According to a recent survey and report by Novarica, 85% of life insurers now have paperless underwriting processes, 77% of them use automated data requests (to third party databases) for underwriting requirements, and 77% rely in part upon automated underwriting for decision-making.1

However, the statistics do not account for those organizations that have not yet started using automated underwriting, or those that have started dabbling in automated underwriting but have not yet realized its full potential.

The motivations that drive insurers toward automation vary greatly. Some companies are looking for expense reduction. Others want to improve efficiency. Still others are looking to improve their client service through a better overall customer experience. In this paper, Paul Okeefe outlines the key factors that insurers should consider, and the questions they must answer, when making automated underwriting a part of their strategic plan.

Introduction

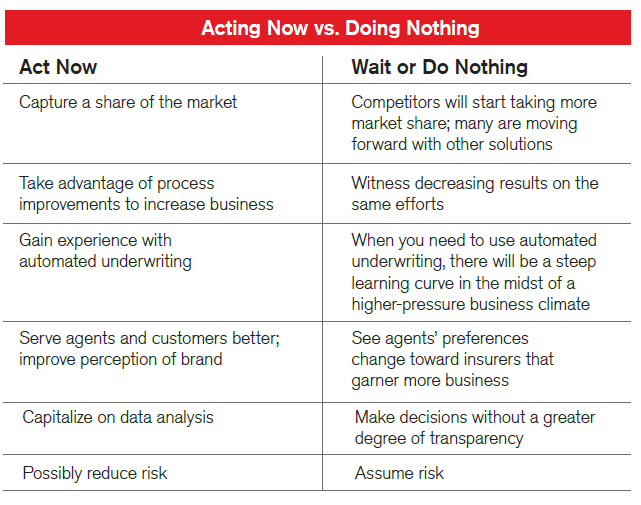

The last decade has revolutionized life underwriting. The industry has had to adapt to a host of global challenges, including a series of economic downturns, new regulations in nearly every quarter of the globe, keeping up with consumer demand and expectations, and the expense of opening new channels and pursuing new technologies. When big data interest, policy administration system overhauls and IT resource shortages are added to the list of insurance company concerns, it seems like automated underwriting would have a difficult time making headway as a business priority.

However, in the last three years, e-underwriting, or automated underwriting (for our purposes, used interchangeably), has experienced a surge of interest, partially due to the maturation of technologies that make it more attractive to companies that want to make e-underwriting a strategic initiative. It now fits well into organizational plans. This rise in interest can also be attributed to the reinsurers and technology providers that have developed a financial model for implementation that gives e-underwriting a small IT footprint and a low price point.

Before getting involved in any underwriting automation plan, it is constructive to review

e-underwriting considerations and ask some important questions that focus on an

organization’s unique set of circumstances. The key questions that should be asked and answered regarding a company’s need and general readiness for e-underwriting include:

- Will it support our business?

- Is it a viable option at this point in time?

- What are our pressing needs (e.g., resource relief, sustainable growth)?

- If growth is a consideration, in which markets do we wish to grow?

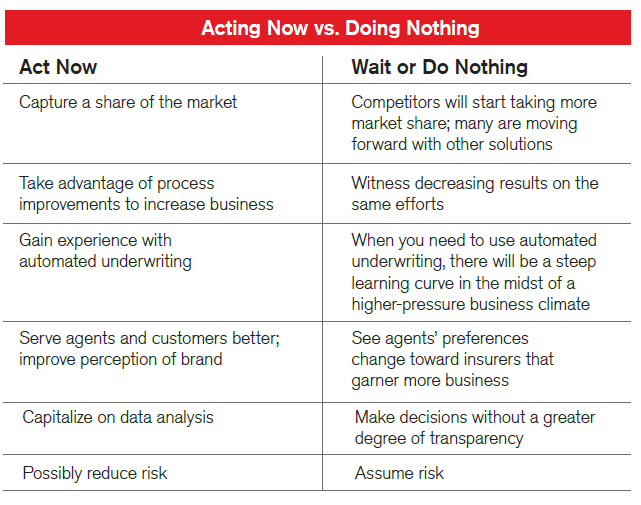

- What happens if we do not move toward automation?

- What kind of process or system makes sense?

- How would it fit into our overall future plans?

