DT in different European countries

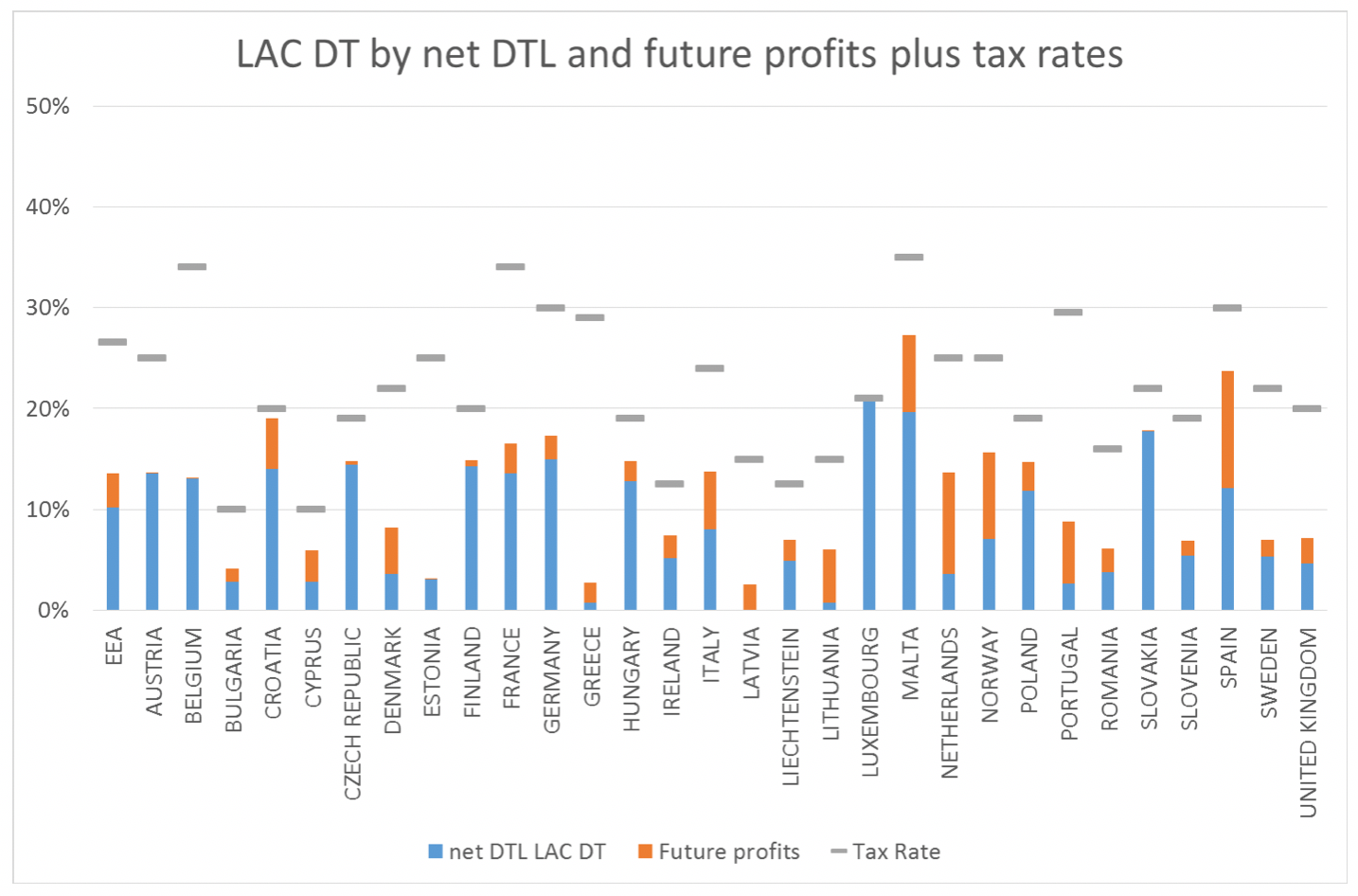

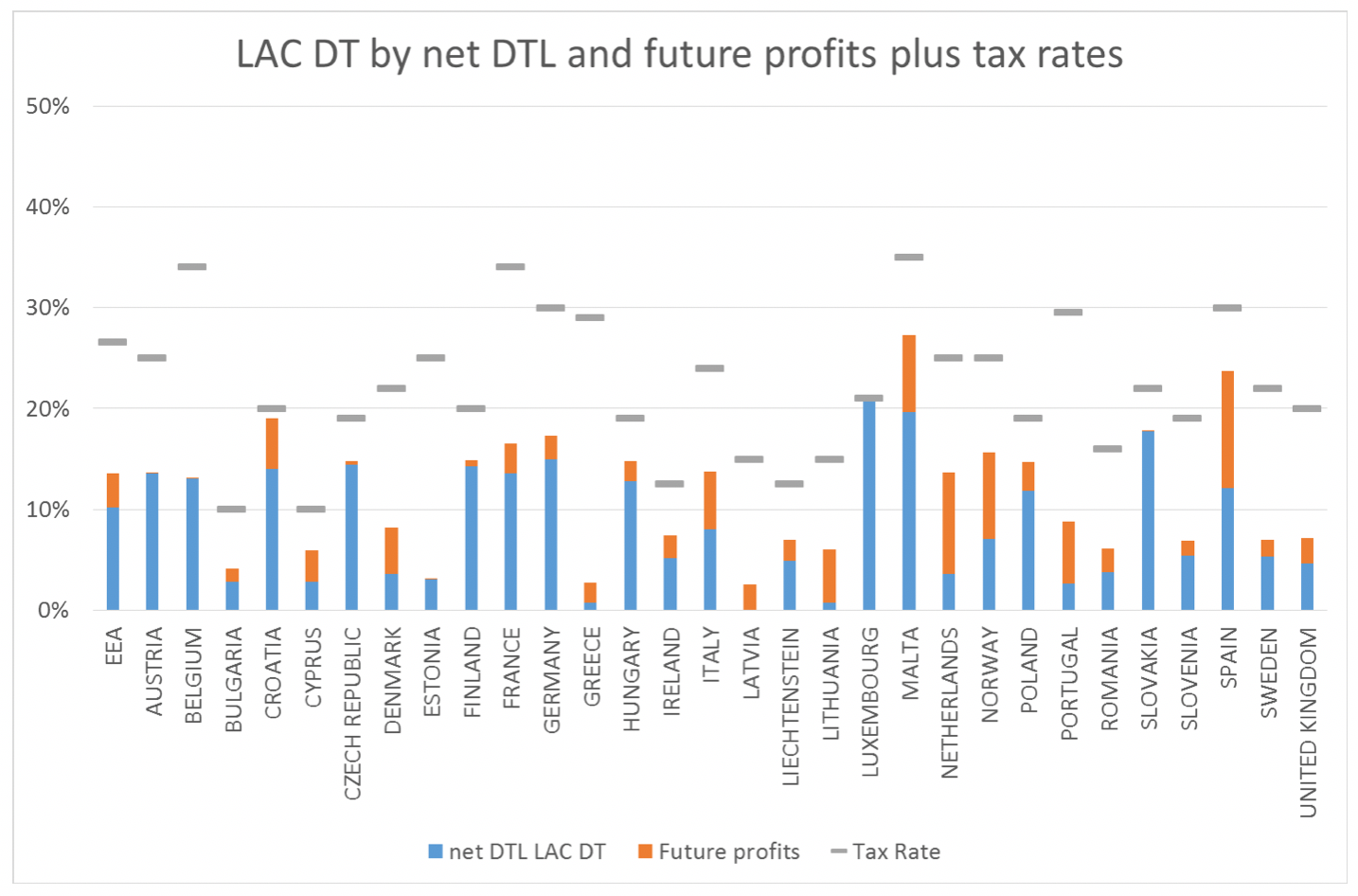

In the EEA 75% of the overall LAC DT is being demonstrated by a net DTL (i.e. reduction in DTL) on the SII B/S.

The following picture shows the composition of the LAC DT according to whether the LAC DT effect comes through a change that ends with a net DTL (blue), or net DTA which can be recognized through future profits (orange), per country. In addition the y-axis shows those effects expressed as a percentage of the BSCR impact per country.

Source: p.105 from EIOPA’s first set of advice to the EC on specific items in the SII Delegated Regulation (“EIOPA-CP-17-004”)

National regulators have different approaches for recognising LAC DT through a DTA which needs to be demonstrated through future taxable profits. There’s a wide range of judgment involved. In spite of the country-specific differences which are due to the different tax regimes, EIOPA intends to achieve convergence in the projection of post stress taxable profits to demonstrate the utilisation of increases in deferred tax assets. EIOPA published a range of key principles to achieve supervisory convergence in the second set of advice to the EC on specific items in the SII Delegated Regulation from 28 February 2018.

Reinsurance in the context of taxes under Solvency II

We have identified two areas in the context of tax treatment under Solvency II where reinsurance could be beneficial:

- In the context of LAC DT, if the company has a net DTA on their shocked SII B/S, reinsurance could support clients in demonstrating that sufficient future profits are available to use the net DTA.

- Companies who have a DTA on the SII B/S, which exceeds 15% of SCR, cannot recognize the amount of the DTA exceeding 15% due to the restriction in SII with respect to eligibility of Own Funds. Reinsurance could help to transform any exceeding amount into Tier 1 capital.

