Go with your gut. Trust your instincts. Follow your intuition.

How often have we heard this advice from experienced businesspeople?

The urge to make snap judgments is understandable. In a highly competitive, fast-paced industry, it’s satisfying to swiftly hone in on a specific conclusion to a problem.

It’s harder to engage in critical thinking, or the conscious, deliberate and often time-consuming process of analyzing and synthesizing facts, testing assumptions, consulting with colleagues, and considering all of the possibilities.

And yet, the use of critical thinking may be the most essential, if underappreciated, facet of any underwriting process. The ability to objectively examine facts is just as valuable as an APS (Attending Physician Statement) in making sound underwriting decisions. Conversely, unconscious bias from intuition can lead to poor life underwriting decisions and expose insurers to greater long-term risk.

It might be best to describe critical thinking as a methodology, not a skill. It’s a set of mental techniques that anyone can apply. And while critical thinking cannot guarantee a best, or even a good outcome, it can enhance your decision-making process in underwriting and in life. Good critical thinking requires almost constant practice, but several basic principles can be applied:

Start an argument, without picking a fight.

It is only human to wish to validate our prior knowledge, to vindicate our prior decisions, or to sustain our earlier beliefs; the best arguments do the opposite. To make the case for a particular conclusion on a case, begin with a hypothesis or proposed solution to a problem, and support this proposition with proof, or supporting evidence. The strength of your argument relies on the power of this proof to convince an audience, recognizing that no proof is equivalent to the absolute truth; we are not talking about a scientific"proof".

This practice is effective because it looks forward, rather than backward into the past. The individual must follow where the facts lead and select the hypothesis with the best proof points, rather than suppressing evidence that does not confirm a preexisting position.

See also: There Is No Partial Credit In Real Life

Build a logical structure.

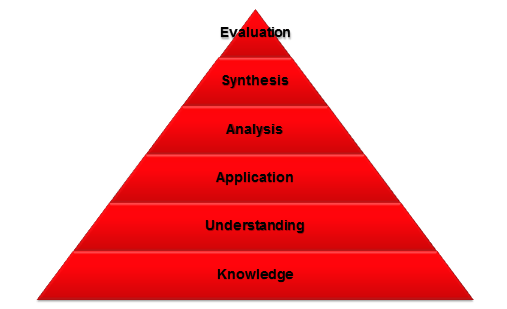

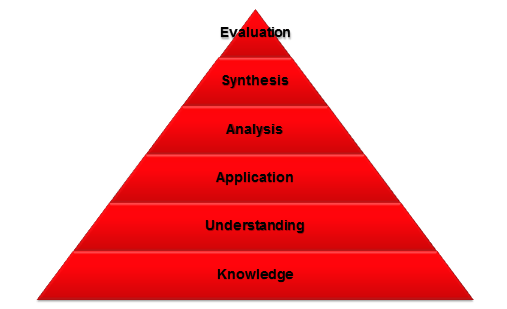

The human brain may be wired to make snap judgments, but the best critical thinkers use higher-order approaches based on a pyramid called the elements of thought, or Bloom’s Taxonomy1. At its base is knowledge, or the accumulation of available facts. From there comes:

- true comprehension of these facts,

- application of this evidence to the problem at hand,

- structured analysis of possible solutions to the problem,

- evaluation of the positives and negatives of these solutions, and

- at the very tip of the pyramid, the creation of the best solution.

Why is this structure important? Great underwriting is a creative – not a rote – process. It takes effort to overcome obstacles such as unconscious bias, time pressure, miscommunication, asymmetric (unbalanced) information between the applicant and insurer, and “groupthink” when a desire for conformity overwhelms good judgment. All of these challenges are common in underwriting, and all can undermine quality.

Don't take anything at face value.

Life underwriting requires context. Successful underwriting requires more than applying standards or even recognizing exceptions, because an underwriter almost never has all the information. After all, specialties are varied, both medical and non-medical factors can factor into a decision. For example, the purpose of the life insurance sale may be relevant to anti-selection and fraud risk assessment. It’s essential to gather all the available data, fully comprehend the connections between disparate pieces of information, and separate the signal from the noise. Every case should be evaluated from multiple points of view to arrive at a competitive risk assessment.

Ask for an outside opinion.

No underwriter knows it all, but experience and case count matter. So, when in doubt, seek a mentor who can question your biases and arguments. It’s also important to recognize team dynamics, which may distort conclusions. Lack of knowledge in a particular domain, unstated assumptions, lack of experience, hierarchies and conflicting analytical approaches and personalities all can cloud objective decisionmaking. By recognizing these realities, the team can overcome them and learn more from each other.

Never stop learning.

Other underwriters are the best teachers. Take advantage of every opportunity to learn from your colleagues, from reading case studies and participating in roundtables and engaging in regular industry education opportunities. Take your Academy of Life Underwriting exams and pursue other credentials. Getting involved can be the best way to get better at the craft of critical thinking.

Also recognize that other knowledge domains can help, from the medical department to the claims group and the actuarial team.

See also: The Lifetime Learner: Self-education brings personal growth and success

Communicate clearly, precisely, and briefly.

If an underwriter’s thoughts are clear, but the message is not, what has been gained? It is important for underwriters to be able to defend their conclusions succinctly and effectively.

Learn from Mistakes

Mistakes are learning opportunities – but only when we take the opportunity to audit outcomes. The most successful underwriters have access to ongoing training and a library of case studies, with complete underwriter notes. These studies should have outcomes that are both excellent and inferior – and perhaps most importantly they should provoke questions and conversation among peers and supervisors. Multiple views and creative solutions should be encouraged. Ask yourselves one important question: Are we evaluating results using the right metrics and reinforcing expectations through a robust training program? If not, how will you improve?

See also: Four Steps to Accountability

To paraphrase the great philosopher Socrates, the unexamined thought is not worth thinking. This is particularly true in life underwriting. So the next time you are challenged to cut corners, think critically instead. Everyone will benefit.