- Do we have the right resources to support this effort?

- How do we get started?

Organizations should also weigh what general benefits they are seeking from automated underwriting. These include:

- Increased sales

- Flexibility

- Better use of traditional underwriting resources

- Significant returns on investment

- Marketing support

- Business strategy support

- Scalability

- Improved risk management

- Increased decision consistency

See also: Future-Proof Underwriting: A Revolution in the Rules Engine

Assessing Drivers

Under what circumstances should an organization consider automated underwriting?

I. Using e-Underwriting to Drive Growth (in New or Old Markets)

All insurers want to remain competitive and grow sales. To grow sales, a business must either tap into existing clients by upselling or create new opportunities for policyholders from an untapped market. Automated underwriting enables growth in both of those markets. When it comes to underwriting new and existing applicants, the closer underwriting gets to the front end of the sales process, the greater the ability of the insurer to capture the sale. It will help to briefly explore why this is the case.

An Agent’s View

There was a time when most agents were not in favor of automated underwriting because it removed some of their control over the process. Most of today’s agents now realize that placement rates increase when the client and the broker have an instant or near-instant decision. In the past, the agent often sent a client home with only a quote and promise to proceed. With the integration of electronic applications and e-underwriting into the sales process, many agents now have the power to quote, submit, receive a decision and issue the policy. They waste far less time and receive fewer not-takens. Healthy distribution always favors insurers that make it easy to sell. It is so easy now that, in many cases, agents and brokers are now participating less in a “process” and more in a transaction.

Automated underwriting in the agent’s office can yield additional sales from current clientele, and it can also add new business for agents who are actively pursuing new clients. For one U.S. property and casualty insurer, agent satisfaction alone was sufficient reason to add automated life underwriting to its mix. The organization simply wanted to give the agents something additional to sell in their yearly appointments with existing clients. Acquiring a cloudbased e-underwriting service allowed this insurer to be up and running with a new life product in a matter of months.

A Direct Carrier’s View

Outside the agent’s office, there are 2.7 billion people online globally, with an additional 6 billion cell phones in use, 2 billion of which have mobile broadband.2 Some of these people are looking for life coverage but do not have an agent. Advertising-savvy insurers are using e-underwriting tools to deliver on promises of “policies in minutes.” They, too, are utilizing a process turned into a transaction by bringing underwriting as close as possible to the point of sale.

Incorporating e-Underwriting in Growth Strategies

Automated underwriting does not accomplish market growth on its own. Its value is limited to how well it is incorporated into comprehensive strategies for creating new products and reaching new markets. While it can be effective in improving the sales processes for existing products, it is most effective when it is tied to a completely new product. An insurer’s strategy will determine how automated underwriting can be used to its best competitive advantage, such as translating underwriting cost savings into lower premiums.

Many organizations are learning that automated underwriting can be a new market perpetuator. One of e-underwriting’s best features is its ability to track decisions, evidence data and outcomes. The management information (MI) that can be gleaned from ongoing data analysis can yield a wealth of pre-sales knowledge. This knowledge can be used to increase automation, improve decisions, change pricing, launch new products and more. The data can also be used to build propensity-to-buy or propensity to-claim models to target future growth and limit future risk.

II. Dealing with Resource Demands

In 2009, a Society of Actuaries survey indicated that the leading reasons insurers were not adopting automated underwriting were: 1) The perceived cost and time of implementation were too high, and 2) IT resources were already strained, and the perception was that automated underwriting would put them under the continual new strain of underwriting system maintenance. In a quote from the survey’s report:

“Rather than a lack in confidence in their [insurers’] ability to deliver improvements in underwriting efficiency, logistical issues appear to be the larger impediment to overcome.” 3

Since that report was issued, two major shifts have occurred to address those common perceptions. The first is that some options for underwriting automation have grown much simpler and dramatically less expensive. The second is that it has been demonstrated that adopting automated underwriting can actually reduce the burden placed on IT and underwriting resources in many cases.

Better Use of Underwriting Resources

Optimizing processes and using existing technologies to reduce resource burdens are always smart practices. Implementing e-underwriting may require cultural and process shifts, but these shifts can reap rewards in flexibility and process optimization. An organization wishing to launch a high-volume product without increasing its underwriting staff will find e-underwriting is a necessity because it is a resource saver.