Reinsurance to support the demonstration of sufficient future profits:

In the 2nd set of advice to the EC on specific items, EIOPA doesn’t explicitly require the compliance with the SCR after the shock. However, there is the implicit assumption that companies can only generate future profits if they comply with the SCR in a post-shock situation, so this can be considered as implicit requirement.

Any reinsurance which improves the solvency ratio as a de-risking measure sufficiently in a post-shock situation contributes to a company’s immediate capitalization after a shock has occurred. Adequate contingent reinsurance, which would be triggered by such a shock scenario and which reduces the post-shock SCR adequately, contributes to the recapitalisation of the company and to its compliance with the SCR. To improve the company’s post-shock SCR more efficiently, contingent SII-efficient solutions could be considered. As an alternative to any contingent reinsurance, any option for reinsurance at pre-defined conditions could achieve the same benefits, but leaves clients more flexibility.

Reinsurance or derivative solutions which transfer DTA into T1 or T2 capital

Any DTA on the SII B/S is categorised as T3 capital, that’s why the amount of DTA is limited by 15% of the SCR. Reinsurance Receivables are considered as T1 capital under SII. A suitable reinsurance solution could transform parts of the DTA exceeding 15% of Own Funds into a Reinsurance Receivable and significantly improve the insurer’s capital position. In such a structure the reinsurer would guarantee (e.g. through a reinsurance commission) that the insurer has sufficient profitable future business beyond the 15% threshold. Adequate Reinsurance could transform the value of future business into Tier 1 capital.

We appreciate any opportunity to discuss the solutions outlined above with you in more detail.