It is important to note here that e-underwriting is nearly always viewed as a supplemental resource, not a replacement. Organizations most commonly position e-underwriting in the following ways:

- Automated underwriting is not designed to replace underwriters. Rather, it seeks to gain efficiencies by allowing straight-through processing for those cases that do not require underwriting intervention.

- Even in cases where underwriters still need to touch an application, automated underwriting can alert underwriters to risk factors, making case review more efficient.

- Underwriting rules contain an organization’s underwriting philosophy and ensure that they are applied consistently across multiple product lines, distribution lines and locations.

III. Delivering Better Customer Service

Customer-centric service has become a vital measure of business health. The proliferation of online insurance options and the ease of finding them make customer service that much more vital. Consumers are time-strapped and impatient. When they compare service times, they are not just comparing insurers to insurers; they are judging service against all of their purchasing experiences. Younger consumers especially have been raised in a culture where products and services can be researched, found, purchased and downloaded in a matter of minutes.

Where does this leave the insurer that needs more time for analysis and decision-making? Once again, the answer lies in automated decisions. Whether it is used to provide “instant” opportunities at the point of sale or to drastically shorten underwriting time for fully underwritten products, e-underwriting helps insurers meet consumer expectations and raise the bar on good service.

As mentioned earlier, improving client service also has the residual effect of improving agent relations. If an agent can pitch, underwrite and close at the point of sale, he or she will certainly be pleased with that insurer’s offering.

IV. The Payback Potential

The business case for automated underwriting varies from insurer to insurer. A recent Celent study found that a full implementation would start “paying back” in four to five years.4 In some cases, e-underwriting benefits can be derived in a pay-as-you-go arrangement that begins to pay an insurer back immediately. A Society of Actuaries survey from 2010 finds that insurers save between 20% and 80% off of their previous underwriting process with automated underwriting. The same study found that 83% of insurers participating in non-medical underwriting are satisfied with the cost savings that automated underwriting brings to the organization.5

The payback begins with lower underwriting costs per application. Automated underwriting allows insurers to gather more disclosure information and make better decisions. Most insurers find that they are able to increase application volumes with new products without hiring additional underwriters, which leads to a lower per-app cost.

E-underwriting also pays back insurers through distribution channel shifts. An application that comes through a Web portal costs less to underwrite than one that requires a tele-interview, which costs less than a full in-person medical review with an exam. Automated underwriting can help an insurer save money through direct channels and by automating processes for other channels.

It is important to acknowledge, moreover, that e-underwriting’s payback is especially significant when viewing the long-term benefits. Its greatest underappreciated asset is that it has the potential to reduce risk and lower long-term financial burdens. Automated underwriting, when implemented properly, brings consistency to the underwriting process.

Organizations considering e-underwriting should invite their finance, marketing, actuarial, and underwriting departments to participate in a forecasting exercise to predict the payback potential, taking all efficiencies and conservative sales goals into account. Building this business case not only allows e-underwriting champions to articulate its possibilities, it also gives everyone a preview – a clearer vision of a transformed process.

Choosing a Process or System That Makes Sense

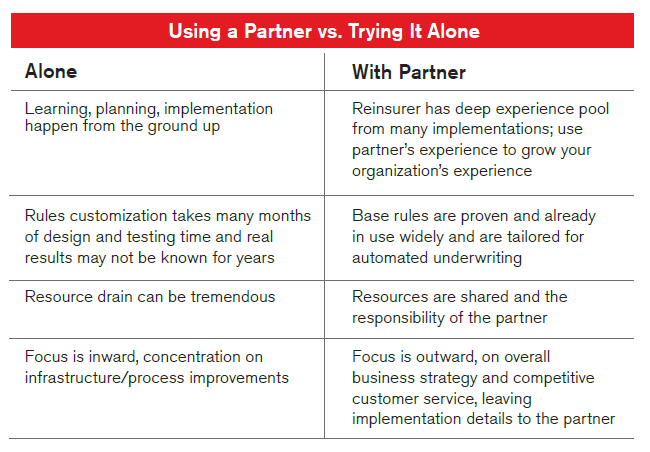

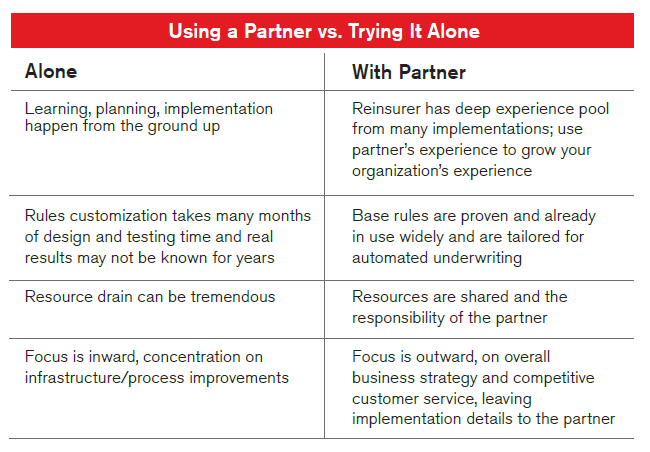

There are many factors to weigh when choosing an automated underwriting system or process, but two that stand out are: knowledge capital and integration/implementation options. Related to both of these considerations is the partner (or partners) an insurer chooses to assist with the process.

V. Leveraging Knowledge Capital

Every insurer houses vast amounts of information – mortality statistics, actuarial formulas, underwriting rules, and their own philosophies that are part of their corporate knowledge base. However, that knowledge is only a slice of the industry experience pie. So, insurers supplement their knowledge by tapping into information databases that help them apply relevant data through the filter of that knowledge.

Another source of consolidated industry knowledge is reinsurers. With their access to data from multiple sources, reinsurers have the experience that encompasses carriers, geographies and products. A good relationship with a reinsurer, such as RGA, can be the gateway to a wealth of support and advice, as well as a pipeline to underwriting philosophies and rules that have proven their value.

Automated underwriting is just as much (if not more) reliant on proven knowledge capital than on technology. Underwriting is not simple. It is highly complex. Implementing good technology, as important as that may be, is useless without underwriting knowledge.

Insurers can deal with their underwriting technology in a number of ways. They may implement an underwriting system that simply routes images but offers no automated underwriting. Then they can take months or even years to translate their underwriting philosophies into a rules engine to automate the process. Others can tap into a reinsurer’s underwriting decisionmaking and routing capabilities to help them bridge the gap between their technology and their knowledge base, driving down the cost and the time of implementation. Still others create products that can be completely underwritten within a reinsurer’s platform, reducing the need for some of their own technology, or bridging the gap between the technology they are currently using and the technology that they hope to use in the future.

In all of these cases, it is wise to first find the best knowledge partner. Finding a trusted reinsurer that is a good fit with the insurer’s underwriting philosophy can bring more to the table than just good decisions. If the reinsurer understands the insurance company’s goals, it is also more likely to be able to help the company tailor its efforts to reduce risk through rules refinement as well as additional reinsurance support.

Yet another advantage to partnering for experience is the “rub off” effect. As an organization taps into knowledge capital, it gains experience it will never lose. This is never more true than with automated underwriting experience, and it leads us to the next consideration – how to introduce it effectively.

VI. Integration Options

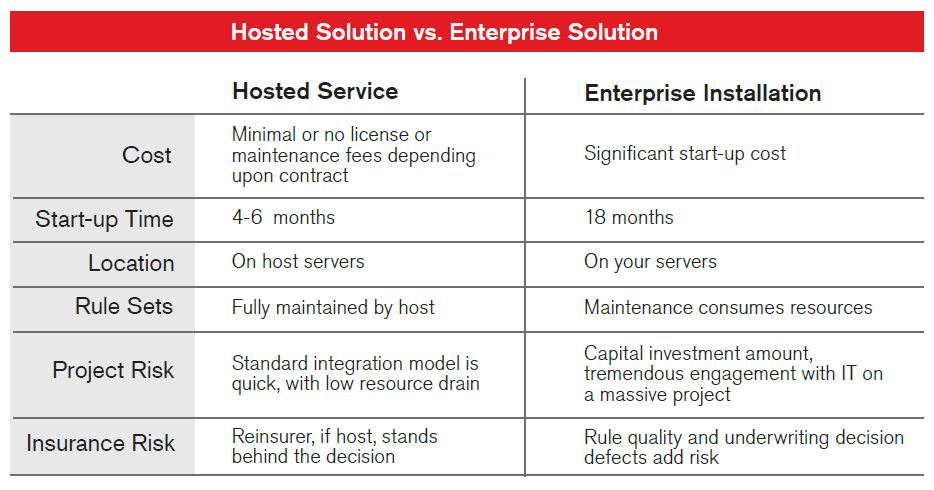

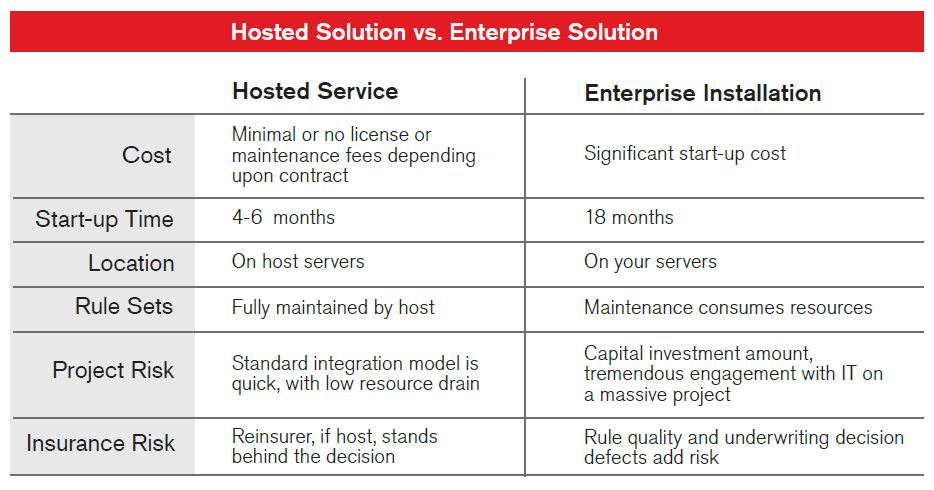

It used to be that adding automated underwriting to the underwriting toolkit meant a full implementation and constant maintenance. Today, many options have minimal impact on IT resources. (See the Hosted Solution vs. Enterprise Solution chart below.) Because business rules are designed for adaptation by underwriters or a rules team, IT may not be needed for those tasks. With cloud-based service options, IT involvement may also be unnecessary for underwriting software updates and traditional maintenance. In many cases IT’s function can be limited to identifying and connecting data integration points into an organization’s current environment.

With many insurers in the process of replacing policy administration systems, today’s underwriting options are flexible enough to be used before, during and after the installation. Companies that are bringing a new underwriting workbench in with their policy admin system can also take advantage of these integration points by simply “plugging” the expertise into the new operation. The admin system still provides the workflow, but the e-underwriting component provides the rules that gather the evidence and make the decisions and recommendations.

Prioritize Knowledge Capital by Focusing on the Underwriting Rules

Because many automated underwriting systems do the same thing, the differentiator in decision quality becomes the rules. Insurers should focus on the rules and the knowledge base that drives the rules. Making rules the center of attention allows insurers to make a clearer decision regarding how those rules are used and presented. Can the current system merely tap into the rules? Is a new system required to make the best use of the rules? Over time, technologies change, user interfaces improve, an insurer’s own systems will be swapped in and out. Concentrating on using the best rules helps a company grow and maintain the quality of its underwriting regardless of any future integration plans.

Committing to a defined rules strategy brings additional clarity to the integration options conversation. Many organizations get caught up in the questions, “How long will this take, and how expensive will it be?” An organization can move forward with a different strategy that might look something like this:

- We have identified rules we wish to use.

- We have identified a short-term process that will support our business and marketing

goals while using the rules quickly and at very low cost. - We have a mid-range plan for incorporating those rules more fully into our process.

- As our system changes in the next few years, we can simply move our use of the rules and our process into our new system.

Are There Best First Steps?

Beyond inviting all interested parties to the table and developing a business case, one of the best first steps is to involve a partner or partners. These partners should be thought leaders and practice leaders in the industry. Involving a partner should not wait until after the business case. It is best to involve the partner early. RGA, for example, has a fairly long list of partnering projects that progressed easier, were implemented faster, and provided more value simply because some creative ideas were born out of early collaborative conversations.

VII. Adopting a Graduated Approach to Use

As useful as it is, automated underwriting is a cold pool to dive into. Jumping “all in” can shock a company in ways that can prove to be disillusioning and damaging in the short term. A gradual process of full adoption across all products allows the organization to learn and grow, gain perspective and translate e-underwriting’s capabilities into real, long-term successes. Here again, an expert partner can make the cycle of learning really pay off. A reinsurer with experience in bringing automation to insurers can act as a mentor, providing guidance that can help an insurer anticipate and surmount hurdles. Focusing on a product where the client will derive the biggest benefit in automation is a good place to start. Simpler products such as life or critical illness are ideal candidates for many insurers because these products offer the highest level of straight-through processing gains. During the initial rules development process, an insurer can focus on learning how to develop e-underwriting rules and growing its internal expertise, which it can later leverage to build more complex rules for other products. This approach also allows an insurer to concentrate on understanding the relationship between the rules and outcomes so it is better positioned to develop robust rules for other products.

At some point, organizations become comfortable enough to roll out automated decisions for additional products. They become experts in their markets and understand how to use automated underwriting to its full potential. By this time, organizations may also have become more experienced with their newfound source of data, and be adept at transferring management information into additional knowledge capital. The business will also have started to accurately predict operational assumptions and be in a better position to allocate ongoing resources.

This gradual strategy may seem to go against the message that hosted automated underwriting can have an organization up and running in a few short months. The two concepts are not incompatible, however. An organization can begin quickly using Software as a Service models, but it is recommended that an insurer test one or two products first.

VIII. Concluding Considerations

Future-Proofing

There is a reason for organizations to get involved in e-underwriting now. What is coming in the future of underwriting is so revolutionary that it will force many insurers into adoption and possibly transform their marketing and business strategies in ways they never imagined. If a complete automated underwriting conversion is in the works, one that looks much more like the world of pre-underwritten credit card offers, then insurers should be doing all they can to bring agility into their organizational toolkit. To capitalize on boom opportunities for growth, the industry will need to reinvent the process and have automated decision-making capabilities at its core. The upside should be a near-constant ability to lower risk that will help to offset the inability to count on the revenue generated by investments. In other words, the future holds the possibility of real, substantial numbers of good applicants contributing to top-line growth.

The Value of Insurers

Sometimes the worst happens. It may involve one life or many lives. Insurers protect loved ones from some of the effects of an important family member’s loss, and automated underwriting makes it possible for them to bring this valuable protection to a larger percentage of the population.

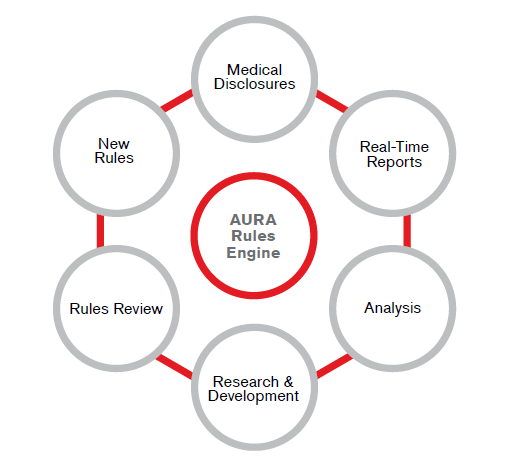

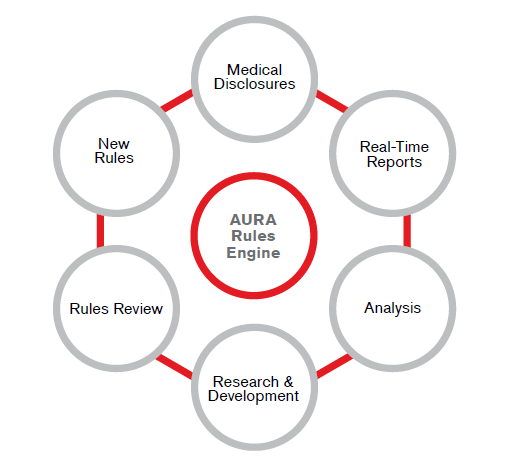

Askaura@rgare.com to learn more about AURA (Automated Underwriting and Risk Analysis) and automated underwriting.